China Automotive Distribution and Aftermarket Industry Report, 2017-2021

-

Jan.2018

- Hard Copy

- USD

$3,400

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZLC063

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

In China, new car sales and used car sales have been growing progressively thanks to robust demand over recent years. From January to November of 2017, China sold 25.84 million new cars, edging up 3.6% year on year, and traded 11.17 million used cars, soaring by 20% year on year.

The channels for automotive distribution in China tend to be diversified. The 4S store mode has been by degrees replaced by business modes like automobile e-commerce and automobile supermarket, with the number of 4S stores in China decreasing by 147 from the total 22,753 in 2016 and expected to further drop to 22,550 in 2017.

There is currently a cut-throat competition in Chinese automotive distribution industry which features a low concentration ratio. In 2016, the automobile sales of top 100 Chinese car dealers footed up to 7.83 million units, seizing 20.4 percent of total automobile sales (inclusive of used cars). As of the end of 2016, the top 100 Chinese car dealers had been in possession of 6,014 4S outlets in all, accounting for 26.4 percent of national total number of 4S stores.

By comparison with car sales with the gross margin of less than 5%, the after-sale services enjoy a gross margin of at least 40%. It is in the recent years that Chinese car dealers have explored the lucrative automobile aftermarket successively.

Chinese automotive distribution industry is evolving towards:

i) Frequent mergers and acquisitions: the car dealer powers not also build new outlets but initiate M&As to expand their coverage. For instance, in the first half of 2017, China Yongda Automobile Services acquired nine 4S stores and one urban exhibition hall; and Baoxin Auto purchased six 4S stores and one exhibition hall.

ii) The networking of automotive distribution: the advancement of the internet leads to changes in the consumers’ habits; automobile e-commerce springs up. To date, the traditional car dealers have made presence in the Internet +, so have the other entrants to seize more market shares. Take example for souche.com, Guazi.com, xin.com, and GOME that have launched online car purchase services in succession.

iii) Automotive finance’ impetus: the burgeoning automotive finance makes cars affordable for more people, particularly the new means like “zero down payment” and “10% down payment” launched by souche.com and Guazi.com make a car purchase be a piece of cake, arouse more wishes to have a car, which beyond doubt facilitates the development of automotive distribution industry.

iv) A surge in used car sales: the growth of new car market conduces to a steady rise in car ownership, providing the space for the development of used cars. Being pushed forward by the policy of limited migration for used cars (limited migration refers to the fact that the cars with low emission standards in one place are limited to be migrated into another place in China; limited migration of used cars have been cancelled in more and more places across China) and the growing maturity of used car e-commerce, the used car trade will be on a steady rise in China, and a total of 20.96 million used cars will be traded in 2021.

China Automotive Distribution and Aftermarket Industry Report, 2017-2021 sheds light on the followings:

China automotive distribution industry (distribution modes, profit models, competitive landscape and development trend);

China automotive distribution industry (distribution modes, profit models, competitive landscape and development trend);

Analysis of new car sales, used car sales, automotive finance, car repair & beauty and automotive insurance markets (status quo, market size, competition, development tendency, etc.);

Analysis of new car sales, used car sales, automotive finance, car repair & beauty and automotive insurance markets (status quo, market size, competition, development tendency, etc.);

14 automotive distribution enterprises (operation, revenue structure, gross margin, automotive distribution business and automotive aftermarket business).

14 automotive distribution enterprises (operation, revenue structure, gross margin, automotive distribution business and automotive aftermarket business).

1. Overview

1.1 Development History

1.2 Distribution Pattern

1.2.1 Main Marketing Models

1.2.2 Characteristics of Marketing Models

1.2.3 Imported Car Distribution Pattern

1.3 Automotive Aftermarket

1.3.1 Market Situation

1.3.2 Main Channels

1.3.3 Status Quo

2. Overview of Automotive Distribution Industry in China

2.1 Distribution Model

2.1.1 Passenger Car Distribution Model

2.1.2 Commercial Vehicle Distribution Model

2.2 Profit Model

2.3 Competitive Landscape

2.3.1 Revenue of Top 100 Companies

2.3.2 Comparison by Enterprises’ Operation

2.3.3 Comparison by Distribution Channels

2.4 Development Trends

2.4.1 Continuous Industrial M&As Further Raise Market Concentration

2.4.2 More Efforts to Expand Automotive Aftermarket

2.4.3 Automotive Distribution Heads towards "Internet +"

2.4.4 Second Child Policy Promotes the Development of the Industry

2.4.5 Used Car Sales Volume Grows

2.4.6 The Rapid Development of Automotive Finance Boosts the Development of Automotive Distribution Industry

2.4.7 4S Stores Decline Gradually

3 Sales Market of New Vehicle in China

3.1 Automobile Market

3.1.1 Output

3.1.2 Sales Structure

3.2 Passenger Car Market

3.2.1 Output & Sales Volume

3.2.2 Sales Structure

3.3 Commercial Vehicle Market

3.3.1 Output & Sales Volume

3.3.2 Sales Structure

3.4 New Energy Vehicles

3.4.1 Output and Sales Volume

3.4.2 Prospects

4 Chinese Used Car Sales Market

4.1 Market Situation

4.2 Distribution Model

4.3 Transaction

4.3.1 Overall Market

4.3.2 Market Structure

4.3.3 Regional Market

4.4 Competitive Landscape

4.5 Prospects

4.5.1 Cancellation of Used Car Immigration Restriction Policy Favors the Development of the Industry

4.5.2 Used Car E-Business Model Promotes Market Development

4.5.3 Forecast for Used Car Trading Volume

5 Chinese Automotive Finance Market

5.1 Status Quo

5.2 Market Size

5.3 Competitive Landscape

5.4 Operation of Auto Finance Companies

5.5 Development Trends

5.5.1 Domestic OEMs Accelerate Their Presence in Auto Finance Field

5.5.2 Market Share of Auto Finance Companies Grows Further

5.5.3 Used Car Financial Business Grows Rapidly

5.5.4 Auto Financial Products Becomes More Diversified

5.5.5 Improved Credit System Pushes the Development of Auto Finance Market

5.5.6 Internet Auto Finance Has Developed into a Trend

5.5.7 Cooperation between Banks and Enterprises Drives Auto Finance

5.5.8 Competition in Auto Finance Industry Intensifies

6 Chinese Auto Repair & Beauty Market

6.1 Market Size

6.2 Investment and Financing

6.3 Competitive Landscape

6.4 Analysis of Channels

6.5 Regional Analysis

6.6 Development Trend

6.6.1 Overall

6.6.2 Channels

6.7 Internet + Auto Repair & Beauty

6.7.1 Status Quo

6.7.2 Business Model

6.7.3 Competitive Landscape

7 Chinese Auto Insurance Market

7.1 Status Quo

7.2 Market Size

7.3 Competitive Landscape

8 Majors Car Dealers in China

8.1 PANGDA Automobile Trade Group Co., Ltd.

8.1.1 Profile

8.1.2 Business Model and Profit Model

8.1.3 Operation

8.1.4 Revenue Structure

8.1.5 Gross Margin

8.1.6 Layout

8.1.7 Sales Volume

8.1.8 Customers

8.1.9 New Energy Vehicle Business

8.1.10 Auto Finance Business

8.1.11 Other Automotive Aftermarket Business

8.2 Sinomach Automobile Co., Ltd.

8.2.1 Profile

8.2.2 Operation

8.2.3 Revenue Structure

8.2.4 Gross Margin

8.2.5 Sales Volume

8.2.6 Imported Car Business

8.2.7 Auto Retail Business

8.2.8 Auto Aftermarket Business

8.3 Zhongsheng Group Holdings Limited

8.3.1 Profile

8.3.2 Operation

8.3.3 Revenue Structure

8.3.4 Gross Margin

8.3.5 Sales Volume

8.3.6 Layout

8.3.7 Development Dynamics

8.4 Dah Chong Hong Holdings Limited

8.4.1 Profile

8.4.2 Operation

8.4.3 Revenue Structure

8.4.4 Gross Margin

8.4.5 Automotive Distribution Business

8.4.6 Layout

8.4.7 Development

8.5 China Grand Automotive Services Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Revenue Structure

8.5.4 Gross Margin

8.5.5 Layout

8.5.6 Automotive Distribution Business

8.5.7 Used Car Business

8.5.8 Other Auto Aftermarket Business

8.6 China ZhengTong Auto Services Holdings Limited

8.6.1 Profile

8.6.2 Operation

8.6.3 Revenue Structure

8.6.4 Gross Margin

8.6.5 Layout

8.6.6 Automotive Distribution Business

8.6.7 Auto Aftermarket Business

8.7 China Yongda Automobile Services Holdings Limited

8.7.1 Profile

8.7.2 Operation

8.7.3 Revenue Structure

8.7.4 Gross Margin

8.7.5 Layout

8.7.6 Automotive Distribution Business

8.7.7 Auto Aftermarket Business

8.7.8 Development Strategy

8.8 Wuxi Commercial Mansion Grand Orient Co., Ltd.

8.8.1 Profile

8.8.2 Operation

8.8.3 Revenue Structure

8.8.4 Gross Margin

8.8.5 Automotive Distribution Business

8.9 Baoxin Auto Group

8.9.1 Profile

8.9.2 Operation

8.9.3 Revenue Structure

8.9.4 Gross Margin

8.9.5 Automotive Distribution Business

8.9.6 Auto Aftermarket Business

8.10 Harmony Auto

8.10.1 Profile

8.10.2 Operation

8.10.3 Revenue Structure

8.10.4 Gross Margin

8.10.5 Automotive Distribution Business

8.10.6 Auto Finance Business

8.10.7 Development Strategy

8.11 Yaxia Automobile

8.11.1 Profile

8.11.2 Operation

8.11.3 Revenue Structure

8.11.4 Gross Margin

8.11.5 Automotive Distribution Business

8.11.6 Automotive Aftermarket Business

8.12 Materials Industry Zhongda Group Co., Ltd.

8.12.1 Profile

8.12.2 Operation

8.12.3 Revenue Structure

8.12.4 Automotive Distribution Business

8.13 Lei Shing Hong

8.13.1 Profile

8.13.2 Automotive Distribution Business

8.14 Hengxin Automotive

8.14.1 Profile

8.14.2 Automotive Distribution Business

Development History of Automotive Distribution in China

Major Means of Automotive Distribution in China

Comparison: Characteristics of Different Automotive Distribution Modes

Comparison: Business Model of Imported Cars and China-made Cars

Automotive Aftermarket Segments

China’s Automotive Aftermarket Size, 2015-2021E

Procedures for Constructing Passenger Car 4S Shop in China

Cost Structure for Constructing 4S Shop

Service Scope of Automotive Distribution in China

Profit Model of New Car Sales of Dealers in China

Dealers’ Profitability from Different Car Models

Total Revenue of Top 100 Dealers in China, 2010-2017

Number of Car Dealers with the Revenue of over RMB10 billion in China, 2010-2016

Revenue of the Ranking No.1 among Top 100 Car Dealers in China, 2010-2016

Vehicle Sales Volume of Top 100 Car Dealers in China, 2010-2016

Top 20 Car Dealers by Revenue in China, 2017

New Car Sales Volume Comparison between Chinese Car Dealers, 2015-2016

Revenue Comparison between Major Chinese Car Dealers, 2013-2017

Net Income Comparison between Major Chinese Car Dealers, 2013-2017

Automobile Sales Gross Margin of Major Chinese Car Dealers, 2013-2017

After-sales Service Gross Margin of Major Chinese Car Dealers, 2013-2017

Comparison between Major Chinese Car Dealers by Number of 4S Shops, 2015-2017

M&A Cases in China Automotive Distribution Industry, 2016-2017

Cases of Automotive Distribution Industry's Layout on Internet + in China, 2015-2017

China’s Used Car Trading Volume, 2016-2021E

Number of 4S Shops in China, 2010-2017

China’s Automobile Output, 2011-2017

China’s Automobile Sales Volume, 2011-2017

China’s Automobile Output and Sales Volume, 2016-2021E

Sales Volume of Top 10 Automotive Brands in China by Type, Jan.-Oct. 2017

China’s Automobile Sales Volume Structure (by Type), 2011-2017

China’s Automobile Sales Volume Structure (by Type), 2016-2021E

China’s Passenger Car Output, 2011-2017

China’s Passenger Car Sales Volume, 2011-2017

China’s Passenger Car Output and Sales Volume, 2016-2021E

China’s Passenger Car Sales Volume (by Type), 2011-2017

China’s Passenger Car Sales Volume Structure (by Type), 2011-2017

Sales Volume of Top 10 Passenger Car Brands in China by Type, Jan.-Oct. 2017

China’s Commercial Vehicle Output, 2011-2017

China’s Commercial Vehicle Sales Volume, 2011-2017

China’s Commercial Vehicle Output & Sales Volume, 2016-2021E

China’s Commercial Vehicle Sales Volume (by Type), 2011-2017

China’s Commercial Vehicle Sales Volume Structure (by Type), 2011-2017

China’s New Energy Vehicle (EV&PHEV) Output and Sales Volume, 2011-2017

China’s New Energy Vehicle (EV&PHEV) Sales Volume (by Type), 2016-2017

China’s New Energy Vehicle (EV&PHEV) Output (by Type), 2016-2017

Ratio of Used Cars to New Cars in China, 2012-2017

Ratio of Used Cars to New Cars in Major Countries

Development Stages of Used Car Market

Main Trade Modes for Used Cars in China

Trade Modes for Used Cars in Major Countries

Trading Volume and YoY Growth Rate of Used Cars in China, 2011-2017

Proportion of Used Car Trading Volume in China (by Type), 2014-2017

Proportion of Used Car Trading Volume in China (by Service Life), Jan.-Nov. 2017

Proportion of Used Car Trading Volume in China (by Price Range), Jan.-Nov. 2017

China’s Used Car Trading Volume (by Region), 2015-2017

China’s Used Car Trading Volume Structure (by Region), Jan.-Nov. 2017

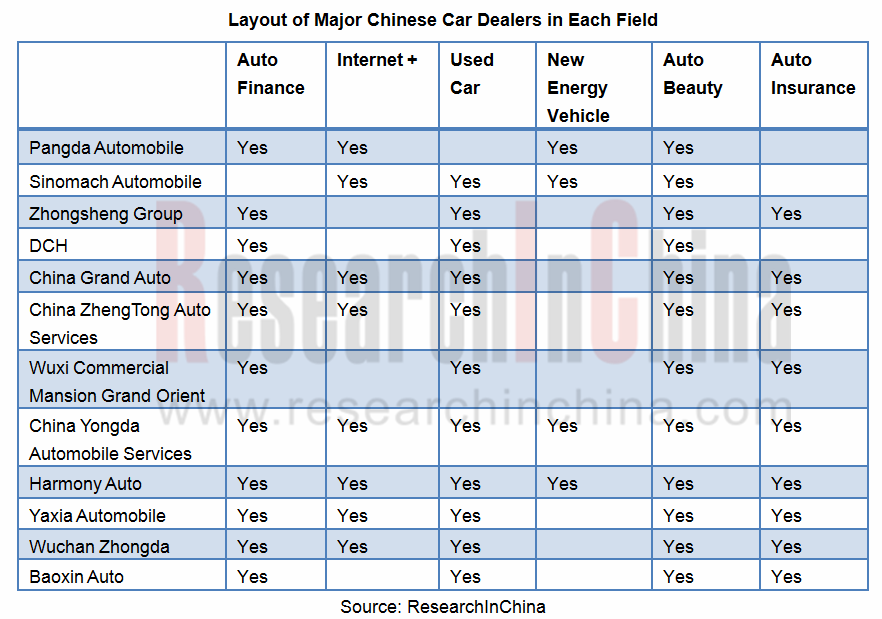

Layout of Major Chinese Car Dealers in Used Car Market

Financing of Major Chinese Used Car Trading Service Platforms, 2017

China’s Used Car Trading Volume, 2016-2021E

Penetration of Auto Finance in China, 2015-2021E

Auto Finance Market Size in China, 2014-2021E

Competition Pattern of Auto Finance Market in China, 2016

Major Auto Finance Companies in China

Operating Results of Major Auto Finance Companies in China, 2016

Total Assets of Auto Finance Companies in China, 2013-2016

Loans of Auto Finance Companies in China (by Type), 2013-2016

Main Business Structure of Auto Finance Companies in China, 2013-2016

Number of Automobiles (by Type) that Received Loans from Auto Finance Companies in China, 2013-2016

Cases of Chinese Internet Firms that Make Layout in Internet Auto Finance

Cases of Banks and Enterprises that Work Together to Make Layout in Auto Finance

Market Size of China’s Auto Repair & Beauty Industry, 2012-2021E

Main Financing Cases of Auto Repair & Beauty Industry, 2016-2017

Major Competitors in China’s Auto Repair & Beauty Industry

Major Offline Auto Repair & Beauty Chain Enterprises in China

Comparison between Main Independent Chain Auto Repair & Beauty Brands in China

Comparison between Auto Repair & Beauty Channels in China

Distribution of Auto Repair & Beauty Chain Brands in China’s Key Areas

Relative Advantages of Network Auto Repair & Beauty

Main Business Models of Internet Platforms for Repair and Maintenance

Some Auto Repair & Beauty Network Platform Projects in China, 2015

Regional Distribution of Auto Repair & Beauty Network Platform Projects in China, 2015

China’s Automotive Insurance Premium Income, 2010-2017

China’s Automotive Insurance Premium Income, 2017-2021E

Top 20 Auto Insurance Companies by Revenue, Jan.-Oct.2017

Procurement Model of Pangda Automobile’s 4S Shops

Sales Model of Pangda Automobile’s 4S Shops

Profit Model of Pangda Automobile’s 4S Shops

Revenue and Net Income of Pangda Automobile, 2013-2017

Revenue of Pangda Automobile (by Business), 2014-2016

Revenue Structure of Pangda Automobile (by Business), 2014-2016

Gross Margin of Pangda Automobile, 2014-2017

Number of Pangda Automobile’s Business Outlets (by Type), 2012-2017

Regional Distribution of Opened Outlets of Pangda Automobile by End 2016

Vehicle Sales Volume and Inventory of Pangda Automobile, 2015-2016

Revenue and % of total Revenue from Top Five Customers of Pangda Automobile, 2013-2016

Core Competitiveness of Pangda Automobile

Revenue and Net Income of Sinomach Automobile, 2013-2017

Purpose of Raised Fund through Private Offering of Sinomach Automobile, 2016

Revenue of Sinomach Automobile (by Business), 2013-2016

Revenue Structure of Sinomach Automobile (by Business), 2013-2016

Revenue of Sinomach Automobile (by Region), 2013-2016

Gross Margin of Sinomach Automobile (by Business), 2013-2016

Sales Volume and Inventory of Sinomach Automobile, 2015-2016

Major Cooperative Manufacturers of Zhongsheng Group

Revenue and Net Income of Zhongsheng Group, 2013-2017

Revenue of Zhongsheng Group (by Business), 2013-2017

Revenue Structure of Zhongsheng Group (by Business), 2013-2017

Gross Margin of Zhongsheng Group, 2013-2017

Gross Margin of Zhongsheng Group (by Business), 2013-2016

New Car Sales Volume of Zhongsheng Group, 2011-2017

Luxury Brand New Car Sales Volume and % of Total Sales Volume of Zhongsheng Group, 2011-2017

Number of Zhongsheng Group’s Outlets (by Region), 2014-2017

Number of Zhongsheng Group’s Outlets (by Grade), 2011-2017

National Layout of Zhongsheng Group, by end of 2016

Revenue and Net Income of DCH, 2013-2017

Revenue of DCH (by Business), 2013-2017

Revenue Structure of DCH (by Business), 2013-2017

Gross Margin of DCH, 2013-2017

Automobile & Automobile-related Business Cutomers of DCH

Revenue of DCH's Automobile and Automobile-related Business (by Region), 2013-2017

Revenue Structure of DCH's Automobile and Automobile-related Business (by Region), 2013-2017

Automobile Sales Volume of DCH (by Region), 2011-2016

Number of DCH’s 4S Shops and Showrooms, 2011-2017

Number of DCH’s Showrooms by Brand, as of the end of Jun.30, 2017

Revenue and Net Income of China Grand Auto, 2014-2017

Revenue of China Grand Auto (by Business), 2015-2016

Revenue of China Grand Auto (by Region), 2016

Gross Margin of China Grand Auto (by Business), 2015-2016

Number of Outlets of China Grand Auto by Region, by Jun 30, 2017

Number of China Grand Auto’s 4S Shops (by Type), ass of Jun.30, 2017

New Car Sales Volume of China Grand Auto, 2014-2017

Number of Vehicles through Used Car Agent Transaction of China Grand Auto, 2015-2017

Number of Times with After-sales Maintenance of Chian Grand Auto, 2015-2017

Number of Vehicles with Financial Leasing Business of China Grand Auto, 2015-2017

Revenue and Net Income of ZhengTong Auto, 2013-2017

Revenue of ZhengTong Auto (by Business), 2013-2017

Revenue Structure of ZhengTong Auto (by Business), 2013-2017

Gross Margin of ZhengTong Auto (by Business), 2013-2017

National Layout of ZhengTong Auto, as of Jun.30, 2017

Number of ZhengTong Auto’s Business Outlets (by Type), as of Jun.30, 2017

New Car Sales Volume of ZhengTong Auto (by Brand), 2013-2017

New Car Revenue of ZhengTong Auto (by Brand), 2013-2017

Industry Chain of Yongda Auto Business

Revenue and Net Income of Yongda Auto, 2013-2017

Revenue of Yongda Auto (by Business), 2013-2017

Revenue Structure of Yongda Auto (by Business), 2013-2017

Gross Margin of Yongda Auto, 2013-2017

Gross Margin of Yongda Auto (by Business), 2013-2017

Number of Outlets of Yongda Auto (by Type), as of June 30, 2017

Outlet Distribution of Yongda Auto in China, as of June 30, 2017

Brand Coverage of Yongda Auto, As of June 30, 2017

New Passenger Car Sales Volume of Yongda Auto (by Type), 2013-2017

Revenue and Net Income of Grand Orient, 2013-2017

Revenue of Grand Orient (by Business), 2013-2017

Revenue Structure of Grand Orient (by Business), 2013-2017

Gross Margin of Grand Orient by Business, 2013-2017

Automobile Sales & Services and Business Model of Grand Orient

Revenue and % of Automobile Sales & Services of Grand Orient, 2013-2017

Revenue and Net Income of Baoxin Auto Group, 2013-2017

Revenue of Baoxin Auto Group (by Business), 2013-2017

Revenue Structure of Baoxin Auto Group (by Business), 2013-2017

Gross Margin of Baoxin Auto Group (by Business), 2013-2017

Sales Volume of Baoxin Auto Group (by Type), 2014-2017

Revenue of Automobile Sales of Baoxin Auto Group (by Type), 2013-2017

Revenue and Net Income of Harmony Auto, 2013-2017

Revenue of Harmony Auto (by Business), 2013-2017

Revenue Structure of Harmony Auto (by Business), 2013-2017

Gross Margin of Harmony Auto (by Business), 2013-2017

New Car Sales Volume of Harmony Auto, 2013-2017

New Car Sales Structure of Harmony Auto by Brand, 2017H1

Revenue and Net Income of Yaxia Automobile, 2013-2017

Revenue Breakdown of Yaxia Automobile by Business, 2013-2017

Revenue Structure of Yaxia Automobile by Business, 2013-2017

Gross Margin of Yaxia Automobile by Business, 2013-2017

Automobile Sales Volume of Yaxia Automobile, 2012-2016

Revenue and Net Income of Materials Industry Zhongda Group Co., Ltd., 2014-2017

Revenue of Materials Industry Zhongda Group Co., Ltd. (by Business), 2014-2017

Vehicle Sales Revenue and % of Total Revenue of Materials Industry Zhongda Group Co., Ltd., 2014-2017

Revenue and Net Income of Zhejiang Materials Industry Yuantong Automobile Group, 2014-2017

Operationn Network of Hengxin Automotive

Cooperated Brands of Hengxin Automotive

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...