Global and China Power Battery Management System (BMS) Industry Report, 2016-2020

-

Aug.2016

- Hard Copy

- USD

$2,600

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

YS015

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,800

-

Battery management system (BMS), a key integral of battery electric vehicle (BEV) and hybrid electric vehicle (HEV), consists mainly of battery electronics (BE) and battery control unit (BCU), with the former responsible for acquiring data on electric current, voltage, and temperature of battery and sending them to BCU for control and the latter also in charge of communicating information with other control units.

Three core functions of BMS are cell monitoring, state of charge (SOC) estimation, and single-cell battery balancing. BMS monitors the operating temperature and electric quantity of single lithium battery cell, and automatically takes steps to balance charge/discharge current and prevent occurrence of over-temperature. Making automotive power battery deliver best performance and longest service life under various working conditions is one of key technologies to develop electric vehicle.

Global electric passenger vehicle sales amounted to 549,000 units in 2015, a 67.4% surge from a year ago, with growth coming primarily from China and Europe. Power battery BMS used in foreign countries commonly adopts active balancing technology, resulting in a higher cost for single vehicle. Global BMS market was valued at USD1.98 billion in 2015 and is expected to hit USD7.25 billion in 2022 at a CAGR of up to 20.5% during 2016-2022, showing huge development potential.

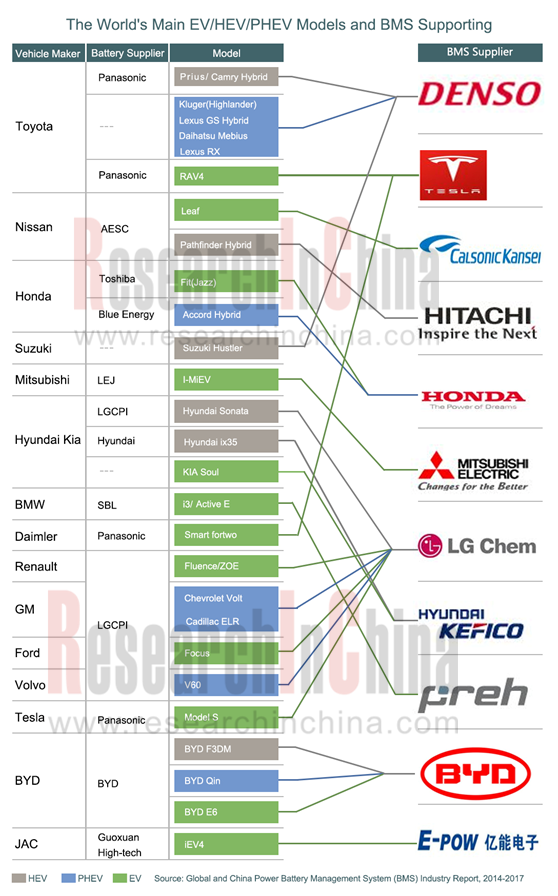

Traditional auto parts makers represented by Denso and Preh have gotten a head start by virtue of their important positions in OEMs’ supply chain. As Toyota’s the most important parts supplier, Denso has provided battery management modules for Prius, Camry Hybrid and other models. Besides serving BMW i-series BEV, Preh also explores the Chinese market with the help of its parent company- Ningbo Joyson Electronic Corp.

Cell makers like LGC attempt to, on the basis of cooperation with existing customers, simplify and generalize BMS by gradually narrowing the scope of functionality, and spin off software and data services which are provided alone to OEMs. Among OEMs, Tesla has mature and sophisticated BMS, and its next-generation BMS technology will get applied to battery packs with larger single cells.

China produced 340,471 and sold 331,092 electric vehicles in 2015, a 3.3-fold and 3.4-fold increase on a year-on-year basis, respectively. Thanks to booming EV market, the Chinese power battery BMS market size swelled to about RMB4 billion in 2015 and is expected to further soar to RMB14-15 billion in 2020.

Chinese power battery BMS market will present the following trends over the next five years:

1) At the policy level, the National Technical Committee of Auto Standardization under China Automotive Technology & Research Center, with the aim of increasing safety of new energy vehicle, is developing national BMS standard which will contribute to more stringent standards on BMS;

2) Management requirements on safety of battery will become stricter along with a higher penetration of ternary lithium battery;

3) The core of BMS lies in the design of active battery balancing and SOC estimation algorithms. Asset-light hardware design houses will enjoy a higher profitability.

4) Both OEMs and cell makers have plans to expand to BMS industrial chain. Constrained by technical barriers and limited R&D spending, it is difficult for upstream and downstream enterprises to move into BMS. Hence, outsourcing of BMS integrated solutions is a rational market behavior.

There are three types of companies in the Chinese BMS market.

1) Third-party BMS vendors, such as Epower Electronics, Shenzhen Klclear Technology,? SINOEV Technologies, and Gold Up New Energy. Epower Electronics enters the industry early with its BMS products having been installed in multiple EV models of Chang’an, Dongfeng Motor, BAIC Motor, Foton, JAC, and ZOTYE. These vendors occupy a 45% share of the overall market.

2)Battery module and PACK packaging companies, like Guoxuan High-tech Power Energy, CATL, Shenzhen OptimumNano Energy, and Sunwoda Electronic, which enter the market via independent R&D or cooperation. These businesses seize a 31% share of the overall market.

3)OEMs represented by BYD and BAIC BJEV, which have relatively perfect layout in the sector, with the former integrating R&D of battery, BMS and EV, thus giving it advantages in terms of cost and efficiency, and the latter boasting research capability for BMS after acquisition of Atieva and no longer needing supplies from third-party BMS companies. These companies take up a 24% of the overall market.

Global and China Battery Management System (BMS) Industry Report, 2016-2020 focuses on the followings:

Overview of global and Chinese EV markets (overview, market size, vehicle output, sales, etc.);

Overview of global and Chinese EV markets (overview, market size, vehicle output, sales, etc.);

Overview of global BMS industry (status quo & forecast, market size, technology trends, etc.);

Overview of global BMS industry (status quo & forecast, market size, technology trends, etc.);

Overview of BMS industry in China (status quo & forecast, price & cost, market size, competitive landscape, supporting, technology trends, etc.);

Overview of BMS industry in China (status quo & forecast, price & cost, market size, competitive landscape, supporting, technology trends, etc.);

Major vendors in global BMS industry (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest developments, business in China, etc. of vendors and their subsidiaries);

Major vendors in global BMS industry (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest developments, business in China, etc. of vendors and their subsidiaries);

Major vendors in BMS industry in China (independent third parties, cell makers, OEMs) (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest projects of companies and their subsidiaries);

Major vendors in BMS industry in China (independent third parties, cell makers, OEMs) (revenue, revenue structure, net income, R&D, products, supporting for OEMs, latest projects of companies and their subsidiaries);

Major makers in BMS cell industry (revenue, revenue structure, net income, BMS cell solutions, etc.)

Major makers in BMS cell industry (revenue, revenue structure, net income, BMS cell solutions, etc.)

1 Overview of BMS

1.1 Definition of Power Battery

1.2 Definition of BMS

1.2.1 Definition

1.2.2 Classification and Technical Features

1.2.3 Core Functions

2 Policies on BMS

2.1 Promulgated Policies

2.1.1 Standard Conditions for Automotive Power Battery Industry

2.1.2 Regulations on New Energy Vehicle Manufacturers and Products Access

2.1.3 National Standards for Power Battery (GB/T)

2.2 Policies Being Made

2.2.1 National Standards for BMS

3 Global BMS Market

3.1 Global EV Market

3.2 Market Size and Development Trends

3.3 Technology Trends

3.4 Supporting

4 Chinese BMS Market

4.1 Chinese EV Market

4.2 Price & Cost

4.3 Market Size

4.4 Competitive Landscape

4.5 Supporting

4.6 Technology Roadmap

4.7 Development Trends

5 Global BMS Vendors

5.1 Denso (Japan)

5.1.1 Profile

5.1.2 BMS Business

5.2 Calsonic Kansei (Japan)

5.2.1 Profile

5.2.2 BMS Business

5.3 Hitachi Automotive Systems (Japan)

5.3.1 Profile

5.3.2 BMS Business

5.4 Mitsubishi Electric (Japan)

5.4.1 Profile

5.4.2 BMS Business

5.5 Hyundai Kefico (Korea)

5.5.1 Profile

5.5.2 BMS Business

5.6 LG Chem (Korea)

5.6.1 Profile

5.6.2 BMS Business

5.7 SK Innovation (Korea)

5.7.1 Profile

5.7.2 BMS Business

5.8 Tesla Motors (USA)

5.8.1 Profile

5.8.2 BMS Business

5.9 Lithium Balance (Denmark)

5.9.1 Profile

5.9.2 Products

5.9.3 Application of Products

5.9.4 Presence in China

5.10Vecture (Canada)

5.10.1 Profile

5.10.2 Products

5.10.3 Application of Products

5.10.4 Industrial Layout

5.11 RimacAutomobili (Croatia)

5.11.1 Profile

5.11.2 Products

5.11.3 Application of Products

5.12 Digi-Triumph Technology (Taiwan)

5.12.1 Profile

5.12.2 Products and Application

5.13 Clayton Power (Denmark)

5.13.1 Profile

5.13.2 Products

6 Chinese BMS Vendors (Independent Third Parties)

6.1 Huizhou E-power Electronics

6.1.1 Profile

6.1.2 BMS Business

6.2 Shenzhen Klclear Technology

6.2.1 Profile

6.2.2 BMS Business

6.3 SINOEV (Hefei) Technologies

6.3.1 Profile

6.3.2 BMS Products

6.4 Ningbo Joyson Electronic Corp. (German Preh GmbH)

6.4.1 Profile

6.4.2 BMS Business

6.5 Harbin Guantuo Power Equipment Co., Ltd.

6.5.1 Profile

6.5.2 BMS Products

6.6 Anhui LIGOO New Energy Technology Co., Ltd.

6.6.1 Profile

6.6.2 BMS Business

6.7 Ningbo Bate Technology Co., Ltd.

6.7.1 Profile

6.7.2 BMS Business

6.8 Ningbo Longway Electrical Co., Ltd.

6.8.1 Profile

6.8.2 BMS Products

6.9 Shenzhen Antega Technology Co., Ltd.

6.9.1 Profile

6.9.2 BMS Products

6.10 Wuhu Tianyuan Automobile Electric Co., Ltd.

6.10.1 Profile

6.10.2 BMS Products

6.11 Shenzhen Battsister Tech. Co., Ltd.

6.11.1 Profile

6.11.2 BMS Business

7 Chinese BMS Vendors (OEMs)

7.1 BYD

7.1.1 Profile

7.1.2 BMS Business

7.2 BAIC BJEV

7.3 Hangzhou Genwell-Power Co., Ltd.

7.3.1 Profile

7.3.2 BMS Business

8 Chinese BMS Vendors (Power Battery)

8.1 Beijing Pride New Energy Battery Technology Co., Ltd.

8.1.1 Profile

8.1.2 BMS Business

8.2 ATL

8.2.1 Profile

8.2.2 BMS Business

8.3 Hefei Guoxuan High-tech Power Energy Co., Ltd.

8.3.1 Profile

8.3.2 BMS Business

8.4 China Aviation Lithium Battery Co., Ltd.

8.4.1 Profile

8.4.2 BMS Business

8.5 Sunwoda Electronic Co., Ltd.

8.5.1 Profile

8.5.2 BMS Business

8.6 Winston Battery

8.6.1 Profile

8.6.2 BMS Products

9 Global BMS Chip Vendors

9.1 Analog Devices (USA)

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 BMS Solutions

9.2 Texas Instruments (USA)

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 Status Quo and Prospects of BMS Chip Business

9.3 Infineon (Germany)

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 Status Quo and Prospects of BMS Chip Business

Power Battery System

Production Cost Breakdown of Power Battery System

BMS Cost Proportion of Battery System

Power Battery Pack System of Typical Battery Manufacturers

Hardware System Diagram of BMS

Four Modules and Functions of BMS

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (First Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Second Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Third Batch)

Companies Complying with "Standard Conditions of Automotive Power Battery Industry" (Fourth Batch)

China's Perfect Electric Vehicle Standard System

Newly Released National Standards on Power Battery, 2015

GB / T 31467 Power Battery System Standards

General Flow (CARTAC) for Battery System Test

Global Electric Passenger Vehicle Sales Volume Comparison (Major Countries or Regions), 2013-2015

Global New Energy Vehicle (EV & PHEV) Monthly Sales Volume, 2014-2016H1

Global Electric Passenger Car (EV & PHEV) Sales Volume, 2011-2020E

Power Battery Suppliers of 54 Foreign Mainstream New Energy Vehicle (EV & PHEV) Models

Scale of Global BMS Industry, 2014-2025E

Costs and Applications of Global BMS Active and Passive Balancing Technologies

China's Vehicle Ownership, Output and Sales Volume, 2010- 2018E

China's Electric Vehicle Output, 2010-2016H1

China's Electric Passenger Vehicle (EV & PHEV) Output, 2011-2020E

China's Electric Bus Output, 2011-2020E

China's Battery Electric Truck / Logistics Vehicle (EV) Output, 2013-2020E

Proportion of Passenger Vehicle/Commercial Vehicle BMS Price in Power Battery Price

China's BMS Market Size (by Passenger Car, Bus, Logistics Vehicle), 2013-2020E

China's New Energy Passenger Vehicle BMS Market Size by Product, 2020

Competitive Landscape of China BMS Market

Main BMS Companies in China

Market Share of New Energy Vehicle BMS Manufacturers in China, 2015

New Energy Passenger Vehicle BMS Suppliers in China, 2015

Market Share of Battery Electric Passenger Vehicle BMS Suppliers (by Type) in China, 2015

Market Share of Battery Electric Passenger Vehicle BMS Suppliers (by Nationality) in China, 2015

New Energy Bus BMS Suppliers in China, 2015

Installed Capacity of China's Top Five Battery Electric Bus BMS Suppliers

Technical Parameter Comparison between Mainstream Chinese and Foreign BMS Suppliers

Comparison between Active and Passive Balancing Technologies

Balancing Technologies of Main BMS Vendors in China

Ranking of Electric Vehicle BMS Patents (by Company), 2016

Sales Structure of Denso’s Automotive Business, FY2015-FY2016

Denso’s Sales Structure by Client, FY2016

Vehicle Models Supported by Denso's BMS, 2013-2015

Denso’s R & D Investment, FY2012-FY2016

Calsonic’s Revenue and Net Income, FY2010-FY2016

Calsonic’s Revenue by Region, FY2016

Vehicle Models Supported by Calsonic Kansei's BMS, 2012-2015

Revenue of Mitsubishi Electric by Business, FY2016

Kefico’s Revenue and Net Income, 2010-2015

Equity Structure of LG Chemical, 2015

LGC’s Operating Results, 2007-2015H1

LGC’s Revenue by Region, 2015

Power Battery Business Framework of LG Chemical

BMS of LG Chemical

Power Batteries and BMS Application of LG Chemical, 2010-2015

Power Lithium Batteries and BMS Technical Parameters of SKI

Tesla’s Revenue from Power System and Related Components, 2011-2014

Smart fortwo Electric Vehicles

Toyota’s RAV4 EV

Scalable BMS (s-BMS)

Integrated BMS (i-BMS)

British Tennant 500ZE

TMHE Electric Forklifts

ECOTRUCK7500 Electric Garbage Collection Trucks

Customers of Lithium Balance

Overview of Lithium Balance’s Agents in China

Vecture's BMS

Application of Vecture's Products

Community Smart Grid Projects

‘Eve’ Project

Rimac’s R-BMS2

Rimac’sConcept_One

Application of JustPower’s BMS Products

JustPower’s Main Co-partners

Clayton’s BMS

Revenue and Net Income of Epower Electronics, 2011-2015

BMS Products of Epower Electronics

Some Partners of Epower Electronics

Operating Results of Klclear Technology, 2012-2015

BMS Revenue of Klclear Technology by Application, 2015

Battery Electric Bus BMS

BMS Function Modules of Klclear Technology

Some Partners of Klclear Technology

Electronics Division and Products of Joyson Electronics

BMW’s i3BMS

Preh’s Revenue, 2005-2015

Preh’s Global Divisions

BF101 BMS

Waterproof Series (BC111 / BS111 / BS113 / BS313)

Main Parameters of Guantuo Power’s BMS

Some Customers of LIGOO New Energy Technology

EK-FT-12 Commercial Vehicle BMS (Enhanced)

Major Customers of Ningbo Bate Technology

BMS of SAIC Roewe 750HEV

Main Parameters of Ningbo Bate Technology’s BMS

BMS- 200 LF of Ningbo Longway Electrical

BMS- 36 LF of Ningbo Longway Electrical

24V100AH Power Lithium BMS

BMS of Wuhu Tianyuan

Main Parameters of Wuhu Tianyuan’s BMS

BMS-108 Electric Vehicle Battery Management Series

Battsister’s Co-partners

LIGOO New Energy Technology’s BMS for Light Vehicles

LIGOO New Energy Technology’s BMS for Large and Medium-sized Vehicles

LIGOO New Energy Technology’s BMS for Mine-use Vehicles

BYD’s Operating Results, 2008-2015H1

BYD’s Revenues Structure (by Business), 2012-2015H1

BYD’s Gross Margin (by Business), 2009-2015H1

BYD’s EV Sales Volume, 2011-2020E

ABM-BMS Active Balancing BMS of Hangzhou Genwell-power

Equity Structure of Beijing Pride New Energy Battery Technology, 2015

Operating Results of Beijing Pride New Energy Battery Technology, 2011-2015

Customers and Cooperation Areas of Beijing Pride New Energy Battery Technology

ATL’s Operating Results, 2008-2015

Customers Supported by ATL

Business Performance of Hefei Guoxuan High-tech Power Energy, 2009-2015

Guoxuan’s High-tech BMS

Equity Structure of China Aviation Lithium Battery, 2016

Business Performance of China Aviation Lithium Battery, 2010-2015

Business Performance of Sunwoda Electronic, 2010-2015

Major Indicators of SunwodaElectronic’s BMS

Revenue and Net Income of Sunwoda Electronic, 2010-2015

Revenue Structure of Sunwoda Electronic by Product, 2015

GTBMS005A-MC 11 Color-screen BMS

ADI’s Revenue and Gross Margin, 2007-2015

ADI’s Net Income and Net Profit Margin, 2007-2015

ADI’s Revenue (by Region), 2010-2015

ADI’s Revenue (by Industry), 2015

ADI’s Gross Margin Growth, 2008-2015

ADI’s HEV/ EV Lithium Battery Management Solutions (≤150 V)

ADI’s HEV/ EV Lithium Battery Management Solutions (≥300 V)

TI’s Revenue and Gross Margin, 2007-2015

TI’s Net Income and Net Profit Margin, 2007-2015

TI’s Revenue (by Product), 2007-2015

TI’s Revenue (by Region), 2010-2015

TI’s Gross Margin Growth, 2007-2015

Operating Margin of TI’s Main Products, 2007-20151

TI’s Hybrid and Battery Electric Vehicle Solutions

TI’s BMS Solutions

TI’s BMS

IFX’s Revenue and Gross Margin, FY2009-FY2015

IFX’s Net Income and Net Profit Margin, FY2009-FY2015

IFX’s Revenue (by Division), FY2009-FY2015

IFX’s Revenue (by Region), FY2009-FY2015

IFX’s Gross Margin Growth, FY2009-FY2015

Market Share of Major Global Automotive Semiconductor Companies, 2014

Revenue of IFX’s Automotive Electronics Division, 2009-2015

Major Clients of IFX’s Automotive Electronics Division

IFX’s BMS Solutions

IFX’s Revenue in China, FY2009-FY2015

Foton’s Revenue and New Energy Vehicle Sales Volume, 2009-2015

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...