China Passenger Car Telematics Industry Report, 2016-2020

-

Aug.2016

- Hard Copy

- USD

$2,400

-

- Pages:187

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LKE001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

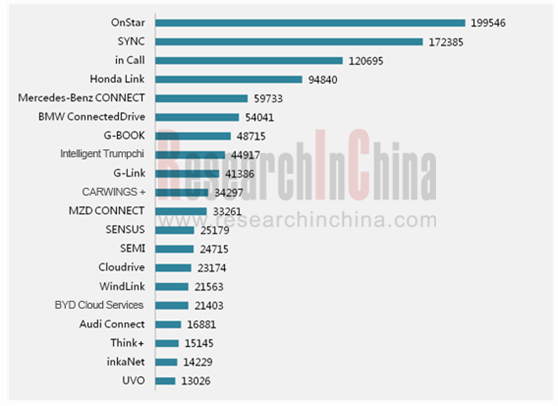

Telematics pre-installations on passenger cars totaled 1.15 million units in China during Jan-May 2016, up 27.8% compared with the same period of the previous year and representing a penetration rate of 12.54%. OnStar rank first with a share of 17.4%, followed by SYNC and In Call. It is worth noting that Chang’anIn Call joined the top three as a self-owned brand, seizing a share of 10.4%. Pre-installations are expected to amount to 2.2 million vehicles in the Chinese market in 2016, creating a market size of over RMB20 billion and marking a penetration rate of 14%. The Chinese Telematics market is expected to exceed RMB50 billion with a penetration rate of above 30% in 2020.

Pre-installations of Major Telematics Brands in the Chinese Passenger Car Market, Jan-May 2016

Source: China Passenger Car Telematics Industry Report, 2015-2018

In 2016, along with Chinese passenger car OEMs’ stepped-up efforts for marketing of Telematics system, wider use of mobile connect (Carplay, Carlife, Android Auto) and 4G LTE technologies and continuous addition & optimization of Telematics entertainment and internet connection deliver better customer experience. Interactive speech/HUD projection and active safety ADAS will find more and more infused applications on in-vehicle terminals; large-screen rearview mirror (transition from mainstream 5-inch to 8/10-inch) and large (vertical)-screen dashboard are increasingly favored by customers; mobile connect functions like social apps, navigation, games, entertainment are reflected more and more in in-vehicle terminal system.

Although the Chinese Telematics market has grown at a CAGR of over 25% in recent years, there are still a lot of problems, such as vague Telematics profit model and low renewal rate of consumer terminals for OEM TSP and attempts of transformation by relying on original OEM business by PATEO and China TSP and continuous searching for consumers’ pain points in Afertermark by LAUNCH and Carsmart.

China Passenger Car Telematics Industry Report, 2016-2020 focuses on the followings:

Overview of Telematics (national policies, favorable factors and obstacles, the Chinese Telematics market size, structure of industrial chain, market value chain, market participants, major solutions, etc.);

Overview of Telematics (national policies, favorable factors and obstacles, the Chinese Telematics market size, structure of industrial chain, market value chain, market participants, major solutions, etc.);

Chinese Telematics market (Telematics (by price/auto model/OEM/Telematics brand) pre-installations and penetration on passenger cars, auto makers and models supported by major Telematics brands, major Telematics brands (safety, navigation, connect/entertainment, charges), etc.);

Chinese Telematics market (Telematics (by price/auto model/OEM/Telematics brand) pre-installations and penetration on passenger cars, auto makers and models supported by major Telematics brands, major Telematics brands (safety, navigation, connect/entertainment, charges), etc.);

China-based JV OEMs’ Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC-GMOnStar/MyLink, Toyota G-BOOK, HondaLink/Honda CONNECT, Volvo SENSUS/Volvo On Call, Chang’an Ford SYNC, Dongfeng Nissan CARWINGS+/Nismo Watch, DongfengYueda KiaUVO, Dongfeng Citro?n Connect, Dongfeng PeugeotBlue-i, Beijing Mercedes-Benz CONNECT, Beijing Hyundai BlueLink, and BMW BrillianceConnectedDrive);

China-based JV OEMs’ Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC-GMOnStar/MyLink, Toyota G-BOOK, HondaLink/Honda CONNECT, Volvo SENSUS/Volvo On Call, Chang’an Ford SYNC, Dongfeng Nissan CARWINGS+/Nismo Watch, DongfengYueda KiaUVO, Dongfeng Citro?n Connect, Dongfeng PeugeotBlue-i, Beijing Mercedes-Benz CONNECT, Beijing Hyundai BlueLink, and BMW BrillianceConnectedDrive);

Local Chinese OEMs’Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC MotorinkaNet, Chang’an In Call, Geely AutomobileG-Netlink/G-Link, and Chery AutomobileCloudrive);

Local Chinese OEMs’Telematics businesses (auto models supported, functions & services, package charges, and Chinese user growth of SAIC MotorinkaNet, Chang’an In Call, Geely AutomobileG-Netlink/G-Link, and Chery AutomobileCloudrive);

Chinese Telematics companies (customers, revenue, revenue structure, and product areas of Navinfo, LAUNCH, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Carsmart, Beijing YESWAY Information Technology, and AutoNavi, etc.)

Chinese Telematics companies (customers, revenue, revenue structure, and product areas of Navinfo, LAUNCH, PATEO, WirelessCar, China TSP, TimaNetworks, Careland, Carsmart, Beijing YESWAY Information Technology, and AutoNavi, etc.)

1 Overview of Telematics

1.1 National Policies for Developing Telematics

1.2 Obstacles and Stimuli to China’s Telematics Industry

1.3 Development Trends in the Chinese Telematics

1.4 Three Major Trends of Onboard Terminals

1.5 China’s Telematics Industry Scale Expected to Reach RMB21 Billion in 2016

1.6 China’s Telematics Penetration Expected to Exceed 14% in 2016

1.7 China’s Telematics Industry Chain and Market Participants

1.8 Structure of Telematics Industry Chain

1.8.1 Telematics Industry Chain-Automobile Manufacturing

1.8.2 Telematics Industry Chain-Automotive Semiconductor

1.8.3 Telematics Industry Chain-Onboard Electronics

1.8.4 Telematics Industry Chain - Software, Applications and Services

1.9 Telematics System Architecture

1.10 Value Chain of Telematics Market

1.11 Major Telematics Market Participants

1.12 Main Solutions for Telematics

1.13 Main Solutions for OEM Telematics

2 Development of China’s Telematics Market

2.1 Cumulative Pre-installation and Penetration of Passenger Car Telematics in China, 2016

2.2 Monthly Connected Pre-installation (units) and Penetration of Passenger Car Telematics in China, 2016

2.3 Installation Rate of Telematics Installed in New Passenger Cars in China, 2016

2.4 Installation Rate of Telematics Installed in Vehicles for Sale in China as of May 2016

2.5 Number of All Models for Sale in China Equipped with Telematics as of May 2016

2.6 Percentage of Models for Sale in China Equipped with Telematics by Price as of May 2016

2.7 Pre-installation of Telematics System in China, 2016-2020E

2.8 Installation Rate of New Vehicles Released in China by Price in the First Five Months of 2016

2.9 Installation Rate of New Vehicles Released in China by OEM in the First Five Months of 2016

2.10 Cumulative Pre-installation of Major Telematics Brands in China in the First Five Months of 2016

2.11 Supporting of Telematics Brands in the Chinese Automobile Market

2.12 Main Telematics Brands

2.12.1 Comparison: Safety Protection Functions

2.12.2 Comparison: Navigation Functions

2.12.3 Comparison: Interconnection and Entertainment Functions

2.12.4 Comparison: Charge Packages

3 Research on Telematics of Joint-ventured OEMs in China

3.1 SAIC-GM

3.1.1 Development History of GM Onstar

3.1.2 Introduction to Onstar Services

3.1.3 Onstar Charge Packages

3.1.4 Technology Roadmap for Onstar

3.1.5 Functions and Parameters of MyLink 2.0

3.1.6 New Onstar Users in Chinses Passenger Car Market, Jan.-May 2016

3.2 Toyota

3.2.1 Comparison of Mobile Phone Connected G-BOOK and DCM Connected G-BOOK

3.2.2 New G-BOOK Users in China, Jan.-May 2016

3.3 Honda

3.3.1 Functions and Services of HondaLink

3.3.2 Honda’s New-Generation Telematics Honda CONNECT

3.3.3 New Honda CONNECT Users in China, Jan.-May 2016

3.3.4 New HondaLink Users in China, Jan.-May 2016

3.4 Volvo

3.4.1 Functions and Services of Sensus Connect

3.4.2 Functions and Services of Volvo On Call

3.4.3 New Sensus Users in China, Jan.-May 2016

3.5 Chang'an Ford

3.5.1 Functions and Services of SYNC

3.5.2 New SYNC Users in China, Jan.-May 2016

3.6 Dongfeng Nissan

3.6.1 Functions and Services of CARWINGS Zhixing+

3.6.2 Functions and Parameters of Nismo Watch

3.6.3 New CARWINGS Zhixing+ Users in China, Jan.-May 2016

3.7 DongfengYuedaKia

3.7.1 UVO System Services

3.7.2 UVO Packages

3.7.3 New UVO Users in China, Jan.-May 2016

3.8 Dongfeng Citro?n

3.8.1 Functions and Services of Citro?n Connect

3.8.2 New Citro?n Connect Users in China, Jan.-May 2016

3.9 Dongfeng Peugeot

3.9.1 Functions and Services of Blue-i System

3.9.2 New Blue-i Users in China, Jan.-May 2016

3.10 Beijing Benz

3.10.1 Functions and Services of Mercedes-Benz CONNECT

3.10.2 New Mercedes-Benz CONNECT Users in China, Jan.-May 2016

3.11 Beijing Hyundai

3.11.1 BlueLink Charge Packages

3.11.2 Services of Blue Link System

3.11.3 New Blue Link Users in China, Jan.-May 2016

3.12 BMW Brilliance

3.12.1 Functions and Services of ConnectedDrive

3.12.2 New ConnectedDrive Users in China, Jan.-May 2016

4 Research on OEM Telematics in China

4.1 SAIC Motor

4.1.1 Functions and Services of inkaNet

4.1.2 inkaNet Charge Packages

4.1.3 New inkaNet Users in China, Jan.-May 2016

4.2 Changan Automobile

4.2.1 Functions and Services of In Call

4.2.2 Models Supported by In Call System and Charge Packages

4.2.3 New In Call Users in China, Jan.-May 2016

4.3 Geely Automobile

4.3.1 Functions and Services of G-Netlink and G-Link

4.3.2 Growth of G-Netlink/ G-Link Users in China

4.4 Chery Automobile

4.4.1 Profile of Cloudrive

4.4.2 Growth of Cloudrive Users in China

5. Chinese Telematics Companies

5.1 NavInfo Co., Ltd.

5.1.1Operating Results, 2014-2015

5.1.2 Operating Results by Sector, 2014-2015

5.1.3 Research and Analysis -- R & D Investment

5.1.4 Top 5 Customers

5.1.5 Top 5 Suppliers

5.1.6 Research and Analysis -- Acquisition Modes of Geographic Information Resources

5.1.7 Subsidiary: Beijing Mapbar Science and Technology Co., Ltd.

5.1.8 Subsidiary: China Satellite Navigation and Communications Co., Ltd.

5.1.9 Product Analysis -- Aerohuanyou Vehicle information Comprehensive Service Platform

5.1.10 Product Analysis -- WeDrive3.0

5.1.11 Strategic Cooperation Framework Agreement with Neusoft

5.1.12 Research and Analysis -- Product Analysis: Chip Optimization - WeLink Program

5.2 LAUNCH Tech Company Limited

5.2.1 Revenue and YoY Growth, 2009-2015

5.2.2 Net Income and YoY Growth, 2009-2015

5.2.3 Revenue Structure (by Product), 2009-2015

5.2.4 R&D Costs and % of Total Revenue, 2009-2015

5.2.5 Latest News

5.3 PATEO

5.3.1 Related Companies

5.3.2 Business Positioning

5.3.3 Product Platform System

5.3.4 Core Technologies and Architecture

5.3.5 Product HMI Features

5.3.6 Telematics Business

5.3.7 Application Cases

5.3.8 Latest News

5.4 WirelessCar

5.4.1 Application Case -Volvo On Call

5.4.2 Application Case - Nissan Infiniti InTouch and new Nissan Connect

5.4.3 Application Case - QorosQloud

5.5 China TSP

5.5.1 Product Structure

5.5.2 Product Application

5.5.3 Application Cases

5.6 TimaNetworks

5.6.1 Three Functions of CarNet Telematics Solutions in Aftermarket

5.6.2 Comparison with Counterpart Telematics System Products

5.6.3 Product Application Structure

5.6.4 Main Function Modules of Products

5.7 Careland

5.7.1 Revenue and Net Income, 2012-2015

5.7.2 R & D Investment, 2012-2015

5.7.3 Revenue Distribution, 2014 & 2015

5.7.4 M330 Networked Intelligent Rearview Mirror Navigation

5.8 Beijing Carsmart Technology Co., Ltd

5.8.1 Revenue and YoY Growth, 2010-2015

5.8.2 Revenue Structure (by Business), 2011-2015

5.8.3 Autofun and UBI Business

5.8.4 Autofun

5.9 YESWAY

5.9.1 Customers

5.9.2 Revenue and YoY Growth, 2011-2015

5.9.3 Net Income and YoY Growth, 2011-2015

5.9.4 OEM Telematics Services

5.9.5 Aftermarket Telematics Services

5.9.6 Intelligent Driving Services

5.9.7 Revenue Structure (by Business), 2011-2015

5.9.8 Gross Margin and R & D Investment, 2011-2015

5.9.9 Revenue from Top 5 Customers, 2013-2015

5.9.10 Latest News

5.9.11 Y-CONNECT is Intelligent Driving Interconnected System

5.10 AutoNavi

5.10.1 R & D Investment in FY2007-FY2014

5.10.2 Revenue by Product, FY2008-FY2014

5.10.3 Operating Results, FY2007-FY2014

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...