Global and China Automotive Instrument Cluster and Head-up Display (HUD) Industry Report, 2016-2020

-

May 2017

- Hard Copy

- USD

$2,400

-

- Pages:90

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW232

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China Automotive Instrument Cluster and Head-up Display (HUD) Industry Report, 2016-2020 highlights the following:

1. Global and China automobile market

2. Instrument cluster and HUD market and industry

3. Development trends of instrument cluster and HUD

4. DLP, laser scanning and AR HUDs

5. Key vendors

HUD (Head-up Display) falls into windshield type (W-type) and combined type (C-type). It was initially mounted on GM Corvette in 2001, and then the first color HUD was launched by BMW in 2004. Global OEM HUD market size attained USD560 million in 2016, surging by 33% from a year earlier, and is predicted to leap to USD1,780 million in 2020. Market size and shipments of W-type were roughly USD530 million and 2 million sets respectively in 2016, and will expectedly move up to USD1,715 million and about 7 million sets in 2020; C-type saw market size of around USD30 million and shipments of 600,000 sets in 2016, and the figures are estimated to climb to USD65 million and 1.7 million sets respectively in 2020.

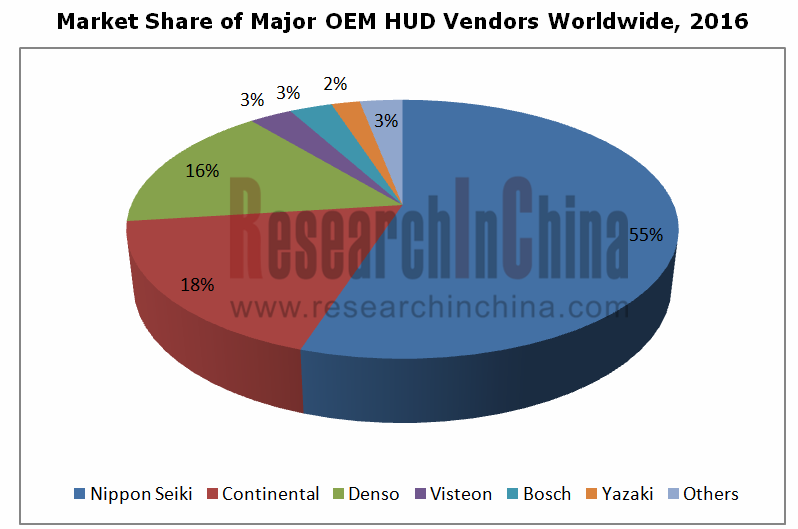

Nippon Seiki under Honda seizes a market share of over 50%. BMW, GM and Audi are the three major clients of Nippon Seiki, and their models including BMW 5 Series, 7 Series, X Series, Audi Q7 and GM Cadillac and Buick all carry Nippon Seiki’s HUDs. The company plans a capacity of 3 million units in 2020, most of which will be W-type. It now has 4 production bases in Japan, North America and the UK, and is building a new one in Miyoshi, Hiroshima Prefecture which is scheduled to come into production next year. Continental’s main clients are Mercedes-Benz, Audi and BMW, and its HUDs find application in Mercedes-Benz C Class, Audi A6 and A7 and BMW 3 Series. In January 2017, Continental and the U.S.-based Digilens reached a strategic cooperation agreement for development of AR-HUD. Denso primarily supports Toyota and Hyundai; Visteon is a supplier of PSA; BMW Mini bears Bosch’s HUD.

In OEM market, C-type will expectedly see a declining market share due to poor user experience, and even Chinese automakers use few HUDs of such type, for example, Geely equips its Borui models with W-type. AR-HUD is the general direction of OEM. To achieve AR (augmented reality) of the true sense, DLP (digital light processing) projection technology is indispensable. AR-HUD will come out in 2018 and be the mainstream in 2021. However, for digital micromirror device (DMD), the core component of DLP projector, and related technologies are monopolized by Texas Instruments, coupled with complicated optical path and much higher price of DMD than TFT-LCD, DLP’s costs will seldom drop despite maturity of the technology for quite a few years. Therefore, laser scanning type HUD is likely to capture the market in the future, hopefully taking a share of 10% in OEM market in 2021, 25-30% in 2025.

As for aftermarket (AM), reflection-type TFT-LCD is dominant as DLP with more complicated optical path and higher internal temperature is unacceptable to AM manufacturers whose technology capabilities are relatively weak. With marked improvement in brightness of OLED, transparent OLED will be the development orientation of AM, but OLED for HUD will not appear in a short time because of little use in AM and monopoly of LG and Samsung in technology and capacity.

1 Global and Chinese Automobile Markets

Global Sales of Light Vehicles, 2010-2020E

Global Sales of Light Vehicles by Region, 2014-2017

Automobile Sales in China, 2005-2017

Overview of Chinese Automobile Market, 2016

2 Automotive HUD and Instrument Cluster Market

OEM Market Size of Automotive HUD, 2015-2021E

Automotive HUD Shipments, 2016-2021E

Aftermarket HUD Shipments Worldwide, 2016-2021E

Distribution of OEM HUD Types by Technology, 2016-2025E

Distribution of Aftermarket HUD Types by Technology, 2016-2025E

Market Share of Major OEM HUD Vendors in the World, 2016

Global Automotive Instrument Cluster Market Size, 2016-2022E

Market Share of Major Automotive Instrument Cluster Makers in the World, 2016

Market Distribution of World’s Automotive Instrument Clusters by Type, 2016-2020E

Automotive Display Market

Market Share of World’s Key TFT-LCD On-board Display Vendors (by Shipment), 2016

Market Share of World’s Key TFT-LCD On-board Display Vendors (by Value), 2016

AMOLED On-board Display

3 Profile of HUD

HUD Falls into Windshield Type and Combined Type

Structure of W-type HUD

Light Path of W-type HUD

Structure of C-type HUD

Parameters of Typical C-type HUD

Cheapest HUD

HUD of Audi A7

Anatomy of Audi A7 HUD

Exceedingly High Technical Threshold

Extreme Difficulty in Production

4 DLP HUD

HUD Basics -- VID

Obvious Superiority of DLP Performance

Problem about Resolution

Interpupillary Distance (IPD)

Comparison of HUD Technologies

DLP is the Most Mature Technology with Best Performance Currently

Light Path of DLP-Type HUD

5 Laser Scanning HUD

PicoP Laser Beam Scan Engine of Microvision

MicroPicoP is Most Typical Laser Scanning

Pocket Projector Celluon PicoPro

Mitsubishi’s and Pioneer’s Laser Scanning HUDs Adopt the Patents of MicroVision

Laser Scanning HUD of Intersil

Laser Scanning HUD of Panasonic

DLP HUD of Panasonic

Jaguar’s First Use of OEM Laser Scanning HUD

Maxim’s Laser Scanning HUD 8-channel DAC and Bridged SoC

1st-generation Navdy DLP Hud is Priced at USD499

Analysis of Navdy

6 AR HUD

HUD Trend – Perfect Fusion of AR (Augmented Reality) with ADAS

Augmented Reality Head-Up Display

Augmented Reality Head-Up Display ACC

AR HUD (of Continental) to be Used on KIA K9

AR HUD Requires Two to Three Display Layers

Continental Adopts Double-Layer Display as well

7 HUD and Instrument Cluster Vendors

Profile of Visteon

Quarterly Revenue and Gross Margin of Visteon for Successive 12 Quarters

Revenue Breakdown of Visteon by Product, 2015-2016

Revenue Breakdown of Visteon by Region/Customer, 2013-2016

More Balanced Distribution of Visteon’s Customers, 2017

HUD Roadmap of Visteon

HUD Orders of Visteon

Profile of Nippon Seiki

Revenue Breakdown of Nippon Seiki by Business, FY2013-FY2017

Revenue Breakdown of Nippon SeikiE by Region, FY2014-FY2017

Revenue Breakdown of Nippon Seiki by Customer, Q2/FY2016/2017

Technology Roadmap of Nippon Seiki

HUD Production Capacity of Nippon Seiki, FY2013-FY2021E

Production Bases of Nippon Seiki

Profile of Shanghai Nissei Display System Co., Ltd.

HUD Subordinate to Instrumentation&Driver HMI Segment under Interior Business

Global Footprints of Instrumentation & Driver HMI (ID)

International Setup for HUDs

Use Example of Continental’s HUD

Typical HUD Parameters of Continental

Introduction to Pioneer SPX-HUD100

Pioneer LaserScan HUD

Bosch HUD for Mini

Profile of Microvision

Revenue Breakdown of Microvision by Business, 2013-2016

Gross Margin of Microvision, Q1 2015 - Q3 2016

Products Adopting Microvision’s Patents

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...