Starting in 2014, Internet giants like LeEco, Alibaba, Tencent, Google, and Baidu announced to set foot in the field of intelligent connected cars successively. Moreover, the emerging internet firms that venture into car manufacturing such as ZHICHEAUTO, Xiaopeng Motors, NextEV, and WM Motor were successively established, which obviously paces up the development of Internet giants' car manufacturing. In 2016, various news about Internet giants' car manufacturing aroused public concern. First, senior executives of traditional automakers left for internet companies that venture into car manufacturing, and then LeSEE was released and NextEV and JAC signed OEM agreements.

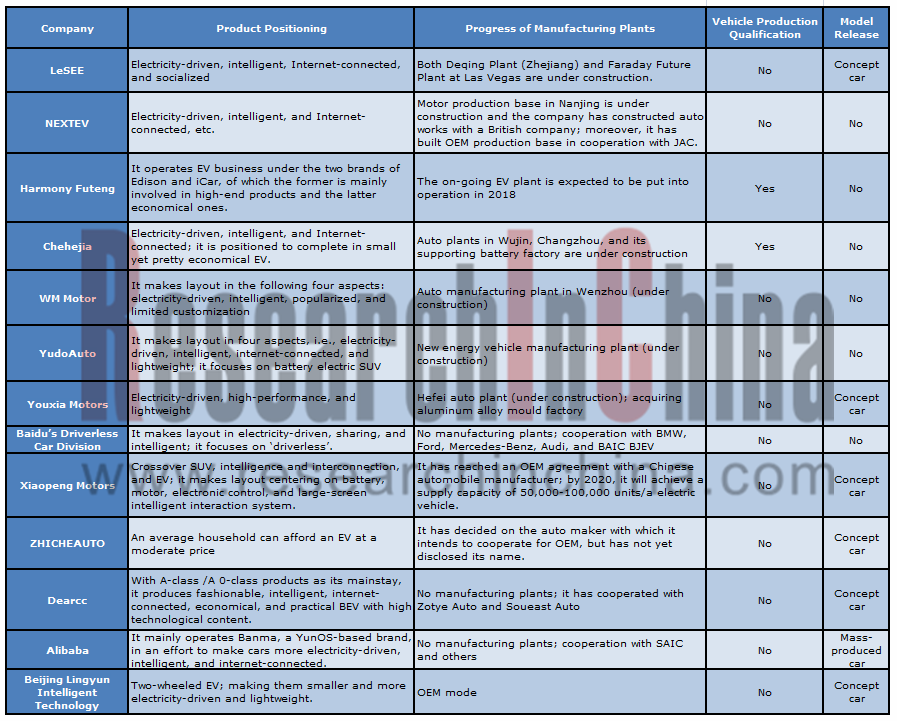

So far, however, the car manufacturing of most internet companies has been still in planning and conceptual phase, but only a few have made substantial progress, which is reflected in the following:

In terms of product, most players have launched concept cars. In July 2016, Alibaba and BAIC jointly rolled out Roewe RX5, a connected car model that can be mass produced, with the order volume of 25,000 units in the first month after the release.

As for the footprint of auto plants, some Internet giants that venture into car manufacturing has started construction of their independent manufacturing factories, such as LeSEE’s Zhejiang Base, Chehejia’sChangwu Base in Changzhou, WM Motor’s Wenzhou Base, and LingyunIntelligent’s Hefei Base; others have confirmed their OEM plants, including NextEV (with JAC), Xiaopeng Motors, and ZHICHEAUTO.

With regard to financing, most Internet giants that venture into car manufacturing have achieved A-round of financing, such as LeSEE (USD1.08 billion), WM Motor (USD1 billion), and Chehejia (USD780 million); only a few companies are conducting B round of financing.

In terms of automotive manufacturing qualification, only a small number of Internet firms have gained qualification for the production of new energy vehicles through M&A or cooperation, these companies including Dearcc (cooperation withSoueast Motor) and Harmony Futeng (through the holding of Zhejiang Green Field Motor). As yet, there has been no individual Internet company that has obtained the qualification for manufacturing new energy vehicles.

In the short run, restricted by basic manufacturing of automobiles and layout of production line, the development of Internet giants that venture into car manufacturing is pessimistic, and they still need to put fund into the development of telematics products, ADAS, and other Internet technological products.

But in the long run, according to the strategic planning for Internet giants' car manufacturing, Internet giants that venture into car manufacturing happen to share the development direction with traditional car makers. Development of electricity–driven, intelligent, and internet-connected auto products helps make it possible to mutually fuse Internet companies’ hardware-oriented development with internet-connection of traditional auto makers, at length leading to a gradual fusion development. This mainly comes out of the following factors: (1) favorable polices on Internet Plus and new energy vehicles; (2) the increase in demand for personalized and customized automobiles; (3) With Internet technical superiority, Internet giants that venture into car manufacturing could easily make layout in Internet-connected vehicles in advance.

The report mainly includes three sections:

(1)Industry policies, development history, development path, financing, and development trend, etc. of China’s Internet giants' car manufacturing industry;

(2)Current situation, enterprise presence, and development trend, etc. of intelligent, electricity-driven, and Internet-connected automobiles in China

(3)Core talents, financing, plants, strategic planning, and development layout, etc. of 13 Chinese Internet giants that venture into car manufacturing

Development History of Major Internet Giants That Venture into Car Manufacturing in China

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...