China Automotive Finance Industry Report, 2016

-

Aug.2016

- Hard Copy

- USD

$2,300

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

ZLC035

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Auto finance industry is flourishing in China with market size approximating RMB850 billion in 2015 and expected to rise by 17.6% from a year ago to around RMB1 trillion in 2016. Compared with mature markets like Europe, the United States and Japan that boast penetration rates above 50%, China’s auto finance penetration rate is low, only 35% or so, indicating large room for growth. As those born in the 1980s and 1990s gradually become the key consumers of cars, changes in consumption habits will promote the development of automotive finance industry, boosting auto finance penetration rate in China to an estimated 50% in 2020.

The Chinese automotive finance market now is still dominated by commercial banks and auto finance companies which together seize a more than 80% share. The remaining less than 20% is shared by financial leasing companies, Internet finance companies and other institutions. However, propelled by favorable policies, these small players will see a further rise in their market shares.

By March 2016, there were 25 auto finance companies approved in China with total assets of RMB419 billion. These players lent a total of RMB391.06 billion in 2015, including retail loans of RMB305.15 billion (78%) and dealership loans of RMB84.05 billion (21.5%).

Among these 25 auto finance companies, several large foreign-funded enterprises including SAIC-GMAC, Volkswagen Finance (China), BMW Automotive Finance (China), and Toyota Motor Finance (China) are highly competitive with rich experience and solid financial strength. The four players booked net interest income of RMB3.8661 billion, RMB2.2921 billion, RMB1.9933 billion, and RMB1.7402 billion in 2015, respectively.

Driven by favorable policies, used car finance and Internet auto finance are ushering in opportunities for development.

Used car finance: Over 9.42 million used cars were traded in China in 2015. The ratio of trade volume of used cars to that of new vehicles was only 0.38, a greater gap compared with 1.5 in foreign countries, indicating a huge potential. This attracts not only traditional auto finance-related companies but also Internet giants (like Bitauto, Tencent, JD, and Alibaba) to make their presence in the segment.

The promulgation of the Opinions on Promoting Convenient Transaction of Used Cars not only regulates used car transaction markets but also increases support for used car transaction credit and lowers credit standards, thus fueling the development of used car finance. The Chinese used car finance market will be gradually opened.

Internet auto finance: Auto finance industry in China has moved into an “Internet Plus”era. Thanks to a series of measures put forward in the Guidance on Promoting the Healthy Development of Internet Finance to encourage Internet finance platform, product, and service innovation and local governments’ support for Internet finance, China’s “Internet + auto finance” is embracing opportunities.

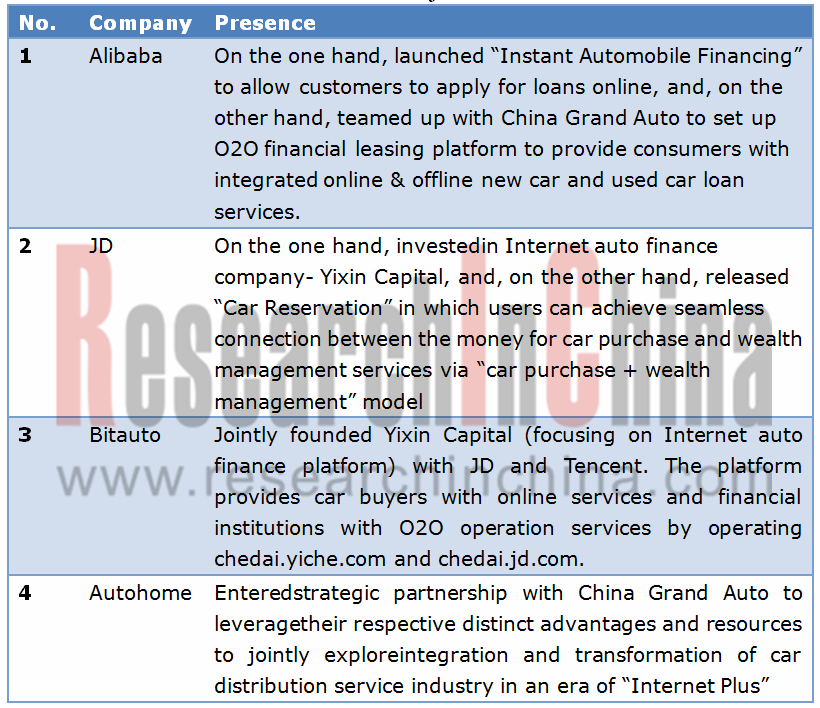

While traditional auto finance-related companies combine their original auto finance business with Internet, the Internet giants like Alibaba, JD, Bitauto, and Autohome also branch out into auto finance sector.

Internet Auto Finance Cases of Internet Giants in China

Source: China Automotive Finance Industry Report, 2016 by ResearchInChina

China Automotive Finance Industry Report, 2016 highlights the followings:

Global auto finance industry (development environment, status quo, development of auto finance in various countries, competitive landscape, etc.);

Global auto finance industry (development environment, status quo, development of auto finance in various countries, competitive landscape, etc.);

Auto finance industry in China (development environment, status quo, market size, competitive landscape, development trends, etc.);

Auto finance industry in China (development environment, status quo, market size, competitive landscape, development trends, etc.);

Chinese auto finance market segments (auto financial leasing, used car finance, and Internet auto finance) (development status, policy support, competitive landscape, etc.);

Chinese auto finance market segments (auto financial leasing, used car finance, and Internet auto finance) (development status, policy support, competitive landscape, etc.);

12 OEM-related auto finance companies, 4 auto finance-related dealers, and 7 other auto finance-related companies (profile, auto finance business, etc.)

12 OEM-related auto finance companies, 4 auto finance-related dealers, and 7 other auto finance-related companies (profile, auto finance business, etc.)

1 Overview

1.1 Definition

1.2 Classification

1.3 Market Players

2 Development of Global Automotive Finance Industry

2.1 Development Environment

2.2 Status Quo

2.3 Overview of Auto Finance in Major Countries

2.3.1 United States

2.3.2 Germany

2.3.3 Japan

2.4 Competitive Landscape

2.5 Global Expansion

3 Development of Automotive Finance Industry in China

3.1 Development Environment

3.1.1 Policy Environment

3.1.2 Economic Environment

3.1.3 Automobile Production and Sales

3.1.4 Car Ownership

3.2 Development History

3.3 Status Quo

3.4 Market Size

3.5 Competitive Landscape

3.6 Operation of Auto Finance Companies

3.7 Development Trends

3.7.1 Domestic OEMs Accelerate Their Presence in Auto Finance Field

3.7.2 New Energy & Used Cars Enjoy Huge Potential with Policy Support

3.7.3 Internet Auto Finance Has Developed into a Trend

3.7.4 Cooperation between Banks and Enterprises Is the Development Direction of Auto Finance

3.7.5 Competition in Auto Finance Industry Pricks Up

3.7.6 Specialized and Diversified Capital Sources

3.7.7 Internationalization

4 Chinese Auto Finance Market Segments

4.1 Auto Financial Leasing

4.1.1 Overview

4.1.2 Development History

4.1.3 Business Model

4.1.4 Status Quo

4.1.5 Policy Support

4.1.6 Competitive Landscape

4.1.7 Problems

4.2 Used Car Finance

4.2.1 Overview

4.2.2 Used Car Market Size

4.2.3 Market Structure

4.2.4 Policies Support the Development of Used Car Finance

4.2.5 Huge Used Car Market Potential

4.2.6 Competitive Landscape

4.3 Internet Auto Finance

4.3.1 Overview

4.3.2 Policy Support

4.3.3 Status Quo

4.3.4 Capitals into Internet Auto Finance

5 OEM-related Auto Finance Companies

5.1 SAIC-GMAC

5.1.1 Profile

5.1.2 Operation

5.1.3 Auto Finance Business

5.1.4 Developments

5.2 Volkswagen Finance (China)

5.2.1 Profile

5.2.2 Operation

5.2.3 Auto Finance Business

5.2.4 Developments

5.3 BYD Auto Finance

5.3.1 Profile

5.3.2 Operation

5.3.3 Auto Finance Business

5.3.4 Developments

5.4 Ford Automotive Finance (China)

5.4.1 Profile

5.4.2 Operation

5.4.3 Auto Finance Business

5.4.4 Developments

5.5 Dongfeng Nissan Auto Finance

5.5.1 Profile

5.5.2 Auto Finance Business

5.5.3 Developments

5.6 Herald International Financial Leasing

5.6.1 Profile

5.6.2 Auto Finance Business

5.7 Toyota Motor Finance (China)

5.7.1 Profile

5.7.2 Operation

5.7.3 Auto Finance Business

5.8 BMW Automotive Finance (China)

5.8.1 Profile

5.8.2 Operation

5.8.3 Auto Finance Business

5.8.4 Developments

5.9 Yulon Motor Finance (China)

5.9.1 Profile

5.9.2 Auto Finance Business

5.10 Chongqing Auto Finance

5.10.1 Profile

5.10.2 Operation

5.10.3 Obtains Capital Increase of RMB2.5 Billion

5.11 GAC-SOFINCO Automobile Finance

5.11.1 Profile

5.11.2 Operation

5.11.3 Auto Finance Business

5.12 Genius Auto Finance

6 Auto Dealers

6.1 Yongda Automobiles

6.1.1 Profile

6.1.2 Operation

6.1.3 Auto Finance Business

6.1.4 Shanghai Yongda Finance Leasing Co., Ltd.

6.1.5 Yongda Financial Group Holdings Limited

6.1.6 Launches First Auto Finance Services for Uber

6.1.7 Strategic Investment to Build Internet Auto Finance

6.2 China Grand Auto

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 All Trust Leasing Co., Ltd.

6.2.5 Financial Leasing Business

6.2.6 Accelerated Presence in Financial Leasing Business

6.2.7 Presence in Internet/Used Car Finance

6.3 Pang Da Automobile Trade

6.3.1 Profile

6.3.2 Operation

6.3.3 Pang Da ORIX Auto Leasing

6.3.4 Pang Da Leye Leasing Co., Ltd.

6.3.5 Cooperates with JD Finance to Expand to Internet Auto Finance Field

6.4 Yaxia Automobile

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Auto Finance Business

6.4.5 Accelerated Presence in Auto Finance Industry

6.4.6 Presence in Internet Auto Finance Field

7 Other Auto Finance Companies

7.1 Great China Finance Leasing

7.1.1 Profile

7.1.2 Auto Finance Business

7.2 Zhejiang Jingu Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Moves into Auto Finance Field

7.3 Yixin Capital

7.3.1 Profile

7.3.2 Auto Finance Business

7.3.3 Secures Investment of Over RMB3.6 Billion from Tencent, Baidu, and JD

7.4 eCapital

7.4.1 Profile

7.4.2 Auto Finance Business

7.4.3 Developments

7.5 CAR Inc.

7.5.1 Profile

7.5.2 Operation

7.5.3 Auto Finance Business

7.6 Dafang Car Rental

7.6.1 Profile

7.6.2 Auto Finance Business

7.7 Jiayin Financial Leasing

7.7.1 Profile

7.7.2 Auto Finance Business

Advantages and Disadvantages of Major Auto Finance Practitioners in China

Global Automobile Output, 2010-2015

Global TOP 20 Countries by Automobile Output, 2015

Output of Passenger Cars Worldwide, 2010-2015

Output of Commercial Vehicles Worldwide, 2010-2015

Profit Structure of Mature Automotive Industry Chain

Global Automobile Percentage by Purchasing Mode

Global Auto Finance Penetration by Country, 2015

Features of Auto Finance Service in the US

Features of Auto Finance Service in Germany

Features of Auto Finance Service in Japan

Structure of Overseas Auto Finance Market by Capital Source, 2015

GM’s Auto Finance Layout Worldwide

Operating Performance of GM’s Auto Finance, 2011-2015

China’s Policies on Auto Finance Industry, 2004-2016

China’s GDP, 2012-2016

China’s Automobile Output, 2010-2020E

China’s Automobile Sales Volume and YoY Growth, 2012-2016

China’s Car Ownership, 2008-2015

Developmental Stages of Auto Finance in China

China’s Auto Finance Penetration, 2015-2020E

China’s Auto Finance Market Size, 2014-2020E

Structure of China’s Auto Finance Market by Capital Source, 2015

Major Auto Finance Companies in China1

Operating Performance of Major Auto Finance Companies in China, 2015

Total Assets of Auto Finance Companies in China, 2013-2015

Net Income of Auto Finance Companies in China, 2013-2015

Loans of Auto Finance Companies in China (by Type), 2013-2015

Main Business Structure of Auto Finance Companies in China, 2013-2015

Number of Automobiles (by Type) that Received Loans from Auto Finance Companies in China, 2013-2015

Cases of Chinese Internet Firms that Make Layout in Internet Auto Finance

Cases of Banks and Enterprises that Work Together to Make Layout in Auto Finance

Financial Leasing Procedure

Main Features of Auto Financial Lease

Comparison between Financial Leasing and Financial Loans

Development Stage of Auto Financial Leasing in China

Comparison of Business Models of Auto Financial Leasing

Penetration of Financial Leasing in Major Countries

Policies on Auto Financial Leasing in China, 2008-2015

Major Participants in Chinese Auto Financial Leasing Market

Trade Volumeof Used Vehicles and YoY Growth in China, 2011-2016

Trade Volumeof Used Vehicles in China by Region, 2015

Trade Volumeof Used Vehicles in China by Region, 2015 (%)

Trade Volumeof Used Vehicles in China by Type, 2014-2015 (%)

Trade Volumeof Used Vehicles in China by Service Life, 2015 (%)

Trade Volumeof Used Vehicles in China by Price Range, 2015 (%)

Ratio of Trade Volumeof Used Vehicles to That of New Vehicles in China, 2012-2015

Ratio of Trade Volumeof Used Vehicles to That of New Vehicles in Major Countries

Advantages and Disadvantages of Used Vehicle Finance Participants

Businesses of Major Suppliers of Used Vehicle Financial Services

Procedures of Internet Auto Finance and Traditional Auto Mortgage Loan

Local Authorities’ Policy Supports for Internet Finance

Cases of Capitals into Internet Auto Finance

Equity Structure of SAIC-GMAC

Net Interest Income and Net Income of SAIC-GMAC, 2013-2015

Main Business Types of SAIC-GMAC

Car Loan Process of SAIC-GMAC

Used Car Loan Service Flow of SAIC-GMAC

Development Course of Volkswagen Finance (China)

Net Interest Income and Net Income of Volkswagen Finance (China), 2013-2015

Main Types of New Car Loans of Volkswagen Finance (China)

Equity Structure of BYD Auto Finance Co., Ltd.

Business Performance of BYD Auto Finance Co., Ltd., 2015

Key Auto Finance Products of BYD Auto Finance Co., Ltd.

Business Flow of BYD Auto Finance Co., Ltd.

Busines Performance of Ford Automotive Finance (China), 2014-2015

Key Auto Finance Products of Ford Automotive Finance (China)

Loan Process of Ford Automotive Finance (China)

Equity Structure of Dongfeng Nissan Auto Finance Co., Ltd.

New Car Loan Products of Dongfeng Nissan Auto Finance Co., Ltd.

Used Car Loan Products of Dongfeng Nissan Auto Finance Co., Ltd.

Car Loan Process of Dongfeng Nissan Auto Finance Co., Ltd.

Dongfeng Nissan Auto Finance’s Low-Interest Promotion Schemes for All Dongfeng Nissan Cars, Jan-Feb 2016

Dongfeng Nissan Auto Finance’s Low-Interest Promotion Schemes for All Venucia Cars, Jan-Feb 2016

Brands Supported by Herald Leasing

Main Financial Leasing Types of Herald Leasing

Net Interest Income and Net Income of Toyota Motor Finance (China), 2013-2016

Loan Program of Toyota Motor Finance (China)

Comparison of Toyota Motor Finance (China)’s Smart Loan Products and Average Capital Plus Interest Products

Equity Structure of BMW Automotive Finance (China)

Net Interest Income and Net Income of BMW Automotive Finance (China), 2013-2015

Main Car Loan Products of BMW Automotive Finance (China)

Example of BMW Automotive Finance (China)’s Financial Leasing- Direct Leasing Scheme

Example of BMW Automotive Finance (China)’s Financial Leasing- Sale-and-Leaseback Scheme

Main Operations of Yulon Motor Finance Co., Ltd.

New Car Loan Types of Yulon Motor Finance Co., Ltd.

Equity Structure of Chongqing Auto Finance Co.,Ltd.

Financial Metrics of GAC-SOFINCO Automobile Finance, 2014-2015

Main Auto Finance Businesses of GAC-SOFINCO Automobile Finance

Approval Process of GAC-SOFINCO Automobile Finance

“360 Programme” After-sales Funds Quota of GAC-SOFINCO Automobile Finance

Equity Structure of Genius Auto Finance

Revenue and Gross Margin of Yongda Automobiles, 2013-2015

Financial Businesses of Yongda Automobiles

Revenue and Net Income of China Grand Auto, 2014-2016

Revenue Breakdown of China Grand Auto by Business, 2015

Financial Data of All Trust Leasing, 2015

Major Financial Leasing Schemes of All Trust Leasing

Financial Leasing Procedures of All Trust Leasing

Equity Structure of Shaanxi ChangyinConsumer Finance Co., Ltd.

Revenue and Net Income of Pang Da Group, 2013-2016

Operating Leasing and Financial Leasing of Pang Da ORIX Auto Leasing

Auto Financial Leasing Procedures of Pang Da ORIX Auto Leasing

Financial Data of Pang Da Leye Leasing, 2014-2015

Revenue and Net Income of Yaxia Automobile, 2013-2016

Revenue Breakdown of Yaxia Automobile by Business, 2013-2015

Revenue Structure of Yaxia Automobile by Business, 2013-2015

Purposes of Capitals Raised via Private Placement Plan of Yaxia Automobile, 2015

Major Partners of Chuangfu Finance Leasing

Features of Chuangfu Finance Leasing

Online Car Purchase Application Procedures of Chuangfu Finance Leasing

Revenue and Net Income of Zhejiang Jingu Co., Ltd., 2013-2016

Equity Structure of Yixin Capital

Major Partners of daikuan.com

Financial Leasing Schemes of eCapital

Major Customers of eCapital

Tesla-dedicated Financial Leasing Products of eCapital

Business Performance of Car Inc., 2014-2016

Revenue Structure of Car Inc., 2013-2016

Fleet Size of Car Inc., 2013-2016

Financial Leasing and Revenue of Car Inc., 2012-2016

Financial Leasing Procedures of Car Inc.

Six Advantages of Dafang Car Rental’s Platform (usedcar.dafang24.com/)

New Car Financing Schemes of Jiayin Financial Leasing

Used Car Financing Schemes of Jiayin Financial Leasing

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...