China New Energy Vehicle Power Electronics Industry Report, 2017-2020

-

Mar.2017

- Hard Copy

- USD

$2,900

-

- Pages:270

- Single User License

(PDF Unprintable)

- USD

$2,700

-

- Code:

YS015

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,300

-

- Hard Copy + Single User License

- USD

$3,100

-

China New Energy Vehicle Power Electronics Industry Report, 2017-2020 by ResearchInChina highlights the following:

Development status of new energy vehicle power electronics in China e.g. drive motor controller, DC/DC converter, on-board charger, including industrial chain, cost analysis, business model, competition pattern, competition of mainstream manufacturers, respective elaborations on passenger vehicle and commercial vehicle power electronics competition pattern as well as a detailed analysis on technical status and trends of automotive power electronics;

Development status of new energy vehicle power electronics in China e.g. drive motor controller, DC/DC converter, on-board charger, including industrial chain, cost analysis, business model, competition pattern, competition of mainstream manufacturers, respective elaborations on passenger vehicle and commercial vehicle power electronics competition pattern as well as a detailed analysis on technical status and trends of automotive power electronics;

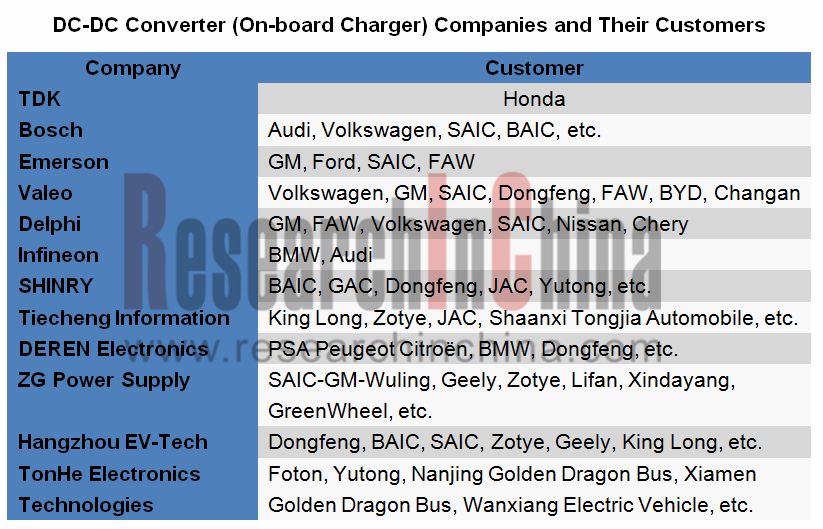

Analysis on 5 Chinese DC/DC and on-board charger enterprises, 22 Chinese motor controller enterprises, 8 global motor controller enterprises and 6 global IGBT enterprises, including corporate operation, development strategy, supply chain, new energy vehicle power electronics;

Analysis on 5 Chinese DC/DC and on-board charger enterprises, 22 Chinese motor controller enterprises, 8 global motor controller enterprises and 6 global IGBT enterprises, including corporate operation, development strategy, supply chain, new energy vehicle power electronics;

Overview of new energy vehicle power electronics, including definition, classification, upstream & downstream industry chain;

Overview of new energy vehicle power electronics, including definition, classification, upstream & downstream industry chain;

Operating environment for new energy vehicle power electronics, involving policy environment, the development of new energy vehicle market as well as its influence on new energy vehicle power electronics.

Operating environment for new energy vehicle power electronics, involving policy environment, the development of new energy vehicle market as well as its influence on new energy vehicle power electronics.

New energy vehicle electronic technology generally consists of battery management system (BMS), on-board charger, inverter, vehicle control unit (VCU)/hybrid control unit (HCU), pedestrian detection system, DC/DC, etc.. BMS, motor control inverter and VCU/HCU as core components of new energy vehicle must have very high security and reliability. New energy vehicle power electronics usually include AC/DC charger, DC-AC inverter and DC-DC; besides, there are motor controller for electric A/C compressor, PTC heater for electric A/C and others.

In the future, DC/DC converter and inverter will be integrated into new energy vehicle power controller, similar to VCU integration effect. However, the controller is generally placed in the nearest inverter unit to make software system shape a larger integration.

Motor controller price varies according to specifications and performance requirements. Currently, motor controller is generally priced at RMB20,000-30,000/set for big buses and RMB5,000-15,000/set for passenger vehicles. PHEV and HEV typically adopt the multi-motor architecture incorporating TM motor and ISG motor, and the corresponding motor controller costs higher.

Prices of DC-DC converter: (1) 2KW, RMB1,800-2,000/set; (2) 1.8KW, RMB1,500-1,700/set; (3) 1KW, RMB1,000/set.

Prices of on-board charger: (1) three-phase charger 10KW, RMB4,500-5,000/set; (2) single phase charger [EV] 6.6~7.2KW, RMB3,200-4,000/set; (3) single phase charger [PHEV] 3.3KW, RMB2,300-3,000/set.

As concerns the technology trends:

At present, EV motor controller mainly uses silica-based material oriented IGBT modules as before, but SiC-based WBG semiconductor devices have broken through limitations of silicon semiconductor devices in pressure-proof level, operating temperature, switching loss and switching speed, e.g. Nissan Leaf integrates motor, reducer and controller. This represents a trend towards standardized product from extremely small volume.

Functional integration is another aspect of system integration degree (SID). EV is possible to act as an energy storage element of new energy grid in the future, which requires the bi-directional association between vehicle and grid (V2G). And vehicle motor control inverter can also be used as charging/grid-feedback inverter for bi-directional connection between battery and grid, thus realizing integration of motor drive and two-way charger.

Two-way DC-DC converter has also been accepted by the market over last two years. It can achieve two-way energy transmission more easily, decrease the use of other electronic devices and economize the cost to some extent; plus advantages like small size and high efficiency, two-way DC-DC converter will find wider applications.

1 Overview of Automotive Power Electronics

1.1 Overview

1.2 Motor Controller (Inverter)

1.2.1 Fundamentals

1.2.2 Product Classification

1.2.3 Technology Roadmap

1.2.4 Technology Trends

1.3 DC-DC Converter

1.3.1 Product Classification

1.3.2 Technology Trends

1.3.3 Technical Evaluation Indicators

1.3.4 Technical Difficulties and Industry Barriers

1.3.5 Main Components and Cost Structure

1.4 On-board Charger (OBC)

1.5 Summary

2 EV Motor Controller Market

2.1 Policy Environment

2.2 Market Size

2.3 Industry Profit

2.4 Supply Modes

2.5 Competitive Landscape

2.6 Supply Relation among Enterprises in the World

3 EV DC/DC and Charger Market

3.1 Market Size

3.2 Competitive Landscape

3.3 Technology Trends

3.4 Supply Relation among Enterprises in the World

4 Major Chinese DC/DC and Charger Enterprises

4.1 Hangzhou EV-Tech Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 Automotive DC/DC and Chargers

4.1.4 Capacity

4.2 SHINRY Technologies Co., Ltd.

4.2.1 Profile

4.2.2 Automotive DC/DC and Chargers

4.2.3 R&D and Technical Capability

4.3 Hangzhou Tiecheng Information Technology Co.,Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Automotive DC/DC and Chargers

4.3.4 Technical Characteristics

4.4 Shijiazhuang Tonhe Electronics Technologies Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 Automotive DC/DC and Chargers Business

4.4.4 Technical Characteristics

4.5 Luoyang Grasen Power Technology Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 Automotive DC/DC and Chargers Business

5 Chinese EV Motor Controller (Inverter) Manufacturers

5.1 Shanghai E-drive Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 EV Motor Controller Business

5.1.4 Technical Characteristics

5.2 Shenzhen Inovance Technology Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Operation of and Development Strategy for EV Motor Controller Business

5.2.4 EV Motor Controllers and Technical Characteristics

5.3 Shanghai Dajun Technologies, Inc.

5.3.1 Profile

5.3.2 Development History

5.3.3 Operation

5.3.4 Business Model

5.3.5 EV Motor Controllers and Technical Characteristics

5.3.6 Business in EV Field

5.3.7 Development Strategy in EV Field

5.4 Tianjin Santroll Electric Automobile Technology Co., Ltd.

5.4.1 Profile

5.4.2 EV Business

5.4.3 Main EV Power System Products and Technical Characteristics

5.4.4 Development Strategy in EV Field

5.5 Zhongshan Broad-Ocean Motor Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 EV Motor Controller Business

5.5.4 R&D

5.5.5 Development Strategy

5.6 United Automotive Electronic Systems Co., Ltd. (UAES)

5.6.1 Profile

5.6.2 Production and R&D

5.6.3 EV Motor Controller Business

5.7 Hunan CRRC Times Electric Vehicle Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 EV Controller Business

5.7.4 Dynamics of Drive System Business

5.7.5 Capacity

5.8 BYD

5.8.1 Profile

5.8.2 Operation

5.8.3 EV Motor Controller Business

5.9 Zhuhai Enpower Electric Co., Ltd.

5.9.1 Profile

5.9.2 Sales and Costs

5.9.3 Sales Model

5.9.4 Major Customers

5.9.5 EV Motor Controllers

5.9.6 EV Motor Controller Business

5.9.7 R&D

5.9.8 Motor Controller Development Strategy

5.10 Shenzhen V&T Technologies Co., Ltd.

5.10.1 Profile

5.10.2 Sales and Costs

5.10.3 Sales Model

5.10.4 Major Customers

5.10.5 EV Motor Controller Business

5.10.6 R&D

5.10.7 Motor Controller Development Strategy

5.11 Fujian Fugong Power Technology Co., Ltd.

5.11.1 Profile

5.11.2 External Cooperation

5.11.3 NEV Drive Assembly Business

5.11.4 Capacity Planning

5.12 Chroma ATE Inc.

5.12.1 Profile

5.12.2 Operation

5.12.3 EV Motor Controller Business

5.12.4 Development Strategy in EV Field

5.13 Delta Electronics

5.13.1 Profile

5.13.2 Operation

5.13.3 Business in EV Field

5.14 Jing-Jin Electric Technologies (Beijing) Co., Ltd.

5.14.1 Profile

5.14.2 EV Motor Controller Business

5.15 DEC Dongfeng Electric Machinery Co., Ltd.

5.15.1 Profile

5.15.2 EV Controller Business

5.16 Nidec (Beijing) Drive Technologies Co., Ltd.

5.16.1 Profile

5.16.2 Operation

5.16.3 EV Motor Controller Business

5.17 Time High-Tech Co., Ltd.

5.17.1 Profile

5.17.2 EV Motor Controller Business

5.18 JEE Automation Equipment Co., Ltd.

5.18.1 Profile

5.18.2 E-drive Products for Passenger Cars

5.18.3 E-drive Products for Commercial Vehicles

5.18.4 EV E-drive Business

5.19 Shandong Deyang Electronics Technology Co., Ltd.

5.19.1 Profile

5.19.2 EV E-drive Business

5.20 Beijing Siemens Automotive E-Drive System Co., Ltd.

5.21 Prestolite E-Propulsion Systems (Beijing) Limited

6 Global Motor Controller (Inverter) Manufacturers

6.1 Hitachi Automotive Systems

6.1.1 Profile

6.1.2 Operation

6.1.3 Business in EV Field

6.2 Mitsubishi Electric

6.2.1 Profile

6.2.2 Operation

6.2.3 Business in EV Field

6.3 Meidensha

6.3.1 Profile

6.3.2 Operation

6.3.3 Business in EV Field

6.4 Toshiba

6.4.1 Profile

6.4.2 Operation

6.4.3 Business in EV Field

6.5 Hyundai Mobis

6.5.1 Profile

6.5.2 Operation

6.5.3 Business in EV Field

6.6 Delphi

6.6.1 Profile

6.6.2 Operation

6.6.3 Business in EV Field

6.7 Bosch

6.7.1 Profile

6.7.2 Operation

6.7.3 Business in EV Field

6.8 Continental

6.8.1 Profile

6.8.2 Operation

6.8.3 Business in EV Field

7 IGBT Suppliers

7.1 Fuji Electric

7.1.1 Profile

7.1.2 Operation

7.1.3 Business in EV Field

7.1.4 Development Strategy in EV Field

7.2 Infineon

7.2.1 Profile

7.2.2 Operation

7.2.3 Business in EV Field

7.2.4 Development Strategy in EV Field

7.3 Denso

7.3.1 Profile

7.3.2 Operation

7.3.3 Business in EV Field

7.4 ROHM

7.4.1 Profile

7.4.2 Operation

7.4.3 Business in EV Field

7.5 IR

7.5.1 Profile

7.5.2 Operation

7.5.3 Business in EV Field

7.6 Semikron

7.6.1 Profile

7.6.2 Operation

7.6.3 Business in EV Field

Diagram for Battery Electric Vehicle Control System

Diagram for Hybrid Electric Vehicle Control System

Types of Energy Conversion Components and Power Devices

Types and Applicable Scope of Automotive Power Electronics

Battery Electric Vehicle-use Power Supply Architecture (IEEE 2015)

Hybrid Electric Vehicle-use Power Supply Architecture (IEEE 2016)

Principle of Electric Vehicle Motor Controllers

Drive Motor Controllers

Inverter Supply Relationship Diagram

Classification of EV Motor Controllers

Second-generation Prius-use IGBT Power Modules and Motor Controllers

Second-generation Prius-use IGBT Power Modules and Motor Controllers

Structure of Hitachi’s First-generation Motor Controllers

Structure of Hitachi’s Second-generation Motor Controllers

Hitachi’s Double-sided Pin-Fin IGBT Modules and Third-generation Motor Controllers

Bosch’s Third-generation Automotive IGBT Power Modules

Bosch’s INV2CON Motor Controller

Bosch’s INVCON2.3 Motor Controller

Continental’s EPF2 Series Motor Controllers

Continental’s New-generation Motor Controllers

SiC (left) and Si (right) Motor Controllers Developed by Toyota and Denso Jointly

Meidensha’s SiC Motor Controller-Motor Integrators

DC-DC Converters

Schematic Diagram of DC-DC High and Low Voltage Converters

Schematic Diagram of DC-DC 12V Voltage Stabilizers

Schematic Diagram of DC-DC High Voltage Boosters

Typical Technical Parameters of DC-DC Converters

Cost Ratio of Electric Vehicle Power Devices

Policies on EV Motor Controllers in China

Motor Drive and Power Electronic Technology R & D Goals and Tasks

China’s EV Motor Controller Demand and Market Size, 2015-2020E

Motor Controller Gross Margin of Inovance Technology and V&T Technologies, 2011-H1 2016

China’s EV Motor Controller Supply Modes

Market Share of Major Electric Passenger Car Motor Controller (Inverter) Manufacturers in China, 2016

Motor and Controller Suppliers of Major Electric Bus Companies in China

Motor and Controller Suppliers of Major Passenger Car Companies in China

Inverter Supply of Some Vehicle Models Worldwide

China’s DC/DC Converter and Automotive Charger Market Size, 2015-2020E

DC-DC Converter (Automotive Charger) Companies and Supporting Situation

DC/DC Converter Supply of Some Vehicle Models Worldwide

Revenue and Profit of Shijiazhuang Tonhe Electronics Technologies, 2015-2016

Equity Structure of Shanghai Edrive (before/after Acquisition)

Operating System of Shanghai Edrive (after Acquisition)

Major Customers of Broad-Ocean Motor and Shanghai Edrive

Financial Indicators of Shanghai Edrive, 2009-2016

Main Products of Shanghai Edrive

Production Base Construction of Shanghai Edrive

Electric Vehicle Drive Motor System Shipment of Shanghai Edrive, 2013-Q1 2015

Core Patented Technologies of Shanghai Edrive

Revenue and Net Income of Inovance Technology, 2009-2016

Gross Margin of Inovance Technology, 2009-2016

Revenue of Inovance Technology by Product, 2012-2016

Gross Margin of Inovance Technology by Product, 2012-2016

EV Motor Controller Project Progress of Inovance Technology, Q1 2016

Automotive Electronics Customers of Inovance Technology

Plug-in Hybrid Electric Bus System Solutions of Inovance Technology

Main EV Motor Controllers and Applications of Inovance Technology

Performance of Shanghai DAJUN Technologies, 2012-2016

Main Materials Purchased by Shanghai DAJUN Technologies

Technical Parameters of N110WSA Motor Controller of Shanghai DAJUN Technologies

Technical Parameters of A360140J Motor Controller of Shanghai DAJUN Technologies

Motor Drive System Output and Sales Volume of Shanghai DAJUN Technologies, 2012-2016

Subsidiaries of Shanghai DAJUN Technologies

Equity Structure of Tianjin Santroll

Key Financial Indicators of Tianjin Santroll, 2014-2015

IV-generation Plug-in Hybrid System Configuration of Tianjin Santroll

Battery Electric Time Share of China’s Typical City Bus Cycle (CCBC)

Actual Operating Proportion of Battery Electric Bus 803 in Tianjin

5th-generation Electronic Control Units of Tianjin Santroll

Equity Structure of Broad-Ocean Motor

New Energy Vehicle Powertrain Revenue of Broad-Ocean Motor, 2012-2016

30KW Motor (YTD030W04) + Controller (KM6025W05) Drive Motor System of Broad-Ocean Motor

Ongoing New Energy Vehicle Electric Drive System Projects of Broad-Ocean Motor

New Energy Vehicle Market Layout of Broad-Ocean Motor

Ten-year Development Strategy of Broad-Ocean Motor

Distribution of UAES’ Production Bases and R & D Centers

Overview of UAES’ R & D Centers

Power Drive Product Lines of UAES

Overview of UAES’ Electric Drive Test Equipment

Planning of UAES in Power Electronic Controllers

R & D Capability of UAES in Power Electronic Controllers

Structure and Specifications of UAES’ Single Motor Control Products

Structure and Specifications of UAES’ Double Motor Control Products

Financial Indicators of Hunan CRRC Times Electric Vehicle, 2011-2015

Motor Controllers of Hunan CRRC Times Electric Vehicle

BYD’s Workforce, 2007-2015

Car Output and Sales Volume of BYD, 2010-2016

Revenue, Net Income and Gross Margin of BYD, 2007-2016

BYD’s Revenue Breakdown (by Product), 2007-2016

BYD’s Gross Margin (by Product), 2008-2016

BYD’s Revenue Breakdown (by Region), 2008-2016

Bidirectional Inversion Charging/Discharging Electric Drive Motor Controllers

BYD’s Bidirectional Inversion Charging/Discharging Technology

BYD’s Process Capability for Motor Controller

BYD’s Key Production Lines and Equipment for Motor Controller

Revenue Breakdown of Zhuhai Enpower Electric Co., Ltd. by Product, 2013-2015

Main Raw Materials Procurement of Zhuhai Enpower Electric Co., Ltd., 2013-2015

Top5 Suppliers and Procurement Breakdown of Zhuhai Enpower Electric Co., Ltd., 2015

Motor Controller Partners of Zhuhai Enpower Electric Co., Ltd.

Top5 Clients and Revenue Breakdown of Zhuhai Enpower Electric Co., Ltd., 2013-2015

Capacity, Output and Sales Volume of Zhuhai Enpower Electric Co., Ltd. by Product, 2013-2015

Average Price of Zhuhai Enpower Electric Co., Ltd.’s Motor Controllers, 2013-2015

R&D Projects of Zhuhai Enpower Electric Co., Ltd.

Overview of Zhuhai Enpower Electric Co., Ltd.’s Projects with Raised Funds via IPO

Revenue and Net Income of Shenzhen V&T Technologies Co., Ltd., 2011-2016

Revenue Breakdown of Shenzhen V&T Technologies Co., Ltd. by Product, 2011-2016

Procurement and Purchase Price of Main Raw Materials for Motor Controller of Shenzhen V&T Technologies Co., Ltd., 2012-2015Q1-Q3

Product Sales Model of Shenzhen V&T Technologies Co., Ltd., 2011-2014

Top5 Customers of Shenzhen V&T Technologies Co., Ltd., 2011-2014

Shenzhen V&T Technologies Co., Ltd.’s Major Customers for Its EV Motor Controllers

Average Unit Price of Shenzhen V&T Technologies Co., Ltd.’s EV Motor Controllers, 2012-2015

EV Motor Controller Capacity and Utilization of Shenzhen V&T Technologies Co., Ltd., 2012-2015

EV Motor Controller Sales Volume of Shenzhen V&T Technologies Co., Ltd., 2012-2015

Shenzhen V&T Technologies Co., Ltd.’s Core Technologies for Motor Controller

Shenzhen V&T Technologies Co., Ltd.’s Projects with Raised Funds via IPO

Main Financial Indices of Fujian Fugong Engineering Technology Co., Ltd., 2014-Oct. 2015

Architecture of CHS Dual-mode Hybrid System

Diagram of Internal CHS Hybrid Transmission Case

Auto Models with CHS Hybrid System

Global Presence of Chroma ATE Inc.

Financial Indices of Chroma ATE Inc. (Group’s Consolidation), 2009-2016

Chroma ATE Inc.’s Revenue Breakdown (by Division), 2012-2016

CR Series Motor Controller Product Line of Chroma ATE Inc.

Key Technical Parameters of Chroma ATE Inc.’s CR Series Motor Controller

Financial Indices of Delta Electronics, 2009-2016

Capacity, Output and Output Value (by Product) of Delta Electronics, 2013-2015

Sales Volume (by Product) of Delta Electronics, 2014-2015

Key R&D Equipment of Jing-Jin Electric Technologies (Beijing) Co., Ltd.

Performance Parameters of 150KW Vehicle-used Motor Controller of Jing-Jin Electric Technologies (Beijing) Co., Ltd.

EV Motor Controllers of DEC Dongfeng Electric Machinery Co., Ltd.

New Energy Vehicle SRD Motor of Nidec (Beijing) Drive Technologies Co., Ltd.

Battery Electric Power & Control System Assemblies of Time High-Tech Co., Ltd.

EV Power Control System Composition Solution of Time High-Tech Co., Ltd.

Key Technical Parameters of Time High-Tech Co., Ltd.’s EV Motor Controller

Revenue of Hitachi Automotive Systems, FY2011-FY2015

Hitachi Automotive Systems’ Major Customers for Its EV Inverters

Mitsubishi Electric’s Financial Indices, FY2010-2016

Mitsubishi Electric’s Revenue Breakdown (by Business), FY2015

Mitsubishi Electric’s Major Customers for Its EV Inverters

Meidensha’s Financial Indices, FY2012-FY2016

Meidensha’s Revenue and Profits (by Division), FY2014-FY2015

Meidensha’s Major Customers for Its EV Inverters

Toshiba’s Revenue and Net Income, FY2011-2015

Toshiba’s Revenue Structure (by Business), FY2011-FY2015

Revenue of Toshiba’s Electronic Devices & Components Division, FY2011-FY2015

Toshiba’s Major Customers for Its EV Inverters

Hyundai Mobis’ Revenue and Operating Margin, FY2006- FY2015

Hyundai Mobis’ Major Customers for Its EV Inverters

Delphi’s Workforce, 2011-2015

Delphi’s Main Financial Indices, 2013-2015

Delphi’s Revenue Structure (by Division), 2011-2015

Delphi’s Gross Margin (by Division), 2010-2015

Main Growth Fields of Delphi (by Division), 2013-2016

Delphi’s Revenue Breakdown (by Region), 2010-2014

Delphi’s Major Customers and Regional Distribution

Delphi’s Major Customers and Revenue Contribution Rates, 2015

Delphi’s Product Distribution in EV Field

Technical Features of Delphi’s EV Inverters

Delphi’s Major Customers for Its EV Inverters

Bosch’s Workforce, 2010-2015

Bosch’s Revenue and EBIT, 2010-2015

Bosch’s Revenue Structure (by Division), 2012-2014

Revenue and EBIT of Bosch’s Automotive Division, 2012-2014

Bosch’s Revenue Structure (by Region), 2012-2014

Bosch’s Revenue in Major Countries, 2012-2014

Bosch’s Major Customers for Its EV Inverters

Continental’s Workforce, 2009-2014

Continental’s Revenue and EBIT, 2009-2015H1

Continental’s Revenue Structure (by Division), 2008-2013

Continental’s Revenue Structure (by Region), 2008-2013

Continental’s Major Customers for Its EV Inverters

Fuji Electric’s Main Financial Indices, FY2010-FY2016

Fuji Electric’s Revenue and Operating Income (by Business), FY2013-FY2016

Fuji Electric’s Revenue Breakdown (by Region), FY2011-FY2016

IGBT and SiC R&D Planning of Fuji Electric, 2015-2021

7th-generation IGBT Product Planning of Fuji Electric, 2016-2018

Industrial IGBT / SiC Loss Comparison, 2015-2017

Automotive Power Module Development Roadmap of Fuji Electric, 2005-2025

Global Rankings of Infineon’s Three Major Businesses, 2013

Infineon’s Revenue Breakdown (by Region), FY2013-FY2015

Infineon’s Revenue Breakdown (by Division), FY2013-FY2015

Infineon EiceDRIVER? Family IGBT Modules

Denso’s Workforce, FY2011-FY2015

Denso’s Revenue and Profits, FY2013-FY2015

Denso’s Operating Income and Net Income, FY2011-FY2015

Denso’s Revenue Structure (by Division), FY2013-FY2015Q1

Denso’s Revenue Breakdown (by Division), FY2013-FY2015Q1

Denso’s Revenue and Operating Income (by Region), FY2013-FY2015

Denso’s Revenue Breakdown (by Customer), FY2010-FY2014

Denso’s Client Structure, FY2013-FY2014

Power Electronics Projects of Japanese NEDO

ROHM’s Financial Indices, FY2010-FY2015

ROHM’s Revenue Breakdown (by Business), FY2012-FY2017

ROHM’s Revenue Breakdown (by Region), FY2012-FY2017

ROHM’s Revenue Breakdown (by Application), FY2012-FY2017

Main Technical Parameters of ROHM’s Vehicle-used IGBT Module

Development History of ROHM’s SiC Products

SiC-based Power Device Lineup of ROHM

IR’s Revenue Breakdown (by Division), FY2012-FY2014

Operation of Semikron

Key IGBT Brands of Semikron

Product Portfolio of Semikron’s SKiM modules

Key Features of Semikron’s SKiM modules

Product Portfolio of S Semikron’s SKiiP IPM

Key Features of Semikron’s SKiiP IPM

Structure of Semikron’s SKAI Power Electronic Platform

Product Portfolio of Semikron’s SKAI Power Electronic Platform

Key Features of Semikron’s SKAI Power Electronic Platform

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...