China End-of-Life Vehicle (ELV) and Dismantling Industry Report,2018-2022

-

Dec.2018

- Hard Copy

- USD

$2,700

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZLC071

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,100

-

- Hard Copy + Single User License

- USD

$2,900

-

Automobile ownership has been climbing steadily in China over the recent years, at a CAGR of 15.2% between 2010 and 2017, and it will continue to rise in the upcoming five years, up to estimated 313.1 million units in 2022, despite a decline in both production and sales in 2018.

As automobile ownership increases in China, more vehicles are due to be scrapped. As estimated, there were a total of 7.3 million end-of-life vehicles (ELV) in China in 2017, with a scrap rate of 4%, but a mere 30% of them were recycled. In the first eleven months of 2018, 1.469 million ELVs were recycled in China, 15.1% more than in the same period of 2017, with the full-year recycling rate expectedly ranging at 20.0%.

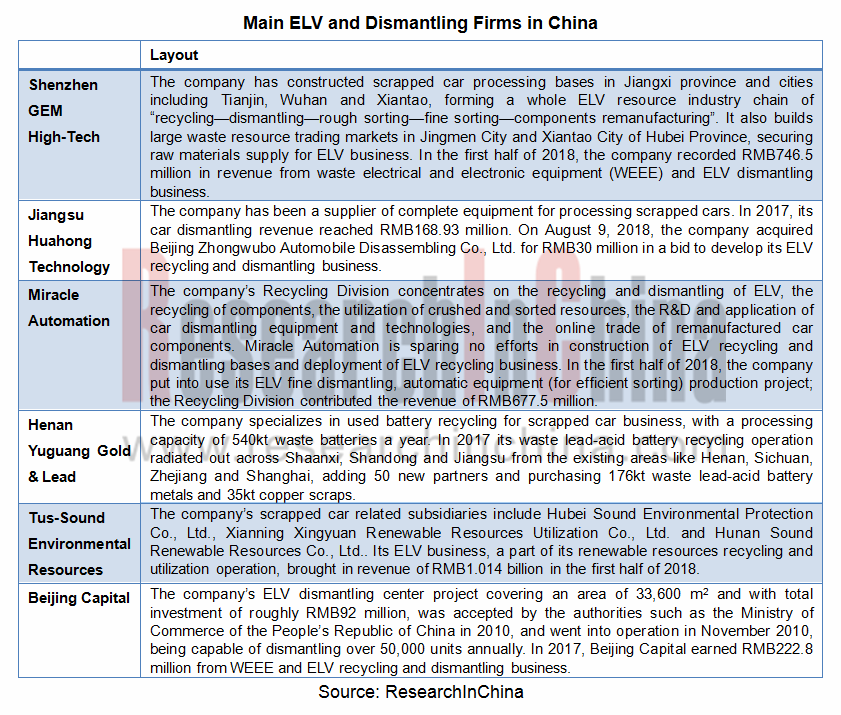

Among 650 to 700 Chinese car dismantling firms for the moment, most are small sized with low annual recycling rate of ELV and scattered resources, though their dismantling networks already take shape. As yet, big players are Shenzhen GEM High-Tech, Jiangsu Huahong Technology, Miracle Automation, Henan Yuguang Gold & Lead, Tus-Sound Environmental Resources and Beijing Capital.

Despite China boasts a huge number of ELVs, its scrap rate remains far lower than the level of 6% to 8% in the developed countries, and a mere 0.5%-1% vehicles out of automobile ownership are recycled compared with a staggering 5%-7% in developed nations. That’s largely because ELV subsidies are directly given to vehicle owners but in small amount, and professional dismantling firms buy their cars at a low price due to weak profitability, which leads to an influx of scrapped cars to the black market which offers a higher price.

The forthcoming new version of the Measures on Management of ELV Recycling, a policy allowing recycling and remanufacturing of “five automotive assemblies” (engine assembly, steering assembly, transmission assembly, front and rear axles, and frame), will promote market growth. With the subsequent issuance of related rules, the ELV and dismantling industry is hopefully to boom, with output value hitting RMB43.43 billion and recycling rate at 24.5% in 2022.

China End-of-Life Vehicle (ELV) and Dismantling Industry Report, 2018-2022 highlights the following:

Global ELV and dismantling industry (overview, development in main countries, and typical companies);

Global ELV and dismantling industry (overview, development in main countries, and typical companies);

China renewable resource industry (policy, status quo, import and export, market segments, and forecast);

China renewable resource industry (policy, status quo, import and export, market segments, and forecast);

China ELV and dismantling industry (policy, upstream sectors, overview, market size, competitive pattern, and summary and forecast);

China ELV and dismantling industry (policy, upstream sectors, overview, market size, competitive pattern, and summary and forecast);

14 Chinese ELV and dismantling firms (operation, gross margin, ELV business, and development strategy).

14 Chinese ELV and dismantling firms (operation, gross margin, ELV business, and development strategy).

1. Overview of ELV & Dismantling Industry

1.1 Definition

1.2 Industry Chain

1.3 Auto Dismantling Process

1.4 Industry Barrier

2. Global ELV& Dismantling Industry

2.1 Overview

2.2 Development in Major Countries

2.2.1 USA

2.2.2 EU

2.2.3 Japan

2.3 Typical Player -- LKQ

3. China Renewable Resource Industry

3.1 Related Policies

3.2 Status Quo

3.3 Import & Export

3.3.1 Import

3.3.2 Export

3.4 Industry Segments

3.4.1 Iron and Steel Scraps

3.4.2 Nonferrous Metal Scraps

3.4.3 Waste Plastics

3.4.4 Waste Paper

3.4.5 Waste Electrical and Electronic Products

3.4.6 End-of-Life Motor Vehicles

3.4.7 Waste Textiles

3.4.8 Scrap Tire

3.4.9 Waste Battery

3.4.10 Waste Glass

3.5 Development Forecast

3.5.1 Iron and Steel Scraps Recycling Trend

3.5.2 Nonferrous Metal Scraps Recycling Trend

3.5.3 Waste Plastics Recycling Trend

3.5.4 Waste Paper Recycling Trend

3.5.5 Waste Electrical and Electronic Products Recycling Trend

3.5.6 End-of-Life Motor Vehicles Recycling Trend

3.5.7 Waste Textiles Recycling Trend

3.5.8 Scrap Tire Recycling Trend

3.5.9 Waste Battery Recycling Trend

3.5.10 Waste Glass Recycling Trend

4. Development Status of China ELV & Dismantling Industry

4.1 Policy Environment

4.2 Downstream Industries

4.2.1 Output and Sales Volume of Automobile

4.2.2 Automobile Ownership

4.3 Development History

4.4 Industry Scale

4.5 Competitive Landscape

4.6 Summary and Forecast

5. Key Players

5.1 Shenzhen GEM High-Tech Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 ELV & Dismantling Business

5.1.6 Development Strategy

5.2 Jiangsu Huahong Technology Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 ELV & Dismantling Business

5.2.6 Development Strategy

5.3 Miracle Automation Engineering Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 ELV & Dismantling Business

5.3.6 Development Strategy

5.4 Henan Yuguang Gold & Lead Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 ELV & Dismantling Business

5.4.6 Development Strategy

5.5 Yechiu Metal Recycling (China) Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 ELV & Dismantling Business

5.5.6 Development Strategy

5.6 Tus-Sound Environmental Resources Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 ELV & Dismantling Business

5.6.6 Development Strategy

5.7 Beijing Capital Co., Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 ELV & Dismantling Business

5.8 Others

5.8.1 Shanghai KIMKEY Environmental S&T Co., Ltd.

5.8.2 Shanghai Xinzhuang Auto Dismantling Co., Ltd.

5.8.3 Baosteel Resources Limited

5.8.4 Anhui Win-win Renewable Resources Group

5.8.5 Chongqing Auto Scrap (Group) Co., Ltd.

5.8.6 Shenzhen End-of-Life Vehicle Recycling Co., Ltd.

5.8.7 Shenyang Qiushi End-of-Life Vehicle Recycling Co., Ltd.

ELV & Dismantling Industry Chain

Auto Dismantling Process Flowchart

Average Annual Processing Capacity of Dismantling Enterprises in Major Countries

Average Annual Processing Capacity of Crushing Enterprises in Major Countries

Subsidies on Motor Vehicle Liquidation in Major Countries

Policies on Vehicle Dismantling in Major Countries

Development Course of USA Automobile Industry

Five Categories of Parts in Automobile Recycling Market in USA

Laws and Regulations on U.S. ELV & Dismantling Industry

Dismantling Industry Overview of U.S. ELV

Laws and Regulations on ELV Processing in EU and Major Countries

Number of ELVs in EU and Major Countries, 2013

Number of Auto Dismantling and Crushing Enterprises in Japan, 2010-2013

Development Course of LKQ

M&A Cases of LKQ

Revenue, Net Income and Growth of LKQ, 2007-2017

Revenue Structure of LKQ by Product, 2017

ELV Recovery Channels of LKQ

Related Policies on Recycling of Renewable Resources in China, 2010-2018

Recycling Quantity of Renewable Resources in China by Category, 2016-2017

Recycling Value of Renewable Resources in China, 2016-2017

Recycling Value Structure of Renewable Resources in China by Category, 2014-2017

Import of Major Renewable Resources in China, 2016-2017

Import Quantity Trend of Major Renewable Resources in China, 2013-2017

Export of Major Renewable Resources in China, 2016-2017

Recycling Amount of Iron and Steel Scraps in China, 2013-2017

Recycling Amount of Nonferrous Metal Scrap in China, 2013-2017

Recycling Amount of Waste Plastics in China, 2013-2017

Recycling Amount of Waste Paper in China, 2013-2017

Recycling Amount of Waste Electrical and Electronic Products in China, 2013-2017

Recycling Amount of End-of-Life Motor Vehicles in China, 2013-2017

Recycling Amount of Scrap Tire in China, 2013-2017

Recycling Amount of Waste Battery (Except Lead-acid Battery) in China, 2013-2017

Recycling Amount of Waste Glass in China, 2013-2017

Policies and Regulations on ELV & Dismantling Industry in China, 2001-2018

Output and Sales Volume of Automobile in China, 2011-2018

Output and Sales Volume of NEV in China, 2011-2018

Automobile Ownership Structure (by Category in China, 2017

Automobile Ownership in China, 2010-2017

Automobile Ownership in China by Region, 2017

Automobile Ownership Structure by Type in China, 2017

Automobile Ownership Structure by Fuel Type in China, 2017

Automobile Ownership Structure by Emission Standard in China, 2017

Development History of ELV & Dismantling Industry in China

Service Life of Main Vehicles in China

Implementation Schedule of China New Motor Vehicle Emission Standards, 1999-2020

Scrapping Quantity of ELV in China, 2007-2017

China’s Car Scrap Rate, 2007-2017

Car Recycling Market Comparison: China vs. USA, 2017

Recycling Number and Growth of ELV in China, 2011-2018

Recycling Number of ELV by Category in China, 2015-2018

Recycling Rate of ELV in China, 2011-2017

Unit Recycling Price of ELV in China, 2011-2018

China Automobile Recycling Value, 2011-2018

Related ELV& Dismantling Companies in China

Revenue Comparison of Major ELV& Dismantling Companies, 2013-2018

Net Income Comparison of Major ELV& Dismantling Companies, 2013-2018

Comparison of Subsidies on ELV in China and USA

Material Structure of Scrapped Sedan

Waste Materials Price of Scrapped Sedan in China, May 14, 2018

Single Car Dismantling Economic Calculation before Five Assemblies Remanufacturing was Allowed

Single Car Dismantling Economic Calculation after Five Assemblies Remanufacturing was Allowed

Output Value of Automobile Recycling Industry in China, 2017-2022E

Automobile Ownership in China, 2017-2022E

Scrapping Quantity of ELV in China, 2017-2022E

China’s Car Scrap Rate, 2017-2022E

Recycling Number of ELV in China, 2017-2022E

Recycling Rate of ELV in China, 2017-2022E

Revenue and Net Income of GEM, 2009-2018

Revenue Breakdown of GEM by Product, 2016-2018

Revenue Structure of GEM by Product, 2016-2018

Gross Margin of GEM, 2012-2018

Revenue from Waste Electronics and ELV& Dismantling Business of GEM, 2016-2018

Revenue and Net Income of Huahong Technology, 2009-2018

Revenue Breakdown of Huahong Technology by Business, 2014-2018

Revenue Structure of Huahong Technology by Business, 2014-2018

Gross Margin of Huahong Technology by Business, 2014-2018

Major Clients of Miracle Automation

Revenue and Net Income of Miracle Automation, 2009-2018

Revenue Breakdown of Miracle Automation by Product, 2014-2018

Revenue Structure of Miracle Automation by Product, 2014-2018

Gross Margin of Miracle Automation by Product, 2014-2018

Revenue from Circulation Segment of Miracle Automation, 2014-2018

Revenue and Net Income of Henan Yuguang Gold and Lead, 2009-2018

Revenue Breakdown of Henan Yuguang Gold and Lead by Product, 2014-2017

Revenue Structure of Henan Yuguang Gold and Lead by Product, 2014-2017

Gross Margin of Henan Yuguang Gold and Lead by Product, 2014-2017

Revenue and Net Income of Ye Chiu Metal Recycling (China) Ltd., 2009-2018

Revenue Breakdown of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Revenue Structure of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Gross Margin of Ye Chiu Metal Recycling (China) Ltd. by Product, 2014-2017

Revenue and Net Income of Tus-Sound Environmental Resources, 2009-2018

Revenue Breakdown of Tus-Sound Environmental Resources by Product, 2014-2018

Revenue Structure of Tus-Sound Environmental Resources by Product, 2014-2018

Gross Margin of Tus-Sound Environmental Resources by Product, 2014-2018

Tus-Sound Environmental Resources’ Scrapped Car Related Subsidiaries and Its Equity Ratio in Them

Tus-Sound Environmental Resources’ Revenue from Renewable Resource Recycling Business and % of Total Revenue, 2015-2018

Revenue and Net Income of Beijing Capital, 2009-2018

Revenue Breakdown of Beijing Capital by Product, 2014-2017

Revenue Structure of Beijing Capital by Product, 2014-2017

Revenue Breakdown of Beijing Capital by Region, 2014-2017

Revenue Structure of Beijing Capital by Region, 2014-2017

Gross Margin of Beijing Capital by Product, 2014-2017

Revenue, Proportion and Gross Margin of Waste Electronic Products and ELV & Dismantling of Beijing Capital, 2016-2017

Equity Structure of Shanghai Xinzhuang Auto Dismantling Co., Ltd.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...