Automotive Head-up Display (HUD) Industry Report: Installation of OEM HUD for Passenger Cars Soared by 94.1% Year on Year in China in 2018

In 2018, 308,900 units of OEM HUDs were installed in passenger cars in China, a 94.1% upsurge from a year earlier, according to our recent report -- Automotive HUD Industry Report, 2018-2019.

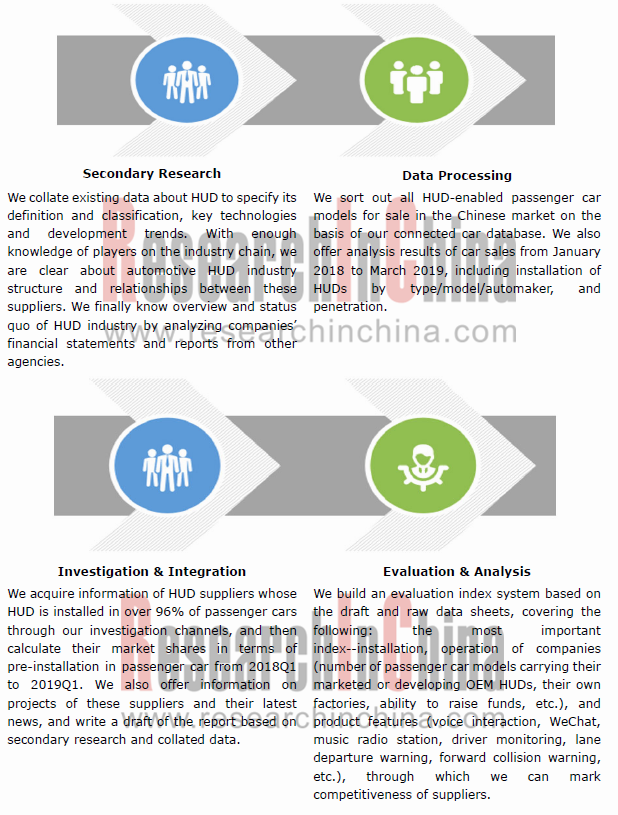

We worked out 2019Q1 lists of passenger car HUD supplier ranking by competitiveness with efforts from secondary research, data processing, and investigation & integration to evaluation & analysis. Denso came to the top spot among all suppliers and CarRobot ranked first among Chinese suppliers.

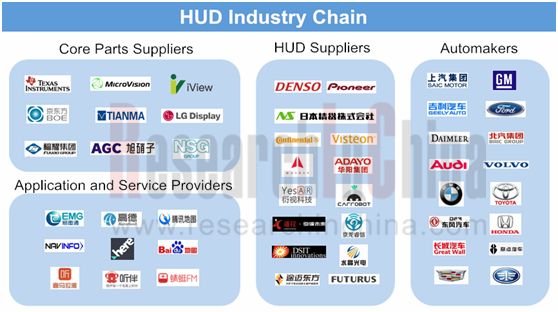

HUD was in vogue from 2014 to 2015. NAVDY that was a typical supplier then, however, doesn’t appear on our latest HUD industry chain.

NAVDY followed a digital light processing (DLP) technology roadmap, but DLP HUD had some drawbacks like complicated design and high cost. In TI’s case, its first-generation DLP chip only worked at temperatures of -40-85℃, short of automotive standards. Navdy raised USD42 million from Qualcomm and several other venture capital firms. Navdy HUD which should have been launched in the first quarter of 2015 came out just in recent two years. In October 2016, the product was put on sale, but its price surged to USD799 from the pre-sale price of USD299. In 2018, NAVDY had to go into liquidation after its failure in aftermarket.

Many a HUD start-up applied Navdy’s technology between 2016 and 2017. Using DLP as display system only left them a range of technology bottlenecks and often deferred launch of products. Most of them then turned to thin film transistor (TFT) display technology. Examples include CarRobot who designed its first-generation HUD with DLP technology but changed to TFT for its second-generation products.

In 2018, TI officially rolled out the 2nd-generation automotive chips DLP3030-Q1 and DLP5530-Q1 featuring smaller size and wider field of view and sufficing for AR head-up display (HUD). DLP3030-Q1 sees the digital micromirror device (DMD) footprint reduction by 65%, enabling smaller picture generation unit (PGU) design. It can operate between -40°C and +105°C

Technically, DLP is the best and most mature display technology by far. Therefore, Sunny Optical and other giants are still optimistic about HUD based on DLP technology, and they even spend tens of millions of yuan on introducing free-form surface mirror production lines.

The second HUD craze since 2018 arises from the emergence of AR HUD.

AR HUD, the augmented reality head-up display technology, superimposes some driving information in the driver's field of vision reasonably and combines it with real traffic conditions. Compared with HUD, AR HUD displays a wider range from a farther distance, and it is more complex. HUD is just a device that projects and displays information, while AR HUD needs to be deeply integrated with ADAS to achieve more advanced effects and functions.

Given the deep integration of AR HUD with ADAS, the burgeoning development of ADAS as a must for automotive intelligence has driven the demand for AR HUD.

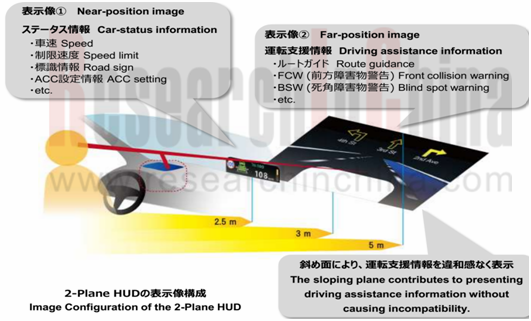

The image display of AR HUD is generally distributed in two or three layers. For instance, the AR-HUD of Nippon Seiki boasts three layers: the near field display layer, the far field display layer, and the side layer. The near field display layer is mainly a presentation of vehicle status, the far field display layer displays ADAS information, and the stereo side layer offers lane or navigation information.

Amid the intelligent connected trend of cars, any automotive electronic product is difficult to be independent. As an automotive electronic product, HUD has been an integral of the cockpit electronics solution and the overall ADAS solution.

Panasonic Automotive showcased its latest SPYDR 2.0 at CES 2019, which is a single-chip cockpit domain controller solution integrating Driver Monitoring System (DMS) with Head-Up Display (HUD). Besides, SPYDR 2.0 can integrate In-Vehicle Infotainment (IVI), dashboard, surround view system, Active Noise Control (ANC), HUD and four IVI displays on a platform

For this integration trend, traditional Tier1 giants enjoy first-mover advantages, whereas independent HUD suppliers have to establish close cooperation with other product suppliers. The collaboration modes -- Jiang Cheng + Baidu, Carrobot + China Unicom, Carrobot + AI Speech, etc. just follow the integration trend.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...