ADAS and Autonomous Driving Industry Chain Report 2018 (VI)- Commercial Vehicle Automated Driving

-

Aug.2018

- Hard Copy

- USD

$3,600

-

- Pages:195

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

ZYW239

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

ADAS and Autonomous Driving Industry Chain Report 2018 - Commercial Vehicle Automated Driving, about 195 pages, covers the following:

Overview of autonomous commercial vehicle industry

Overview of autonomous commercial vehicle industry

Technologies, stages and costs of autonomous commercial vehicle

Technologies, stages and costs of autonomous commercial vehicle

Truck platooning autonomous driving

Truck platooning autonomous driving

Foreign commercial vehicle automated driving solution providers

Foreign commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Chinese commercial vehicle automated driving solution providers

Layout of foreign commercial vehicle makers in autonomous driving

Layout of foreign commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

Layout of Chinese commercial vehicle makers in autonomous driving

With the enforcement of the new standard Safety Specifications for Commercial Bus, the commercial vehicle ADAS market in China springs up, and start-ups such as Roadefend, Maxieye, Minieye and INVO have earned the revenue of tens of millions or even hundreds of millions of yuan.

In terms of autonomous commercial vehicle, solution providers such as Westwell Lab, TrunkTech, PlusAI, TuSimple and FABU Technology have arisen. Most of them are committed to unmanned port trucks with autonomous container truck solutions. In China, there are more than 20,000 container trucks at ports, and each driver is paid about RMB300,000 per year, an opportunity for autonomous driving replacement.

There are many challenges for the access of autonomous driving to any particular scenario. For instance, driverless container trucks need to be in line with the production logic and dock management system of ports and interact with bridge cranes, tire cranes and other equipment. It sounds like autonomous driving along fixed routes. In fact, a new driving environment will be created in less than half a day after the containers stacked at ports are hoisted back and forth.

Autonomous commercial vehicles are first seen as port container trucks, which is quite similar to low-speed automated vehicle applied for driverless delivery. Closed areas, low-speed driving, the rising labor costs as well as the developed e-commerce and logistics in China are all driving factors.

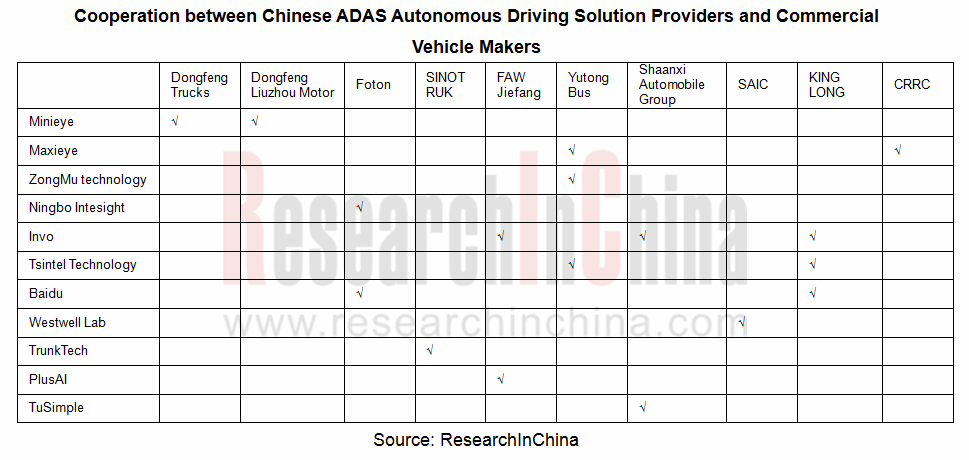

Commercial vehicle automated driving solution providers often partner with commercial vehicle manufacturers to enter a target market.

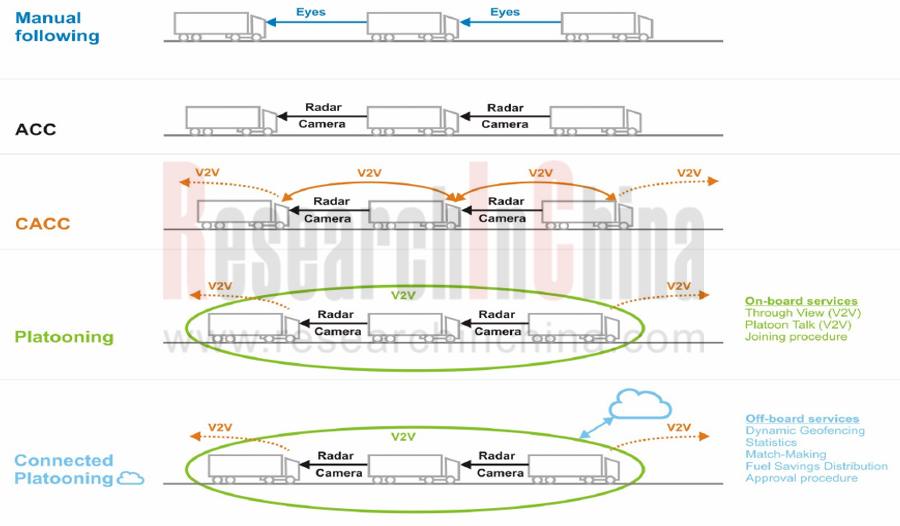

After the first-kilometers and last-kilometers unmanned freight market starts, the much larger freeway autonomous truck market will grow in a progressive way. Initially, autonomous trucks will be realized through platooning -- the first truck is manipulated by a driver while the following trucks are not.

Platooning will go through CACC, Platooning, Connected Platooning and other stages.

Europe is a leader in platooning. Individual carmakers conduct Platooning tests, and multiple automakers organize cross-brand trucks for driving tests and even hold European Truck Platooning Challenge. There is an urgent need for Chinese companies to catch up in this field.

The amazingly huge autonomous driving market is full of difficulties and challenges to ground, and the commercialization process is slower than expected. Fortunately, the Chinese market has witnessed the world's largest number of autonomous driving start-ups that work closely with traditional automakers to step into various segments and solve all technical problems around the clock. Like Chinese electric vehicle market which is the largest in the world, China's autonomous driving market is bound to be the biggest one around the globe.

1 Overview of Commercial Vehicle Automated Driving Industry

1.1 Active Safety and ADAS Become Mandatory Requirements

1.2 Safety Specifications for Commercial Vehicle for Cargo Transportation (2018)

1.3 Domestic Laws on Active Safety and ADAS

1.4 Reference Architecture of Commercial Vehicle Automated Driving

1.5 Evolution of Commercial Vehicle Automated Driving

1.6 Typical Application Scenarios of Commercial Vehicle Automated Driving

1.7 Technical Solutions for Typical Application Scenarios of Commercial Vehicle Automated Driving

1.8 Roadmap of Commercial Truck Automated Driving

1.9 Key Challenges of Commercial Vehicle Automated Driving

1.10 Most Problems in Truck Industry Can Be Solved via Automated Driving

1.11 Port Driverless Truck

2 Technology, Stages and Costs of Commercial Vehicle Automated Driving

2.1 Technology and Development Stages of Commercial Vehicle Automated Driving

2.1.1 Commercial Vehicle Automated Driving Technology: Perception, Decision-making and Control

2.1.2 Key Technologies of Autonomous Truck

2.1.3 Expected Development Paths of Automated Commercial Vehicle

2.1.4 Truck Automated Driving by Stage

2.1.5 Functions in L0-L5

2.2 ADAS Functions Required by Commercial Vehicle

2.2.1 The Most Fundamental ADAS Functions on Truck

2.2.2 ADAS on Volvo Commercial Vehicles

2.3 Costs of Truck Automated Driving

2.3.1 Impact of Truck Automated Driving on Operating Costs

2.3.2 Three Application Cases of Truck Automated Driving

2.3.3 Calculation of Payback Period of Automated Driving in Application Cases

2.3.4 Impact of Vehicle Platooning on Payback Period

2.4 Challenges and Influence of Automated Truck

2.4.1 Impact on Stakeholders in Truck Industry

2.4.2 Technology Push of Different Stakeholders

3 Commercial Vehicle Platooning Autonomous Driving

3.1 Overview of Truck Platooning

3.1.1 Key Components for Autonomous Truck Platooning

3.1.2 Truck Platooning Technology: Truck Connection

3.1.3 Truck Platooning Technology: CACC (Cooperative Adaptive Cruise Control)

3.1.4 Vehicle Platooning Technology: from ACC, CACC to Connected Platooning

3.1.5 Design Structure of Truck CACC System

3.1.6 Cooperative Truck Platooning Aerodynamics

3.2 Participants in Truck Platooning

3.2.1 Competitive Edges of Large Fleet Operators in Platooning

3.2.2 List of Participants in Platooning Field

3.3 Business and Social Value of Truck Platooning

3.4 Procedures of Truck Platooning

3.5 Development of Truck Platooning in Europe

3.5.1 Roadmap of Truck Platooning Automated Driving in Europe

3.5.2 European Truck Platooning Challenge (ETPC)

3.5.3 Multi-brand Truck Platooning Programs in Europe

3.5.4 Truck Platooning Program in Europe: Sweden4Platooning

3.5.5 Truck Platooning Program in Europe: ENSEMBLE

3.5.6 Finland-Norway Truck Platooning Test

3.6 Truck Platooning Programs in the United States

3.6.1 FHWA-FMCSA Truck Platooning Program

3.6.2 Nine States Allow Tests and Over 20 States Are Interested in It

4 Foreign Providers of Commercial Vehicle Automated Driving Solutions

4.1 Starsky Robotics

4.1.1 Technology Solutions

4.2 Embark

4.2.1 Embark AI System

4.3 Peloton Technology

4.3.1 Peloton Team

4.3.2 Peloton Truck Platooning System

4.3.3 Peloton PlatoonPRO

4.3.4 Peloton + Omnitracs Strengthen Fleet Management and Platooning

4.3.5 Industry Leaders’ Investment into Peloton Technology

4.3.6 FCAM Reduces Rear-end Collisions by 71%

4.4 BestMile

4.4.1 Core Engine of BestMile Mobility Platform

4.4.2 System Architecture of BestMile Mobility Platform

4.4.3 APP of BestMile Mobility Platform

4.4.4 BestMile’s Solutions for Autonomous Fleet Management

4.4.5 Application of BestMile’s Products to Autonomous Bus

4.4.6 BestMile’s Specific Solutions: Ride-hailing and Micro-transit

4.4.7 Integration under Multi-mode Environment

4.4.8 Value Chain, Customers and Partners of BestMile

4.4.9 Cooperative Projects of BestMile

4.5 Oxbotica

4.5.1 Oxbotica’s Products

4.5.2 Oxbotica’s Automated Driving Programs

4.6 Einride

4.6.1 T-Pod and T-Log

4.7 KeepTruckin

4.7.1 KeepTruckin’s Products

4.8 INRIX

4.8.1 INRIX AV Road Rules Platform

4.9 WABCO

4.9.1 Development Course

4.9.2 Layout in Automated Driving Products

4.9.3 OnGuardACTIVE

4.9.4 ADAS System

4.9.5 Industry Leader

4.10 Kodiak

5 Chinese Commercial Vehicle Automated Driving Solution Providers

5.1 Tianjin Tsintel Technology Co., Ltd.

5.1.1 Tsintel’s Commercial Vehicle AEB

5.1.2 Architecture and Application Cases of Tsintel’s Commercial Vehicle AEB Systems

5.1.3 Tsintel’s Automated Driving Solutions for Specific Scenarios

5.2 Beijing TuSimple Future Technology Co., Ltd.

5.2.1 Core Technologies and Position

5.2.2 TuSimple Makes Inroad into the Field of Port Container Truck Autonomous Transportation

5.3 Shanghai Westwell Information Technology Co., Ltd.

5.3.1 Core Technologies

5.3.2 Products and Applications

5.4 Hangzhou Zhuying Technology Co., Ltd./Fabu Technology Limited

5.4.1 Core Technologies

5.4.2 Products and Development Strategy

5.5 PlusAI Inc.

5.5.1 Core Technologies and Application Scenarios

5.5.2 Application Cases

5.6 TrunkTech

5.6.1 TrunkTech’s Autonomous Electric Trucks

5.7 Changsha Intelligent Driving Research Institute – A Supplier of Intelligent Logistics Vehicles and Systems

5.7.1 Heavy Truck Automated Driving Solutions

5.8 Henan Huhang Industry Co., Ltd.

5.8.1 Coach Application Solution

5.8.2 Bus Application Solution

5.8.3 Hazardous Chemicals Transport Vehicle Application Solution

5.8.4 Truck Application Solution

5.8.5 Learner-driven Vehicle Application Solution

5.9 G7

6 Automated Driving Layout of Foreign Commercial Vehicle Companies

6.1 Volkswagen (VW)

6.1.1 VW’s Automated Driving Projects

6.1.2 AdaptIVe Project

6.1.3 L3PILOT Project

6.1.4 Roadmap of Mobility Services and Products

6.1.5 MaaS Commercial Vehicles

6.1.6 Autonomous Truck Layout

6.1.7 MAN SE’s Autonomous Trucks for Highway Construction

6.2 PACCAR

6.2.1 Share in Heavy Truck Market and Industry Ranking

6.2.2 Financial Data

6.2.3 New Products and Technologies

6.2.4 Automated Driving Technologies and Truck Platooning

6.3 Volvo

6.3.1 Financial Status by Division

6.3.2 Mass-produced Active Safety Systems

6.3.3 Future Trucks

6.3.4 Layout of Commercial Vehicle Automated Driving

6.4 Daimler

6.4.1 Layout of Commercial Vehicle Automated Driving

6.4.2 SuperTruck 1 Project – Development Roadmap

6.4.3 SuperTruck 1 Project – Overview

6.4.4 SuperTruck 2 Project – Challenges

6.4.5 SuperTruck 2 Project – Development Steps

6.4.6 SuperTruck 2 Project – Stages

6.4.7 Autonomous Truck Layout and Partners

6.4.8 Autonomous Truck ADAS Roadmap

6.5 SCANIA

6.5.1 Financial Status, 2013-2017

6.5.2 Operating Business and Market Status

6.5.3 Automated Driving Solutions

6.5.4 Autonomous Trucks and Bus Solutions

6.5.5 Autonomous Tramcar, Truck and Bus

6.5.6 Automated Driving Test

6.5.7 Autonomous Truck Platooning

7 Automated Driving Layout of Chinese Commercial Vehicle Companies

7.1 Beiqi Foton Motor Co., Ltd.

7.1.1 Strategic Clients and Global Partners

7.1.2 Foton and Baidu Cooperated to Launch Autonomous Trucks

7.1.3 Foton Acquired China’s First Commercial Vehicle Automated Driving Test License

7.1.4 Foton’s Intelligent Driving Layout

7.1.5 Foton’s Commercial Vehicle Ecosystem

7.2 Dongfeng Motor Corporation

7.2.1 Dongfeng’s Commercial Vehicle Application Scenario Planning

7.2.2 Intelligent Vehicle Planning of Dongfeng Liuzhou Motor Co., Ltd.

7.3 China National Heavy Duty Truck Group Co., Ltd. (SINOTRUCK)

7.4 FAW Jiefang Automotive Co., Ltd.

7.5 Shaanxi Automobile Holdings Limited

7.6 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd.

7.7 Zhengzhou Yutong Bus Co., Ltd.

7.8 Xiamen King Long United Automotive Industry Co., Ltd.

7.9 CRRC Corporation Limited

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...