Global and China Automotive Transmission Industry Report, 2017-2021

-

Aug.2017

- Hard Copy

- USD

$3,200

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZJF108

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

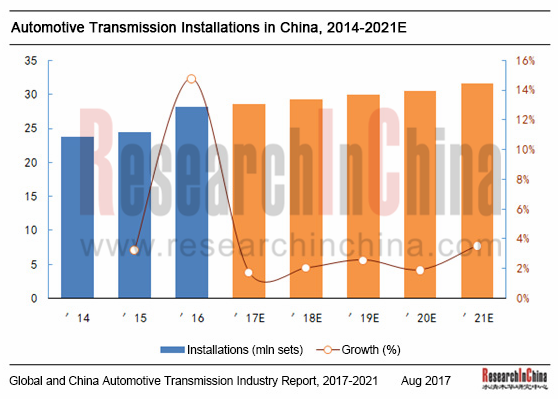

The market demand for transmission, one of essential automotive parts, has direct bearing on the development of the automobile industry. According to China Association of Automobile Manufacturers (CAAM), the country’s auto production and sales hit all-time highs again in 2016, amounting to 28.119 million units and 28.028 million units, up 14.5% and 13.7% year on year, respectively, which in turn drove the demand for transmission up to 28.119 million sets (AM is ignored because of rare demand), a 14.5% rise from a year earlier. Aggregate demand for transmission will expand along with further development of the automobile industry, expected to hit 31.64 million sets in 2021, representing a CAGR of 2.4% during 2016-2021.

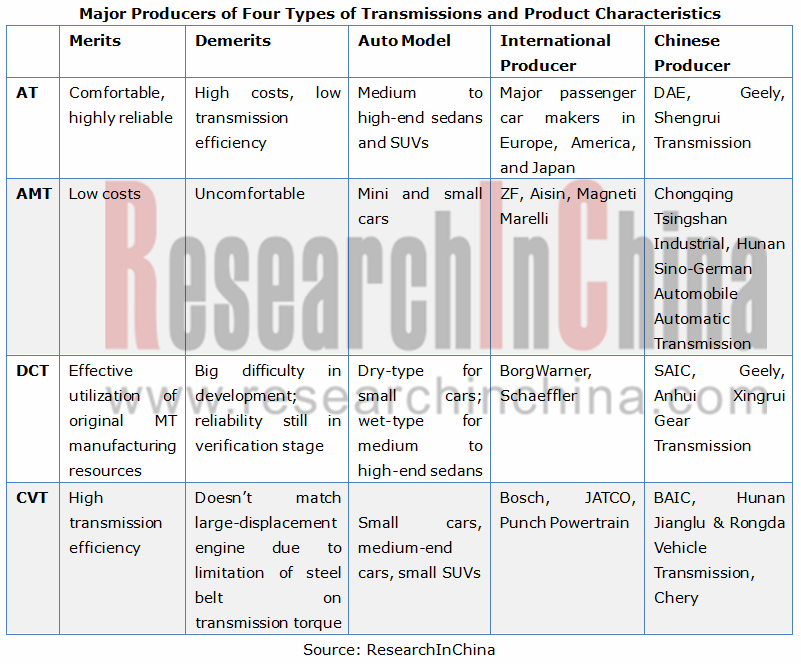

Market structure: In China, automotive transmissions are primarily divided into manual transmission (MT) (including semi-automatic transmission) and automatic transmission (AT) with the latter further classified into stepped transmission (AT/AMT/DCT) and continuously variable transmission (CVT). MT, AT and AMT, all applicable to passenger cars and commercial vehicles, held a 47.6%, 28.0% and 1.4% market share in 2016, respectively; DCT and CVT, generally assembled in passenger cars, occupied a 10.9% and 11.1% market share in the same year, separately.

Like other key auto parts, the automotive transmission market remains relatively stable. Local suppliers still cannot replace foreign counterparts due to a large gap in the aspects of strength, precision, vibration noise and anti-fatigue of transmission gear. In the CVT market, Japanese JATCO and Aisin AW are dominant globally, while domestic Zhejiang Wanliyang and Hunan Jianglu&Rongda Vehicle Transmission serve mainly local brands like Chery; in DCT field, with core technologies originating from Luk (a member of the Schaeffler Group) and BorgWarner, the product is widely used in European and American cars (Volkswagen, Ford, etc.), while domestic BYD and SAIC achieve in-house supply via cooperation; AT suppliers include Japanese Aisin AW and JATCO (AT for passenger cars and light commercial vehicles), Allison (AT for heavy commercial vehicles), and German ZF (AT for passenger cars and light/heavy commercial vehicles), compared with in-house supply for local enterprises like Geely.

Global and China Automotive Transmission Industry Report, 2017-2021 highlights the followings:

Overview of automotive transmission industry (definition & classification, development trend, industry policy, etc.)

Overview of automotive transmission industry (definition & classification, development trend, industry policy, etc.)

Overview of the automobile industry in China and worldwide (car production, sales and ownership, etc.);

Overview of the automobile industry in China and worldwide (car production, sales and ownership, etc.);

Global automotive transmission market (installations, market structure, market segments (AT, MT, CVT, DCT), competitive landscape, etc.);

Global automotive transmission market (installations, market structure, market segments (AT, MT, CVT, DCT), competitive landscape, etc.);

Chinese automotive transmission market (installations, market structure, competitive landscape, etc.);

Chinese automotive transmission market (installations, market structure, competitive landscape, etc.);

Chinese passenger car transmission market (installations, market structure, market segments (AT, MT, CVT, DCT), competitive landscape, etc.)

Chinese passenger car transmission market (installations, market structure, market segments (AT, MT, CVT, DCT), competitive landscape, etc.)

Chinese commercial vehicle transmission market (installations, market structure, market segments (AT, MT, AMT), competitive landscape, etc.)

Chinese commercial vehicle transmission market (installations, market structure, market segments (AT, MT, AMT), competitive landscape, etc.)

26 enterprises at home and abroad including JATCO, Aisin, BorgWarner, ZF, Schaeffler, Hyundai Dymos, Zhejiang Wanliyang, Chongqing Tsingshan Industrial, Shaanxi Fast Auto Drive, and Shanghai Automobile Gear Works (profile, financial position, output & sales, main products, production bases, latest developments, etc.)

26 enterprises at home and abroad including JATCO, Aisin, BorgWarner, ZF, Schaeffler, Hyundai Dymos, Zhejiang Wanliyang, Chongqing Tsingshan Industrial, Shaanxi Fast Auto Drive, and Shanghai Automobile Gear Works (profile, financial position, output & sales, main products, production bases, latest developments, etc.)

1 Automotive Transmission

1.1 Introduction

1.2 Classification

1.3 Innovative Solutions and Optimization of Various Transmissions

1.4 Development Trends

2 Global and Chinese Automobile Markets

2.1 Global

2.2 China

2.2.1 Overview

2.2.2 Recent Developments

3 Global Transmission Market

3.1 Overview

3.1.1 Installations

3.1.2 Market Structure

3.2 AT

3.2.1 Major Manufacturers

3.2.2 Supply Relation

3.2.3 Production Bases

3.3 CVT

3.3.1 Major Manufacturers

3.3.2 Supply

3.3.3 Production Bases

3.4 AMT

3.5 DCT

4 China Automotive Transmission Industry

4.1 Policy Environment

4.2 Market Status

4.2.1 Installations

4.2.2 Market Structure

4.3 Business Models

4.4 EV Automatic Transmissions

4.4.1 Status Quo

4.4.2 Hybrid Power Solutions of Major Enterprises

4.4.3 Electric Drive Solutions of Major Enterprises

5 Chinese Passenger Car Transmission Market

5.1 Size and Structure

5.2 Manual Transmissions

5.3 Automatic Transmissions

5.3.1 AT

5.3.2 DCT

5.3.3 CVT

5.3.4 AMT

5.4 Capacity

5.5 Patent Protection

5.6 Development Trends

6 Chinese Commercial Vehicle Transmission Market

6.1 Size and Structure

6.2 Manual Transmissions

6.3 Automatic Transmissions

6.4 Competitive Landscape

6.5 Supply Relationship

6.6 Transmission Supply of Major Enterprises

6.7 Development Trends

7 Global Major Transmission Manufacturers

7.1 Jatco

7.1.1 Profile

7.1.2 Operation

7.1.3 Main Products

7.1.4 Production Bases

7.1.5 Supply Relation

7.1.6 Jatco (Guangzhou) Automatic Transmission Ltd.

7.2 Aisin Seiki

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Major Subsidiaries

7.2.5 Main Products

7.2.6 Supply Relation

7.2.7 TAGC Co., Ltd.

7.2.8 Tianjin AW Automatic Transmission Co., Ltd.

7.2.9 AW Tianjin Co., Ltd.

7.2.10 AW Suzhou Co., Ltd.

7.2.11 Dynamics

7.3 BorgWarner

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Main Products

7.3.5 BorgWarner United Transmission Systems Co., Ltd

7.4 ZF Friedrichshafen AG

7.4.1 Profile

7.4.2 Operation

7.4.3 Main Products

7.4.4 ZF Transmissions Shanghai Co., Ltd.

7.4.5 ZF Drivetech (Hangzhou) Co. Ltd.

7.4.6 ZF Drivetech (Suzhou) Co., Ltd.

7.4.7 Dynamics

7.5 GETRAG

7.5.1 Profile

7.5.2 Main Products

7.5.3 Supply

7.5.4 GETRAG (Jiangxi) Transmission Co., Ltd

7.5.5 Dongfeng GETRAG Transmission Co., Ltd.

7.5.6 Dynamics

7.6 Schaeffler

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Transmission Business

7.6.5 Business in China

7.6.6 Hybrid Power Solutions for the Chinese Market

7.7 Magneti Marelli

7.7.1 Profile

7.7.2 Operation

7.7.3 Transmission Business

7.8 Oerlikon Graziano

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Transmissions

7.9 Hyudai Dymos

7.9.1 Profile

7.9.2 Operation

7.9.3 Transmission Business

7.9.4 Layout in China

7.10 Continental AG

7.10.1 Profile

7.10.2 Operation

7.10.3 Revenue Structure

7.10.4 Business in China

7.10.5 Dynamics

7.11 Eaton

7.11.1 Profile

7.11.2 Operation

7.11.3 Revenue Structure

7.11.4 Transmissions

7.11.5 Dynamics

7.12 Punch Powertrain

7.12.1 Profile

7.12.2 Operation

7.12.3 Revenue Structure

7.12.4 Main Products

7.12.5 Production and Marketing

7.12.6 Major Customers

7.12.7 Nanjing Punch Powertrain Co., Ltd

8 Chinese Automotive Transmission Manufacturers

8.1 Chongqing Tsingshan Industrial Co., Ltd.

8.1.1 Profile

8.1.2 Main Products

8.1.3 Marketing Network

8.2 Shaanxi Fast Auto Drive Group Company

8.2.1 Profile

8.2.2 Main Products

8.2.3 Production Layout

8.3 Zhejiang Wanliyang Co., Ltd.

8.3.1 Profile

8.3.2 Operation

8.3.3 Main Products

8.3.4 Production and Marketing

8.3.5 R & D Investment

8.3.6 Strategy

8.3.7 Shandong Menwo Transmission Co., Ltd.

8.4 Shanghai Automobile Gear Works Co., Ltd.

8.4.1 Profile

8.4.2 Main Products

8.4.3 Marketing Network

8.4.4 Production Bases

8.4.5 Project Investment

8.5 Shengrui Transmission Corporation Limited

8.5.1 Profile

8.5.2 Main Products

8.5.3 Dynamics

8.6 China National Heavy Duty Truck Group Datong Gear Co., Ltd.

8.6.1 Profile

8.6.2 Main Products

8.7 Hunan Jianglu & Rongda Vehicle Transmission Limited Company

8.7.1 Profile

8.7.2 Major Customers

8.7.3 Dynamics

8.8 Qijiang Gear Transmission Co., Ltd.

8.8.1 Profile

8.8.2 Transmission Business

8.9 Volkswagen Automatic Transmission

8.9.1 Volkswagen Automatic Transmission (Shanghai) Co., Ltd.

8.9.2 Volkswagen Automatic Transmission (Dalian) Co., Ltd.

8.9.3 Volkswagen Automatic Transmission (Tianjin) Co., Ltd.

8.10 Hangzhou IVECO Automobile Transmission Technology Co., Ltd.

8.10.1 Profile

8.10.2 Main Products

8.10.3 Dynamics

8.11 Harbin DongAn Automotive Engine Manufacturing Co., Ltd.

8.11.1 Profile

8.11.2 Transmission Business

8.11.3 Dynamics

8.12 Toyota Motor (Changshu) Auto Parts Co., Ltd.

8.12.1 Profile

8.12.2 Main Products

8.13 Honda Auto Parts Manufacturing Co., Ltd

8.13.1 Profile

8.13.2 Main Products

8.14 Inner Mongolia OED Powertrain Co., Ltd.

8.14.1 Profile

8.14.2 Main Products

9 Summary and Forecast

9.1 Market

9.2 Enterprises

9.2.1 Production Capacity

9.2.2 Product Support

9.3 Forecast for Market Development Directions

9.3.1 Development Route

9.3.2 Development Trends

Gears of Manual Transmission

Advantages and Disadvantages of Manual Transmission and Automatic Transmission

Main Manufacturers and Characteristics of Four Types of Automatic Transmission

Gearing, Shift Modes and Features of Various Automatic Transmissions

Innovative Solutions for MT

Innovative Solutions for AT

Innovative Solutions for DCT

Product Optimization for AT

Product Optimization for CVT

Product Optimization for DCT

Global Automotive Transmission Torque Trends, 2006-2022E

Global Automobile Sales and YoY Growth, 2005-2016

Global Automobile Sales Structure by Country/Region, 2016

Global Passenger Car Sales and YoY Growth, 2005-2016

Global Passenger Car Sales Structure by Country/Region, 2016

Global Commercial Vehicle Sales and YoY Growth, 2005-2016

Global Commercial Vehicle Sales Structure by Country/Region, 2016

Sales Volume, YoY Growth and Percentage of TOP20 Countries by New Vehicle Sales, 2013-2016

China’s Automobile Output, 2010-2021E

Monthly Sales and Output of Automobiles, 2017H1

Monthly Sales and Output of Passenger Cars, 2017H1

Passenger Car Sales Structure in China by Brand, 2017H1

Monthly Sales and Output of Commercial Vehicles, 2017H1

Monthly Sales and Output of New Energy Vehicles, 2017H1

Global Automotive Transmission Installations, 2012-2021E

Global Automotive Transmission Demand Structure by Country, 2012-2021E

Global Automotive Transmission Market Structure, 2016/2021E

European Automotive Transmission Market Structure, 2016/2021E

AT Suppliers for Japanese Automakers

AT Suppliers for US Automakers

AT Suppliers for European Automakers

Production Bases of Global Major AT Suppliers

CVT Suppliers for Global Major Automakers

Production Bases of Global Major CVT Suppliers

AMT Suppliers for Japanese and Korean Automakers

AMT Suppliers for American and European Automakers

DCT Trade Names and Types by Auto Brand

DCT Suppliers for Japanese and Korean Automakers

DCT Suppliers for US Automakers

DCT Suppliers for European Automakers

Policies on Automotive Transmission Industry in China

China’s Automotive Transmission Installations, 2012-2021E

China’s Automotive Transmission Market Structure, 2016/2021E

Matching Modes of China Automotive Transmission Industry

China’s New Energy Vehicle Sales, 2011-2021E

EV Automatic Transmission R&D Enterprises in China

Comparison between Hybrid Solutions of Schaeffler

Hybrid Solutions of ZF

Commercial Vehicle Hybrid Solutions of Corning

Electric Drive Roadmap of ZF

Electric Drive Solutions of Proteen Electric

Electric Drive Solutions of Continental

Electric Drive Solutions of GETRAG

China’s Passenger Car Transmission Installations, 2012-2021E

China’s Passenger Car Transmission Market Structure, 2016/2021E

Supply Relationship between MT Manufacturers and Automakers in China

MT Gear Number Distribution in China, 2015-2017

Main Passenger Car Models Assembled with AT in China

Capacity and Supported Automakers of Major AT Enterprises in China, 2016

AT Gear Number Distribution in China, 2015-2017

Main Passenger Car Models Assembled with DCT in China

Main DCT Types in Chinese Passenger Car Market

Capacity and Supported Automakers of Major DCT Enterprises in China, 2016

WDCT and DDCT Market Share in China, 2013-2021E

DCT Gear Number Distribution in China, 2015-2017

Main Passenger Car Models Assembled with CVT in China

Capacity and Supported Automakers of Major CVT Enterprises in China, 2016

Main Passenger Car Models Assembled with AMT in China

Capacity and Supported Automakers of Major AMT Enterprises in China, 2016

AMT Gear Number Distribution in China, 2015-2017

China’s Passenger Car Automatic Transmission Capacity Structure by Type, 2016

Prospects for Independent R&D of Automatic Transmission

China and Foreign Passenger Car Automatic Transmission Installation Ratio

China’s Commercial Vehicle Transmission Installation, 2012-2021E

China’s Commercial Vehicle Transmission Market Structure, 2016/2021E

Transmission Internal-Supply of Major Heavy Truck Enterprises in China

Capacity of Major Commercial Vehicle Automatic Transmission Enterprises in China

Market Share of Major Commercial Vehicle Transmission Enterprises in China

Major Commercial Vehicle Transmission Suppliers in China

Transmission Supply Relationship of Major Medium & Heavy Truck Enterprises in China

Types and Competitive Edges of Main Heavy & Medium Duty Transmission Products in China

Transmission Technology Sources, Development Modes, Capacity and Technical Features of Major Medium & Heavy Truck Enterprises in China

Comparison between Major Heavy Truck Transmissions by Type

Jatco’s Revenue, Operating Income and Net Income, FY2012-FY2016

Main CVT Products of Jatco

Main AT Products of Jatco

Main Hybrid Transmission Products of Jatco

Jatco’s Production Bases in Japan

Jatco’s Factories Abroad

Jatco’s R&D Bases

Supply Relationship of Jatco’s Main Products

Development Course of Jatco (Guangzhou) Automatic Transmission Ltd.

Main Products and Supply Relationship of Jatco (Guangzhou) Automatic Transmission Ltd.

Aisin Seiki’s Revenue and Profits, FY2010-FY2018

Aisin Seiki’s Revenue and Profits in Main Areas, FY2016-FY2017

Aisin Seiki’s Revenue from Main Customers, FY2016-FY2017

Revenue of Aisin Seiki’s Main Subsidiaries, FY2017

Aisin AW’s Revenue and Operating Income, FY2014-FY2018

Aisin AI’s Revenue and Operating Income, FY2015-FY2018

Aisin Seiki’s Transmission Products

Aisin Seiki’s Representative Transmission Products (AT, CVT, Dual-Motor Hybrid)

Aisin Seiki’s Transmission Sales Volume, FY2015-FY2018

Supply Relationship of Aisin Seiki’s Transmissions

Aisin Seiki’s Main Transmission Subsidiaries in China

Main Transmission Products of AGC Co., Ltd.

Main Customers of AGC Co., Ltd.

Main Transmission Products and Supply Relationship of Tianjin AW Automatic Transmission Co., Ltd.

Profile of AW Tianjin Co., Ltd.

Profile of AW Suzhou Co., Ltd.

BorgWarner’s Revenue and Operating Income, 2012-2016

BorgWarner’s Revenue Breakdown by Business, 2014-2016

BorgWarner’s Revenue from Main Customers, 2016

BorgWarner’s Revenue from Power System, 2012-2016

Profile of BorgWarner United Transmission Systems Co., Ltd.

Revenue of BorgWarner United Transmission Systems Co., Ltd., 2012-2016

List of ZF’s Main Businesses

ZF’s Revenue, 2015-2016

ZF’s Revenue Breakdown by Region, 2016

ZF’s Revenue Breakdown by Business, 2015-2016

Profile of ZF Transmissions Shanghai Co., Ltd.

Profile of ZF Drivetech (Hangzhou) Co., Ltd.

Profile of ZF Drivetech (Suzhou) Co., Ltd.

Main Customers of ZF Drivetech (Suzhou) Co., Ltd.

GETRAG’s Operations

GETRAG’s Manual Transmission

GETRAG’s DCT

GETRAG’s Hydraulic Transmission

GETRAG’s Transmission Supply Relationship

Profile of GETRAG (Jiangxi) Transmission Co., Ltd.

Main Production Bases of GETRAG (Jiangxi) Transmission Co., Ltd.

Main Customers of GETRAG (Jiangxi) Transmission Co., Ltd.

Profile of Dongfeng GETRAG Transmission Co., Ltd.

Main Technical Parameters of DCT 150

Main Technical Parameters of DCT 200

Schaeffler’s Main Businesses and Operations

Presence of Schaeffler’s Footholds and R&D Centers by the end of 2016

Schaeffler’s Revenue, EBIT and Net Income, 2015-2017

Schaeffler’s Revenue Structure by Region, 2016-2017

Schaeffler’s Revenue Structure by Division, 2016

Schaeffler’s Automotive Revenue Structure by Product, 2016-2017

Schaeffler’s Transmission Revenue, 2015-2017

Schaeffler’s Main Automotive Customers

Schaeffler’s Main Footholds in China and Their Profile, 2016

Schaeffler’s Revenue in China, 2012-2016

Schaeffler’s Supporting Business Revenue and Key Customers in China, 2016

Standard P2 Hybrid Module Schaeffler Developed for Chinese Market

Global Presence of Magneti Marelli’s Operations

Magneti Marelli’s Main Operating Data, 2014-2016

Main Models Assembled with Magneti Marelli’s Transmission

Number of Oerlikon’s Employees, 2012-2016

Oerlikon’s Staff Composition by Division/Region, 2016

Oerlikon’s Business Structure, 2016

Oerlikon’s Revenue, 2012-2016

Oerlikon’s Revenue Structure by Division/Region, 2016

Oerlikon’s Revenue from Power Division, 2015-2016

Performance Indicators of Oerlikon Graziano’s Electric and Hybrid Transmissions

4-speed Electric Transmission of Oerlikon Graziano

Transmission Supply Relationship of Oerlikon Graziano

Hyundai Dymos’ Revenue, 2012-2016

Hyundai Dymos’ Net Income, 2012-2016

Performance Indicators of Hyundai Dymos’ 6-speed DCT

Performance Indicators of Hyundai Dymos’ 7-speed DCT

Supply Relationship of Hyundai Dymos’ 6-speed and 7-speed DCTs

Main Customers of Hyundai Dymos

Profile of Beijing Dymos Transmission Co., Ltd.

Profile of Hyundai Dymos Powertrain System (Rizhao) Co., Ltd.

Continental’s Business Structure, 2016

Continental’s Revenue and EBIT, 2011-2017

Continental’s Revenue Breakdown by Division, 2015-2016

Continental’s Revenue Breakdown by Region, 2015-2016

Revenue Breakdown of Continental’s Powertrain Division by Region, 2016

Presence of Continental’s Bases in China

Eaton’s Revenue and Operating Income, 2014-2016

Eaton’s Revenue and Operating Income by Business, 2014-2016

Eaton’s Revenue Breakdown by Region, 2014-2016

Equity Structure of Punch Powertrain

Operating Revenue and Profits of Punch Powertrain, 2015-2016

Revenue Breakdown of Punch Powertrain by Business, 2015-2016

Revenue Breakdown of Punch Powertrain by Region, 2015-2016

Main Transmission Products of Punch Powertrain

Transmission Capacity, Output and Sales Volume of Punch Powertrain, 2015-2016

Average Unit Price of Transmissions of Punch Powertrain, 2015-2016

Main Supported Customers of Punch Powertrain

Punch Powertrain’s Revenue from TOP5 Customers and % of Total Revenue, 2016

Main Customers of Nanjing Punch Powertrain Co., Ltd.

Operating Revenue and Profits of Nanjing Punch Powertrain Co., Ltd., 2015-2016

Transmission Product Pedigree of Chongqing Tsingshan Industrial

Progress of Transmission Projects of Chongqing Tsingshan Industrial, 2016

Marketing Network of Chongqing Tsingshan Industrial

Organizational Structure of Shaanxi Fast Auto Drive

Main Subsidiaries of Shaanxi Fast Auto Drive

Revenue and Gross Margin of Zhejiang Wanliyang, 2012-2017

Revenue and Gross Margin of Zhejiang Wanliyang by Product, 2013-2016

Passenger Car Transmissions of Zhejiang Wanliyang

Typical Commercial Vehicle Transmissions of Zhejiang Wanliyang

Transmission Development Course of Zhejiang Wanliyang

Sales Volume, Average Price and Sales/Output Ratio of Passenger Car and Commercial Vehicle Transmissions of Zhejiang Wanliyang, 2015-2016

Capacity, Output and Capacity Utilization of Passenger Car and Commercial Vehicle Transmissions of Zhejiang Wanliyang, 2015-2016

R&D Costs of Zhejiang Wanliyang, 2015-2016

Patents of Zhejiang Wanliyang, 2015-2016

Total Assets, Net Assets, Revenue and Net Income of Shandong Menwo Transmission, 2011-2016

List of Main Transmission Products of Shanghai Automobile Gear Works

Global Marketing Layout of Shanghai Automobile Gear Works

Global Main Customers of Shanghai Automobile Gear Works

Production Layout of Shanghai Automobile Gear Works

Hybrid EDU Transmission Capacity Expansion and Product Upgrade Projects of Shanghai Automobile Gear Works

8AT Prototype of Shengrui Transmission

List of Main Transmissions of China National Heavy Duty Truck Group Datong Gear

Main Conventional Transmission Products and Technical Parameters of Hunan Jianglu & Rongda Vehicle Transmission

Main New Energy Vehicle Automatic Transmission Products and Technical Parameters of Hunan Jianglu & Rongda Vehicle Transmission

Technical Parameters of Main Products of Volkswagen Automatic Transmission (Tianjin)

Main Transmission Products of Hangzhou IVECO Automobile Transmission Technology

Main Customers of Hangzhou IVECO Automobile Transmission Technology

Equity Structure of Harbin DongAn Automotive Engine Manufacturing

M6F Manual Transmission of Harbin DongAn Automotive Engine Manufacturing

Automatic Transmissions of Harbin DongAn Automotive Engine Manufacturing

Main Supported Manufacturers of Harbin DongAn Automotive Engine Manufacturing

Capacity and Capacity Utilization of Main Products of Harbin DongAn Automotive Engine Manufacturing

Progress of Transmission Projects of Harbin DongAn Automotive Engine Manufacturing by the end of 2016

Toyota’s S-CVT Supply Layout

Toyota’s CVT Development Course

Main Transmission Product Types of Toyota

Technical Parameters of Main Transmission Products of Inner Mongolia OED Powertrain

Global and China’s Automotive Transmission Market Size Growth, 2013-2021E

Global and China’s Automatic Transmission Installation Rate, 2013-2021E

Product Types and Production Capacity of Major Transmission Manufacturers in China, 2016

Transmission Supply Relationship of Global Major Manufacturers

Transmission Supply Relationship of Major Manufacturers in China

Localization Ways for Various Automatic Transmissions

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...