ADAS and Autonomous Driving Industry Chain Report 2018 (IV)-OEMs and Integrators

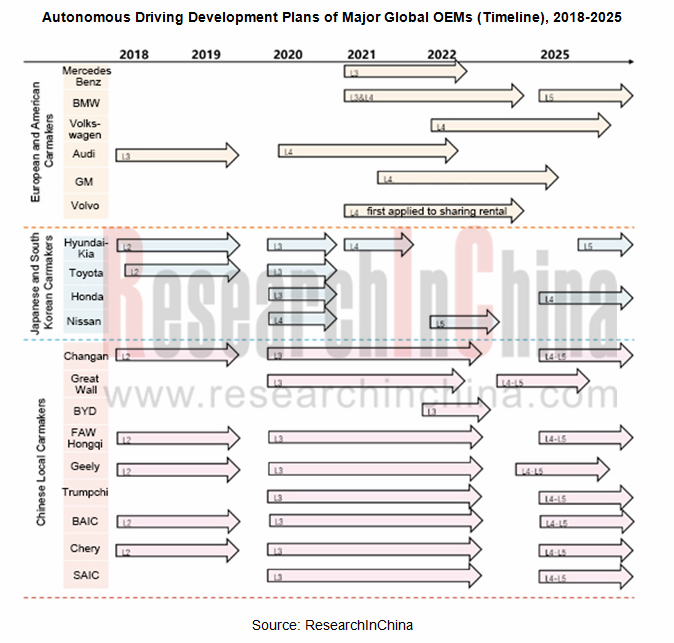

Globally, all major OEMs now develop ADAS and autonomous driving systems. Regionally, European and American OEMs take a lead in the development of autonomous driving, having achieved L2/L3 advanced driver assistance on large scale and expected to seal the accomplishment of L3/L4 autonomous driving around 2021; Japanese and South Korean OEMs hold a relatively conservative attitude to autonomous driving. Take Toyota for example, it designs two development paths for autonomous driving: Guardian (advanced safe driving assistance) and Chauffeur (autonomous driving), but without specific timetable for L4/L5; China’s home-grown OEMs are catching up, as an array of models with L2 ADAS functions will be mass-produced in 2018 according to plans of OEMs including Changan Automobile, FAW Hongqi, Geely, BAIC and Chery. Local carmakers plan to achieve L4/L5 during 2025-2030.

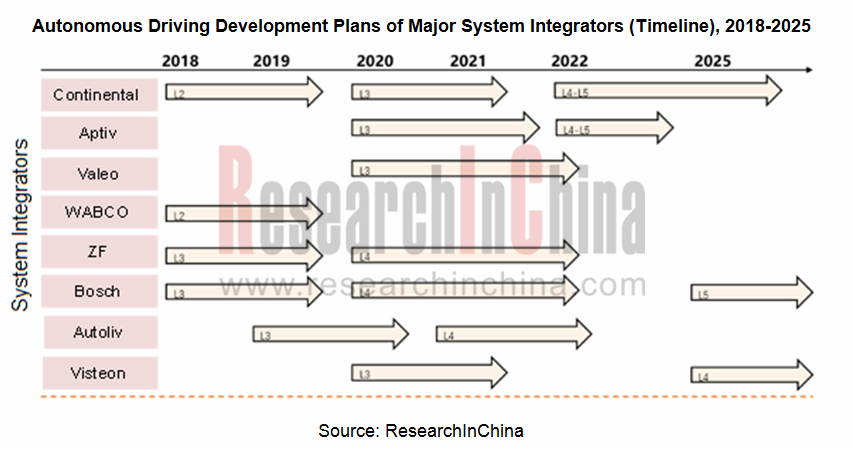

The world-renowned ADAS and autonomous driving system integrators consist of Continental, Aptiv, Valeo, ZF, Bosch, etc., and they are featured in 2018 as follows:

1) The system integrators are gearing towards the suppliers of fusion solutions along with technological advances. Bosch, for instance, set up in 2017 a team engrossed in the development of domain controller whilst developing new-generation sensors (next-generation MMW radar, next-generation front camera, next-generation around view system, and the LiDAR under way), in a bid to meet the massive computing demand to be brought by fusion of sensors in future and to provide its partners with overall package. Abroad, Bosch together with Daimler is pushing forward the L4 autonomous driving development, and in China it has provided ADAS solutions to the carmakers like Geely. Besides, Bosch is to provide L2 high-speed cruise solutions to a Chinese OEM, and mass-production is to be realized in 2020.

2) It grows evident that system integrators seek for collaboration. For example, Continental develops controllers based on NVIDIA DRIVE platform and carries cooperation with many companies like HERE, easyMILE, BMW-Intel-Mobileye Alliance, Huawei, Baidu and China Unicom, leading to a Continental-led autonomous driving ecosystem. Via investments and collaboration, ZF boasts a great many partners such as TRW, IBEO, ASTYX, e.Go, HELLA, NVIDIA and Baidu and has business covering system development, sensors, software decision, HD map, vehicle development and smart cockpit.

In China, the system integrators spring up, represented by Baidu, Neusoft and HiRain Technologies among which Baidu’s development is most impressive. As of July 2018, Baidu’s Apollo autonomous driving platform has attracted 116 partners and 26 carmakers (most of local Chinese carmakers and four foreign peers, i.e., Daimler, Ford, Hyundai and Honda). Apollo 3.0 ushers in mass-production of autonomous driving vehicle in parks and Baidu focuses more on the implementation of L2-L3 autonomous driving solutions. Baidu’s autonomous driving projects in tandem with the automakers starts practical application from 2018 on.

ADAS and Autonomous Driving Industry Chain Report 2018 (IV) OEMs and Integrators by ResearchInChina highlights the following:

European and American OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

European and American OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Japanese and South Korean OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Japanese and South Korean OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Chinese OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.)

Chinese OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.)

Global integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.);

Global integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.);

Chinese integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.).

Chinese integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.).

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...