Global and China UBI Industry Report, 2017-2021

-

Oct.2017

- Hard Copy

- USD

$2,900

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,700

-

- Code:

ZJF110

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$3,100

-

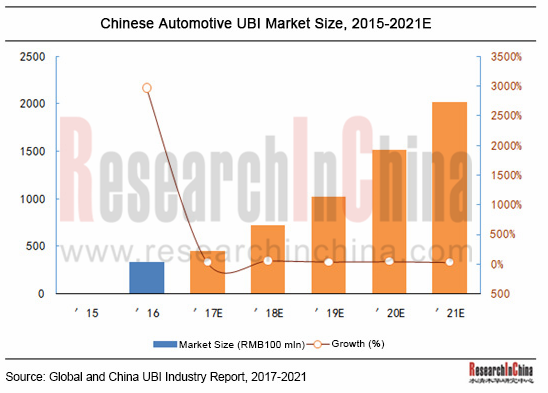

Starting in China in 2012, later than in foreign countries, UBI is primarily developed by mainly referring to foreign products and mature models. Auto insurance, always the largest subsector of property insurance in China, reported original premium income of RMB683.455 billion in 2016, up 10.3% from a year earlier and accounting for 78% of property-insurance original premium income. The reform of commercial car insurance rate management system was piloted from May 2015 and the market-oriented reform of car insurance rate was staged nationwide on July 1, 2016. Also, the rapid evolution of automotive IoT (Internet of Things) gives great impetus to the automotive UBI industry. The Chinese automotive UBI market is expected to value RMB201.8 billion in 2021 at a CAGR of 43.0%.

China’s UBI models are led by the “entities + insurers” one. Entities include OEMs, connected car firms, independent service providers, and big data companies.

1. OEMs + Insurers: OEMs usually cooperate with third parties and insurers in UBI field, represented by SAIC Motor + Cihon + CPIC. SAIC Motor and CPIC give a personalized quote for car insurance on auto models carrying OnStar according to consumers’ driving habits, mileage, and other factors. Cihon is responsible for data analysis and insurance model development.

2. Connected Car Platforms + Insurers: Connected car platforms are dominated by Aftermarket TSP (telematics service provider) in UBI field. For example, the insurer (PICC), via Shenzhen Autonet’s connected car platform, provides car owners with one-key insurance claim, quick settlement of claim, and inquiry of insurance status, and develops floating car insurance business.

3. Independent Service Providers + Insurers: Independent service providers usually acquire customer data via APP + OBD to work with insurers to develop UBI and at the same time provide customers with car maintenance and other services.

4. Big Data + Insurers: In UBI field, some insurers, on the one hand, have self-run platforms, such as Zhong An Online P&C Insurance’s O2O car insurance, and on the other hand, co-develop platforms with Internet businesses or other connected car firms. For instance, CPIC organized Internet companies with Baidu and invested in Atzuche. Big data companies employ various methods in UBI field, like Beijing Jingyou Times Information Technology, a provider of database and risk models.

Global and China UBI Industry Report, 2017-2021 highlights the following:

UBI overview (definition, pricing, value, methods of UBI data acquisition, etc.);

UBI overview (definition, pricing, value, methods of UBI data acquisition, etc.);

Foreign UBI markets (global; UBI in United States, Canada, UK, and Germany;

Foreign UBI markets (global; UBI in United States, Canada, UK, and Germany;

10 UBI companies and their products in United States, Canada, UK, Germany, and Italy);

10 UBI companies and their products in United States, Canada, UK, Germany, and Italy);

UBI business in China (future scale, drivers, entities, development trends);

UBI business in China (future scale, drivers, entities, development trends);

Local Chinese UBI companies (business, operation, and UBI products of China Life, PICC, Ping An Insurance, Carsmart, Zhong An Online P&C Insurance, Cihon, DiNA Technology, PingJia Technology, Shenzhen Dingran Information Technology, Shenzhen Autonet, Launch Tech, Renrenbao, MSD, Deren Electronic and Zebra-Drive)

Local Chinese UBI companies (business, operation, and UBI products of China Life, PICC, Ping An Insurance, Carsmart, Zhong An Online P&C Insurance, Cihon, DiNA Technology, PingJia Technology, Shenzhen Dingran Information Technology, Shenzhen Autonet, Launch Tech, Renrenbao, MSD, Deren Electronic and Zebra-Drive)

1 Overview of UBI

1.1 Definition

1.2 Pricing

1.3 Value

1.4 Means of Acquisition

2 Global Telematics Insurance Market

2.1 Global

2.2 U.S. UBI Market

2.3 Canadian UBI Market

2.4 UK UBI Market

2.5 German UBI Market

3 Car Insurance and UBI Localization in China

3.1 Status Quo of Car Insurance in China

3.2 UBI Participants in China

3.2.1 OEMs + Insurance Companies

3.2.2 Telematics Platforms or Parts Suppliers + Insurance Companies

3.2.3 Independent Service Providers + Insurance Companies

3.2.4 Big Data Companies

3.2.5 Insurers

3.3 UBI Trends

3.3.1 Chinese UBI Market Size of RMB200 Billion in 2021

3.3.2 Market-based Reform of Car Insurance Rates Will Bring Unprecedented Opportunities to the Development of UBI

3.3.3 Diversified UBI Preferentials

3.3.4 Diversified Means of UBI Acquisition

3.3.5 Diversified Modes of Services Provided by Insurers

4 UBI Cases in Europe

4.1 UnipolSai

4.1.1 Profile

4.1.2 Operating Performance

4.1.3 UBI Business

4.2 Generali

4.2.1 Profile

4.2.2 UBI Business

4.3 Allianz

4.3.1 Profile

4.3.2 Operating Performance

4.3.3 UBI Business

4.4 Insure The Box

4.4.1 Profile

4.4.2 UBI Business

4.4.3 Advantages of InsuretheBox

4.5 RISK Technology

4.5.1 Profile

4.5.2 UBI Business

4.5.3 Methods of Risk Assessment

5 UBI Cases and Companies in North America

5.1 Progressive

5.1.1 Profile

5.1.2 UBI Business

5.1.3 Developments

5.2 State Farm

5.2.1 Profile

5.2.2 Operating Performance

5.2.3 UBI Business

5.3 Allstate

5.3.1 Profile

5.3.2 Operation

5.3.3 UBI Business

5.4 Desjardins

5.4.1 Profile

5.4.2 Operation

5.4.3 UBI Business

5.5 Hartford

5.5.1 Profile

5.5.2 Operation

5.5.3 UBI Business

6 UBI-related Companies in China

6.1 China Life Property & Casualty Insurance Co., Ltd.

6.1.1 Profile

6.1.2 UBI Business

6.2 PICC P&C

6.2.1 Profile

6.2.2 UBI Business

6.3 Ping An Property & Casualty Insurance Co. of China

6.3.1 Profile

6.3.2 Operation

6.3.3 UBI Business

6.4 Zhong An Online P&C Insurance Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 UBI Business

6.5 Carsmart

6.5.1 Profile

6.5.2 UBI Business

6.6 Cihon

6.6.1 Profile

6.6.2 UBI Business

6.6.3 Cooperative Mode of SAIC Motor, Cihon and CPIC

6.7 DiNA Technology

6.7.1 Profile

6.7.2 UBI Services

6.7.3 DiNa Telematics Function

6.7.4 DiNA’s Value to Insurers

6.8 PingJia Technology

6.8.1 Profile

6.8.2 UBI Business

6.9 Shenzhen Dingran Information Technology

6.9.1 Profile

6.9.2 UBI Business

6.9.3 Usage Mode

6.9.4 A-Round of Financing

6.10 Shenzhen Autonet

6.10.1 Profile

6.10.2 Insurance Solutions

6.10.3 Way of Cooperation with PICC and China Grand Auto

6.10.4 UBI by Day

6.10.5 Business Trends

6.11 Launch Tech

6.11.1 Profile

6.11.2 Operating Performance

6.11.3 UBI Business

6.12 MSD

6.12.1 Profile

6.12.2 UBI Business

6.12.3 News about MSD UBI Business

6.13 Nanjing Renrenbao Network Technology Co., Ltd.

6.13.1 Profile

6.13.2 UBI Chebao

6.13.3 UBI Lichengbao

6.14 Deren Electronic

6.14.1 Profile

6.14.2 UBI Business

6.14.3 UBI Products

6.15 Zebra-Drive

6.15.1 Profile

6.15.2 UBI Business

Main Parts of UBI System

Diagram of UBI Pricing Models

Diagram and Classification of UBI Parameters

Impact of UBI on Car Owners and Insurers

Comparison between UBI Data Acquisition Modes

Global Presence of UBI Companies, 2016

Global UBI Projects, Countries, and Number of Policies, 2015-2016

UBI Projects and Number of Policies in UK, United States, and Italy, 2015-2016

Pricing Models of Some UBI Companies in North America, Europe and Asia

UBI Business of U.S. Progressive, State Farm, and Allstate

Number of UBI Purchased by Young Drivers in UK, 2009-2016

PAY AS YOU DRIVE and THE IN-TELE-BOX UBI in UK

China’s Premium Income from Property Insurance and Car Insurance, 2012-2016

Total Premium Income and Car Insurance Premium Income of PICC, Ping An and CPIC, 2016

UBI Models Adopted by OEMs

UBI Models of Telematics Platforms or Parts Manufacturers

UBI Models Adopted by Independent Service Providers

UBI Models Adopted by Big Data Companies

UBI Models Adopted by Insurers

Chinese UBI Market Size, 2015-2021E

Process of Pilot Reform of Commercial Car Insurance Terms & Rates Management System

Foreign Main UBI Billing Modes

Optional Preferentials of a Foreign UBI Company

Changes in Driver's Data Acquisition Modes, 2015-2016

Some UBI Companies Using Mobile Phone APP to Collect Data at Home and Abroad

Organizational Structure of UnipolSai

Financial Position of UnipolSai, 2015-2017

Revenue and Profit of UnipolSai by Business, 2015-2017

Development Track and Strategic Path of UnipolSai’ Insurance Services, 2003-2018E

Non-life Insurance Services of UnipolSai, 2012-2018E

Illustration of Unibox

Advantages of UnipolSAI UBI

Financial Position of Generali, 2015-2017H1

Computation Steps of Generali

Interface of Pago como conduzco

Global Presence of Allianz

Total Premium of Allianz, 2013-2016

Revenue and Profit of Allianz, 2012-2017

Comprehensive Loss Ratio of Allianz, 2012-2016

Operation of Allianz by Business, 2015-2017

Allianz’s Global Partners in the Automotive Industry

Optional UBI Index Libraries of IMS

UBI-based Auto Insurance Application Modules

BonusDrive APP

Insurance Application Steps of Insurethebox

Elements and Functions of Black Box

Advantages of InsuretheBox

Application of Risk Technology’s Telematics in Insurance Business

Claim Ratio of Risk Technology

Cases of Risk Technology in Score Evaluation

Revenue and Net Income of Progressive, 2011-2017

Mobile Phone APP Interface Diagram of Progressive's Snapshot Project

Progressive’s Telematics Box

Premium Income and Growth Rate of State Farm, 2010-2016

Promised Loss Ratio of State Farm, 2010-2016

Net Income of State Farm, 2010-2016

Usage Steps of DSS

Renewal Discounts between DSS Users and Non-DSS Users

Optional Discounts of State Farm

Premium Income and Net Income of Allstate, 2011-2017

Revenue of Allstate by Business, 2017

Quarterly Premium Income and Effective Policy Volume of Allstate, 2014-2017

Product Display of Allstate's DriveWise OBD

Service Contents on Allstate's Drivewise APP

Other Discounts on DriveWise

Main Business Distribution of Desjardins Insurance

Financial Position of Desjardins Insurance, 2013-2017

Revenue of Desjardins Insurance by Business, 2015-2017

Diagram of Ajusto Small Wireless Device

Ajusto Program with Telematics Device

Diagram of Ajusto Interface

Driving Scores vs. Preferential Margin of Desjardins Insurance

Revenue and Net Income of Hartford, 2012-2016

Revenue Structure of Hartford, 2016

Optional Discounts of Hartford’s Auto Insurance

Revenue of China Life Property & Casualty Insurance, 2015-2016

Revenue and Profit of China Life Property & Casualty Insurance by Coverage, 2016

Main Functions of Autofun Box

Revenue and Net Income of PICC P&C, 2012-2016

Insurance Amount, Premium Income and Profit of PICC P&C by Coverage, 2016

Revenue of Ping An by Business, 2015-2016

Revenue Structure of Ping An Insurance by Business, 2016

UBI Preferentials of I'chezaixian

Operating Revenue and Profit of Zhong An, 2014-2017

Operating Revenue of Zhong An by Coverage, 2014-2017

OBD Box of Baobiao Auto Insurance

Telematics Solutions for the Insurance Industry

3 APP Functional Modules of Autofun Box

UBI Business Architecture of Carsmart

Profile of Cihon

Main Function Modules of Cihon’s UBI Client

Calculation Methods of Cihon UBI

Profile of Cihon’s UBI

Profile of DiNA Technology

UBI Driving Behavior Scoring Factors of DiNA Technology

Diagram of Che Xing Zhe APP User Interface

Profile of PingJia Technology

Main Products and Functions of PingJia Technology

Big Data Solutions of PingJia Technology

UBI Model Development Process of PingJia Technology

Insurance Partners of PingJia Technology

Profile of Shenzhen Dingran Information Technology

Diagram of Lubi’s OBD Box

Diagram of Lubi’s APP Interface

Profile of Shenzhen Autonet

Business Model of Shenzhen Autonet

Cooperative Mode of Shenzhen Autonet, China Grand Auto and PICC P&C

Features and Service Process of Insurance by Day

Main Performance Parameters of Di Di Hu's Hardware Products

FRMS of Shenzhen Autonet

Profile of Launch Tech

Cooperative Enterprises of Launch Tech

Revenue and Net Income of Launch Tech, 2014-2017

Business Models of Launch Tech

Applications Based on golo Cloud Platform

Diagram of Enterprise Chain of MSD

Diagram of MSD OBD

Diagram of MSD APP

Screening of Driving Behavior Data and UBI Modeling

Workflow Chart of MSD UBI Service

Diagram of MSD Simplified Insurance Claim Flow

Diagram of Enterprise Chain of Renrenbao

Diagram of Mobile Chebao Interface

Diagram of Lichengbao's Interface

Diagram of Lichengbao's Purchase Interface

Diagram of Enterprise Chain of Deren Electronic

Deren Electronic's UBI Business Plans

Dedao TSP's Solution Path Diagram

Diagram of Dedao TSP's Intelligent Hardware T.30

Diagram of Dedao TSP's Intelligent Hardware PA54

Diagram of Dedao TSP's Application Service Platform

Strategic Partners of Zebra-Drive

Analysis Models of Zebra-Drive

Intelligent Driving System of Zebra-Drive

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...