OEM ADAS and Autonomous Driving Strategy Research: At least Billions of Dollars and Thousands of Software Engineers are Required.

The new trends “electrification, networking, intelligence and sharing” led by autonomous driving are disrupting the traditional automotive industry.

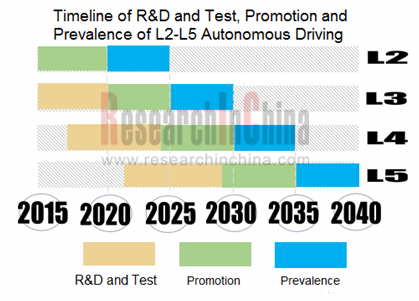

Yet, barriers to L4 and above autonomous driving are so high that no one can image. WAYMO that has spent over a decade and billions of dollars on the technology, has slowed its pace of commercialization even if being far ahead of its rivals, and has admitted that the fully automated driving will take time. As Waymo CEO John Krafcik said in late 2018, though driverless cars are “truly here”, they aren’t ubiquitous yet and autonomy always will have some constraints for decades to come.

Source: ResearchInChina

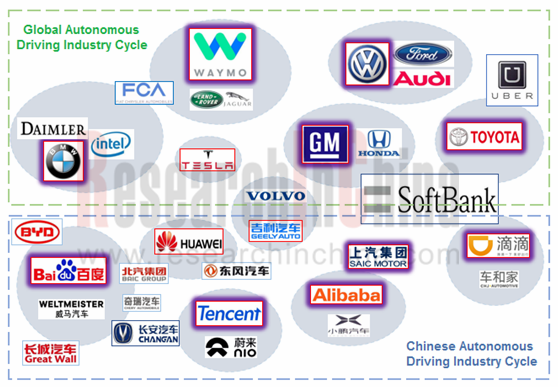

This means that autonomous driving costs too much and those who shell out for it will face long-term loss. To cope with the challenges posed by Waymo, traditional OEMs are forming alliances. Examples include the partnership among Daimler, BMW and Intel (Mobileye) and the collaborations between GM and Honda, VW and Ford.

Source: ResearchInChina

Typical leagues in China embrace Baidu + Weltmeister, Alibaba + Xpeng Motors and Didi + CHE Automotive. Traditional Chinese automakers prefer not to partner with only one or two of the four IT giants (Baidu, Alibaba, Tencnet and Huawei) but keep an open cooperative relationship with all of them. SAIC is striving to foster its own ecosystem by investing many start-ups.

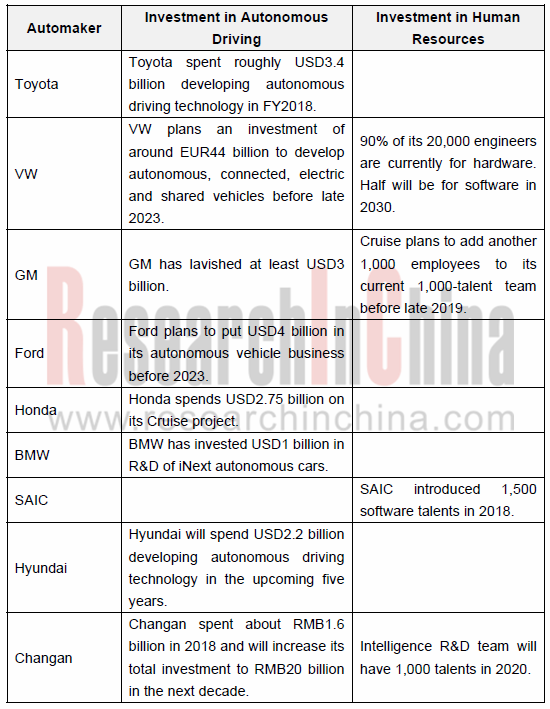

Besides the way of cooperation for complementing with each other and apportioning research and development and operation expenses, OEMs are also racing to invest more in recruiting software engineers.

“Software will account for 90 percent of future innovations in the car. Today, our 20,000 developers are 90 percent hardware-oriented. That will change radically by 2030. Software will account for half of our development costs”, says Herbert Diess, CEO of Volkswagen, which means VW’s software engineers will be 10,000 or so.

American tech firms make enormous investments in autonomous driving as well. Apple autonomous car team claims 5,000 people, and Uber possesses about 1,500.

Autonomous driving market has been an arena for big names, and other small and medium players have to take sides.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...