Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

Electronic control unit (ECU) serves as an automotive computer controller. Automotive electronic controller is used to receive and process signals from sensors and export control commands to the actuator to execute. Microprocessors, the core of an automotive ECU, embrace micro control unit (MCU), microprocessor unit (MPU), digital signal processor (DSP) and logic integrated circuits (IC). The global ECU leaders are Bosch, Denso, Continental, Aptiv, Visteon, among others.

As vehicle trend to use more electronics, ECU is making its way into all auto parts from anti-lock braking system, four-wheel drive system, electronically controlled automatic transmission, active suspension system and airbag system to body safety, network, entertainment and sensing and control systems. Vehicles’ consumption of ECU then booms: high-class models use 50-70 ECUs on average, and some even carries more than 100 units.

When the one-to-one correspondence between the growing number of sensors and ECUs gives rise to underperforming vehicles and far more complex circuits, more powerful centralized architectures like domain control unit (DCU) and multi-domain controller (MDC) come as an alternative to the distributed ones.

The concept of domain control unit (DCU) was initiated by tier-1 suppliers like Bosch and Continental as a solution to information security and ECU development bottlenecks. DCU can make systems much more integrated for its powerful hardware computing capacity and availability of sundry software interfaces enable integration of more core functional modules, which means lower requirements on function perception and execution hardware. Moreover, standardized interfaces for data interaction help these components turn into standard ones, thus reducing the spending on research and development or manufacture. In other words, unlike peripheral parts just playing their own roles, a central domain control unit looks at the whole system.

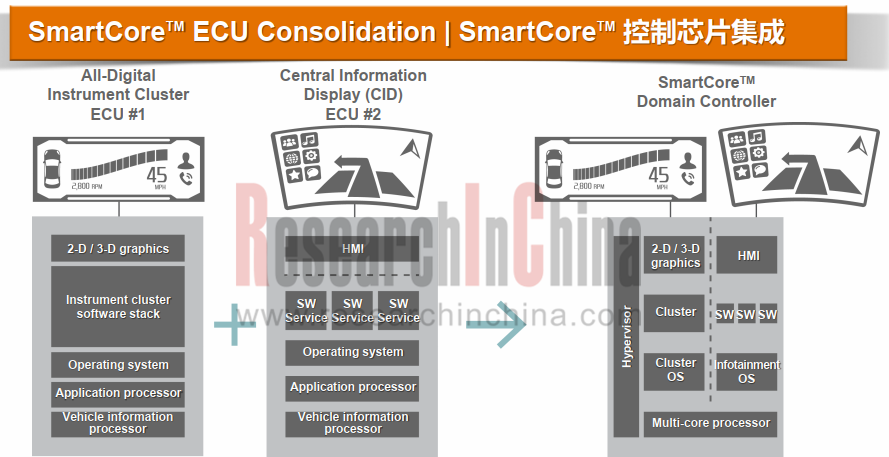

Figure 1: Visteon integrates instrument ECU and head unit ECU into SmartCore cockpit domain controller

Autonomous vehicle requires domain controllers not only to be integrated with versatile capabilities such as multi-sensor fusion, localization, path planning, decision making and control, V2X and high speed communication, but to have interfaces for cameras (mono/stereo), multiple radars, LiDAR, IMU, etc.

To complete number crunching, a domain control unit often needs a built-in core processor with strong computing power for smart cockpit and autonomous driving at all levels. Solution providers include NVIDIA, Infineon, Renesas, TI, NXP and Mobileye. The scheme that powerful multi-core CPU/GPU chips are used to control every domain in a centralized way can replace former distributed automotive electric/electronic architectures (EEA).

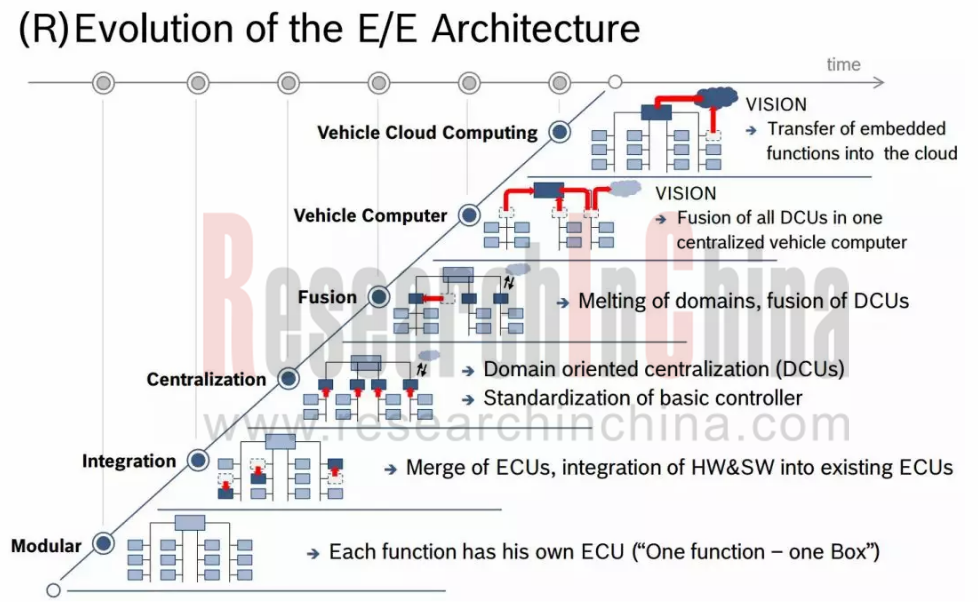

Figure 2: evolution of Bosch E/E architecture. It has six layers, i.e., Modular,Integration, Centralization, Fusion, Vehicle Computer and Vehicle Cloud Computing. DCU is applied to the third layer (Centralization), and MDC the fourth (Fusion).

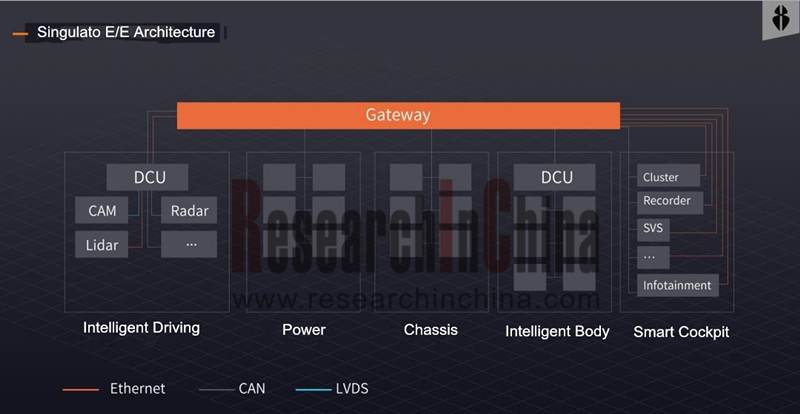

In current stage, most new vehicles adopt DCU-based E/E architectures. In Singulato iS6’s case, a DCU + automotive Ethernet based network topology is used to divide E/E architecture into 5 domains: intelligent driving, smart cockpit, body, chassis and power; an integrated design allows fusion of all sensor data into the intelligent driving domain controller which is in charge of data processing and decision making to implement ADAS functions such as adaptive cruise control, lane keeping and automatic parking. All imply that automakers need to develop their own ADAS/AD systems.

The study by “Cool Wax Gourd”, a technical expert’s Twitter-like Sina Weibo account, shows that: the evolution of three generations of Tesla models from Model S to Model X to Model 3, is actually a process of functional redistribution, namely, developing capabilities based on those from suppliers; Model S E/E architecture has been a fifth-layer one (Vehicle Computer) at the start.

As automotive E/E architectures evolve, there is a big shift in relationship between OEMs and automotive electronics suppliers, too. The trend for integrated automotive electronic hardware leads to the smaller number of electronics suppliers and the more important role of DCU vendors.

Being generally integrated with instrument clusters and head unit, a cockpit domain controller for instance, will be fused with air conditioner control, HUD, rearview mirror, gesture recognition, DMS and even T-BOX and OBU in future.

An autonomous vehicle that generates 4TB data an hour, needs a domain control unit to have some advanced competencies such as multi-sensor fusion and 3D localization.

Central gateway closely tied with domain controllers, takes charge of sending and receiving key security data, and is directly and only connected to the backstage of automakers. Through OTA updates to domain controllers, carmakers can develop new capabilities and ensure network security for faster deployment of functions and software.

DCU vendors and automakers will deepen their partnerships in research and development.

Desay SV argues that: tier-1 suppliers and OEMs will collaborate in the following two ways in the area of autonomous driving domain controller:

First, tier-1 suppliers are devoted to making middleware and hardware, and OEMs develop autonomous driving software. As tier-1 suppliers enjoy edges in producing products at reasonable cost and accelerating commercialization, automakers are bound to partner with them: OEMs assume software design while tier-1 suppliers take on production of hardware and integration of middleware and chip solutions.

Second, tier-1 suppliers choose to work with chip vendors in solution design and research and development of central domain controllers, and then sell their products to OEMs. Examples include Continental ADCU, ZF ProAI and Magna MAX4.

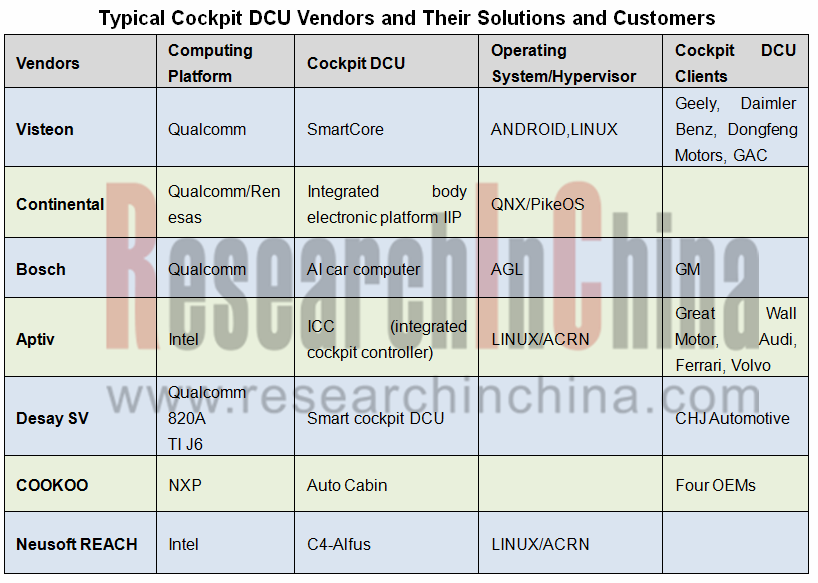

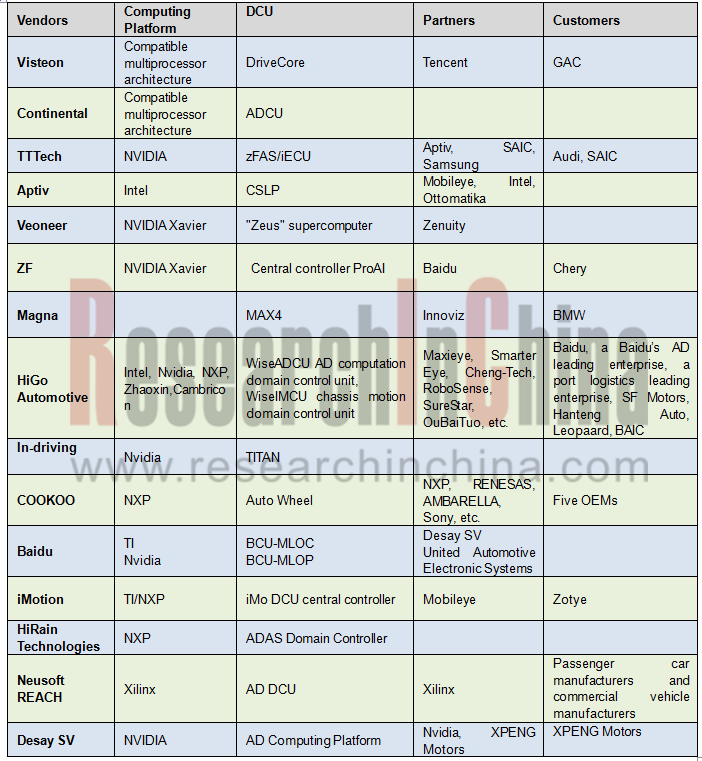

It can be seen from the two tables below that there is a tendency towards cooperation between controller vendors and OEMs, domain controller suppliers and chip vendors, in both cockpit and autonomous driving domain controllers.

Typical Autonomous Driving DCU Vendors and Their Customers and Partners

DCU, as a kind of OEM automotive electronics, usually takes over two years from design to mass production and launch. Most of the above suppliers are still researching and developing DCU. Aptiv and Visteon are far ahead of peers and have mass-produced DCU.

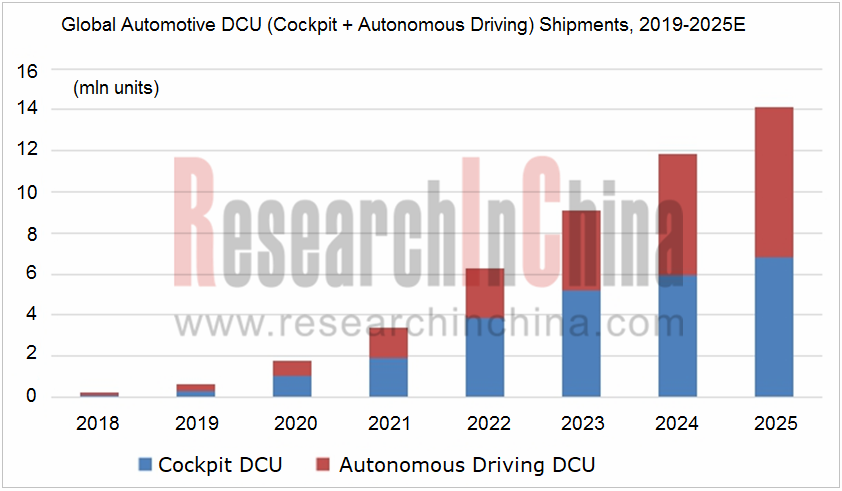

The global automotive DCU (cockpit + autonomous driving) shipments will exceed 14 million sets in 2025, with the average annual growth rate of 50.7% between 2019 and 2025, according to ResearchInChina.

Throughout the DCU industry, Chinese companies have emerged strikingly in the past two years, such as Desay SV, Baidu, Neusoft, HiGO Automotive, COOKOO, In-driving, iMotion, etc., all of which now takes emerging and non-first-tier traditional automakers as their key clients.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...