With a boom in sharing economy, car sharing companies represented by Zipcar, Uber, Getaround, and Car2go have flourished, pushing forward the development of car sharing around the world.

Fully-developed car sharing in foreign countries is primarily divided into three models: car-hailing apps, P2P car rental, and timeshare rental with the first represented by Uber, Lyft, and Ola Cabs, the middle Getaround, Turo, and Flightcar, and the latter Zipcar, Car2go, NriveNow, and Autolib.

Uber, the world’s largest car-hailing app player, has so far obtained a dozen rounds of financing and now is valued at USD60 billion. The company has penetrated into a total of 447 cities in countries consisting of the United States, China, India, Singapore, Malaysia, etc.

The Chinese car sharing market is still in the phase of rapid growth but has showed huge potential. A series of laws & regulations and policies, including the Guidance on Promoting Green Consumption and the Guidance on Promoting the Development of New Energy Vehicle Timeshare Sector in Shanghai, have been introduced by the central government and local authorities so as to regulate and encourage the development of car sharing industry.

Car-hailing apps: A competitive landscape with DidiChuxing, YidaoYongche, Uber, ShenzhouZhuanche, 51 Yongche, Dida Pinche, and TiantianYongche as major players have taken shape in the Chinese car-hailing apps market. Orders for car-hailing services totaled about 2 billion in China in 2015, including 1.43 billion or 71.5% of the total amount from DidiChuxing, followed by Uber with a percentage of 18.3%.

DidiChuxing, a result of the merger between DidiDache and KuaidiDache, combines their own advantages. Having raised more than USD5 billion, it is the largest domestic car-hailing app platform in China valued at USD20 billion. The number of drivers connected to the platform had exceeded 14 million and registered users amounted to 250 million by the end of 2015.

P2P car rental: With PP Zuche rolling out its services in China, PP car rental platforms like Atzuche, UU Cars, Baojia, and KuaikuaiZuche have sprung up around China.

P2P car rental firms now rely heavily on financing for capital to expand business scope and grab customers. PP Zuche, with the largest amount of financing, got RMB500 million in financing in Sept 2015, the largest one in P2P car rental market.

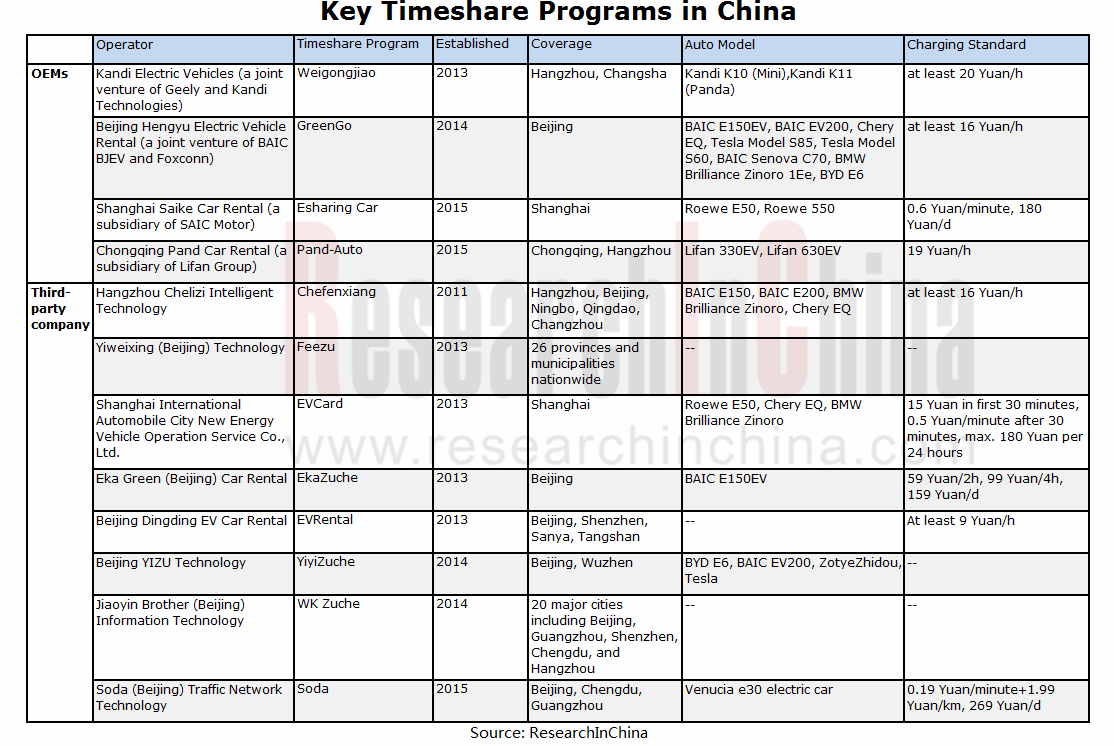

Timeshare: With growing heat-up of new-energy vehicle timeshare, localities have been active in developing new energy vehicle timeshare rental sector. And, new energy vehicle timeshare programs are being carried out in dozens of cities including Beijing, Shanghai, Hangzhou, and Shenzhen.

Propelled by favorable policies, carmakers, telematics enterprises, and Internet firms have flooded into the field. In addition, P2P car rental company- UU Cars announced in Oct 2015 that it would transform to timeshare model, plan to put 1,000 vehicles into operation by the end of 2015 and raise the figure to more than 6,000 units in the first half of 2016.

Major timeshare rental companies include Feezu, YiyiZuche, EVCard, WK Zuche, Soda, and EkaZuche. In addition, BAIC BJEV have launched GreenGo timeshare program, SAIC Motor E-sharing car, GeelyWeigongjiao, LifanPand-Auto, and Shou Qi Group Gofun.

The Chinese car sharing market will still be complementarily composed of car-hailing app firms, P2P car rental companies, and timeshare enterprises in the future.

Car-hailing apps market will be dominated by comprehensive mobile platforms represented by DidiChuxing and Uber; P2P car rental market will be further regulated with only two to three players surviving fierce competition; blossoming timeshare market will grow more mature under the joint efforts of market participants.

China Car Sharing Industry Report, 2016-2020 highlights the followings:

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

Global car sharing industry (development course, status quo, market segments (status quo, competitive landscape));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

China’s car sharing industry (status quo of development, competitive landscape, and development trends of market segments (car-hailing apps, P2P car rental, timeshare));

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

11 global and 24 domestic car sharing-related companies (profile, financing, and developments).

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...