China Low-speed Electric Vehicle (LSEV) Industry Report, 2017-2021

-

Jun.2017

- Hard Copy

- USD

$3,000

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZJF103

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,400

-

- Hard Copy + Single User License

- USD

$3,200

-

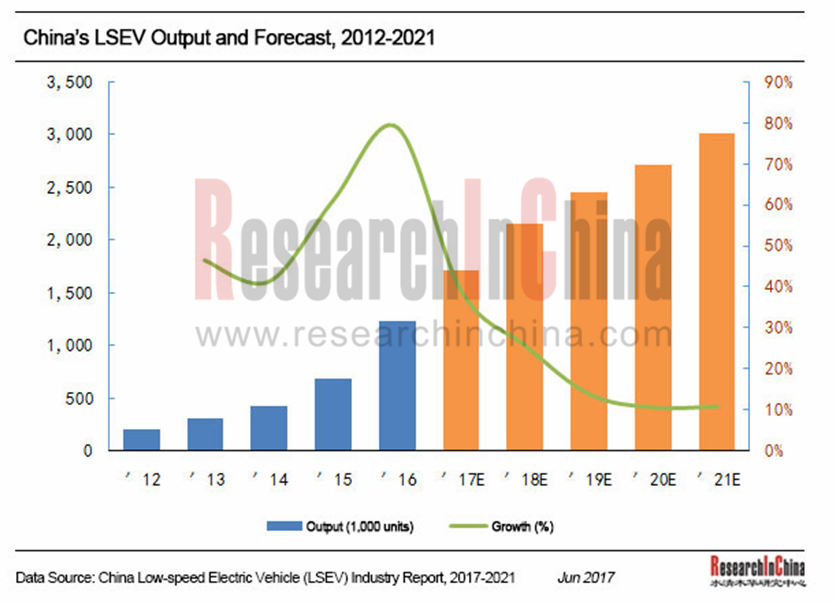

Despite absence of industry standards and of the basis for running on the road, low-speed electric vehicle (LSEV) still enjoys a huge market in rural and periurban areas because of mobility and low use costs. It takes less than a decade for the LSEV industry in China to grow from infancy and take shape. The Standardization Administration of the People’s Republic of China showed the intention to adopt stricter standards and meanwhile the State Council defined the guideline of “upgrading a batch, regulating a batch, and eliminating a batch” last year. Even so, LSEV output still soared from 688,000 units in 2015 to 1.232 million units in 2016, an upsurge of 79.1% year on year.

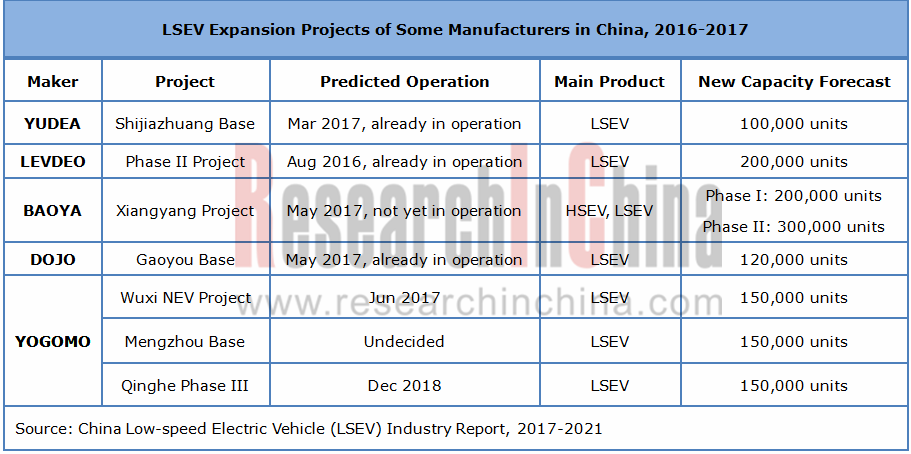

BYVIN, YOGOMO, and DOJO are the top3 players in the LSEV market. BYVIN, as a market bellwether, is the first enterprise with annual output of more than 150,000 units by adopting multi-brand (including LEVDEO) strategy to expand its market share in all market segments; YOGOMO, the largest LSEV enterprise in Hebei province, boasts four brands (YOGOMO, CYAHOR, YGM, and LaVie) and produces about 110,000 units annually; DOJO, the largest LSEV maker in Jiangsu province, put its Gaoyou base (with capacity of 230,000 units/a) into production in May 2017, and ranked third with output of 90,000 units last year.

Although the LSEV industry has grown rapidly in China, industry standards and polies remain unclear. In light of this, some companies, such as GreenWheel and Henan SD, jumped out of LSEV field and entered micro high-speed electric vehicle industry and have obtained the license for the production of battery electric vehicle. Meanwhile, there are still many makers that are still optimistic about the market and have increased investment, like YOGOMO’s two 150,000 unit/a LSEV projects in Mengzhou and Qinghe and Baoya’s 500,000 unit/a NEV base in Xiangyang city.

China Low-speech Electric Vehicle (LSEV) Industry Report, 2017-2021 highlights the following:

Overview of the LSEV industry in China (definition, classification, development trends, etc.);

Overview of the LSEV industry in China (definition, classification, development trends, etc.);

LSEV market segments including electric bicycle, electric tricycle, LSEV, and all-terrain vehicle (industry standards, relevant policies, market size, competitive landscape, development trends, etc.);

LSEV market segments including electric bicycle, electric tricycle, LSEV, and all-terrain vehicle (industry standards, relevant policies, market size, competitive landscape, development trends, etc.);

Market for relevant key parts (battery, motor, and motor controller) (competitive landscape, manufacturers, etc.);

Market for relevant key parts (battery, motor, and motor controller) (competitive landscape, manufacturers, etc.);

16 major manufacturers (Yadea, AIMA, SUNRA, BYVIN, Jinpeng, Dojo, YOGOMO, BYVIN, Shifeng Group, Tokng, Fulu Vehicle, LEVDEO, KNDI, Lichi, Rainchst, and Baoya) (profile, financial position, leading products, R&D, distribution of production bases, technical features, etc.)

16 major manufacturers (Yadea, AIMA, SUNRA, BYVIN, Jinpeng, Dojo, YOGOMO, BYVIN, Shifeng Group, Tokng, Fulu Vehicle, LEVDEO, KNDI, Lichi, Rainchst, and Baoya) (profile, financial position, leading products, R&D, distribution of production bases, technical features, etc.)

1. Overview of LSEV Industry

1.1 Definition and Classification of LSEV

1.2 Industry Characteristics

1.2.1 Intense Competition

1.2.2 Geographical Concentration

2. Development of Two-wheeled Electric Vehicle Industry

2.1 Standard of Two-wheeled Electric Vehicle

2.2 Policies

2.3 Market Size

2.4 Regional Pattern

2.5 Competitive Landscape

2.6 Industry Forecast

3. Development of Three-wheeled Electric Vehicle Industry

3.1 Standard of Three-wheeled Electric Vehicle

3.2 Market Size

3.3 Development in Major Regions

3.4 Competitive Landscape

3.5 Industry Forecast

4. Development of LSEV Industry

4.1 Policies on Four-wheeled Electric Vehicle

4.1.1 National Policies and Standards

4.1.2 Local Policies

4.2 Market Size

4.3 Development in Major Regions

4.3.1 Shandong

4.3.2 Hebei

4.4 Competitive Landscape

4.5 Mini Electric Vehicle

4.6 Industry Forecast

5. Development of All-Terrain Vehicle Industry

5.1 Market Size

5.2 Regional Development

5.3 Competitive Landscape

5.4 Industry Forecast

6. Main Parts Market

6.1 Battery

6.1.1 Status Quo and Trends of LSEV Battery

6.1.2 Major Manufacturers and Competitive Landscape

6.1.3 Products of Major Manufacturers

6.1.4 Advantages and Disadvantages of Major Manufacturers

6.2 Motor

6.2.1 Major Manufacturers and Competitive Landscape

6.2.2 Products of Major Manufacturers

6.2.3 Advantages and Disadvantages of Major Manufacturers

6.3 Motor Controller

6.3.1 Major Manufacturers and Competitive Landscape

6.3.2 Products of Major Manufacturers

6.3.3 Advantages and Disadvantages of Major Manufacturers

7. Chinese LSEV Manufacturers

7.1 AIMA

7.1.1 Profile

7.1.2 Production

7.1.3 Major Products

7.1.4 Production Bases

7.1.5 Marketing Network

7.1.6 Operation of Sichuan Base

7.2 Yadea

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Marketing Network

7.2.5 Production Bases

7.2.6 Plans for Capacity Expansion

7.3 BYVIN

7.3.1 Profile

7.3.2 Electric Bicycle

7.3.3 Electric Tricycle

7.3.4 LSEV

7.3.5 Main Production Bases

7.3.6 Plans for EV Capacity Expansion

7.3.7 Smart Electric SUV BYVIN V7

7.4 SUNRA

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Production and Marketing

7.4.5 Electric Bicycle

7.4.6 Electric Tricycle

7.4.7 Electric All-terrain Vehicle

7.4.8 Marketing Network

7.4.9 Production Bases

7.4.10 Investment Projects by IPO

7.5 Jinpeng

7.5.1 Profile

7.5.2 Major Products

7.5.3 Main Production Bases, and Production and Sales

7.5.4 Latest Developments

7.6 YOGOMO

7.6.1 Profile

7.6.2 Output and Sales Volume

7.6.3 Independent Operation of YOGOMO Brand

7.6.4 Major Products

7.6.5 YOGOMO’s Main Production Bases

7.6.6 Qinghe Factory III and Mengzhou Base

7.6.7 2020 Strategic Planning

7.7 Shifeng Group

7.7.1 Profile

7.7.2 Operation

7.7.3 Production

7.7.4 Shifeng Central Research Institute

7.7.5 Strategic Planning

7.8 Tokng

7.8.1 Profile

7.8.2 Major Products

7.8.3 Strategic Cooperation between Shandong Tangjun Ouling Automobile Manufacture and Camel Group

7.9 Fulu Vehicle

7.9.1 Profile

7.9.2 Major Products

7.9.3 Fulu Launches Efficient Intelligent Low Speed HEV

7.9.4 Capacity Expansion Plan

7.10 Dojo

7.10.1 Profile

7.10.2 Major Products

7.10.3 Production Bases and Capacity

7.10.4 Dojo’s Gaoyou Base Was Officially Put into Operation

7.11 Baoya

7.11.1 Profile

7.11.2 Major Products

7.11.3 Production Bases

7.11.4 Marketing Network

7.11.5 Agreement for BaoyaXiangyang Project Signed

7.12 LEVDEO

7.12.1 Profile

7.12.2 Major Products

7.12.3 Production Base

7.12.4 LEVDEO Launches iV-Drive Lithium Battery Super E-drive Technology

7.13 Lichi

7.13.1 Profile

7.13.2 Revenue

7.13.3 Major Products

7.13.4 Launch of Nine-balance Anti-attenuation Technology for Battery Management System (BMS)

7.14 Rainchst

7.14.1 Profile

7.14.2 Major Products

7.14.3 Production Bases

7.14.4 Brand Strategic Upgrading of Weifang Rainchst

7.15 Xinyuzhou (Yudea Group)

7.15.1 Profile

7.15.2 Major Products

7.15.3 Production Base

7.15.4 Main Qualifications

7.15.5 Production of New Base

7.16 KANDI

7.16.1 Profile

7.16.2 Revenue

7.16.3 Main Business

7.16.4 Major Products

7.16.5 Production Bases

Main Classifications of LSEVs

Main Types of Tricycles on the Market

Economic Benefits Comparison between LSEV and Other Types of Vehicles

Main Applications of LSEV

Technical Standards of Electric Bicycle (1999 Version, 2015 Amendment, and 2016 Draft)

Policies on Electric Bicycle in China in Recent Years

Electric Bicycle Forbidding Policies Promulgated by Some Cities in China

Output of Electric Bicycles in China, 2009-2016

Ownership of Electric Bicycles in China, 2009-2016

Ranking of Top10 Electric Bicycle Provinces/Municipalities by Output, 2016

Ranking of Electric Bicycle Manufacturers by Output in China, 2016

Ranking of Electric Bicycle Manufacturers by Sales Volume in China, 2016

Forecast of Electric Bicycle Output in China, 2015-2021E

Key Reference Indicators in Technical Requirements on Electric Tricycle for Express Delivery

China’s Electric Tricycle Output, 2009-2016

China’s Electric Tricycle Output and Sales Volume by Market Segment, 2016

China’s Electric Tricycle Ownership, 2009-2016

Major Electric Tricycle Production Bases and Sales Regions in China

China’s Electric Tricycle Competition Pattern, 2016

China’s Electric Tricycle Output, 2015-2021E

Partial Contents of Three Meetings of Work Team for Low Speed Electric Vehicle Standard Formulation, 2016

Local Policies on LSEV in Major Regions

Interpretation of Local Policies and Regulations on LSEV in Recent Years

Regulations on LSEV in Shandong (Trial) (Part)

Regulations on LSEV in Some Cities in Shandong

Provisions on Relevant Technical Indicators in Regulations on LSEV in XingtaiCity (Trial)

China’s Low-speed Electric Vehicle Output, 2009-2016

China’s Low-speed Electric Vehicle Ownership, 2009-2016

Shandong’s Low-speed Electric Vehicle Output, 2009-2016

National Share of Shandong’s Low-speed Electric Vehicle Output, 2016

Shandong’s Monthly Low-speed Electric Vehicle Output, 2016

Low Speed Electric Vehicle Sales Distribution in China, 2016

Ranking of Chinese Low Speed Electric Vehicle Manufacturers by Sales Volume, 2015-2016

Subsidy Policies of Central and Local Governments for Battery Electric Passenger Vehicles (Incomplete Statistics), 2017

Main Technical Indicators of Some Best-selling Minicars

Main Approaches of Low Speed Electric Vehicle Manufacturers to Obtain Electric Vehicle Production Qualification

Output of Low Speed Electric Vehicles in China 2015-2021E

ATV (All-Terrain Vehicle) Output in China, 2009-2016

ATV Sales Volume in China, 2009-2016

Field Vehicle Sales Volume in China’s Main Regions, 2009-2016

Top5 Sightseeing Cart Manufacturers in China by Sales Volume, 2016

Forklift Output Breakdown in China by Market Segment, 2015-2016

Top10 Forklift Manufacturers in China by Sales Volume, 2016

ATV Vehicle Output and Sales Volume Forecasts in China, 2015-2021E

Performance Comparison of EV Batteries

Comparison of Typical Lead-acid and Lithium Battery Vehicles

Major Battery Supplier’s Share in Two-wheeled and Three-wheeled Electric Vehicle Market, 2016

Major Battery Suppliers’ Share in Low-speed Electric Vehicle Market, 2016

Chaowei Power’s Main Batteries for LSEV

Tianneng Power’s Main Batteries for LSEV

Sacred Sun’s Sealed Lead-acid Batteries for Electric On-road Vehicle

Comparison of Chaowei Power and Tianneng Power

Capacity of Major Motor Manufacturers in Two-wheeled and Three-wheeled Electric Vehicle Industries in China

Shandong Xindayang’s Main Motors for Two-wheeled and Three-wheeled Electric Vehicles

Ananda’s Main Motors

Boyu’s Main Motors of LSEV

YuchengFutong Motor’s Main Motors

Capacity of Major Manufacturers of Motor Controller for Electric Bicycle in China

Capacity of Major Manufacturers of Motor Controller for Electric Vehicle in China

Deyang Electronic Technology’s Main Motor Controllers

Ananda’s Main Controllers

Wuxi Jinghui Electronics’ Main EV Controllers

Tianneng Power’s Main Motor Controllers

Shanghai Edrive’s Motor Control Systems for LSEV

Tianjin Santroll Electric Automobile Technology’s Main Motor Controllers for LSEV

V&T’s Main EV Controllers

AIMA’s Electric Vehicle Output, 2010-2016

Performance Parameters of MINE and Snow Leopard, AIMA’s Two Main Brands

AIMA’s Main Electric Vehicles and Their Performance

Main Production Bases of AIMA

Capacity of AIMA’s Main Production Bases and Investment

EV Distribution Network of AIMA

Revenue and Net Income of Yadea, 2013-2016

Yadea’s Revenue from Major Products, 2013-2016

Yadea’s Sales of Major Products, 2013-2016

Distribution of Yadea’s Distributors Nationwide by end of 2016

Profile of Yadea’s Wuxi Headquarters

Profile of Yadea’s Zhejiang Base

Profile of Yadea’s Tianjin Base

Profile of Yadea’s Guangdong Base

Yadea’s Plans for Capacity Expansion

BYVIN’s Main Two-Wheeled Electric Vehicles

Configuration Parameters of BYVIN’s Main Electric Bicycles

BYVIN’s Main Three-wheeled Electric Vehicles

Main Parameters of BYVIN Spring Breeze Electric Tricycles

Main Parameters of BYVIN M8 Electric Vehicle

Main Parameters of BYVIN M7 Electric Vehicle

Main Parameters of BYVIN M6 Electric Vehicle

Major New Energy Power Technologies of BYVIN

Main Two-wheeled Electric Vehicle Products Bases of BYVIN

BYVIN’s Electric Vehicle Production Bases and Capacity Expansion Plans

Key Performance Indicators of BYVIN V7

Xinri’s Revenue and Net Income, 2014-2016

Xinri’s Revenue by Product, 2014-2016

Xinri’s Revenue by Region, 2014-2016

Xinri’s Electric Bicycle Capacity, Output and Sales Volume, 2014-2016

SUNRA’s Major Two-wheeled Electric Vehicles

SUNRA’s Major Three-wheeled Electric Vehicles

SUNRA’s Major AVTs

Distribution of Xinri’s Dealers, end of 2016

Basic Information of Tianjin Xinri

Basic Information of Hubei Xinri

Basic Information of Guangdong Xinri

Xinri’s Investment Projects by IPO

Jinpeng’s Main Electric Vehicles

Capacity of Some Production Bases of Jinpeng

YOGOMO’s Sales of LSEV, 2011-2016

Three Electric Vehicle Brands and Market Segmentation of YOGOMO

Main Configuration Parameters of YOGOMO 330

Main Configuration Parameters of YOGOMO Q Electric Vehicle

Main Configuration Parameters of YOGOMO A260 Electric Vehicle

Main Configuration Parameters of YOGOMO S325 Electric Vehicle

Main Configuration Parameters of YOGOMO X260 Electric Vehicle

Main Configuration Parameters of YOGOMO X6320 Cargo Van

Main Configuration Parameters of YOGOMO M6320

YOGOMO’s Main Production Bases and Products

Capacity and Products of YOGOMO's Main Production Bases

Operating Revenue and Profits & Taxes of Shifeng Group, 2010-2016

Vehicle and Electric Vehicle Output of Shifeng Group, 2010-2016

Main Performance Parameters of Tokng Sunny Angel

Main Performance Parameters of Tokng Prince

Main Performance Parameters of Tokng Minivan

Main Performance Parameters of FuluLetu

Main Performance Parameters of FuluLechi

Main Performance Parameters of FuluMeike

Main Performance Parameters of Fulu New Xiangrui (FLE360-F)

Main Performance Parameters of Fulu Turui

Main Technical Parameters of Dojo Pilot

Main Technical Parameters of Dojo CooYes

Main Technical Parameters of Dojo Dream Achiever

Main Production Bases of Dojo

Baoya’s Main Electric Vehicle Models

Main Configuration Parameters of BaoyaYabei LSEV

Main Configuration Parameters of BaoyaTongnian LSEV

Main Production Bases of Baoya Group

Baoya’s International Marketing Network

Baoya’s Domestic Marketing Network

Configuration Parameters of D80 Low-speed Vehicle

Main Configuration Parameters of D50 LSEV

Main Configuration Parameters of D70 LSEV

Main Configuration Parameters of LEVDEO V60

Revenue and Net Income of Lichi, 2014-2016

Mini (Low Speed) Electric Car Sales Volume of Lichi, 2014-2016

Parameter Comparison of Lichi’s Main Electric Vehicles

Main Parameters of Rainchst A00 EV

Main Parameters of Rainchst A0 EV

Main Parameters of Rainchst A EV

Main Parameters of Rainchst MMPV EV

Main Parameters of Rainchst Electric Mini-trucks

Main Parameters of Rainchst Electric Sports Cars

Main Parameters of Rainchst Electric Sightseeing Vehicle

Main Technologies Adopted in Rainchst’s Production Bases

Main Technical Parameters of Xinyuzhou Yudea’s Electric Police Cars

Main Technical Parameters of XinyuzhouYudea’s Electric Sightseeing Carts

Main Parameters of Yudea T80

Main Parameters of Yudea T60

Main Parameters of Yudea T70

Main Production Bases of Yudea Group

Revenue and Net Income of Kandi, 2009-2016

Process of Kandi EV Business Change

Revenue Breakdown of Kandi by Product, 2013-2016

Revenue Breakdown of Kandi by Region, 2013-2016

Kandi “Global Hawk K11D” Model

Kandi “Global Hawk K10D” Model

Kandi “Global Hawk K17A” Model

Technical Parameter of Kandi’s E7000MB2 Electric Tricycle

Technical Parameter of Kandi’s KD-250GKD-2 Electric Utility Vehicle

Main Production Bases of KANDI

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...