Global and China Automotive Camera ADAS Industry Report, 2016-2021

-

May 2017

- Hard Copy

- USD

$2,700

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZYW233

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

Global and China Automotive Camera ADAS Industry Report, 2016-2021 highlights the following:

1 Analysis and Forecast of Global and China Automotive Camera ADAS Market;

2 Analysis and Forecast of Global and China Automotive Camera ADAS Industry;

3 Status Quo and Trends of Automotive Camera ADAS Technology;

4 Study on Major Vendors

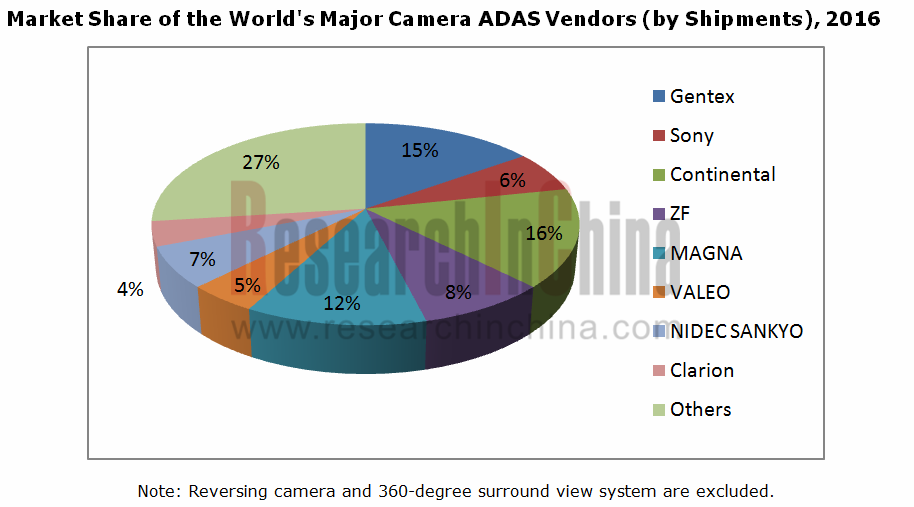

Broadly-defined camera ADAS includes 360-degree surround view system and park assist system. In 2016, broadly-defined camera ADAS shipments totaled roughly 40.1 million sets, of which, park assist (reversing camera) makes up the highest 34% or so, followed by 360-degree surround view system (about 20%) and FCW (about 13.7%). It is expected that by 2021 camera ADAS shipments will reach 71.4 million sets, of which park assist, 360-degree surround view system and AEB will capture 30.5%, 21.2% and 19.5%, separately. Narrowly-defined camera ADAS (excluding 360-degree surround view system and park assist system) shipments totaled approximately 15.2 million sets. By shipments, Continental Automotive, Gentex, Magna, ZF TRW, NIDEC SANKYO, Valeo, Sony and Clarion are successively ranked. In terms of camera ADAS processor, Mobileye, TI, Xilinx, Ambraella, Renesas, Toshiba, Hitachi, ADI and NXP are successively ranked by shipments.

The global camera ADAS market was worth USD2,667 million in 2016, an increase of 21.3%, and is expected to rise 24.4% to USD3,320 million in 2017. With the advent of L3/L4 self-driving in 2020, the deeply-learned embedded system will bring another marketing leap to an estimated USD7,760 million in 2021. Automotive camera module shipments totaled approximately 66.5 million sets in 2016 and are expected to rise 21.5% to 80.8 million sets in 2017 and then 117 million sets in 2021. In the unmanned era, Lidar will enter into rivalry with camera over the position of master sensor and is more likely to win out. Camera module won't see dramatic increase in shipments in the unmanned era.

Technologically,? stereo camera's price has gone down and competitiveness has been boosted as shipments increase. Concerning luxury cars, main products of Benz, BMW, JLR and Lexus are likely to be configured with stereo camera in 2021. At the end of 2016, Denso launched small stereo camera, which would find wide application in Toyota compact cars. Besides, Honda and Hyundai are developing?stereo camera?system. It is predicted that by 2020 stereo camera will win one-third market share. Trifocal essentially as monocular camera poses no threat to stereo camera and has very limited market potential (only to be employed by Tesla and Volvo).

In China, local brand vendors with technical incompetence hope suppliers provide complete solutions containing millimeter-wave radar and actuator, and Bosch has monopolized the ESP market of local brands, therefore occupying the vast majority of local vendors' ADAS market. Local brand vendors are most interested in AEB, AHB and BSD, instead of alert and LKW applications.

1 Global Vision ADAS System Market and Industry

Camera ADAS Market Size, 2015-2021E

Camera ADAS Shipments by Technology, 2016-2021E

Camera ADAS Market by Technology, 2016-2021E

Global Automotive Camera Module Shipments, 2015-2021E

Park Assist System Shipments by Technology in the United States, 2015/2020E

EU Park Assist System Shipments by Technology in EU, 2015/2020E

Park Assist System Shipments by Technology in Asia-Pacific Region, 2015/2020E

Park Assist System Shipments by Technology in China, 2015/2020E

Supporting Relationship between Japanese Vendors and ADAS Sensor Suppliers (Who Supply Whom)

Supporting Relationship between American/Korean/Chinese Vendors and ADAS Sensor Suppliers (Who Supply Whom)

Supporting Relationship between European Vendors and ADAS Sensor Suppliers (Who Supply Whom)

Market Share of World’s Major Camera ADAS Vendors by Shipments, 2016

Market Share of World’s Surround View Suppliers, 2015

Market Share of World’s Rear View Suppliers, 2015

Market Share of World’s Automotive CMOS Image Sensor Suppliers, 2016

Market Share of World’s Automotive Camera Module Suppliers by Turnover, 2015

Market Share of Camera ADAS Processor Vendors, 2016

ADAS Shipments by Technology in China, Jan. 2017

ADAS New Car Carrying Rate in China, 2016

ADAS Cumulative Carrying Rate in China, 2016

ADAS and Brand Correspondence in China, 2017

2 Lane Detection

LDW Overview

Lane Assist Trend

Difference of LDW/LKA/LCA

Lateral Control (“Lane Centering”)

LDW Principle

LDW&ACC&TJA Block Diagram

Control Structure Diagram for a Lane Keep Assist/Lane

Centering Assist System

Control Structure Diagram for a Conventional Hydraulic Brake System with Electronic Stability Control

Control Structure Diagram for an Electric Power Steering System

Control Structure Diagram for a Steer-by-Wire

System

LKW Algorithm

Hough Transform

Lane Detection Camera

3 Emergency Braking (Collision Avoidance)

AEB Will Become Mandatory Standard Configuration Sooner or Later

Proportion of Models with Front Crash Prevention IIHS, 2000-2015

Automotive Brand AEB Performance

Introduction to AEB (Advanced/Autonomous Emergency Brake)

AEB Sensor Fusion

AEB Sensor Matching and Merging

Forward Crash Avoidance and Mitigation (FCAM) and AEB

Collision Mitigation is Extended AEB

TRW Emergency Steer Assist (ESA)

Nisan Autonomous Emergency Steering

Continental SRL 111

Cheap Fixed Beam Infrared Lidar

Unique Design of Three Beam Light

4 Night Vision and High Beam Assist

Night Vision Overview

Night Vision Static

BMW Night Vision

Night Vision Trend

HBA (High Beam Assist)/Smart Beam Overview

HBA (High Beam Assist) Needs LED Headlamp

HBA (High Beam Assist) Image Sensor

Overview of Gentex Smart Beam

HW-Architecture of SmartBeam

5 Vision for Parking Assist

Comparison of Sensors by Type

Introduction to Rear View Camera System

Reversing Camera System Composition of VW Touran

VW Rear View Camera System CAN Network

Dense Stereo for Parking Assist

Motion-stereo Parking Assistant at BMW

Future Star might be 79GHz UWB

Daimler 360 Degrees Surround View

Delphi 360 Degrees Surround View Image Processing

Delphi 360 Degrees Surround View Image Processing

Adjusting Scope of Surround View

6 Vision ADAS Vendors

6.1 Mobileye

Revenue and Gross Profit of Mobileye, 2011-2017

Revenue of Mobileye by Business for 12 Consecutive Quarters

Product Roadmap of Mobileye

Revenue of Mobiley by Customer2013-2017

Block Diagram of Mobileye EyeQ3

Block Diagram of Mobileye EyeQ4

Block Diagram of Mobileye EyeQ5

6.2 MCNEX

6.3 ONSEMI

ISG History of ON-SEMI

Quarterly Revenue of ON Semiconductor by Business, Q1 2014 - Q4 2016

Quarterly Revenue of ON Semiconductor Image Sensor Group, Q3 2014-Q42016

6.4 Sunny Optical

Revenue and Gross Margin of Sunny Optical, 2004-2016

Auto Lens Sales of Sunny Optical, 2012-2016

6.5 Subrau Eyesight

Eyesight Ver3.0 Overview

History of Eyesight

Eyesight Ver3.0 Function

Eyesight Roadmap

Next Generation Eyesight

Typical Stereo Vision Pipeline

Block Diagram of Eyesight Ver3.0

Principles of Stereo Camera

6.6 Magna

Market Position and Partners of Magna

Magna Gen 1.0 Applications

Magna Gen 2.5 Applications

Magna’s Roadmap

Magna’s Strategy

6.7 Autoliv

Revenue Structure of Autoliv by Customers and by Region, 2015-2016

Autoliv Revenue by Product, 2014-2016

Autoliv Shipments by Product, 2009-2016

Autoliv Technology Distribution

6.8 Valeo CDA Division Overview

Valeo’s Position in Automotive ADAS

Valeo’s Partners

Valeo’s Park4U

Park4U ECU

6.9 Continental Automotive ADAS

Continental Automotive ADAS Revenue by Region, 2015 & 2018

Continental Automotive 360 View Component

Continental Automotive 360 View for Commercial Vehicles Examples

Continental Automotive 360 View Next-Remote Control Parking

Continental Camera Overview

Continental MFC2 Data

6.10 Bosch

Bosch Stereo Camera Overview

Bosch MPC2 Overview

6.11 Clarion

Clarion Revenue by Region, FY2009-FY2017

Clarion Around View Next -Automated Parking

Clarion’s Surroundeye for Commercial Vehicles

6.12 FUJITSU TEN

Fujitsu 360 Wrap Around Video Imaging

Fujitsu 360 Wrap Around Video Imaging Component

Fujitsu 360 Wrap Around Video Software

Block Diagram of Fujitsu MB86R12

Fujitsu MB86R12 Communication

Park4U ECU

6.13 Gentex Overview

Gentex Revenue vs. Gross Margin, 2012-2017

Gentex Smart Mirror for Cadillac

6.14 Kostal

Kostal ADAS Camera Roadmap

Close Cooperation between Kostal and Mobileye

Kostal Roadmap

6.15 TRW (ZF)

2014 TRW Revenue by Customer

2014 TRW Revenue by Region

6.16 Denso Customer Distribution, FY2017Q1-Q3

Denso Revenue by Segment

Denso Stereo Camera

Denso Supply Toyota Safety Sense P

Denso ADAS Product Roadmap

Denso ADAS Roadmap

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...