ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

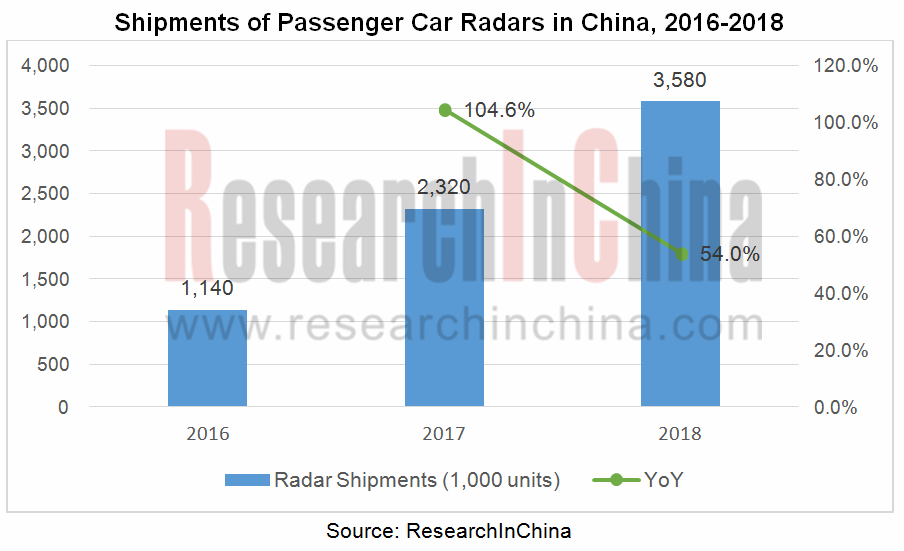

China’s passenger car radar market gathered pace from 2017, with shipments approaching 2.32 million units in the year, an annualized spurt of 104.6%. The growth trend continued in the first half of 2018 but slowed markedly in the second half due to a decline in automobile sales, leading to a much lower full-year growth in shipments. In 2018, the shipments of passenger car radars reached 3.58 million units in China, up by 54% versus 2017.

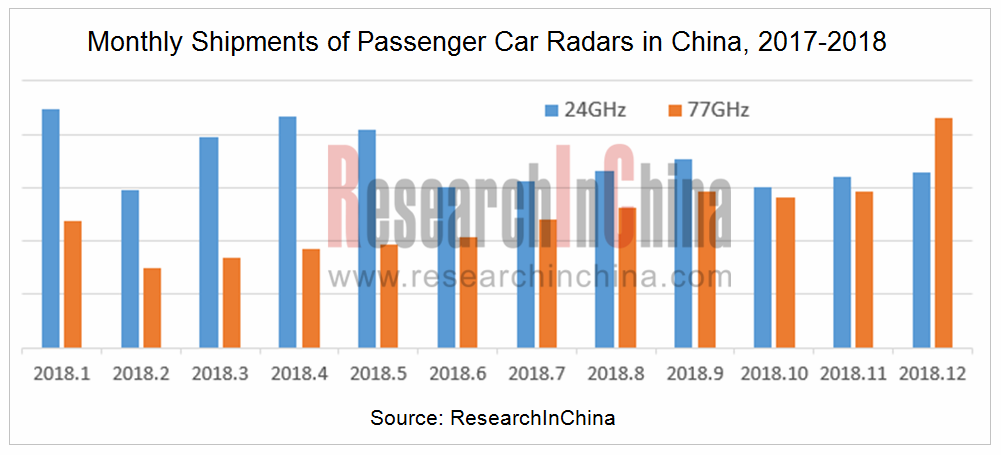

According to our monthly study of radar, 77GHz radar was narrowing its shipment gap with 24GHz radar in recent years, and came from behind at last in December 2018, two years earlier than we expected.

It also comes as a surprise that Chinese radar chip vendors have sprung up. Main players include Xiamen IMSEMI Technology Co., Ltd., Radaric (Beijing) Technology Co., Ltd., SGR Semiconductors Inc., Calterah Semiconductor Technology (Shanghai) Co., Ltd., Nanjing Citta Microelectronics Co., Ltd. and Hangzhou Andar Technology Co., Ltd.

In 2017, Calterah Semiconductor Technology (Shanghai) Co., Ltd. released Yosemite (2T4R/4T8R), a 77GHz transceiver chip series for CMOS-based automotive radars; in 2018 Xiamen IMSEMI Technology Co., Ltd. rolled out SG24TR12, a 24GHz 1T2R chip and SG24TR14, a 24GHz 1T4R chip.

Radaric (Beijing) Technology Co., Ltd. founded in 2010 with the background of Tsinghua University, designed a CMOS-based 77GHz multi-channel monolithic integrated radar chip. SGR Semiconductors Inc., the successor of RFIC Division under Shanghai Industrial μTechnology Research Institute (SITRI), closed series A funding of RMB80 million in 2017 and finished capital increase in the A-round in 2018.

In February 2019 Hangzhou Andar Technology Co., Ltd. unveiled ADT2001, a phased array architecture-based 16T16R 77GHz radar chip with CMOS process and ADT1002, a 2T2R radar chip.

Though there are radar chip start-ups in China, they commit themselves to the development of RF transceiver modules. Their transceiver units play a small role in the whole radar system and cost not much. China-made radar chips are still not provided with the core function of algorithms about processing radar signals.

Foreign chip leaders are heading towards integration and high precision. In June 2018, Texas Instruments (TI) announced mass production of AWR1642, a highly integrated ultra-wideband radar sensor boasting remarkable technical superiorities as it integrates microcontroller (MCU) and digital signal processor (DSP). Many a start-up uses AWR1642 to develop “4D radar” (4D=3D position + 1D speed).

High resolution imaging, 79Ghz and CMOS hold the new trends for radars.

CMOS-based chip ecosystem has yet to be built even if a radar with CMOS process will be a typical one in the future. Chinese radar start-ups face challenges of immature technology and unverified products in spite of a large number. For automotive industry with a high demanding on mature and reliable technologies, the long-used silicon germanium process still prevails, so the giants like Bosch, Continental, Aptiv, Denso and Veoneer still rule the roost. In 2018, the top three players in China’s passenger car 77G long-range radar (LRR) OEM market seized a combined 80% share.

In 2018, new radar entrants in China grew up fleetly by resorting to the strategy of “encircling the cities from the rural areas”.

Wuhu Sensortech Intelligent Technology Co., Ltd. was invested by security giant Hikvision and affiliates of BAIC and GAC, with team members growing to over 300 persons. In 2018, Sensortech shipped more than 100,000 radars, generating the revenue of nearly RMB100 million. Security and transportation were main markets using around 70% of Sensortech’s radars.

Quite a few start-ups in China apply the business model: polishing products in other markets whilst forging ahead in automotive market. Sensortech’s radars will be available to 10 models in 2019 after being used in two mass-produced passenger car models in 2018. Sensortech targets to earn RMB200 million in 2019, including 40% from automotive business.

Sensortech also plans to expand its team members to 1,000 in the next two years from the current 300 with the help of Hikvision.

Suzhou Millimeter-wave Technology Co., Ltd. saw shipments of 2,000 sets of 24Ghz automotive radars in OEM market in 2018 before expectedly shipping 50,000 sets for passenger cars in 2019 as it becomes a designated supplier of two automakers for five of their models.

In August 2018, Shenzhen Anngic Technology Co., Ltd. announced the closing of RMB50 million series A rounds. Its products get utilized in automobiles, drones, security, transportation, etc..

The trend for high precision forces not only Chinese radar start-ups but time-honored brands to have stronger competence in radar signal processing algorithms. For instance, Analog Devices, Inc. (ADI), a 15-year-old company managed in March 2018 to acquire Germany-based Symeo whose RF and sensor technologies enable real-time position detection and distance measurement. ADI will leverage Symeo’s signal processing algorithms to offer customers a radar platform with significant improvements in angular accuracy and resolution.

Vision-radar Fusion Solutions

It grows a trend that vision and radar get fused safer and more reliable ADAS capabilities. Take Volvo S90 city safety system as an example. The Aptiv RACam system for it combines a 77GHz radar and a monocular camera mounted at the top of the windshield to deliver such functions as FCW, AEB and ACC.

Suzhou Millimeter-wave Technology Co., Ltd. is creating a radar and camera all-in-one. With pre-fusion technology for pixel-level fusion of two sensors, the device becomes much more aware of surroundings and robust in object recognition.

Sensortech and Hikvision team up to develop pixel-level radar and vision fusion technologies.

ADAS and Autonomous Driving Industry Chain Report, 2018-2019 of ResearchInChina covers following 17 reports:

1)Global Autonomous Driving Simulation and Virtual Test Industry Chain Report, 2018-2019

2)China Car Timeshare Rental and Autonomous Driving Report, 2018-2019

3)Report on Emerging Automakers in China, 2018-2019

4)Global and China HD Map Industry Report, 2018-2019

5)Global and China Automotive Domain Control Unit (DCU) Industry Report, 2018-2019

6)Global and China Automated Parking and Autonomous Parking Industry Report, 2018-2019

7)Cooperative Vehicle Infrastructure System (CVIS) and Vehicle to Everything (V2X) Industry Report, 2018-2019

8)Autonomous Driving High-precision Positioning Industry Report, 2018-2019

9)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Processor

10)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Lidar

11)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Radar

12)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Automotive Vision

13)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Passenger Car Makers

14)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– System Integrators

15)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Commercial Vehicle Automated Driving

16)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– Low-speed Autonomous Vehicle

17)ADAS and Autonomous Driving Industry Chain Report, 2018-2019– L4 Autonomous Driving

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...