Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018

Autonomous driving fuses emerging technologies in many industries, and springs up with combinations of new technologies, solutions and products. Cellular vehicle-to-everything (C-V2X) and cooperative vehicle infrastructure system (CVIS) as the two most valued technologies expectedly boomed last year.

Preparing the report brings us back to the development course of personal digital assistant (PDA) and cellphone industry as we are a research institution experiencing how cellphones become intelligent.

There was a melee between PDA and PDA cellphone before iPhone. Palm was the first one sought after by numerous PDA-fanciers who voluntarily wrote evaluation reports and organized fan exchange clubs for the firm, an echo to today’s Tesla.

Many independent operating system developers and open API-based PDA and cellphone vendors (like Nokia) which were active players in the market, then disappeared. These days some OEMs are either developing operating systems by themselves or open software/hardware interfaces. Emerging car manufacturing forces mushroom as herds of cellphone knockoffs did in those years. History does often rhyme.

Without doubt, car manufacturing differs a lot from cellphone industry for its industry scale and complexity more than ten times larger, so it is not quite right to draw a full analogy between them.

Apple’s APPSTORE model, the built 2.5G/3G/4G wireless data networks and the unified smartphone operating systems (with developers reduced to 2 or 3 from dozens) served as a premise of the subsequent prosperity, application and service expansion of mobile internet. Intelligent vehicle industry is probable to follow suit.

IT firms that foray into car manufacturing initially made fun of automakers by saying they still lived in “primitive society” in applying IT and they followed the beaten track with so low efficiency -- even the most intelligent vehicle still lagged behind smartphone by generations in terms of connectivity.

The truth is that chip computing, network transmission and infrastructure still fall short of basic requirements of automobile industry, and intelligent and connected trends of cars still have not been pushed ahead on a gigantic scale.

Connected car alone is little more than a “top student” with high IQs but low EQs.

Connected cars that can only predict intentions of other road users without communicating with surroundings, just act like a “straight-A student” who is a low EQ intellectual performing well on campus (simple traffic scene) but probably falling flat in society (complicated traffic scene).

Human drivers can communicate with pedestrians by expression in their eyes and gestures when crossing an intersection with no traffic signals, through which both drivers and pedestrians can know who will go first. Automated vehicles are however incapable of intentional communication in spite of sensors.

Traffic environment is quite complex and changeable, especially in China where several traffic scenes co-exist under mixed traffic flow. Current automated vehicles have yet to experience so many scenes to travel safely that commercialization of connected cars is faced with high risks.

If wanting to well know intentions of other traffic participants, connected cars undoubtedly need to communicate with them and surroundings. CVIS and V2X then play a key part.

Advantages of CVIS

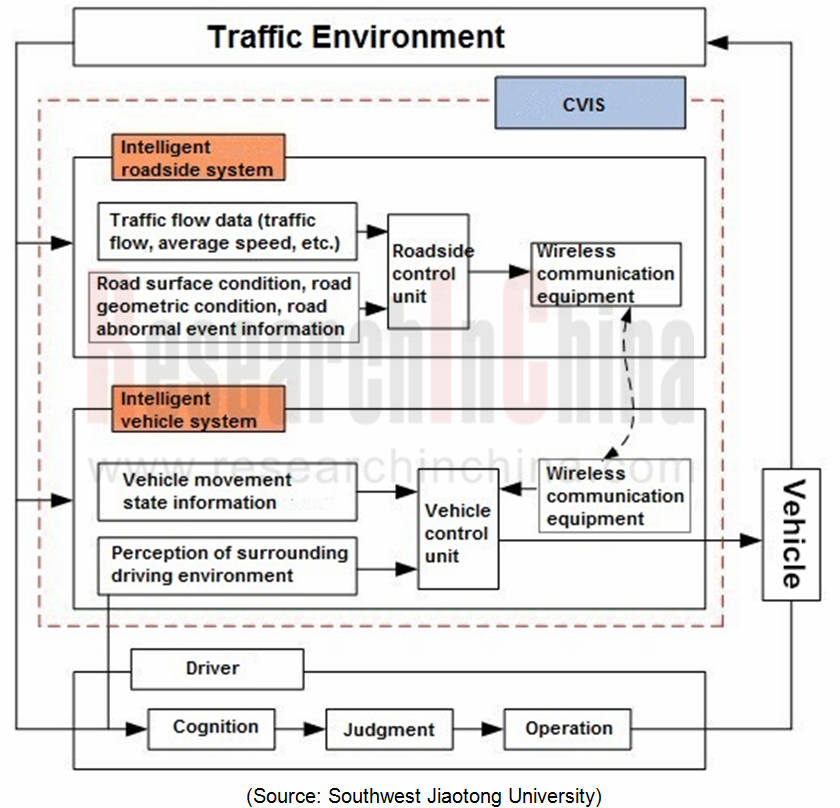

Cooperative vehicle-infrastructure system (CVIS) can acquire vehicle and road information by use of wireless communication and sensor detection technologies, allowing interaction and data sharing between vehicles, between vehicles and infrastructures. The system is a good solution to intelligent communication and coordination between vehicles and infrastructures, making system resources used in a more efficient way, enabling safer road traffic and reducing traffic jams. CVIS is a new trend for intelligent transportation system (ITS).

CVIS is an interaction that interprets the intentions of traffic participants with great precision. It not only guesses what the car is going to do, but also perceives the situation accurately, so that it can make correct judgments.

In addition to interactive capabilities, CVIS can substantially improve perception of autonomous vehicles. Vision, radar, LiDAR and other sensors can be mounted on cars and street light poles which evolve into all-in-one signal poles, all-in-one traffic poles, and all-in-one electric alarm poles. The simultaneous perception of cars and road terminals can minimize blind zones and notify the collision out of sight in advance.

Road terminals deliver enough instructions and suffice the decision-making of autonomous vehicles whose complexity will be reduced remarkably and costs will get much lowered because they need not go through all scenarios. Accordingly, autonomous driving will be earlier commercialized than expected.

In addition to the perception and communication facilities at cars and roads, Ministry of Transport of the People's Republic of China (MOT) is planning to transform roads into intelligent ones and suit them for autonomous driving.

In February 2018, Ministry of Transport issued Notice of MOT’s General Office on Accelerating the Next-Generation National Traffic Control Network and Smart Highway Pilots, proposing to focus on traffic control network and smart roads, involving: (1) digitalization of infrastructure, (2) integrated road transport CVIS, (3) synthetic application of Beidou high-precision positioning, (4) integrated management of road network based on big data, (5) “Internet +” road network integrated services, (6) the new generation of national traffic control network. It is decided in the Notice that smart road trials will accelerate to be carried out in provinces including Beijing, Hebei, Jilin, Jiangsu, Zhejiang, Fujian, Jiangxi, Henan, and Guangdong.

CVIS has just emerged, while the race in autonomous driving enters the second half.

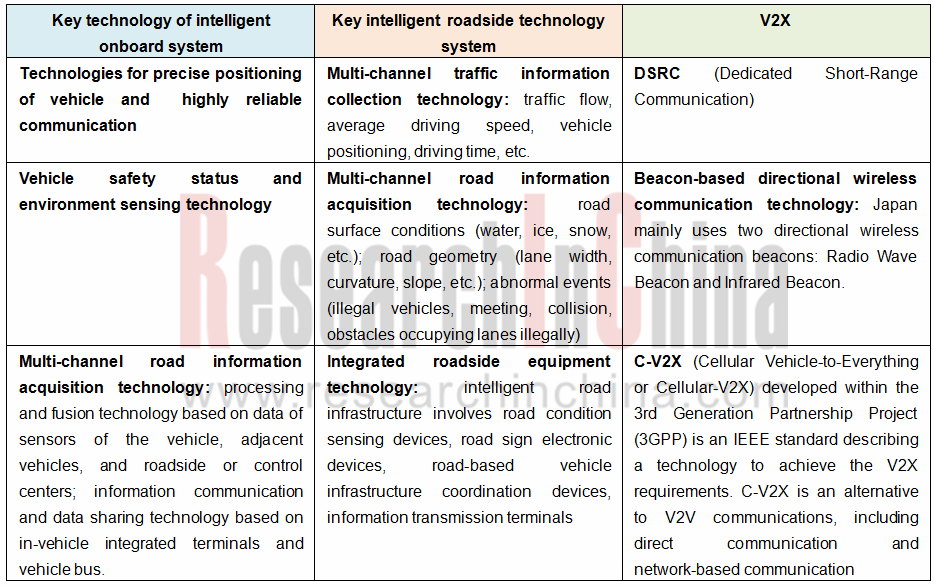

Intelligent Transportation Systems (ITS) has been developing for many years. As the advanced stage of ITS, CVIS deals with technologies such as intelligent onboard system technology, intelligent road test technology, and V2X.

Intelligent onboard system technology and automotive intelligent technology have great common ground, but the perception of the road surface partly depends on the road test unit.

In short, the “smart cars + intelligent roads + CVIS” eligible for fully autonomous driving has just begun. Despite the automotive intelligence of giants like Waymo and Tesla grows mature, it is still far away from fully autonomous driving. The competition in autonomous driving is ushering in the second half when infrastructure will get improved and the market space for car manufacturing will be narrowing, while the market of operations, applications and services will be developing apace.

Competitiveness will be increasingly shown from such technical capabilities as chassis control, sensing systems, chips, power batteries, communication systems, artificial intelligence, intelligent roads, CVIS, big data, cloud computing, etc., and cross-industry competition and cooperation will be an forever subject.

In the second half, most small- and medium-sized enterprises will have to give in to giants (such as Velodyne) with strong core competencies. It is crucial to choose a reliable technical route, because a variety of embedded LINUXs in the early stage of smart phones vanished long ago; it is very important to define the appropriate product positioning, because core parts suppliers outlive vendors of complete machines; it is vital to keep abreast of the developments in the industry since the complexity and scope of the autonomous driving industry is far beyond imagination and new competitors flock to the industry all the time.

As abovementioned, Tesla, who temporarily goes ahead of others, may not be able to take the lead for a long time. Powerful Huawei, Apple and other giants have not yet exerted themselves utterly, which means the second half of autonomous driving contest has just kicked off.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...