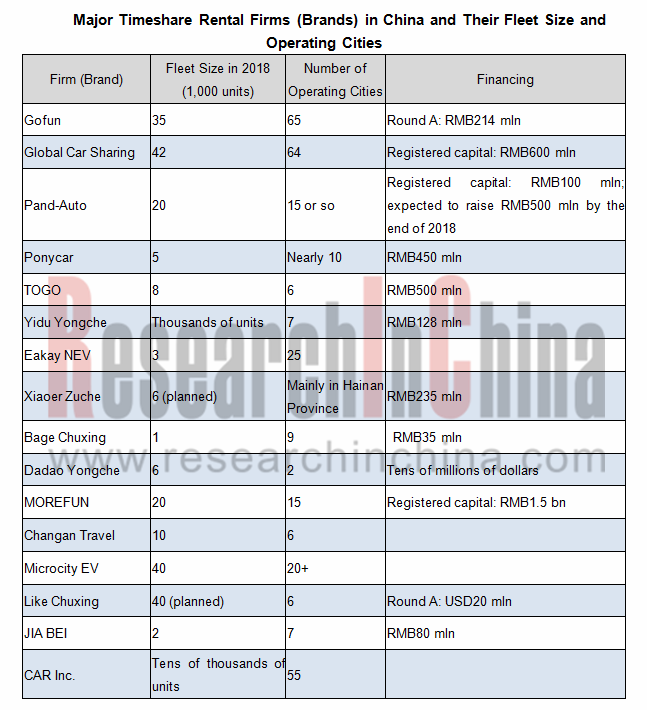

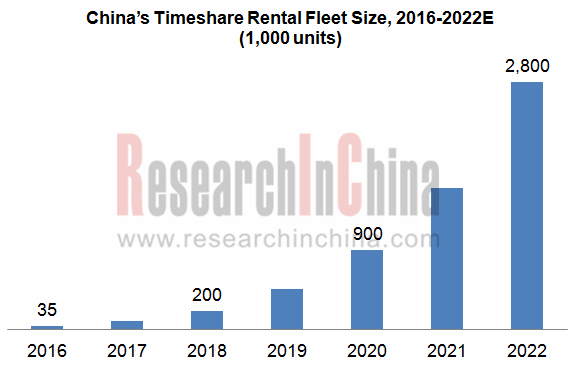

Car sharing exists in three forms: timeshare rental, ride-hailing, and P2P (peer-to-peer) car rental. In China, ride-hailing now prevails; P2P car rental firms almost have gone out of business; only timeshare rental gathers pace. China is expected to see its timeshare rental fleets have 200,000-250,000 cars by the end of 2018, according to the data of ResearchInChina.

It is predicted that China’s timeshare rental fleet size will outnumber 900,000 units by 2020 before hitting more than 2.8 million units in 2022.

Timeshare rental boom in 2018 is largely credited to the following:

Electric vehicles can travel a far longer distance, allowing customers to use more often;

Electric vehicles can travel a far longer distance, allowing customers to use more often;

The use of more customized car models for timeshare rental enables lower car cost;

The use of more customized car models for timeshare rental enables lower car cost;

The influx of funds helps to increase fleets and scale effect plays a part;

The influx of funds helps to increase fleets and scale effect plays a part;

The improving scheduling strategy and algorithms lower operating cost;

The improving scheduling strategy and algorithms lower operating cost;

Delivering cars to users’ door and allowing them to rent and return at any time among other services make it more convenient to use cars;

Delivering cars to users’ door and allowing them to rent and return at any time among other services make it more convenient to use cars;

Automakers put more resources into timeshare rental as their car sales drop

Automakers put more resources into timeshare rental as their car sales drop

On the whole, lower price and more convenience for renting a car conduce to timeshare rental sustaining over 100% growth in recent two years. The introduction of autonomous driving technology will be another reason to let customers find it cheaper and easier to use a car in the future. As a result, timeshare rental and ride-hailing services will roll into one, that is, autonomous taxi service.

Some start-ups also have their eye on the promising timeshare rental market. They can provide a host of solutions from fleet management and scheduling to autonomous valet parking.

Among Chinese firms, FutureMove Automotive positions itself as a provider of mobility services. Its solutions like “automotive software and cloud platform”, “digital operation service” and “intelligent vehicle hardware” have been available to multiple scenarios such as ride-hailing, timeshare rental, business purpose vehicle, industrial customer fleet management and test ride and drive.

Autonomous valet parking (AVP), a key link to timeshare rental service, saves users a lot of picking and returning time. Leading autonomous driving solution providers like Baidu, UISEE and ZongMu Technology, all have announced to put their AVP service into trial operation by cooperating with timeshare rental firms and automakers.

Timeshare rental already begins to shake traditional car rental industry in which the typical firm, CAR Inc. also has announced the launch of a timeshare rental service this year. In the first half of 2018, the car rental giant spent RMB3.42 billion buying new cars, most of which would be for expanding its timeshare rental fleets, a move sending its total fleet size to 123,879 units.

In 2020, China will boast the timeshare rental fleet size of more than 900,000 cars, equivalently replacing over 4.5 million private cars, and the figures to reach over 2.8 million and 14 million in 2022, respectively.

The report will explain the industry development trends and analyze 15 timeshare rental operators and 10 solution providers for their products and services, target market and operation strategy.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...