China Independent Clinical Laboratory Industry Report, 2019-2025

-

Apr.2019

- Hard Copy

- USD

$3,200

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC077

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

China's independent clinical laboratory industry is still in its infancy. In 2018, it only saw the penetration rate of about 5%, far below 40% or more in Europe, the United States and Japan. The main reason is that the laboratory and pathology departments of public hospitals occupy the leading position in the industry in China.

In China, large independent clinical laboratories can provide more than 2,000 test items, while first-class AAA hospitals can only offer over 300-500 test items. With the acceleration of population aging, higher incidence of various chronic diseases and favorable policies, the penetration rate and scale of China's independent clinical laboratory industry will increase year by year.

China's independent clinical laboratory market size presented the CAGR of 40.9% during 2010-2018, and approximated RMB18.6 billion in 2018, a year-on-year increase of 37.8%. By 2025, it is expected to reach RMB96.7 billion with the growth rate of above 20%.

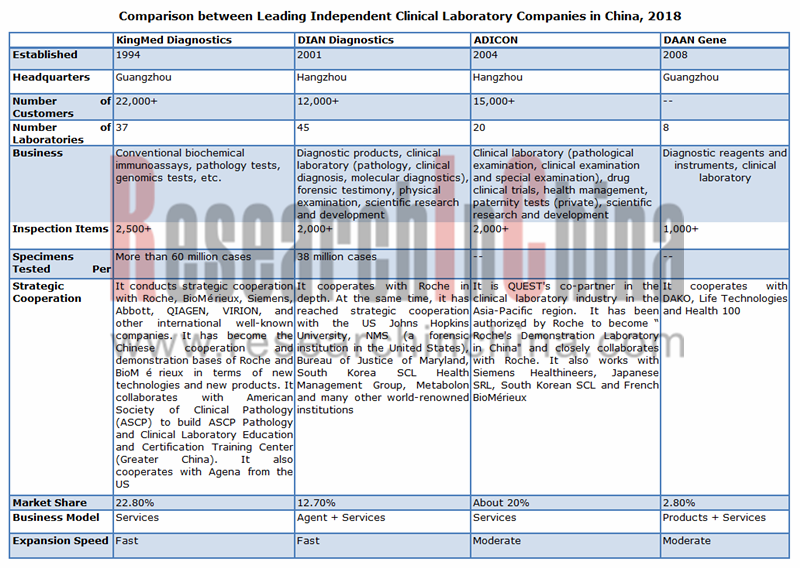

As of September 2018, there had been 1,271 independent clinical laboratories in China, indicating gradually intensified competition in the industry. At present, major players in China include KingMed Diagnostics, ADICON, DIAN Diagnostics, DAAN Gene, MedicalSystem Biotechnology and so forth. Particularly, KingMed Diagnostics is the industry’s leader with a 22.8% market share in 2018.

As the competition intensifies, the market share of the giant KingMed Diagnostics has reduced from 32.9% in 2014 to 22.8% in 2018. In the future, small ICL companies without competitive advantages are likely to be phased out and the industry will be more concentrated.

China Independent Clinical Laboratory Industry Report, 2019-2025 highlights the following:

Overview of China’s independent clinical laboratory industry, covering development environment, status quo, market size, competitive landscape and development trend;

Overview of China’s independent clinical laboratory industry, covering development environment, status quo, market size, competitive landscape and development trend;

Upstream and downstream sectors of China’s independent clinical laboratory industry;

Upstream and downstream sectors of China’s independent clinical laboratory industry;

Operation, gross margin, R&D investment, independent clinical laboratory business and development strategy of 21 companies in China.

Operation, gross margin, R&D investment, independent clinical laboratory business and development strategy of 21 companies in China.

1. Overview of Independent Clinical Laboratory

1.1 Definition

1.2 Industry Chain

2. Overview of China Independent Clinical Laboratory Industry

2.1 Policy Environment

2.1.1 Access Policy

2.1.2 Industry Policy

2.2 International Environment

2.2.1 Status Quo

2.2.2 Benchmarking Enterprises

2.3 Status Quo

2.4 Market size

2.5 Competitive Landscape

2.6 Development Trends

2.6.1 Industry Scale Expands Constantly

2.6.2 Hierarchical Medical System Will Boost the Rapid Development of the Industry

2.6.3 The Laboratory Outsourcing Proportion of Public Hospitals Will Rise due to Cost Control

2.6.4 High-end Test Items Will Make More Revenue Contribution

2.6.5 The Rapid Development of Private Hospitals Will Stimulate the Demand in the Independent Clinical Laboratory Market

2.6.6 Independent Clinical Laboratory Institutions Will Become Technical Leaders amid Quick Technological Upgrades

2.6.7 The Aging Population Balloons and the Demand for Medical Laboratory Will Soar

2.6.8 Internet Will Stimulate the Business Model Upgrade of Independent Clinical Laboratory Industry

2.6.9 Intensified industry competition Forced Small Capacity to Withdraw

3. Upstream and Downstream Sectors of China Independent Clinical Laboratory Industry

3.1 Upstream Sector

3.1.1 Status Quo

3.1.2 Market Size

3.1.3 Competitive Landscape

3.1.4 Development Trend

3.2 Downstream Sector

3.2.1 Quantity

3.2.2 Medical Services

3.2.3 Revenue

3.2.4 Health Costs

4. Key Players

4.1 KingMed Diagnostics

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Gross Margin

4.1.5 R&D and Investment

4.1.6 Major Customers

4.1.7 Independent Clinical Laboratory Business

4.1.8 Development Strategy

4.2 DIAN Diagnostics

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Gross Margin

4.2.5 R&D and Investment

4.2.6 Independent Clinical Laboratory Business

4.2.7 Development Strategy

4.3 Shanghai Labway Clinical Laboratory

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Gross Margin

4.3.5 R&D and Investment

4.3.6 Independent Clinical Laboratory Business

4.4 DAAN Gene

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 R&D and Investment

4.4.5 Major Customers

4.4.6 Independent Clinical Laboratory Business

4.4.7 Development Strategy

4.5 ADICON Clinical Laboratories

4.5.1 Profile

4.5.2 Independent Clinical Laboratory Business

4.5.3 Developments

4.6 NYMPHAVN Biotechnology

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 Gross Margin

4.6.5 R&D and Investment

4.6.6 Independent Clinical Laboratory Business

4.6.7 Development Strategy

4.7 SurExam Biotechnology

4.7.1 Profile

4.7.2 Operation

4.7.3 Revenue Structure

4.7.4 Gross Margin

4.7.5 Independent Clinical Laboratory Business

4.8 MedicalSystem Biotechnology

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.4 Gross Margin

4.8.5 R&D and Investment

4.8.6 Independent Clinical Laboratory Business

4.8.7 Development Strategy

4.9 Beijing Lawke Health Laboratory

4.9.1 Profile

4.9.2 Operation

4.9.3 Revenue Structure

4.9.4 Gross Margin

4.9.5 R&D and Investment

4.10 Beijing Lepu Gene Technology

4.10.1 Profile

4.10.2 Operation

4.10.3 Revenue Structure

4.10.4 Gross Margin

4.10.5 R&D and Investment

4.10.6 Major Customers

4.11 Shanghai Biotecan Pharmaceuticals

4.11.1 Profile

4.11.2 Operation

4.11.3 Revenue Structure

4.11.4 Gross Margin

4.11.5 Independent Clinical Laboratory Business

4.12 Jiangsu Superbio Life Science

4.12.1 Profile

4.12.2 Operation

4.12.3 Revenue Structure

4.12.4 Gross Margin

4.12.5 Financing

4.13 Amoy Diagnostics

4.13.1 Profile

4.13.2 Operation

4.13.3 Revenue Structure

4.13.4 Gross Margin

4.13.5 Independent Clinical Laboratory Business

4.13.6 Development Strategy

4.14 Guangdong Hybribio Biotech

4.14.1 Profile

4.14.2 Operation

4.14.3 Revenue Structure

4.14.4 Gross Margin

4.14.5 R&D

4.14.6 Independent Clinical Laboratory Business

4.14.7 Development Strategy

4.15 Other Enterprises

4.15.1 Kindstar Global

4.15.2 CapitalBio Corporation

4.15.3 Beijing Adinovo Gene Technology Co., Ltd.

4.15.4 Deyi Diagnostics

4.15.5 IPE Center for Clinical Laboratory

4.15.6 Centre Testing International Group Co., Ltd. (CTI)

4.15.7 SinoPath Diagnosis

Independent Clinical Laboratory Industry Chain

Comparison of Independent Clinical Laboratory Undertakers between China and USA

Policies Concerning Independent Clinical Laboratory Industry in China, 2010-2018

Development History of U.S. Independent Clinical Laboratory Industry

U.S. Independent Clinical Laboratory Market Share by Test Item

U.S. Clinical Laboratory Market Share by Demand Side

Comparison of Independent Clinical Laboratory Market Penetration among Europe, Americas and Japan, 2018

Revenue and Net Income of Quest Diagnostics, 2009-2018

Revenue of Quest Diagnostics by Business, 2014-2018

Major M&As of Quest Diagnostics, 2006-2018

Revenue and Operating Income of LabCorp, 2010-2018

Revenue Breakdown of LabCorp by Division, 2013-2018

Revenue Structure of LabCorp by Division, 2013-2018

Major M&As of LabCorp, 2007-2017

Comparison of Independent Clinical Laboratory Market Penetration between China, and Europe, Americas and Japan, 2018

Comparison of Number of Diagnostic Items among Various Medical Institutions

Independent Clinical Laboratory Market Size in China, 2010-2018

Number of Independent Clinical Laboratories in China, 2007-2018

Independent Clinical Laboratory Revenue of Main Independent Clinical Laboratory Enterprises in China, 2014-2018

Marker Share of Independent Clinical Laboratory Enterprises in China, 2018

Independent Clinical Laboratory Market Size and YoY Growth in China, 2018-2025E

Policies Concerning Public Hospital Reform in China, 2015-2019

Number of Private Hospitals and YoY Growth in China, 2009-2018

Clinic Visits of Private Hospitals in China, 2012-2018

Population Aged over 60 in China, 2009-2018

Market Share of KingMed Diagnostics, 2014-2018

Classification of In Vitro Diagnosis

Development History of In Vitro Diagnostic Industry in China

In Vitro Diagnosis Market Size in China, 2009-2018

In Vitro Diagnosis Market Size in China, 2018-2025E

In Vitro Diagnosis Market Structure in China, 2018

Comparison of Diagnostic Instrument Varieties between Domestic and Foreign Enterprises

Competition Pattern of Diagnostic Reagent Industry in China

IVD Revenue of Major Diagnostic Reagent Enterprises in China, 2014-2018

IVD Market Share of Major Diagnostic Reagent Enterprises in China, 2014-2018

Population Aged over 60 in China, 2009-2018

Policies Concerning In Vitro Diagnosis in China

Comparison of Prospects between In Vitro Diagnosis Segments in China

Number of Medical and Health Institutions in China, 2015-2018

Number of Hospitals in China, 2009-2018

Number of Hospitals in China by Economic Type, 2009-2018

Clinic Visits of Medical Institutions in China, 2015-2018

Clinic Visits of Hospitals in China, 2009-2018

Clinic Visits of Hospitals in China by Economic Type, 2012-2018

Total Revenue of Medical and Health Institutions in China, 2010-2018

Total Revenue of Medical and Health Institutions in China, 2018-2025E

Total Revenue of Hospitals in China, 2009-2018

Public Hospitals’ Inspection Revenue and % of Total Inspection Revenue in China, 2010-2018

Total Health Expenditure in China, 2010-2018

Revenue and Net Income of KingMed Diagnostics, 2014-2018

Revenue Breakdown of KingMed Diagnostics by Product, 2014-2018

Revenue Breakdown of KingMed Diagnostics by Region, 2014-2018

Gross Margin of KingMed Diagnostics by Product, 2014-2018

KingMed Diagnostics’ R&D Costs and % of Total Revenue, 2014-2018

KingMed Diagnostics’ Revenue from Top5 Clients and % of Total Revenue, 2014-2018

Independent Clinical Laboratory Subsidiaries of KingMed Diagnostics

Operating Results of Main Companies KingMed Diagnostics Controls or Has a Stake in, 2017-2018 (Unit: RMB mln)

Output, Capacity and Capacity Utilization of KingMed Diagnostics, 2014-2016

Unit Prices of Main Services of KingMed Diagnostics, 2014-2016

Revenue and Net Income of DIAN Diagnostics, 2013-2018

Revenue Breakdown of DIAN Diagnostics by Product, 2013-2018

Revenue Breakdown of DIAN Diagnostics by Region, 2013-2018

Gross Margin of DIAN Diagnostics by Business, 2013-2018

DIAN Diagnostics’ R&D Costs and % of Total Revenue, 2013-2018

DIAN Diagnostics’ Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2018

Independent Clinical Laboratory Subsidiaries of DIAN Diagnostics

Regional Layout of Shanghai Labway Clinical Laboratory

Revenue and Net Income of Shanghai Labway Clinical Laboratory, 2013-2017

Operating Revenue Breakdown of Shanghai Labway Clinical Laboratory by Business, 2013-2017

Gross Margin of Shanghai Labway Clinical Laboratory by Business, 2013-2016

Shanghai Labway Clinical Laboratory’s R&D Costs and % of Total Revenue, 2013-2017

Independent Clinical Laboratory Subsidiaries of Shanghai Labway Clinical Laboratory

Main Diagnostic Items of Shanghai Labway Clinical Laboratory

Shanghai Labway Clinical Laboratory’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2017

Revenue and Net Income of DAAN Gene, 2013-2018

Revenue Breakdown of DAAN Gene by Product, 2013-2018

Revenue Breakdown of DAAN Gene by Region, 2013-2018

DAAN Gene’s R&D Costs and % of Total Revenue, 2013-2018

DAAN Gene’s Revenue from Top 5 Clients and % in Total Revenue, 2015-2018

DAAN Gene’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2018

Independent Clinical Laboratory Subsidiaries of DAAN Gene

Development Course of ADICON Clinical Laboratories

Revenue and Net Income of Nymphavn Biotechnology, 2013-2018

Revenue Breakdown of Nymphavn Biotechnology by Business, 2014-2018

Gross Margin of Nymphavn Biotechnology, 2013-2018

Nymphavn Biotechnology’s R&D Costs and % of Total Revenue, 2013-2018

Nymphavn Biotechnology’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2018

Subsidiaries and Main Businesses of Surexam Biotechnology

Revenue and Net Income of SurExam Biotechnology, 2013-2018

Operating Revenue Breakdown of SurExam Biotechnology by Business, 2013-2018

Gross Margin of SurExam Biotechnology, 2013-2018

SurExam Biotechnology’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2017

Revenue and Net Income of Medicalsystem Biotechnology, 2013-2018

Revenue Breakdown of Medicalsystem Biotechnology by Business, 2013-2018

Gross Margin of Medicalsystem Biotechnology by Business, 2013-2018

Medicalsystem Biotechnology’s R&D Costs and % of Total Revenue, 2013-2018

Investment Progress of Fundraising Projects of Medicalsystem Biotechnology by the end of 2018

Medicalsystem Biotechnology’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2013-2018

Financial Data of Main Independent Clinical Laboratory Subsidiaries of Medicalsystem Biotechnology, 2016-2018

Newly-established Independent Clinical Laboratory Subsidiaries of Medicalsystem Biotechnology, 2016-2018

Revenue and Net Income of Beijing Lawke Health Laboratory, 2013-2017

Revenue Breakdown of Beijing Lawke Health Laboratory by Region, 2014-2017

Gross Margin of Beijing Lawke Health Laboratory, 2013-2017

Beijing Lawke Health Laboratory’s R&D Costs and % of Total Revenue, 2013-2017

Revenue and Net Income of Beijing Lepu Gene Technology, 2013-2018

Revenue Breakdown of Beijing Lepu Gene Technology by Business, 2014-2018

Gross Margin of Beijing Lepu Gene Technology, 2013-2018

Beijing Lepu Gene Technology’s R&D Costs and % of Total Revenue, 2014-2018

Beijing Lepu Gene Technology’s Revenue from Top 5 Clients and % in Total Revenue, 2015-2018

Revenue and Net Income of Shanghai Biotecan Pharmaceuticals, 2013-2017

Revenue Breakdown of Shanghai Biotecan Pharmaceuticals by Business, 2014-2017

Gross Margin of Shanghai Biotecan Pharmaceuticals, 2013-2017

Shanghai Biotecan Pharmaceuticals’ Revenue from Independent Clinical Laboratory and % of Total Revenue, 2014-2017

Subsidiaries of Jiangsu Superbio Life Science as of Apr 2019

Revenue and Net Income of Jiangsu Superbio Life Science, 2014-2017s

Revenue Breakdown of Jiangsu Superbio Life Science by Business, 2014-2017

Gross Margin of Jiangsu Superbio Life Science, 2014-2017

Revenue and Net Income of Amoy Diagnostics, 2014-2018

Operating Revenue Breakdown of Amoy Diagnostics by Business, 2014-2018

Gross Margin of Amoy Diagnostics, 2014-2018

Gross Margin of Amoy Diagnostics by Business, 2014-2018

Clinical Laboratory Testing Service Process of Amoy Diagnostics

Main Bioassay Service Partners of Amoy Diagnostics

Amoy Diagnostics’ Revenue from Independent Clinical Laboratory and % of Total Revenue, 2014-2018

Revenue and Net Income of Guangdong Hybribio Biotech, 2014-2018

Operating Revenue Breakdown of Guangdong Hybribio Biotech by Product, 2014-2018

Gross Margin of Guangdong Hybribio Biotech by Business, 2014-2018

Guangdong Hybribio Biotech’s R&D Costs and % of Total Revenue, 2017-2018

Progress of Committed Fundraising Projects of Guangdong Hybribio Biotech by the end of 2018

Guangdong Hybribio Biotech’s Revenue from Independent Clinical Laboratory and % of Total Revenue, 2014-2018

Milestones of Kindstar Global

Some Strategic Partners of ADINOVO