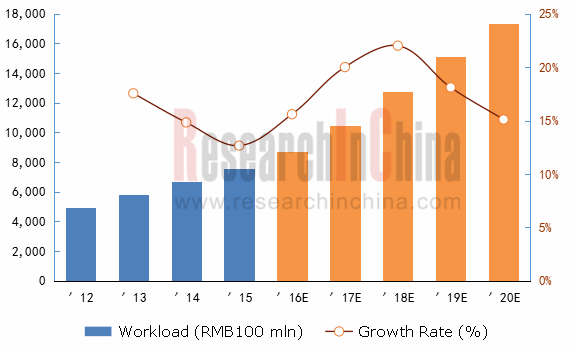

The huge Chinese automobile market always stimulates the demand for auto repair & beauty. According to the National Bureau of Statistics of China, the country's car ownership reached 172 million at the end of 2015, rising 11.7% over last year. Chinese auto repair & beauty market size amounted to RMB754.8 billion in 2015, jumping by 12.66% year on year. In future, the market size will show an annual growth rate of 19.17% during 2015-2020 with the consumers’ enhanced maintenance awareness and longer ownership time, and the market scale will report RMB1.7364 trillion in 2020.

Chinese Auto Repair & Beauty Market Size, 2012-2020E

Source: ResearchInChina

As for the competitive landscape, the main participants in China's auto repair industry include 4S stores, franchised maintenance service stations, comprehensive repair workshops, fast repair chain stores, special repair shops and a large number of roadside shops. There are more than 400,000 registered maintenance &repair enterprises which are divided into three categories with nearly 5 million employees in China, embracing at least 370,000 non-4S stores. The industry features a low concentration rate.

In China, auto 4S stores charge very high although their service quality is excellent, while repair shops and roadside repair shops claim low fees but their services vary dramatically, which cannot make consumers feel assured. Well-known chain stores offer the prices between 4S stores and roadside repair shops, embodying obvious cost advantages.

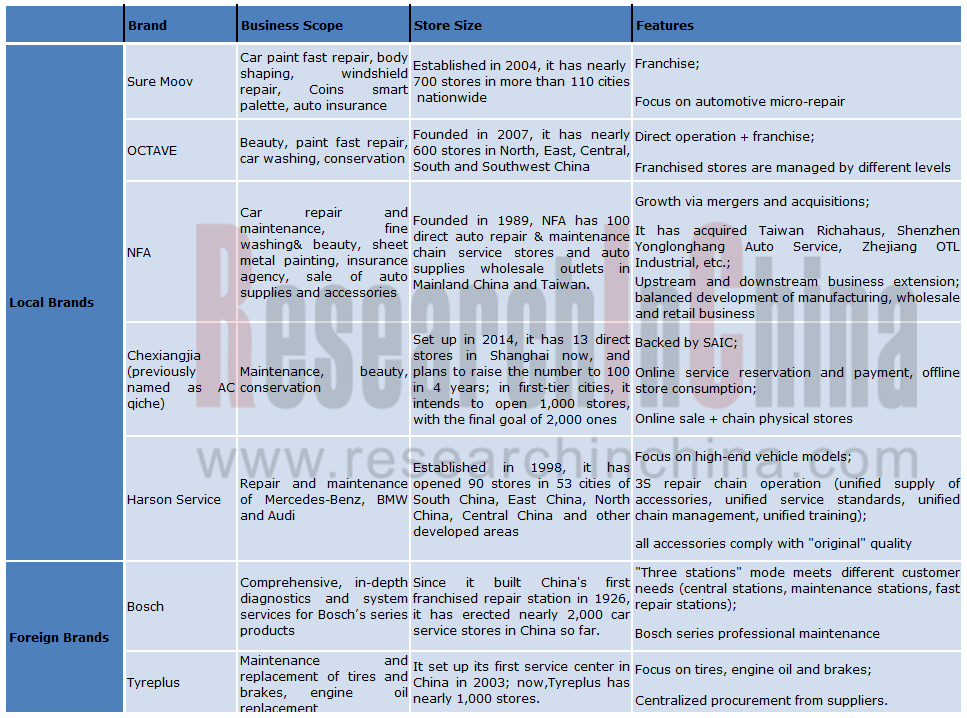

Currently, foreign brands Bosch and Michelin, as well as local brands Harson Service, Sure Moov and NFA have forged brand chain effect and enjoy better reputation. Bosch and Sure Moov have realized national layout, and other enterprises are actively expanding the network and making the layout rationally.

Under Bosch Group, Bosch Car Service is one of the largest independent automotive service networks in the world with a history of more than 95 years and boasting more than 17,000 service stations in over 150 countries. Its services consist mainly of comprehensive services and fast services, involving "vehicle maintenance inclusive of sheet metal & paint business and fast repair services" and "car beauty, car maintenance and tire services". The two types of services adopt franchise mode. Up to now, Bosch Car Service has opened 2,000 franchised stores in China.

Founded in 1989, NFA is listed on the Hong Kong Stock Exchange (00360.HK) and has more than 100 direct auto repair & maintenance chain service stores and auto supplies wholesale outlets in Mainland China and Taiwan. Its domestic auto repair & beauty subsidiaries contain New Focus Aiyihang, Changchun Quangda, Shanghai New Focus and New FocusYonglonghang. In addition, the company also operates New Focus Lighting & Power Technology (Shanghai) Co., Ltd. which involves in the production of automotive products. Therefore, the company holds a perfect aftermarket industrial chain.

Comparison between Major Independent Chain Auto Repair & Beauty Brands in China

Source: ResearchInChina

The enormous market potentials of the auto repair & beauty industry have attracted various investors to compete in the field, which not only injects adequate capital to the market, but also brings multiple innovative business models. For instance, Taobao, Jingdong (JD) and other Internet giantspump much capital in acquiring or creating start-ups, and then erect the O2O business model hereof. Meanwhile, some parts manufacturers and distributors move back into the downstream of the industry chain, so as to step in the auto repair & beauty industry; for example, Mobil No.1 keeps an eye on lubricating oil, and mailuntai.cn focuses on tire distribution; most of these companies expand the original product-based business to auto repair & beauty business.

The report highlights the following:

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

Overview of China auto repair & beauty industry (including definition, classification, industrial chain, industry policies and development trends, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China's auto aftermarket industry (including automobile industry, used car market, car rental, automobile insurance, etc.);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

The overall market size of China auto repair & beauty industry (including market size, investment and financing, competition pattern, channels and regional analysis);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Innovative business models of China auto repair & beauty industry (including the Internet +, parts +, etc.);

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

Profile, financial standing, service facilities, service networks and financing of 11 auto repair & beauty chain enterprises including Bosch, Michelin Tyreplus, Sure Moov, OCTAVE, AutoPrince, AnjiAutobund, NFA, Harson Service, Taobao Car, Chexiangjia and y1s.cn.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...