Global and China Silicon-based Anode Material Industry Report, 2017-2020

-

Jul.2017

- Hard Copy

- USD

$3,000

-

- Pages:122

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

LT035

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,400

-

- Hard Copy + Single User License

- USD

$3,200

-

At present, commercial lithium-ion battery anode materials are mostly based on graphite. High-end graphite-based anode materials which have been successfully developed and put into use, have capacity of 365mAh/g, close to the theoretical capacity of graphite (372mAh/g), with compaction density ranging at 1.7~1.75g/cm3. There is seldom an improvement in energy density of anode materials in terms of capacity per gram and compaction density of graphite.

Moreover, in lithium-ion battery market, especially power battery market, requirements on energy density of batteries are increasingly high. According to Chinese government’s plan for power battery (as of 2020), specific energy of new lithium-ion power battery cell shall exceed 300Wh/kg and that of the system shall be up to 260Wh/kg. In current stage, mainstream graphite-based anode materials are hardly satisfying the needs of improving specific capacity of batteries. New high-capacity anode materials such as Si-C composite are the future development trend.

Presently, a solution of Si-based materials doped with graphite is common for pure Si-based materials which have great expansion and high costs in spite of energy density of up to 4200mAh/g, and more doping renders higher concentration of silicon in the materials. Silicon carbon anode material (SiC) and silicon oxide anode material (SiO) are the mainstream technical solutions at present.

Currently, around 10% of Si-based material can be added into SiC anode material. In line with the China’s plan for specific energy of power battery cell of 300Wh/Kg, that of anode materials shall attain 600-800ah/g. Hence, Si-based material will see a rising share to 25%-35% and above in the anode material in the coming several years.

The output of anode materials reached 122,500 tons in China in 2016, an upsurge of 68.3% from a year ago. As it is still at the infancy of industrialization and features low penetration rate, the SiC anode material demand stands at 300 tons or more. If the average addition of Si-based materials is up to 30% or so in 2020, the demand for Si-based anode materials will soar to roughly 40,000 tons and the overall market size will reach about RMB8 billion.

By far, Japanese companies are at the forefront of the SiC anode composites, and some companies have supplied of small-batch products. Among Chinese enterprises, Shenzhen BTR New Energy Materials Co., Ltd has been in the leading position in the R&D and production of SiC anode domestically by dint of its technical superiority in anode materials. The company’s SiC anode materials, which passed Samsung’s certification in 2013, has current capacity of 300 t/a.

Shanshan Corporation started R&D of SiC anode materials in 2009 and has already realized ton-level sales per month. Obtaining many patents in regions like Japan, South Korea and China, Shanshan will build a 4,000 t/a SiC anode material production line at the end of 2017, according to its planning.

Global and China Silicon-based Anode Material Industry Report, 2017-2020 by ResearchInChina highlights the following:

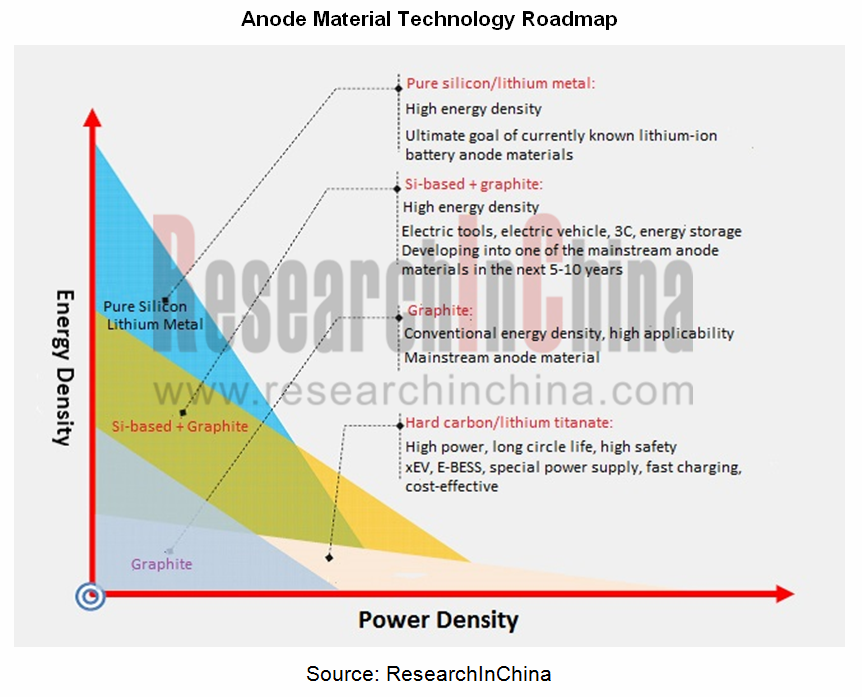

Development background and technology roadmap of silicon-based anode materials;

Development background and technology roadmap of silicon-based anode materials;

Global lithium battery anode material market (scale, competitive landscape, etc.);

Global lithium battery anode material market (scale, competitive landscape, etc.);

Chinese lithium battery anode material industry (policies, market size, competitive pattern, price trend, etc.);

Chinese lithium battery anode material industry (policies, market size, competitive pattern, price trend, etc.);

Progress in industrialization of silicon-based anode materials, domestic and foreign companies’ layout, the market demand for silicon-based anode materials in China;

Progress in industrialization of silicon-based anode materials, domestic and foreign companies’ layout, the market demand for silicon-based anode materials in China;

World’s six silicon-based anode companies (operation, anode material business, R&D and industrialization progress of silicon-based anode materials);

World’s six silicon-based anode companies (operation, anode material business, R&D and industrialization progress of silicon-based anode materials);

Ten Chinese silicon-based anode companies (operation, anode material business, R&D and industrialization progress of silicon-based anode materials).

Ten Chinese silicon-based anode companies (operation, anode material business, R&D and industrialization progress of silicon-based anode materials).

1 Overview of Silicon-based Anode Material for Lithium Battery

1.1 Background

1.2 Classification and Preparation Methods

1.3 Technology Roadmap

2 Global Lithium Battery Anode Material Market

2.1 Market Size

2.2 Competitive Pattern

3 Chinese Lithium Battery Anode Material Market

3.1 Industrial Policy

3.2 Market Size

3.3 Competitive Pattern

3.4 Price Trend

4 Application and Market Prospects of Silicon-based Anode Material

4.1 Application

4.2 Demand

5 Downstream Lithium Battery Market

5.1 Market Size

5.1.1 Global

5.1.2 China

5.2 Market Structure

5.2.1 Global

5.2.2 China

5.3 Competitive Pattern

5.3.1 Global

5.3.2 China

5.4 Demand

5.4.1 Consumer Electronics (3C)

5.4.2 Electric Vehicle

5.4.3 Industrial Energy Storage

6 Key Foreign Silicon-based Anode Material Companies

6.1 Hitachi Chemical

6.1.1 Profile

6.1.2 Development Course

6.1.3 Production Base

6.1.4 Lithium Battery Anode Material Business

6.1.5 Layout in China

6.1.6 Operating Data

6.2 3M

6.2.1 Profile

6.2.2 Development Course

6.2.3 Silicon-based Anode Material Business

6.2.4 Layout in China

6.2.5 Operating Data

6.3 Shin-Etsu Chemical

6.3.1 Profile

6.3.2 Development Course

6.3.3 Production Base

6.3.4 Silicon-based Anode Material Business

6.3.5 Operating Data

6.4 XG Sciences

6.4.1 Profile

6.4.2 Production and R&D

6.4.3 Silicon-based Anode Material Business

6.4.4 Operating Data

6.5 Nexeon

6.5.1 Profile

6.5.2 Silicon-based Anode Material Business

6.6 Amprius

6.6.1 Profile

6.6.2 Silicon-based Anode Material Business

7 Key Chinese Silicon-based Anode Material Companies

7.1 Shenzhen BTR New Energy Materials Co., Ltd.

7.1.1 Profile

7.1.2 Industrial Layout

7.1.3 Products, Technologies and Solutions

7.1.4 Silicon-based Anode Material Business

7.1.5 Customer Support

7.1.6 Production and Sales

7.1.7 Core Competence

7.1.8 Operating Data

7.2 Shanshan Technology Co., Ltd.

7.2.1 Profile

7.2.2 Affiliates

7.2.3 Silicon-based Anode Material Business

7.2.4 Products, Technologies and Solutions

7.2.5 Customer Support

7.2.6 Production and Sales

7.2.7 Core Competence

7.2.8 Operating Data

7.3 Hunan Shinzoom Technology Co., Ltd.

7.3.1 Profile

7.3.2 Products, Technologies and Solutions

7.3.3 Silicon-based Anode Material Business

7.3.4 Core Competence

7.3.5 Customer Support

7.3.6 Operating Data

7.4 Huzhou Chuangya Power Battery Materials Co., Ltd.

7.4.1 Profile

7.4.2 Products, Technologies and Solutions

7.4.3 Silicon-based Anode Material Business

7.4.4 Customer Support

7.4.5 Production and Sales

7.4.6 Core Competence

7.4.7 Operating Data

7.5 Jiangxi Zhengtuo New Energy Technology Co., Ltd.

7.5.1 Profile

7.5.2 Products, Technologies and Solutions

7.5.3 Silicon-based Anode Material Business

7.5.4 Customer Support

7.5.5 Supply System

7.5.6 Production and Sales

7.5.7 Operating Data

7.6 Jiangxi Zichen Technology Co., Ltd.

7.6.1 Profile

7.6.2 Customer Support

7.6.3 Production and Sales

7.6.4 Silicon-based Anode Material Business

7.7 Hefei Guoxuan High-Tech Power Energy Co., Ltd.

7.7.1 Profile

7.7.2 Battery Technologies

7.7.3 Customer

7.7.4 Production and Sales

7.7.5 Silicon-based Anode Material Business

7.8 Other Companies

7.8.1 Shenzhen Sinuo Industrial Development Co., Ltd.

7.8.2 Hunan Morgan Hairong New Materials Co., Ltd.

7.8.3 Dalian Hongguang Lithium Co., Ltd.

Performance Comparison of Lithium Battery Anode Materials

Specific Capacitance Comparison of Commercial Anode Materials

Volume of Lithium-ion after Forming Li-Si Alloy by Embedding

Classification of Silicon-based Anode Materials

Si/C Composites Capable of Achieving Complementary Advantages between Silicon and Carbon

Classification of Si/C Composites

Schematic Diagram of Si/C Composites Preparation by Chemical Vapor Deposition (CVD) Method

Four Conventional Preparation Methods of Si/C Composites

Development Trend of Anode Material Technology Roadmap

R&D and Application Route of Silicon-based Anode Materials

Global Shipments of Lithium Battery Anode Materials, 2010-2020E

Global Anode Material Product Structure, 2015-2020E

Competitive Pattern of Global Anode Material Companies, 2016

Capacity Proposed/under Construction of Global Anode Material Producers, 2016

Major Suppliers and Buyers of Anode Materials Worldwide (by Product)

Policies on Lithium Battery Industry in China

Requirements on Performance Indicators of Lithium Battery Anode Materials in China

Output of Lithium Battery Anode Materials in China, 2010-2020E

Output Value of Lithium Battery Anode Materials and YoY Growth in China, 2010-2020E

Sales Volume of Anode Materials in China as a Percentage of Global Total, 2010-2020E

Rankings of Major Anode Material Producers in China, 2016H1

Price Trend of Anode Materials in China, 2010-2020E

Progress in Application of Si/C Anode Materials

Si/C Anode Material Business Layout of Major Lithium Battery Materials Companies in China

Silicon-based Anode Material Demand and Market Size in China, 2016-2020E

Structure of Lithium Battery

Market Share of Power Batteries by Material, 2016

Global Lithium Battery Industry Scale, 2010-2020E

Global Lithium Battery Sales Structure by Country, 2011-2016

China’s Lithium Battery Sales Structure by Province, 2013-2016

Global Lithium Battery Manufacturer Echelons

Competitive Pattern of Global Lithium Power Battery Manufacturers, 2016

Output of Major Power Battery Companies Worldwide, 2015-2016H1

Competitive Pattern of Lithium Battery Market in China, 2016

Major Lithium Battery Manufacturers in China

Lithium Power Battery Supply System in China

Market Share of Lithium Power Batteries by Application in China, 2016

Shipments of Major Battery Manufacturers, 2016 (MWh)

Applications of Lithium-ion Batteries

Global Lithium Battery Demand Structure, 2012-2020E

Global Demand from Consumer Electronics for Lithium Battery and YoY Growth, 2013-2020E

Global Sales Volume of Mobile Phones and Demand for Lithium Battery, 2012-2020E

Global Sales Volume of Tablet Computers and Demand for Lithium Battery, 2012-2020E

Competitive Pattern of Global Tablet Computer Market, 2013-2016

Global Sales Volume of Notebook Computers and Demand for Lithium Battery, 2012-2020E

Capacity and Endurance of Batteries of Major Electric Vehicles Worldwide

Single-vehicle Battery Capacity of Electric Passenger Cars Worldwide, 2011-2020E

Production and Sales of New Energy Vehicle (by Type) in China, 2011-2016

Production and Sales of New Energy Vehicle in China, 2016-2020E

Sales Volume of Electric Passenger Cars (EV&PHEV) in China, 2011-2020E

Lithium Power Battery Demand (by Type) in China, 2011-2020E

Energy Storage Lithium Battery Demand in China, 2014-2020E

Energy Storage Lithium Battery Demand Structure (by Sector) in China, 2020E

Major Manufacturers of Energy Storage Battery in China

Development Course of Hitachi Chemical

Presence of Hitachi Chemical’s Major Subsidiaries

Main Business Divisions and Their Business of Hitachi Chemical

Structure of Silicon-based Anode Material of Hitachi Chemical

Hitachi Chemical’s Layout in China

Financial Factsheet of Hitachi Chemical, FY2010-FY2016

Development Course of 3M

List of Lithium Battery Material Solutions of 3M

Structure of Silicon-based Anode Material of 3M

Cycling Stability of Silicon-based Anode Material of 3M -- dQ/dV

Rate Performance of Silicon-based Anode Material of 3M

Cyclic Performance of 3M’s Silicon-based Anode Material Coupling 18650 Battery

3M’s Layout in China

Revenue of 3M, 2012-2016

Profitability of 3M, 2012-2017Q1

Revenue and Operating Income of 3M by Region, 2014-2015

Revenue and Operating Income of 3M by Business, 2014-2015

Development Course of Shin-Etsu Chemical

Distribution of Shin-Etsu Chemical’s Headquarter, Production Bases and Branches, 2016

Global Presence of Shin-Etsu Chemical’s Operations, 2016

Number of Silicon-based Anode Material Patents of Shin-Etsu Chemical

Performance of SiO-based Anode Material of Shin-Etsu Chemical

Revenue of Shin-Etsu Chemical by Business, FY2016-FY2017

Revenue and Profit Structure of Shin-Etsu Chemical by Business, FY2017

Revenue Structure of Shin-Etsu Chemical by Region, FY2017

Revenue and Net Income of Shin-Etsu Chemical, FY2012-FY2017

Product Lines of XG Sciences

Distribution of XG Sciences’ Customers Worldwide

Cyclic Performance of SiG-based Anode Material of XG Sciences

XG Sciences’ AN-S-100 Anode Material---Performance Indicators

XG Sciences’ AN-S-100 Anode Material---Electron Micrograph

Revenue and Profits of XG Sciences, 2014-2015

Silicon-based Anode Material Technology Roadmap of Amprius

Structure of Silicon Nanowire Anode Material of Amprius

R&D/Production System of Amprius

Development Course of Shenzhen BTR New Energy Materials

Industrial Layout of Shenzhen BTR New Energy Materials

Main Subsidiaries and Their Capacity of Shenzhen BTR New Energy Materials, 2016

Subsidiaries of Shenzhen BTR New Energy Materials

Main Anode Material Products of Shenzhen BTR New Energy Materials

Si-based Composites of Shenzhen BTR New Energy Materials -- Electron Micrograph

Si-based Composites of Shenzhen BTR New Energy Materials -- Physical and Chemical Indicators

SiO-based Anode Material of Shenzhen BTR New Energy Materials -- Electron Micrograph

SiO-based Anode Material of Shenzhen BTR New Energy Materials -- Physical and Chemical Indicators

Revenue and Net Income of Shenzhen BTR New Energy Materials, 2012-2016

Development Course of Shanshan Technology and Ningbo Shanshan in Anode Material

Affiliates of Shanshan Technology

Physical and Chemical Performance of Low-capacity Nano-silicon /carbon Products of Shanshan Technology

Physical and Chemical Performance of Si/C-based Composites of Shanshan Technology

Anode Material Products of Shanshan Technology

Revenue and Net Income of Shanshan Technology, 2012-2016

Development Course of Hunan Shinzoom Technology

Anode Material Products of Hunan Shinzoom Technology

Technical Indicators of Artificial Graphite of Hunan Shinzoom Technology

Technical Indicators of Natural Graphite of Hunan Shinzoom Technology

Technical Indicators of Artificial Graphite Composites of Hunan Shinzoom Technology

Si/C Anode Material of Hunan Shinzoom Technology -- Main Technical Indicators

Si/C Anode Material of Hunan Shinzoom Technology -- Electrochemical Performance

Revenue and Net Income of Hunan Shinzoom Technology, 2012-2016

Revenue Structure of Hunan Shinzoom Technology by Product, 2012-2015

Anode Material Products of Huzhou Chuangya Power Battery Materials

Revenue and Net Income of Huzhou Chuangya Power Battery Materials, 2012-2015

Development Course of Jiangxi Zhengtuo New Energy Technology

Anode Material Products of Jiangxi Zhengtuo New Energy Technology

Name List and Revenue Contribution of Top5 Customers of Jiangxi Zhengtuo New Energy Technology, 2015

Revenue and Net Income of Jiangxi Zhengtuo New Energy Technology, 2012-2016

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 380mAh/g

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 400mAh/g

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 420mAh/g

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 450mAh/g

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 600mAh/g

Performance Indicators of Si/C Composites of Jiangxi Zichen Technology -- 950mAh/g

Operating Results of Hefei Guoxuan High-Tech Power Energy, 2009-2016

Specifications of LiFePO4 Power Battery of Hefei Guoxuan High-Tech Power Energy

Parameters of Models Carrying Power Batteries of Hefei Guoxuan High-Tech Power Energy

Price of Power Battery Pack of Hefei Guoxuan High-Tech Power Energy, 2009-2015

Power Battery Shipments of Hefei Guoxuan High-Tech Power Energy, 2009-2016

Capacity Layout of Hefei Guoxuan High-Tech Power Energy, 2015-2017

Main Technical Parameters of Silicon Oxide of Hefei Guoxuan High-Tech Power Energy

Porous Si/C Composite Anode Material of Shenzhen Sinuo Industrial Development -- Low-temperature Discharge Curve at -20℃

Porous Si/C Composite Anode Material of Shenzhen Sinuo Industrial Development -- 1C Cycle Curve

Electron Micrograph of Soft Carbon Material of Hunan Morgan Hairong New Materials

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...