Autonomous Driving High-precision Positioning Industry Report, 2018-2019

The existing positioning technology falls into outdoor and indoor positioning. Outdoor positioning technology involves traditional satellite positioning, radar positioning, inertial measurement unit (IMU) positioning and cellular mobile network positioning. Indoor positioning technology embraces WLAN positioning, Zigbee positioning, Bluetooth positioning, ultra wideband (UWB) positioning, infrared positioning, computer vision positioning and ultrasonic positioning.

The solution to the problem of knowing where a vehicle is (initial position) and where it is going (target position) is indispensable to autonomous driving. High level of autonomous driving demands centimeter-level positioning technology. High-precision positioning technology, therefore, plays a vital role in L3-above autonomous driving.

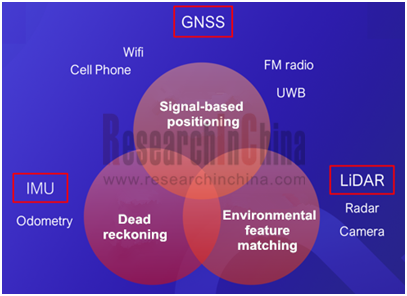

High-precision positioning technology for autonomous driving is classified by positioning method into the three types as follows:

(1)Signal-based positioning technology such as global navigation satellite system (GNSS), UWB and 5G;

(2)Dead reckoning, an IMU-based technology that reckons current position and direction of a vehicle after learning where it was;

(3)Environmental feature matching, or LiDAR and vision sensor-based positioning, that is, matching features observed with those stored in database to know where the vehicle is and what it looks like.

Among signal-based positioning methods, GNSS and 4G/5G are often used for outdoor positioning, and UWB for the indoor.

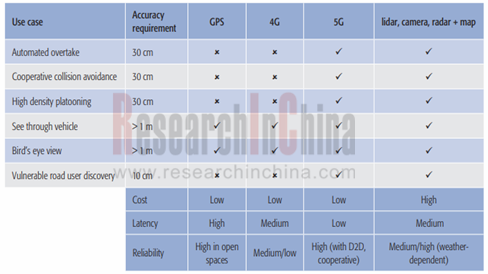

Through comparing different positioning technologies, 5G and vehicle body sensor fusion (combining radar, camera, LiDAR and map) are the two optimal solutions for L4/L5 autonomous driving in the densely populated areas.

Satellite positioning, however, is more applicable to sparsely populated places where it is unfitted to build 5G base stations on a large scale.

GNSS with a meter-level positioning accuracy falls far short of autonomous driving. The centimeter-level satellite positioning needs correction of GNSS positioning errors caused by ionosphere, which is often done by real time kinematic (RTK), a technology having evolved from a conventional 1+1 or 1+2 system to a wide area differential one. The continuous operational reference station (CORS) built in some cities improves RTK measurement range significantly.

Correcting satellite positioning errors by multiple stationary CORS on the ground is also called “ground based augmentation”. Qianxun SI has constructed over 2,400 ground based augmentation stations across China as its Beidou-based positioning system has served a total of 190 million users.

Ground based augmentation system (GBAS) offers limited coverage albeit with a high accuracy. The system only works for targets in the coverage of its communication signals which find it hard to reach high altitudes, seas, deserts and mountains, so it misses out a large area. To meet the needs of high-precision positioning on a larger scale, correction parameters collected from CORS are sent to satellites for broadcast, so that user end can be free of inadequate communication capacity. Such a correction method is referred to as satellite based augmentation.

Ground based augmentation system (GBAS) has so many technical defects from limited communication capacity and non-uniform architecture to heavy concurrent load and high maintenance cost that GBAS is bound to be replaced by satellite based augmentation system (SBAS).

Autonomous vehicles need to not only carry sensors like LiDAR but be capable of centimeter-level positioning for self-driving in any scenario. SBAS will be the best choice for L5 autonomous driving for its unique ability to provide rapid global coverage for billions of users at the same time and at an ultralow cost.

Satellite navigation and positioning system is heading to the integration between SBAS and GBAS, between communication and navigation.

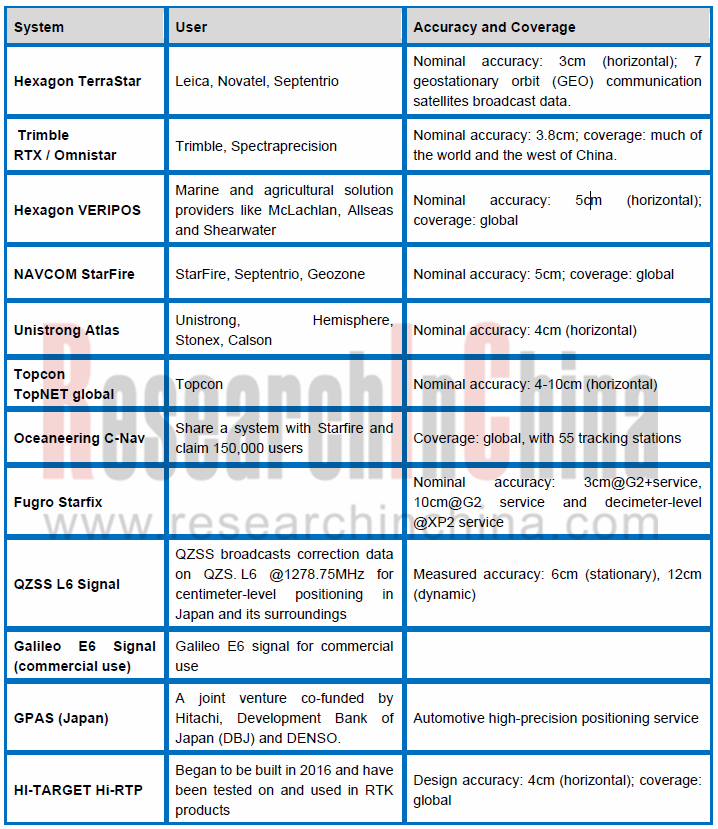

Many a company is setting about building SBAS.

The large number of competitors means that users have to bind receiver hardware or some one’s SBAS, which goes against the prevalence of high-precision positioning technology in mass market. Sapcorda was thus founded.

Sapcorda

On August 8, 2017, Bosch, Geo++, Mitsubishi Electric and u-blox announced the creation of Sapcorda Services GmbH, a joint venture that will bring high precision GNSS positioning services to mass market applications. Sapcorda will offer globally available GNSS positioning services via internet and satellite broadcast and will enable accurate GNSS positioning at centimeter level. The services are mainly for autonomous vehicle, industrial and consumer markets. The real-time correction data service is delivered in a public and open way and does not bind with receiver hardware or systems.

Sapcorda wants to be a trailblazer providing new-generation intercontinental GNSS correction data services in Europe, America and the rest of the world. Yet the company has not released any information since its inception. It may suffer a setback in multi-party cooperation or may be just engrossed in a big plan.

It is imaginable that coordinating its shareholders, Bosch, Mitsubishi Electric and u-blox, all of which are big names in technology world, is almost a tall order.

U-blox focuses on development and sale of GNSS chips and modules, and has more than 5,900 customers in 66 countries. Its unit shipment surged from 4.5 million to 90 million between 2007 and 2017. In OEM market, it is a GPS chip supplier of Mercedes-Benz, BMW, Ferrari, Porsche and Audi among other auto brands. Its latest F9 GNSS technology platform offers mainstream GNSS correction services (processing positioning correction data provided by Qianxun SI), and an open interface to GNSS correction service providers.

Bosch has forayed into most autonomous driving industry chain links, of course, including the key technology, high-precision positioning. Bosch already provides inertial sensors as it did in 2016 when SMI130, a 6-axis inertial motion sensor, was unveiled. As an inertial sensor bellwether, InvenSens has been a long-term sole supplier of motion sensor modules for Apple iPhone. In May 2017, Bosch won orders from Apple to supply the next iPhone with some of its motion sensors, breaking the monopoly of InvenSens.

Bosch also has strong technology competence in the fields of automotive camera, radar and LiDAR, staying ahead of its counterparts in installations of cameras and radars. Its three high-precision positioning solutions are applied to scenarios of highway, city road and long non-GNSS tunnel, respectively:

Automotive camera + radar based positioning technology;

Automotive camera + radar based positioning technology;

GPS+ correction technology, providing vehicle motion and position sensors (VMPS);

GPS+ correction technology, providing vehicle motion and position sensors (VMPS);

Bosch road feature + HD map based positioning technology.

Bosch road feature + HD map based positioning technology.

Mitsubishi Electric develops a positioning method---“centimeter level augmentation service” (CLAS) with data broadcast from Japanese Quasi-Zenith Satellite System (QZSS). The company is the major contractor of the government’s QZSS project. The solution runs by using data from satellites, ground sensors to detect vehicle position and “positioning-augmentation” algorithm to correct some errors. CLAS algorithm enables a centimeter-level accuracy compared with the 10-meter of a general satellite, with horizontal accuracy of 12cm and vertical accuracy of 24cm.

Mitsubishi Electric names its autonomous driving technology “Diamond Safety”. The self-sensing driving technology combines various peripheral-sensing technologies, including a forward-monitoring radar with wide viewing angle, a forward-monitoring camera and a backward side-monitoring radar. Its infrastructural driving technology uses high-accuracy 3D mapping in combination with CLAS broadcast from QZSS.

Apart from the three giants working hard on poisoning technology, SpaceX, founded by Elon Musk, the co-founder and CEO at Tesla, has outlined a more ambitious plan -- Starlink internet satellite constellation project.

Musk's Starlink

With Starlink, SpaceX intends to put a 4,425-satellite constellation in low earth orbit, thereby providing high-speed, cable-like internet to every corner of the planet. The project is expected to cost a total of around USD10 billion. Each satellite measures 4 x 1.8 x 1.2 m and weighs 390 kg or so. Their orbits are between 1,150 and 1,325 km above the Earth's surface.

SpaceX will officially launch satellites in 2019 and provide limited services by 2020. It is expected that the business will have 40 million subscribers or more and earn over $30 billion in revenue by 2025.

In November 2018, SpaceX adjusted its technical solution and filed a request to the Federal Communications Commission (FCC) in which it details plans to send 1,584 satellites to orbit at an altitude of 550km, about one-third of the originally planned 4,400+ satellites. The latency in signals will also be reduced from 25 milliseconds to 15 milliseconds.

In February 2019, SpaceX filed an earth-station license application with the Federal Communications Commission. The application seeks blanket approval for up to a million earth stations that would be used by customers of the Starlink satellite internet service. The stations would rely on a flat-panel, phased-array system to transmit and receive signals in the Ku-band to and from the Starlink constellation.

According to Liu Jingnan, an academician of the Chinese Academy of Engineering, Starlink features high precision, high availability and high reliability. It can not only provide broadband Internet services, but also allow communication, and can be used as centimeter-level positioning augmentation and navigation services as well. Therefore, it is suitable for high-precision positioning and serves sectors such as autonomous driving.

China also has a Starlink-like project -- "Hongyan" system of China Aerospace Science and Technology Corporation. It consists of 54 core satellites and 270 small supporting satellites, which together form a 324-satellite constellation. The Hongyan system also features satellite positioning augmentation, which can further improve the positioning accuracy for the Beidou navigation system. It will launch 6 satellites by 2020 to realize LAN link verification, and complete the launch of 54 backbone satellites by 2023.

Since 2018, autonomous driving has slowed down the pace of development, and L2-L3 has remained a focus for the moment. The large-scale application of L4-above AD requires that communication networks should transfer from C-V2X to 5G-V2X and satellite positioning should shift from large-scale ground-based augmentation (Qianxun SI, etc.) to large-scale satellite-based augmentation (Starlink, Hongyan, etc.).

The autonomous driving industry is advancing gradually in due order and the vision after 2023 is worth anticipating.

1 Concept and Technology of High-precision Positioning for Autonomous Driving

1.1 Positioning Technology

1.1 High-precision positioning of Autonomous Driving

1.2 Classification of High-precision Positioning Technology

1.3 Signal-based Positioning

1.3.1 Satellite-based Positioning

1.3.2 UWB-based Positioning

1.3.3 5G-based Positioning

1.3.4 Positioning System Integrating Communications with GNSS

1.3.5 Communication-Navigation Integration and Starlink

1.4 Positioning Based on Dead Reckoning - Inertial Navigation System

1.4.1 Gyroscope

1.4.2 Accelerometer

1.5 Positioning Based on Environmental Feature Matching

1.5.1 Lidar-based Positioning

1.5.2 Vision Technology-based Positioning

1.6 Integrated Positioning

1.6.1 Combination of GNSS and IMU

1.6.2 Baidu multi-sensor Positioning Technology Solution

1.6.3 Lane-level Positioning Based on Vision and Radar

2 Positioning Chips, Modules and Related Companies

2.1 u-blox

2.1.1 Development History

2.1.2 Global Operations

2.1.3 Business and Product Technology Roadmap

2.1.4 GNSS Positioning Platform Products

2.1.5 ZED-F9P GNSS Positioning Modules

2.1.6 Global GNSS Correction Services

2.2 STMicroelectronics

2.2.1 Automotive Business

2.2.2 Automotive Business and Core Technology

2.2.3 High-precision Positioning Chip

2.2.4 Teseco APP

2.2.5 ST ASM330LHH

2.3 ADI

2.3.1 Inertial Navigation Products

2.3.2 ADIS16490

2.4 Decawave

2.5 InvenSens

2.6 Bosch

3 Inertial Navigation Positioning Technologies and Companies

3.1 Development trend

3.2 Market size

3.3 DAISCH

3.3.1 Automotive Inertial Navigation System

3.3.2 Key Features and Commercialization of Products

3.4 eCHIEV

3.4.1 GEMINI OpenPilot Platform

3.4.2 EC-MU101 Combined Positioning Units

3.5 Xilang Technology

3.6 StarNeto

3.7 Navtech

4 Signal-based Positioning Technologies and Companies

4.1 Satellite-based High-precision Positioning Technology

4.1.1 Overview of SBAS

4.1.2 Trimble SBAS

4.2 5G-based Positioning Technology

Strengths and Challenges of 5G Positioning

4.3 UWB-based Positioning

4.4 Qianxun SI

4.4.1 Autonomous Driving High-precision Positioning Solution

4.4.2 Telematics High-precision Positioning Solution

4.4.3 Time-Space City Brain Project

4.4.4 Create OEM High-precision Positioning Modules with Quectel

4.4.5 Huawei Vehicle Terminal Integrates Positioning Services of Qianxun SI

4.4.6 Development Trends

4.5 Sapcorda

4.6 Mitsubishi Electric

CLAS Services

4.7 Hi-Target

4.7.1 Positioning Technology Development History

4.7.2 Layout in Autonomous Driving

4.7.3 Hi-RTP Global Positioning Service Technology Solution

4.7.4 Hi-RTP Global Positioning Service Construction Planning and Product Mass Production Solution

4.8 BroadGNSS Technology

4.9 South Survey

4.10 Swift Navigation

4.10.1 Piksi Multi and Duro GPS Receiver

4.10.2 Swift Starling Positioning Engine

4.11 Unistrong

Beidou Navigation Agricultural Machinery Autonomous Driving System

4.12 Kunchen

4.12.1 Hawkeye Ultra-Wideband Positioning System Architecture

4.12.2 Industrial Customers and High-precision Positioning Solution

4.12.3 AVP Application Solution Based on UWB Positioning Technology

4.12.4 Application Cases

4.13 Jingwei Technology

5 Integrated Positioning Technology Solution and Companies

5.1 Integrated Positioning Technology

5.2 Novatel

5.2.1 Product Line

5.2.2 SPAN Inertial Navigation System Configuration and Level 1 System

5.2.3 SPAN Inertial Navigation Level 2/3 System

5.2.4 Inertial Navigation System Application

5.3 Trimble Navigation

5.3.1 Trimble RTX Positioning Technology

5.3.2 Trimble Offers High-precision Positioning for Cadillac

5.4 BDStar Navigation

5.5 CTI

5.6 Starcart

5.7 Baidu

5.7.1 Baidu’s Multi-sensor Fusion Positioning System Architecture

5.7.2 Point Cloud Positioning Algorithm Architecture

5.7.3 RTK Positioning

5.7.4 Inertial Navigation Solution

5.7.5 Multi-module Fusion

5.7.6 Multi-sensor Fusion Positioning Hardware Architecture

5.8 Wayz.ai

5.8.1 Business Layout

5.8.2 Three Services

5.9 AutoNavi (amap.com)

5.9.1 Camera-based Positioning Solution

5.9.2 Integrated Solution Based on HD Map and High-precision Positioning

5.9.3 Technology Roadmap

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...