China NVH (System, Parts, Materials) Industry Report, 2017-2021

-

Aug.2017

- Hard Copy

- USD

$2,700

-

- Pages:115

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZLC055

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

Automotive NVH parts can be divided into shock absorber and noise reduction products, of which the former covers rubber shock absorber and spring vibration damper, while the latter includes soundproof products and sealing products.

1) The Market of Rubber Shock Absorbers

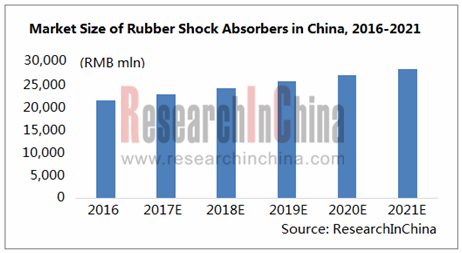

With steady development of Chinese automobile industry, the market size of rubber shock absorbers grew as well. In 2016, the Chinese market size of rubber shock absorbers was approximately RMB21.367 billion, of which OEM accounted for 74.3% and AM 25.7%. In the next five years, the market size of rubber shock absorbers in China will still present steady growth, but with a slowdown in growth rate.

Currently, there are only around 50 manufacturers of automotive rubber shock absorber that have tapped into the passenger car OEM market, and a few of them are capable of synchronous R&D, system integration and batch supply. Some medium and high-end automotive rubber dampers still rely on imports from abroad. Nowadays, the local powerful companies mainly consist of Tuopu Group, Anhui Zhongding Sealing Parts, Zhuzhou Times New Material Technology, JX Zhao’s Group Corp, and so forth.

2) The Market of Soundproof Products

In 2016, the market size of soundproof products in China reported RMB26.695 billion or so, including RMB24.4 billion from soundproof products for passenger cars. In the upcoming five years, the market size of soundproof products in China will surge to RMB32.395 billion in 2021, along with the steady development of Chinese automobile market.

So far, there have been over 100 producers of automotive soundproof products in China, and the key competitors involve Tuopu Group, Zhuzhou Times New Material Technology, Changshu Automotive Trim, Shanghai Car Carpet Plant, etc.

Tuopu Group is the leader in the market of vibration damper and soundproof products for OEM cars in China, with customers such as SAIC-GM, Geely, and Changan Ford. In 2016, the company’s output and sales volume of rubber shock absorbers reached 4.0802 million sets and 3.8997 million sets, respectively; and output and sales volume of soundproof products was up to 1.9133 million sets and 1.7334 million sets, respectively.

From 2008 to 2016, Anhui Zhongding Sealing Parts successively acquired the leading players in the NVH industry like American AB, BRP, MRP, COOPER, ACUSHNET, German KACO, WEGU, TFH, French FM Seal, and Swiss Green Motion SA, and brought the upgrading of products into reality and explored the overseas market in a bid to further sharpen its competitiveness.

Zhuzhou Times New Material Technology accessed into the NVH field by acquiring German BOGE. In 2016, company’s NVH business revenue reached RMB5.778 billion, up 9.8% year on year mainly because BOGE’s new product plastic pedal case received large orders from Volkswagen and Porsche and active control vibration damper engine strut gained Audi’s orders worth EUR6 million.

China NVH (System, Parts, Materials) Industry Report, 2017-2021 mainly highlights the following:

Current situation, system integration, competitive landscape, development trend, etc. of Chinese automotive NVH market;

Current situation, system integration, competitive landscape, development trend, etc. of Chinese automotive NVH market;

Market size, competitive pattern, etc of NVH parts in China (rubber shock absorbers, soundproof products, sealing products);

Market size, competitive pattern, etc of NVH parts in China (rubber shock absorbers, soundproof products, sealing products);

Upstream and downstream of Chinese NVH industry;

Upstream and downstream of Chinese NVH industry;

10 NVH companies (profile, operation, customers, NVH business, etc.)

10 NVH companies (profile, operation, customers, NVH business, etc.)

1 Overview of NVH

1.1 Definition

1.2 Classification

1.3 Production Technology

1.3.1 Shock Absorber Products

1.3.2 Sound Insulation Products

1.4 Industry Chain

2 Overview of NVH Market

2.1 Industry Policy

2.2 Development

2.3 System Integration

2.3.1 Global Market

2.3.2 Chinese Market

2.4 Competitive Landscape

2.5 Industry Barrier

2.6 Development Trend

3 NVH Parts Market

3.1 Rubber Shock Absorber Products

3.1.1 Overview

3.1.2 Market Size

3.1.3 Competitive Landscape

3.2 Sound Insulation Products

3.2.1 Overview

3.2.2 Market Size

3.2.3 Competitive Landscape

3.2.4 Development Trend

3.3 Seal Products

3.3.1 Market Size

3.3.2 Competitive Landscape

4 Upstream Raw Material Market

4.1 Rubber

4.1.1 Rubber Products

4.1.2 Natural Rubber

4.1.3 Synthetic Rubber

4.2 Polyurethane

4.2.1 Global Market

4.2.2 Chinese Market

4.3 Polypropylene

4.4 Polyethylene

5 Downstream Demand Market

5.1 Auto Parts Market

5.1.1 Industry Characteristics

5.1.2 Development

5.1.3 Industry Operation

5.1.4 Import and Export

5.2 Automobile Market

5.2.1 Global

5.2.2 China

6 Key Chinese NVH Enterprises

6.1 Tuopu Group

6.1.1 Profile

6.1.2 Industrial Layout

6.1.3 Products, Technologies, and Solutions

6.1.4 NVH Business

6.1.5 Supported Customers

6.1.6 Suppliers

6.1.7 R&D

6.1.8 Product Production and Sales

6.1.9 Core Competitiveness

6.1.10 Operation

6.2 Anhui Zhongding Sealing Parts Co., Ltd.

6.2.1 Profile

6.2.2 Industrial Layout

6.2.3 R&D

6.2.4 Denotative Expansion

6.2.5 Zhongding Damping Rubber Technology Co., Ltd.

6.2.6 Operation

6.3 Zhuzhou Times New Material Technology Co., Ltd.

6.3.1 Profile

6.3.2 Industrial Layout

6.3.3 Products, Technologies, and Solutions

6.3.4 Customers

6.3.5 NVH Business

6.3.6 Operation

6.4 Wuhu Yuefei Sound-absorbing New Materials Co., Ltd.

6.4.1 Profile

6.4.2 Industrial Layout

6.4.3 Products, Technologies, and Solutions

6.4.4 R&D

6.4.5 Supported Customers

6.4.6 Suppliers

6.4.7 NVH Business

6.4.8 Operation

6.5 Changshu Automotive Trim Co., Ltd.

6.5.1 Profile

6.5.2 Industrial Layout

6.5.3 Product and Supported Customers

6.5.4 Operation

6.6 ASIMCO NVH Technologies Co., Ltd. (Anhui)

6.6.1 Profile

6.6.2 Industrial Layout

6.6.3 Supported Customers

6.7 JX Zhao’s Group Corp.

6.7.1 Profile

6.7.2 Development History

6.7.3 Product and Supported Customers

6.8 Shanghai Car Carpet Plant Co., Ltd.

6.8.1 Profile

6.8.2 Industrial Layout

6.8.3 Product and Supported Customers

6.8.4 Operation

6.9 Huayu-Cooper Standard Sealing Systems Co., Ltd.

6.9.1 Profile

6.9.2 Product and Supported Customers

6.10 Beijing Wanyuan-Henniges Sealing Systems Co., Ltd.

6.10.1 Profile

6.10.2 Supported Customers

Transfer Path of Automotive Noise and Vibration

Classification of Automotive NVH Parts

NVH Industry Chain

Policies on Automotive NVH Industry in China

Development of NVH at Home and Abroad

NVH Development of Auto Makers in China

Revenue of Global Top 10 Auto Parts Manufacturers, 2016

China’s GDP, 2012-2017

Auto Production and YoY Growth, 2011-2017

AutoSales and YoY Growth, 2011-2017

Automotive Rubber Shock Absorber Products

OEM Market Capacity of NVH Rubber Shock Absorber Products in China, 2011-2021E

AM Market Capacity of NVH Rubber Shock Absorber Products in China, 2011-2021E

Market Size of Rubber Shock Absorber Products in China, 2011-2021E

Major Rubber Shock Absorber Product Manufacturers in China, 2016

Auto Body Parts Equipped with Sound Insulation Products

Classification of Automotive Sound Insulation Products

Introduction to Main Automotive Sound Insulation Products

Comparison of Commonly-used Automotive Sound Insulation Materials

OEM Market Capacity of NVH Sound Insulation Products in China, 2011-2021E

Major Sound Insulation Products Manufacturers in China, 2015

Market Capacity of NVH Sealing Products in China, 2011-2020E

Major Seals Suppliers and Supported Customers in China, 2015

Classification of Rubber Products

Overview of Main Automotive Non-tire Rubber Products

Global Top10 Non-tire Rubber Product Manufacturers and Their Sales, 2015

Output and Consumption of Natural Rubber in China, 2009-2016

Market Price of Natural Rubber (Standard Rubber and SCRWF) in China, 2015-2016

Output and Apparent Consumption of Synthetic Rubber in China, 2009-2016

China’s Synthetic Rubber Import and Export Volume, 2009-2016

Polyurethane Products and Their Raw Materials and Applications

Global Polyurethane Product Demand, 2010-2016

Global Product Mix of Polyurethane Products by Demand, 2016

Global Regional Distribution of Polyurethane Products by Output, 2016

Global Demand for Car-used Polyurethane, 2011-2016

China’s Polyurethane Product Demand and YoY Growth, 2009-2016

Product Mix of Polyurethane Products in China by Demand, 2016

Market Size of Automotive Polyurethane in China, 2010-2016

Import and Export Volume of Polyurethane Resin in China, 2010-2016

Capacity of PP Facilities in China, 2006-2016

PP Output and Apparent Consumption in China, 2009-2016

China’s PP Import and Export Volume, 2009-2016

Market Price for PP (T30S) in China, 2014-2016

PE Output and Apparent Consumption in China, 2009-2016

China’s PE Import and Export Volume, 2009-2016

Market Price for PE in China, 2014-2016

Classification of Auto Parts

Difference Between OEM and AM Markets

OEM Auto Parts Supplier System

Supported Parts for Different Auto Brands

Operating Revenue and Growth Rate of Auto Parts in China, 2006-2016

Total Profits and Growth Rate of Auto Parts in China, 2006-2016

Import and Export Value of Auto Parts in China, 2013-2016

Global Automobile Output and Sales Volume, 2011-2016

China’s Automobile Output and Sales Volume, 2009-2016

Passenger Vehicle Ownership in China per Thousand Persons, 2009-2016

Tuopu’s Industrial Layout Worldwide

Tuopu’s Member Enterprises and Production Capacity

Tuopu’s Major Subsidiaries, 2016

Revenue and Net Income of Tuopu’s Major Subsidiaries, 2016

Distribution of Tuopu’s Automotive Rubber Shock Absorber Products in Vehicles

Distribution of Tuopu’s Automotive Sound Insulation Products in Vehicles

Revenue of Tuopu by Product, 2014-2016

Revenue Structure of Tuopu by Product, 2014-2016

Revenue of Tuopu by Region, 2013-2016

Revenue Structure of Tuopu by Region, 2013-2016

Gross Margin of Tuopu by Product, 2014-2016

Tuopu’s Major Customers

Tuopu’s Market Distribution and Supported Customers in China

Tuopu’s Global Market Distribution and Supported Customers

Tuopu’s Revenue from Top 5 Customers and % of Total Revenue, 2013-2016

Name List and Revenue Contribution of Tuopu’s Top 5 Customers, 2014

Name List and Revenue Contribution of Tuopu’s Top 5 Customers by Rubber Shock Absorber Products, 2014

Tuopu’s Sound Insulation Products and Supply Relationship, 2014

Tuopu’s New Orders from Shanghai GM, 2015-2017

Tuopu’s Production Cost Structure of Rubber Shock Absorber Products, 2012-2014

Tuopu’s Production Cost Structure of Sound Insulation Products, 2012-2014

Tuopu’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013-2016

Name List and Procurement of Tuopu’s Top 5 Suppliers and % of Total Procurement, 2014

Tuopu’s R&D Costs and % of Total Revenue, 2013-2016

NVH Product Market Share of Tuopu, 2012-2014

Tuopu’s Rubber Shock Absorber Product Capacity and Output, 2012-2014

Tuopu’s Sound Insulation Products Capacity and Output, 2012-2014

Output, Sales Volume, and Growth Rate of Tuopu’s Main Products, 2016

Average Prices of Tuopu’s Rubber Shock Absorber Products and Sound Insulation Products, 2012-2014

Revenue and Net Income of Tuopu, 2011-2017Q1

R&D Costs and % of Total Revenue of Anhui Zhongding Sealing Parts, 2013-2016

Denotative Expansion of Anhui Zhongding Sealing Parts, 2008-2016

Revenue and Net Income of Zhongding Damping Rubber Technology, 2011-2016

Revenue and Net Income of Anhui Zhongding Sealing Parts, 2013-2017

Revenue Structure of Anhui Zhongding Sealing Parts by Product, 2013-2016

Revenue Structure of Anhui Zhongding Sealing Parts by Region, 2013-2016

Main Production Bases and Capacity of Zhuzhou Times New Material Technology, 2015

Major Automotive Products of Zhuzhou Times New Material Technology

Main Business Segments and Customers of Zhuzhou Times New Material Technology

Automobile Revenue of Zhuzhou Times New Material Technology, 2013-2016

Revenue and Net Income of Zhuzhou Times New Material Technology, 2011-2017

Revenue Structure of Zhuzhou Times New Material Technology by Segment, 2014-2016

Revenue Structure of Zhuzhou Times New Material Technology by Region, 2013-2016

Industrial Layout of Wuhu Yuefei Sound-absorbing New Materials

Subsidiaries of Wuhu Yuefei Sound-absorbing New Materials, 2016

Revenue and Net Income of Subsidiaries of Wuhu Yuefei Sound-absorbing New Materials, 2015-2016

Wuhu Yuefei Sound-absorbing New Materials’ Two-component Sound-absorbing Cotton Application in Automobile

Wuhu Yuefei Sound-absorbing New Materials’ PET Upright Cotton Application in Automobile PET

Foamed Polyethylene Insulation Pad Products of Wuhu Yuefei Sound-absorbing New Materials

R&D Costs and % of Total Revenue of Wuhu Yuefei Sound-absorbing New Materials, 2013-2016

Revenue from Top 5 Customers and % of Total Revenue of Wuhu Yuefei Sound-absorbing New Materials, 2013-2016

Name List and Revenue Contribution of Top 5 Customers of Wuhu Yuefei Sound-absorbing New Materials, 2015-2016

Wuhu Yuefei Sound-absorbing New Materials’ Procurement from Top 5 Suppliers and % of Total Procurement, 2013-2016

Name List and Procurement of Wuhu Yuefei Sound-absorbing New Materials’ Top 5 Suppliers and % of Total Procurement, 2015-2016

Revenue of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue Structure of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue of Wuhu Yuefei Sound-absorbing New Materials by Region, 2013-2015

Revenue Structure of Wuhu Yuefei Sound-absorbing New Materials by Region, 2013-2015

Gross Margin of Wuhu Yuefei Sound-absorbing New Materials by Product, 2013-2015

Revenue and Net Income of Wuhu Yuefei Sound-absorbing New Materials, 2013-2016

Main Products of Changshu Automotive Trim

Major Customers of Changshu Automotive Trim

Revenue and Net Income of Changshu Automotive Trim, 2013-2017Q1

Revenue Structure of Changshu Automotive Trim by Product, 2013-2016H1

Output, Sales Volume and Inventory of Main Products of Changshu Automotive Trim, 2016

Global Industrial Layout of ASIMCO

Development History of JX Zhao’s Group

Supported Auto Makers of JX Zhao’s Group

Parts Integrators of JX Zhao’s Group

Production Base Distribution of Shanghai Car Carpet Plant

Joint Venture Distribution of Shanghai Car Carpet Plant

Main Product Range of Shanghai Car Carpet Plant

Total assets and Net income of Shanghai Car Carpet Plant, 2013-2015

Major Customers and Their Vehicle Models of Beijing Wanyuan-Henniges Sealing Systems

Customer Distribution of Beijing Wanyuan-Henniges Sealing Systems

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...