ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture

ADAS and Autonomous Driving Industry Chain Report 2018 (I) - Computing Platform and System Architecture underscores the followings:

Introduction to ADAS and autonomous driving;

Introduction to ADAS and autonomous driving;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving market forecast;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

ADAS and autonomous driving strategy of carmakers including Geely, GM, SAIC, Dongfeng, Great Wall, GAC, Chang’an, NIO, Xpeng and BYTON;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Software architecture of ADAS and autonomous driving, including AUTOSAR Classic and Adaptive, ROS 2.0 and QNX;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Hardware architecture of ADAS and autonomous driving, including automotive Ethernet, TSN, Ethernet switch and gateway, and domain controller;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Safety certification of ADAS and autonomous driving, including ISO26262 and AEC-Q100;

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

Study into processor firms, including NXP, Renesas, Texas Instruments, Mobileye, Nvidia, Ambarella, Infineon and ARM.

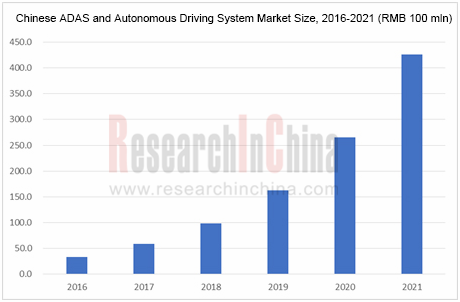

According to ResearchInChina, the Chinese ADAS and autonomous driving market was worth about RMB5.9 billion in 2017 and is expected to reach RMB42.6 billion in 2021 at an AAGR of 67% or so.

Automotive vision, MMW radar and ADAS are the market segments that develop first with the MMW radar market enjoying an impressive growth rate, closely followed by low-speed autonomous driving. While LiDAR, commercial-vehicle autonomous driving and passenger-car autonomous driving markets lag behind.

As the automobile enters an era of ADAS and autonomous driving, product iteration races up and lifecycle of products is shortened. The automotive market is far smaller than consumer electronics market but sees bigger difficulty in design and higher design and production costs than that in consumer electronics market. Thus automotive ADAS and autonomous driving processor is confronted with higher risks. Hence adequate financial and human resources are required to support the development of automotive ADAS and autonomous driving processors. Globally, only very a few enterprises like NXP and Renesas are capable of developing whole series of ADAS and autonomous driving processors.

With regard to safety certification, autonomous driving chips must attain ASIL B at least, a level only Renesas R-CAR H3 has reached for now. As GPU is a universal design and not car-dedicated design, it is hard to reach the certified safety level of ISO26262 from the point of design. The certification cycle of ASIL is up to two to four years.

Reliability, precision and functionality of stereo camera are well above that of mono camera, but as the stereo camera must use FPGA, it costs much. High costs restraint the application of the stereo camera only on luxury cars. However, with emergence of Renesas and NXP hardcore stereo processors, the stereo camera will be vastly used in ADAS and autonomous driving field, expanding from luxury models to mid-range ones.

With an explosive growth in data transmission, automotive Ethernet will become a standard configuration of the automobile, and Ethernet gateway or Ethernet switch is indispensable to autonomous driving.

Autosar will act as a standard configuration in ADAS and autonomous driving field.

CNN/DNN graphics machine leaning: GPU is most suitable when data is irrelevant to sequence. Nvidia GPU can be used in multiple fields except for automobile and finds shipments far higher than that of automotive ASIC, enjoying superiority in cost performance. TPU lifts speed and reduces power consumption (only 10% of that of GPU) at the expense of the precision of computation.

RNN/LSTM/reinforcement learning sequence-related machine learning: FPGA has distinct advantages, particularly in power consumption, consuming less than one-fifth of GPU under same performance. However, high-performance FPGA is incredibly costly. FPGA can also process graphics machine leaning and improve performance by reducing precision.

ASIC stands out by performance-to-power consumption ratio but has shortcomings of long development cycle, the highest development cost and the poorest flexibility. The unit price will be very high or firms will make losses if the shipments are small (at least annual shipments of 120 million units if 7-nanometer process is employed). Most ASICs for deep-learning graphics machine learning are similar to TPU.

Power consumption and cost performance are crucial in in-vehicle field. GPU is no doubt a winner in graphic machine learning. However, as algorithms are constantly improved, the ever low requirements on the precision of computation, and low power consumption will ensure a place of FPGA in graphics machine learning. FPGA has overwhelming advantages in sequence machine learning.

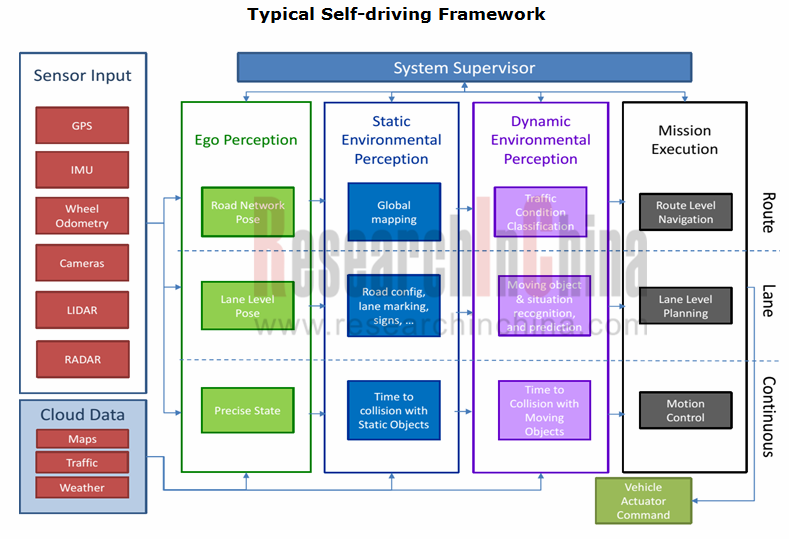

Autonomous driving can be divided into two types, one represented by Waymo, which has solved most of the problems concerning environmental perception and concentrates on behavior decision-making with computing architecture of CPU+FPGA (usually Intel Xeon 12-core and above CPU plus Altera or Xilinx’s FPGA; the other represented by Mobileye which has not solved all problems involving environmental perception and concentrates on it with computing architecture of CPU+GPU/ASIC.

CPU+GPU will be the mainstream in the short run, but CPU+FPGA/ASIC may dominate in the long term, largely due to continuous decline in the precision of computation of graphics because of improvement in algorithms and performance of sensors (LiDAR in particular), which is conducive to FPGA, while it is hardly for the power consumption of GPU to fall. It is easier for FPGA to meet car-grade requirements.

In chip contract manufacturing field, TSMC has won all 7-nanometer chip orders, including A12 exclusively provided for Apple, marking for the first time TSMC overtook Intel to become the vendor with the most advanced semiconductor manufacturing process, a must in the production of digital logic chip whose computing capability is underlined in AI autonomous driving.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...