China Automotive Anti-lock Braking System (ABS) Industry Report, 2017-2021

-

Jul.2017

- Hard Copy

- USD

$3,000

-

- Pages:158

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

ZJF104

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,400

-

- Hard Copy + Single User License

- USD

$3,200

-

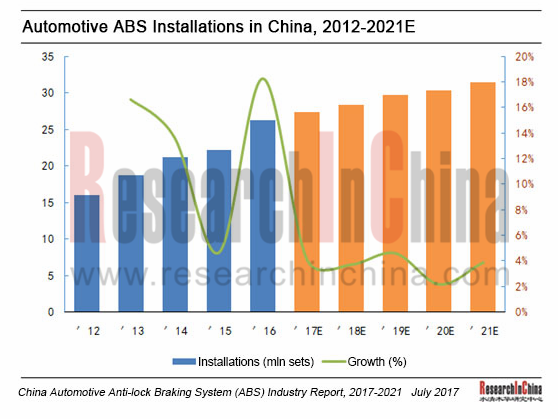

With the continuous development of the automobile industry in China, people have higher requirements on driving safety, thus fueling the demand for automotive anti-lock braking system (ABS). In addition, hydraulic ABS has virtually spread from mid-to high-end passenger cars to low-end models and the introduction of “Safety Specifications for Power-driven Vehicles Operating on Roads” (GB7258) and other relevant documents have boosted the installation rate of ABS in commercial vehicle field in recent years. 24.03 million sets of automotive ABS were installed in China in 2016, up by 18.3% from a year ago and driven by both policy incentives and a year-on-year 14.5% growth in auto sales. As the country’s auto production rose by only 4.6% in the first half of 2017, ABS growth also slowed correspondingly. China's demand for ABS is expected to hit 30.68 million sets in 2021 at a CAGR of 5.0%.

Product segments: the ABS on passenger cars and small commercial vehicles are largely hydraulic ones and the ABS on large and medium-sized commercial vehicles pneumatic ones. As the output and sales volume of passenger cars obviously exceed that of commercial vehicles, combined with passenger car makers’ and consumers’ greater emphasis on safety system, the installation rate of ABS in passenger cars is far higher than that in commercial vehicles. In 2016, 22.58 million sets of ABS were installed in passenger cars, representing an installation rate of 92.5%. As the standard GB7258 is implemented in a stricter manner, the installation rate of ABS in commercial vehicles is predicted to rise significantly over the next couple of years.

Competitive landscape: like other automotive parts, the automotive ABS market is more stable. Passenger car ABS market is practically monopolized by foreign brands. Continental-invested Shanghai Automotive Brake Systems Co., Ltd. (SABS) started local production of ABS in 1997 and BOSCH, MANDO and NISSIN began entering the Chinese market from 2004 to serve JV brands and some homegrown brands. Chinese enterprises (like Wanxiang Qianchao and Zhejiang Asia-pacific Mechanical & Electronic) have made remarkable headway in recent years but are still weak as a whole, lagging behind foreign counterparts in terms of product quality and technology. They serve mainly homegrown car brands whose sales rise in recent years and which have helped local ABS suppliers achieve exceptional performance. About half of commercial vehicle ABS market is occupied by WABCO, while emerging Chinese players like Kormee, VIE, and JuNeng will, hopefully, further raise their market share.

China Anti-lock Braking System (ABS) Industry Report, 2017-2021 focuses on the following:

Automotive ABS industry in China (definition and classification, development trends, etc.);

Automotive ABS industry in China (definition and classification, development trends, etc.);

Automobile industry and ABS industry in China (auto output, sales, and ownership, ABS installations, supporting relationship, etc.);

Automobile industry and ABS industry in China (auto output, sales, and ownership, ABS installations, supporting relationship, etc.);

Chinese automotive ABS market segments (hydraulic ABS and pneumatic ABS (market size, competitive landscape, development trends, etc.));

Chinese automotive ABS market segments (hydraulic ABS and pneumatic ABS (market size, competitive landscape, development trends, etc.));

Nine international players (Bosch, Continental, ZF, ADVICS, Mando, Nissin Kogyo, Hyundai Mobis, WABCO, KNORR) and nine Chinese peers (Zhejiang Asia-pacific Mechanical & Electronic, HUAYU Automotive Systems, Zhejiang Vie Science & Technology, Wuhu Bethel Automotive Safety Systems, Wanxiang Qianchao, Fawer Automotive Parts, Guangzhou Ruili Kormee Automotive Electronic, Chongqing JUNENG, and Dongfeng Electronic Technology) (profile, financials, main products, R&D, distribution of production bases, technical characteristics, etc.)

Nine international players (Bosch, Continental, ZF, ADVICS, Mando, Nissin Kogyo, Hyundai Mobis, WABCO, KNORR) and nine Chinese peers (Zhejiang Asia-pacific Mechanical & Electronic, HUAYU Automotive Systems, Zhejiang Vie Science & Technology, Wuhu Bethel Automotive Safety Systems, Wanxiang Qianchao, Fawer Automotive Parts, Guangzhou Ruili Kormee Automotive Electronic, Chongqing JUNENG, and Dongfeng Electronic Technology) (profile, financials, main products, R&D, distribution of production bases, technical characteristics, etc.)

1 Overview of Industry

1.1 Definition

1.2 Development History

1.3 Policy Environment

1.4 Supply Chain

1.5 Automotive ABS Outlook

1.5.1 Pneumatic ABS

1.5.2 Hydraulic ABS

2 Chinese Automotive ABS Market

2.1 Chinese Automobile Market

2.1.1 Output

2.1.2 Ownership

2.2 Automotive ABS Market Size

3 China Hydraulic ABS Market

3.1 Passenger Car Market Size

3.2 Hydraulic ABS Market

3.3 Competitive Landscape

3.4 Supporting

4 Chinese Pneumatic ABS Market

4.1 Commercial Vehicle Market Size

4.2 Market Size

4.3 Competitive Landscape

4.4 Supporting

5 Global Companies

5.1 Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Braking System Business

5.1.5 Performance in China

5.1.6 Production Base

5.1.7 R&D

5.2 Continental

5.2.1 Profile

5.2.2 Operation

5.2.3 Braking System Business

5.2.4 Business in China

5.2.5 Continental Automotive Changchun Co., Ltd.

5.2.6 Latest Developments

5.3 ZF

5.3.1 Profile

5.3.2 Operation

5.3.3 Braking System Business

5.3.4 Business in China

5.3.5 R&D

5.3.6 Latest Developments

5.4 ADVICS

5.4.1 Profile

5.4.2 Operation

5.4.3 Braking System Business

5.4.4 Business in China

5.4.5 ADVICS Tianjin Automobile Parts Co., Ltd.

5.4.6 ADVICS Guangzhou Automobile Parts Co., Ltd.

5.5 Mando China

5.5.1 Profile

5.5.2 Operation

5.5.3 Main Products

5.5.4 Supporting Relationship

5.5.5 Production Layout

5.6 Nissin Kogyo

5.6.1 Profile

5.6.2 Operation

5.6.3 Braking System Business

5.6.4 Major Customers

5.6.5 Business in China and Production Bases

5.6.6 Capacity Expansion of Zhongshan Nissin Industry

5.7 Hyundai Mobis

5.7.1 Profile

5.7.2 Operation

5.7.3 Braking System Business

5.7.4 Business in China

5.7.5 Wuxi Mobis Automotive Parts Co., Ltd.

5.7.6 Tianjin Mobis Automotive Parts Co. Ltd.

5.8 WABCO

5.8.1 Profile

5.8.2 Operation

5.8.3 Braking System Business

5.8.4 Business in China

5.8.5 Production Bases

5.9 KNORR-BREMSE

5.9.1 Profile

5.9.2 Operation

5.9.3 Braking System Business

5.9.4 Business in China

6 Chinese Companies

6.1 Zhejiang Asia-pacific Mechanical & Electronic

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Major Customers

6.1.5 Braking Electronics Business

6.1.6 Layout in Intelligent Car Business

6.1.7 Technological Transformation of Automotive Braking System ECU with Raised Funds

6.1.8 Development Forecast

6.2 HUAYU Automotive Systems

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Output

6.2.5 Shanghai Automotive Brake Systems Co., Ltd. (SABS)

6.2.6 Continental Huayu Brake Systems (Chongqing) Went into Operation

6.3 Zhejiang Vie Science & Technology

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Major Customers

6.3.5 Production Bases and Supporting Relationship

6.3.6 New Projects

6.3.7 Layout in Intelligent Vehicle

6.4 Wuhu Bethel Automotive Safety Systems

6.4.1 Profile

6.4.2 Operation

6.4.3 Major Customers

6.4.4 Supply of Raw Materials

6.4.5 Production Capacity

6.4.6 Sales

6.4.7 Projects with Raised Funds

6.5 Wanxiang Qianchao

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Braking System Business

6.5.5 R&D

6.5.6 Supporting Relationship

6.5.7 Projects with Raised Funds

6.6 Fawer Automotive Parts

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Major Products and Customers

6.6.5 Production Bases

6.7 Guangzhou Ruili Kormee Automotive Electronic

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 ABS Business

6.7.5 Subsidiaries

6.8 Chongqing JUNENG

6.8.1 Profile

6.8.2 ABS Business

6.9 Dongfeng Electronic Technology

6.9.1 Profile

6.9.2 Operation

6.9.3 Braking System Business

Policies and Standards for Automotive ABS in China

Supply Chain of Main Parts of Automotive Braking System in China

Automobile Output in China, 2010-2021E

Automobile Ownership in China, 2007-2021E

Installation Rate of Automotive ABS in China, 2014-2021E

Installations of Automotive ABS in China, 2014-2021E

Major ABS Suppliers and Their Supported Customers in China

Passenger Car Output and Sales in China, 2008-2017

Passenger Car Output Forecast in China, 2017-2021E

Installations of ABS for Passenger Cars in China, 2008-2016

Estimated Installations of ABS for Passenger Cars in China, 2016-2021E

Market Share of Major Brands in ABS Supporting Market of Passenger Car in China, 2016

ABS Matching of Passenger Car Makers in China

Commercial Vehicle Output and Sales in China, 2008-2017

Commercial Vehicle Output Forecast in China, 2016-2021E

Installations of ABS for Commercial Vehicle in China, 2009-2016

Estimated Installations of ABS for Commercial Vehicle in China, 2016-2021E

Market Share of Major Brands in ABS Supporting Market of Commercial Vehicle in China, 2016

ABS Matching of Major Commercial Vehicle Makers in China

Revenue of Bosch, 2010-2016

Revenue Structure of Bosch by Region, 2016

Revenue Structure of Bosch by Business, 2016

Main Chassis Control System Products of Bosch

Development History of Bosch’s Automotive Electronics Business

Main Supported Models of Bosch’s Braking System and Electronic Control System Products

Bosch’s Revenue in China, 2012-2016

Main ABS Production Bases of Bosch in China

Main Automotive-related R&D Centers of Bosch in China

Revenue and EBIT of Continental, 2011-2017

Revenue and Employees of Continental by Division, 2016

Revenue, EBIT, and Employees of Continental’s Chassis & Safety Division, 2017Q1

Main Products of Continental’s Chassis & Safety Division

Main Models Supported by Continental’s Braking System and Electronic Control System Products

Presence of Continental’s Bases in China

Profile of Continental Automotive Changchun Co., Ltd.

List of ZF’s Main Businesses

Revenue of ZF, 2015-2016

Revenue of ZF by Region, 2016

Revenue of ZF by Business, 2015-2016

Main Products of ZF TRW’s Chassis System and Electronic Parts Divisions

Main Models Supported by ZF’s Braking System and Electronic Control System Products

Main ABS Production Bases of ZF in China

R&D Centers of TRW (Acquired by ZF) in China

Global Footprints and Workforce of ADVICS

Revenue and Profit of ADVICS, FY2014-FY2016

Workforce of ADVICS, FY2014-FY2016

Main Products of ADVICS

Main Models Supported by ADVICS’ Braking System and Electronic Control System Products

ADVICS’ Subsidiaries in China

Workforce of Mando in China, 2012-2016

Revenue of Mando China, 2012-2016

Net Income of Mando China, 2012-2016

Key Products of Mando China

Main Models Supported by Mando’s Braking System and Electronic Control System Products

Key Facilities Layout for Mando China

Basic Information (equity, customers, products, etc.) of Mando (Beijing) Automotive Chassis System Co., Ltd.

Basic Information (equity, customers, products, etc.) of Mando (Suzhou) Automotive Chassis System Co., Ltd.

Basic Information (equity, customers, products, etc.) of Mando (Ningbo) Automotive Parts Co., Ltd.

Revenue and Net Income of Nissin Kogyo, FY2015-FY2017

Revenue of Nissin Kogyo by Region, FY2017

Revenue of Nissin Kogyo by Business, FY2016-FY2017

Main Models Supported by Nissin Kogyo’s ABS Products

Revenue Structure of Nissin Kogyo by Customer, FY2016-FY2017

Main Production Bases of Nissin Kogyo in China

Main Products of Zhongshan Nissin Industry

Capacity of Main Products of Zhongshan Nissin Industry (as of Nov. 2016)

Revenue and Operating Margin of Hyundai Mobis, 2015-2016

Operating Data of Hyundai Mobis by Region, 2016

Operating Data of Hyundai Mobis by Business, 2016

Key Parts of Braking System of Hyundai Mobis

Production Bases of Hyundai Mobis in South Korea

Main Models Supported by Hyundai Mobis’ Braking System and Electronic Control System Products

Hyundai Mobis’ Subsidiaries in China

Basic Information of Wuxi MOBIS Automotive parts Co., Ltd.

Basic Information of Tianjin MOBIS Automotive Parts Co., Ltd.

Global Presence of Operations of WABCO

Revenue and Operating Income of WABCO, 2014-2016

Revenue of WABCO by Region/Business, 2015-2016

Main Products of WABCO

WABCO’s Subsidiaries in China

Main Production Bases of WABCO in China

Basic Information and Supported Customers of Shandong Weiming Automotive Products Co., Ltd.

Overview of WABCO Vehicle Control Systems (China) Co., Ltd.

Revenue and Net Income of Knorr-Bremse, 2012-2016

Revenue of Knorr-Bremse by Region, 2016

Revenue of Knorr-Bremse by Business, 2016

Main Products of Knorr-Bremse’s Commercial Vehicle Systems Division

Subsidiaries of Knorr-Bremse’s Commercial Vehicle Systems Division in China

Revenue and Net Income of Zhejiang Asia-Pacific Mechanical & Electronic, 2011-2016

Revenue of Zhejiang Asia-Pacific Mechanical & Electronic by Product, 2014-2016

Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2012-2016

Revenue from Top 5 Customers of Zhejiang Asia-Pacific Mechanical & Electronic, 2015-2016

Enterprises and Models Supported with EBS of Zhejiang Asia-Pacific Mechanical & Electronic

Layout of Zhejiang Asia-Pacific Mechanical & Electronic in Intelligent Vehicle Industry Chain

Products of Shenzhen Forward Innovation Digital Technology

“Tima Cloud” Telematics Integrated Application System

Fundraising Projects of Zhejiang Asia-Pacific Mechanical & Electronic by Issuing Convertible Bonds, 2017

Revenue, Net Income and Gross Margin of Zhejiang Asia-Pacific Mechanical & Electronic, 2016-2021E

Main Business of HUAYU Automotive Systems

Revenue and Net Income of HUAYU Automotive Systems, 2014-2016

Revenue of HUAYU Automotive Systems by Product, 2015-2016

Output and Sales Volume of HUAYU Automotive Systems by Product, 2016

Equity Structure of Shanghai Automotive Brake Systems

ABS Supply Relationship of Shanghai Automotive Brake Systems

Winter Test Center of Shanghai Automotive Brake Systems

Revenue and Net Income of Zhejiang Vie Science & Technology, 2011-2016

Revenue of Zhejiang Vie Science & Technology by Product, 2014-2016

Gross Margin of Zhejiang Vie Science & Technology by Product, 2014-2016

Main Commercial Vehicle Products of Zhejiang Vie Science & Technology

Main Passenger Car Products of Zhejiang Vie Science & Technology

Main Customers of Zhejiang Vie Science & Technology

Main Production Bases and Supported Customers of Zhejiang Vie Science & Technology

List of Fundraising Projects of Zhejiang Vie Science & Technology by Non-public Offering of Shares, 2016

Operating Indices of Wuhu Bethel Automotive Safety Systems, 2013-2016

Operating Revenue of Wuhu Bethel Automotive Safety Systems by Product, 2014-2016

Top 5 Customers of Wuhu Bethel Automotive Safety Systems, 2013-2016

Procurement of Main Raw Materials of Wuhu Bethel Automotive Safety Systems, 2014-2016

Top 5 Raw Material Suppliers of Wuhu Bethel Automotive Safety Systems, 2013-2016

Production Lines and Capacity of Wuhu Bethel Automotive Safety Systems, 2014-2016

ABS Pneumatic Production Technology of Wuhu Bethel Automotive Safety Systems

ABS/ESC Hydraulic Production Technology of Wuhu Bethel Automotive Safety System

Output and Sales Volume of Wuhu Bethel Automotive Safety System by Product, 2014-2016

Prices of Main Products of Wuhu Bethel Automotive Safety System, 2014-2016

Fundraising Projects of Wuhu Bethel Automotive Safety System by Initial Public Offering, 2017

Revenue, Net Income and Gross Margin of Wangxiang Qianchao, 2013-2016

Operating Revenue and Gross Margin of Wangxiang Qianchao by Business, 2014-2016

Operating Revenue and Gross Margin of Wangxiang Qianchao by Region, 2014-2016

ABS Subsidiaries of Wangxiang Qianchao

Output and Sales Volume of Wangxiang Qianchao by Product, 2014-2016

Overview of Wanxiang Research Institute

Braking System Supply Relationship of Wangxiang Qianchao

Fundraising Projects of Wangxiang Qianchao by Allotment of Shares, 2017

Revenue, Net Income and Gross Margin of FAWER Automotive Parts, 2013-2016

Operating Revenue and Gross Margin of FAWER Automotive Parts by Region, 2014-2016

Operating Revenue and Gross Margin of FAWER Automotive Parts by Business, 2014-2016

Regional Distribution and Customers of FAWER Automotive Parts

Output and Sales Volume of FAWER Automotive Parts by Product, 2014-2016

Braking System Subsidiaries of FAWER Automotive Parts

Revenue, Gross Margin and Net Income of Guangzhou Kormee Automotive Electronic Control Technology, 2014-2016

Revenue of Guangzhou Kormee Automotive Electronic Control Technology by Product, 2015-2016

ABS Supply Relationship of Guangzhou Kormee Automotive Electronic Control Technology

Revenue and Net Income of Holding Subsidiaries of Guangzhou Kormee Automotive Electronic Control Technology, 2015-2016

ABS Supply Relationship of Chongqing Juneng Automotive Technology

Revenue, Net Income and Gross Margin of Dongfeng Electronic Technology, 2013-2016

Operating Revenue and Gross Margin of Dongfeng Electronic Technology by Business, 2014-2016

Output and Sales Volume of Dongfeng Electronic Technology by Product, 2014-2016

Sales Volume of Main Products of Dongfeng Electronic Technology in Supporting Market, 2016

Capacity of Main Products and Utilization Rate of Dongfeng Electronic Technology, 2016

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...