The report covers the following:

1. Composition and function of automotive seating

2. Size and Trends of global and Chinese automotive seating market

3. Competitive landscape and trends of global and China’s automotive seating industry

4. Automotive seating supply chain of major global and Chinese carmakers

5. Global and Chinese automotive seating manufacturers

Automotive seating industry, seemingly without technological barriers, is actually a capital-intensive business that does with high-tech expertise. First, automotive seating plants are usually adjacent to car factories, for the products are too large to be transported easily. Therefore, as carmakers add a new production base, automotive seating manufacturers need to follow up. In this case, substantial funds become a must. Second, safety, comfort, and light weight- three requirements on automotive seating- need rich technological accumulation and present high technological threshold. Moreover, a huge number of employees in automotive seating industry pose great challenges to managerial competencies.

Global automotive seating market has grown steadily on account of the two aspects. First, higher barriers in automotive seating industry lead to high market concentration and little competition. Automotive seating manufacturers have a greater say which enables them to raise prices constantly. Second, consumption is upgraded, a phenomenon starkly seen in China where consumers have higher requirements on automotive seating. Automotive seating saw an ASP of USD723 in 2010 with a market size of USD54 billion. The figures for 2015 were USD790 and USD70.1 billion. It is expected the market size will be valued at USD72.9 billion in 2016, and USD84.3 billion in 2020 when ASP arrives at USD865.

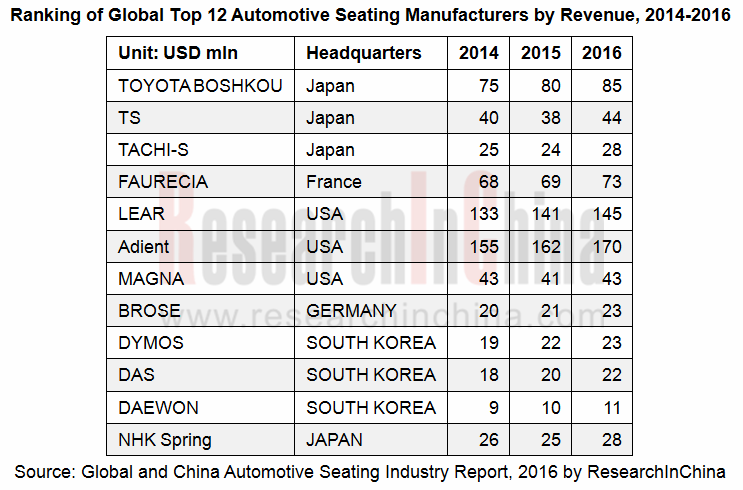

In automotive seating industry, Adient (a spin-off of Johnson Controls) and Lear are in the first camp, together holding about 48% of passenger car market. Adient has a broad customer base with almost all carmakers being its customers, while Lear provides products mainly for Ford, GM, BMW, and FCA and operates chiefly in North America and Europe but gets far less involved in the Asian-Pacific region. Adient seizes a dominant position in China with a market share of 40%.

Toyota Boshoku (a member of Toyota Group) and Faurecia (a subsidiary of PSA) fall into the second camp. Toyota Boshoku has been actively developing new customers outside Toyota in recent years. Faurecia serves mainly VW, PSA, and Renault-Nissan with its operations concentrated in Europe.

In the Chinese automotive seating market, almost all American cars and German cars are equipped with automotive seats from Adient and Lear, and among Japanese cars, all Honda cars carry automotive seats from TS, the majority of Toyota cars with automotive seats from Toyota Boshoku, and Nissan cars with automotive seats from a number of suppliers. Most of Chinese car brands use seats from joint ventures. Great Wall, BYD, Chery, and Geely adopt the model of partial own production and partial purchase from joint ventures. The joint ventures deliver cost-competitive products with better performance by relying on economy of scale and complete supply chain, while local brands retain their seating businesses just for enough say in negotiation with JVs and greater resilience in supply chain.

Most of Great Wall car seats come from its own seating business division and a few are provided by the joint venture between Great Wall and Yanfeng Johnson Controls. BYD’s car seats are largely supplied by its No. 16 business division and partly by Tachi-S, a three-party joint venture. Chery has low-end seats furnished by Wuhu Ruitai Auto Parts (a subsidiary of Chery) and high-end seats by Lear, making less and less purchase from Johnson Controls and GSK. Major suppliers of seats for Geely are Johnson Controls, Zhejiang Xindaimei Automotive Seating, and Zhejiang Jujin Automobile & Motor-cycle Accessories. Cooperation with South Korean Das provides solid support for Zhejiang Xindaimei Automotive Seating to gain a foothold in Geely. Zhejiang Jujin Automobile & Motor-cycle Accessories has investment from Geely and is also backed by Tachi-S.

As consumers pursue high-quality products, the ratio of home-grown seats will gradually fall, while that of JV seats will rise.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...