ADAS and Autonomous Driving Tier 1 Suppliers Report, 2018-2019

-

May 2019

- Hard Copy

- USD

$3,200

-

- Pages:145

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

LY006

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

ADAS and Autonomous Driving Tier 1 Suppliers Report, 2018-2019: Huge Investment, Increasing Orders, and Soaring Labor Cost

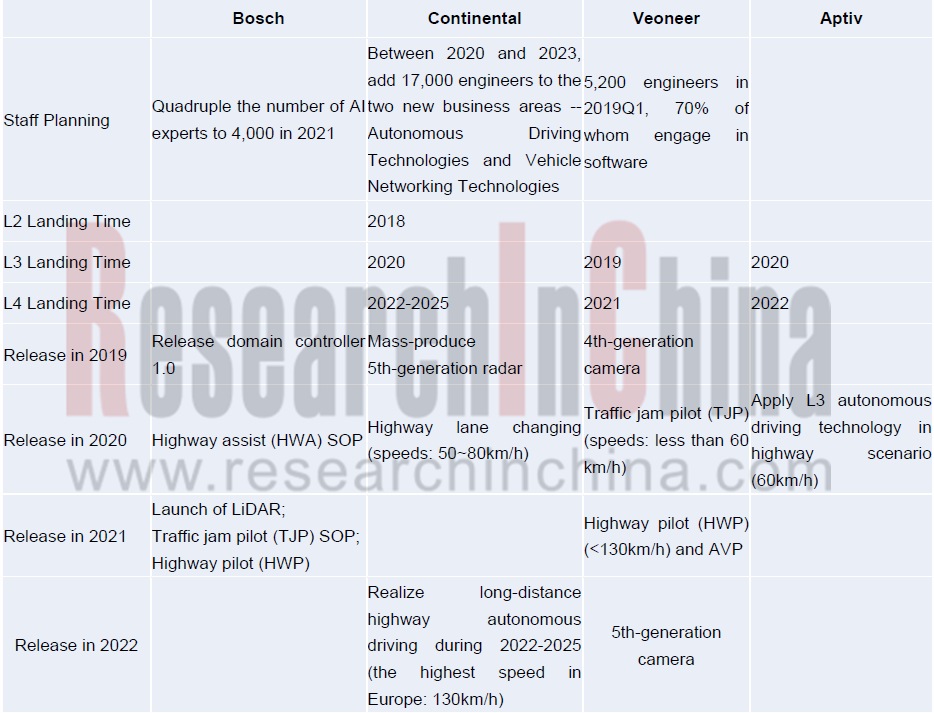

From the progress of the world’s main Tier1 suppliers in autonomous driving, it can be seen that the giants like Bosch and Continental are moving forward at their own pace in line with their timetable.

Traditional Tier1 suppliers are sparing no efforts in enlarging talent teams (especially software), developing ADAS/AD domain controllers, acquiring sensor firms and self-development, testing autonomous driving technology in various scenarios (industrial park, highway, parking, etc.), expanding autonomous fleets for road test, building test fields on their own or together with others, establishing operation and data management centers, and allying themselves with more partners.

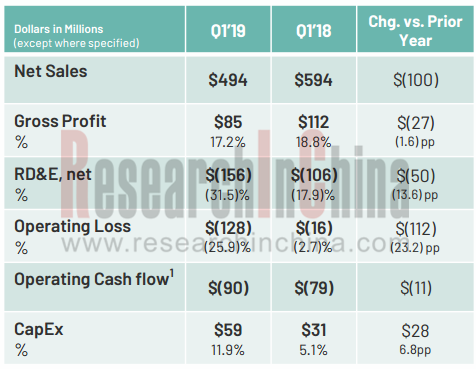

Tier1 suppliers suffer a slump in profits and even a bigger loss because of huge investment in autonomous driving, but there is good news that orders are increasing.

Veoneer’s operating loss for 2019Q1 jumped to USD128 million compared with USD16 million in 2018Q1; its R&D expenses rose to USD156 million from USD106 million in 2018Q1; capital expenditure surged from USD31 million to USD59 million largely for camera capacity expansion, according to Veoneer’s 2019Q1 financial results in the table above.

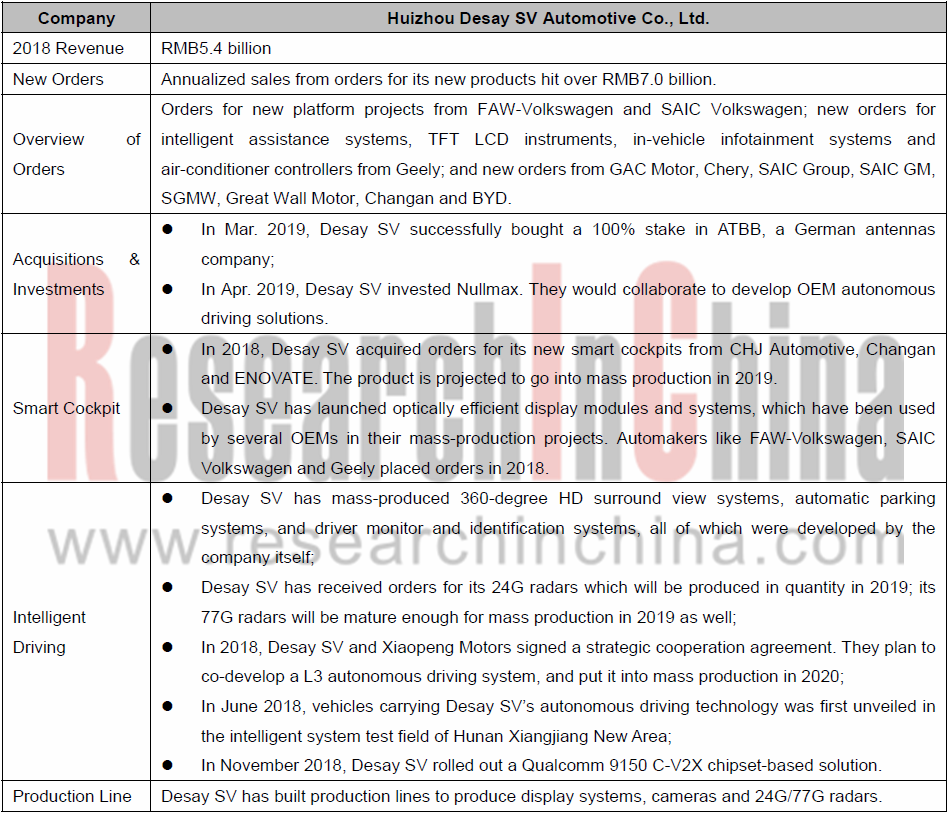

Among Chinese Tier1 suppliers, Huizhou Desay SV Automotive Co., Ltd., a leading player in ADAS and autonomous driving field, also sees its profit decline. The supplier’s operating results for 2019Q1 indicate that its net income attributable to the shareholders of the listed company stood at RMB43.54 million, a 72.82% plunge on an annualized basis, which was caused by a nosedive in China’s 2019Q1 automobile sales and the company’s huge investment in research and development of new technologies. In 2018, the company reported RMB5.4 billion in revenue, with annualized sales from orders for its new products outnumbering RMB7.0 billion.

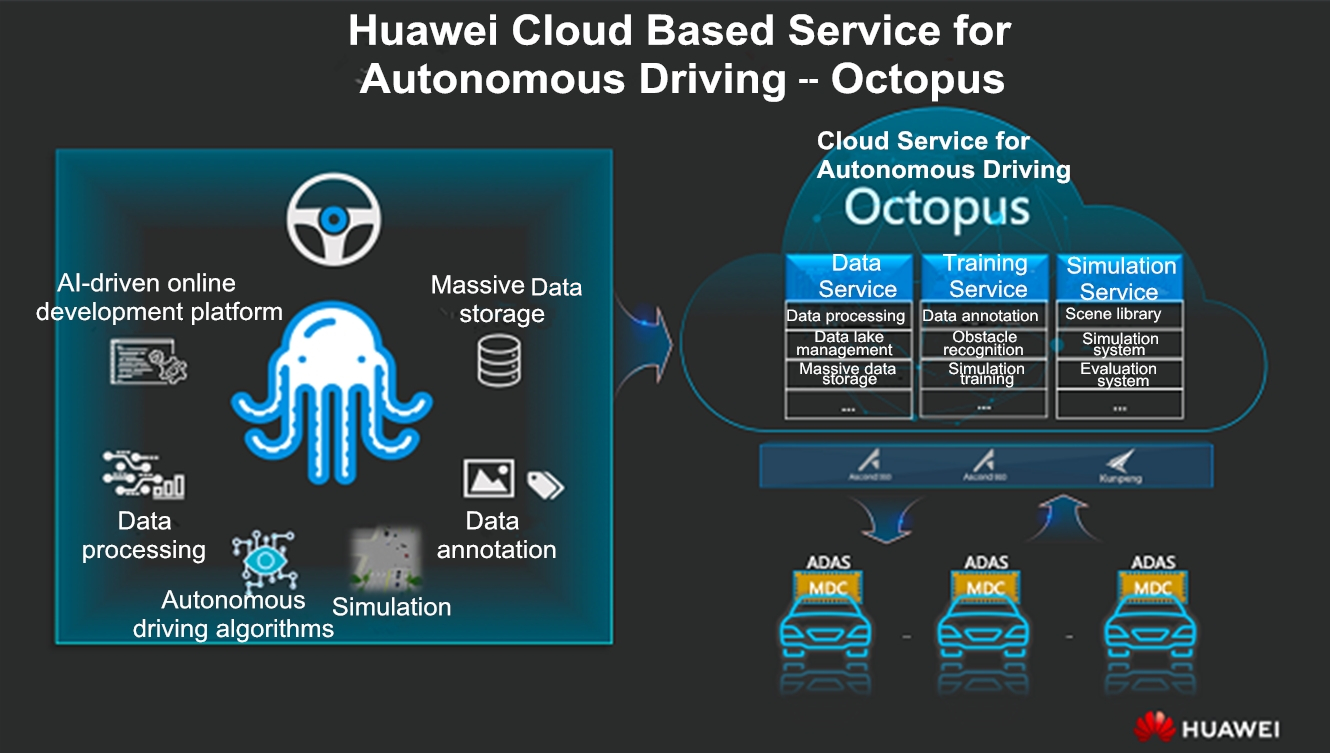

In April 2019, Huawei made its debut as a Tier1 supplier at Auto Shanghai, and exhibited solutions such as MDC, intelligent connectivity, Huawei Cloud (Octopus) and three types of sensors.

Huawei’s entry will intensify the already fierce competition among Tier1 suppliers of ADAS and autonomous driving solutions.

1 Comparative Analysis of Main ADAS and Autonomous Driving Tier1 Suppliers

1.1 Autonomous Driving System Is Divided into Three Levels

1.2 Autonomous Driving Planning, Commercialization Process and Development Features of Foreign Tier1 Suppliers

1.3 Product Layout of Foreign Tier1 Suppliers

1.4 Comparison of Foreign Tier1 Suppliers (including Revenue, Profit, Orders, Partners and Investment)

1.5 Planning Comparison of Foreign Tier1 Suppliers (including Personnel Planning, Launch Time of L2-L4, Products to Be Launched in 2019-2022)

1.6 Vision Product Investment Comparison of Foreign Tier1 Suppliers (Monocular, Stereo, etc.)

1.7 Radar Investment Comparison of Foreign Tier1 Suppliers (Millimeter Wave Radar, LiDAR, Ultrasonic Radar)

1.8 Other Technology Investment Comparison of Foreign Tier1 Suppliers (V2X, HD Map, High-precision Positioning, Domain Controller)

1.9 Autonomous Driving Application Scenario R&D Comparison of Main Tier1 Suppliers (Minibus, City, Highway, Parking)

1.10 Autonomous Driving Test and Operation Comparison of Main Tier1 Suppliers (Test Field, Test Vehicle, Base, etc.)

1.11 Development Layout Comparison of Chinese Tier1 Suppliers

2 Tier1 Suppliers of ADAS and Autonomous Driving Solutions Worldwide

2.1 Bosch

2.1.1 Profile

2.1.2 Autonomous Driving Sensor

2.1.3 Autonomous Driving Positioning Solution

2.1.4 Decision: Domain Controller

2.1.5 Autonomous Driving Product Layout

2.1.6 Autonomous Shuttle

2.1.7 Autonomous Driving Partners

2.1.8 ADAS and Autonomous Driving in 2018-2019

2.2 Continental

2.2.1 Profile

2.2.2 Performance

2.2.3 Organizational Restructuring Will Be Completed by 2020

2.2.4 Sensors

2.2.5 Autonomous Driving Development Plan

2.2.6 Three Integrated Solutions for Autonomous Driving

2.2.7 CuBE and Seamless Driving & Delivery

2.2.8 Autonomous Driving Layout and Partners

2.2.9 Autonomous Driving Layout in 2018-2019

2.3 Aptiv

2.3.1 Profile

2.3.2 Revenue and Orders

2.3.3 Strategic Positioning

2.3.4 Multi-domain Controller

2.3.5 ADAS Sensor

2.3.6 Autonomous Driving Route

2.3.7 Autonomous Driving Solution CSLP

2.3.8 L4 Test Autonomous Vehicle

2.3.9 Cooperation with Lyft in Autonomous Driving

2.3.10 Expedited Layout in Autonomous Driving Industry Chain through Investments, Acquisitions and Collaborations

2.3.11 Autonomous Driving Layout in 2018-2019

2.4 Valeo

2.4.1 Profile

2.4.2 Sensor Product Layout

2.4.3 Sensing Solution

2.4.4 Three Autonomous Driving Systems and Technology Roadmaps

2.4.5 Cruise4U (Highway)

2.4.6 Drive4U (Urban Road)

2.4.7 Automated Parking System Park4U

2.4.8 Autonomous Driving Partners

2.4.9 Autonomous Driving Dynamics in 2018-2019

2.5 ZF

2.5.1 Profile

2.5.2 Product Layout

2.5.3 ZF Sensors

2.5.4 ProAI

2.5.5 Autonomous Taxi and IoT Platform

2.5.6 Autonomous Driving Partners

2.5.7 Autonomous Driving Dynamics in 2018-2019

2.6 Hyundai Mobis

2.6.1 Profile

2.6.2 Autonomous Driving Layout

2.6.3 Research Progresses of ADAS and Autonomous Driving

2.6.4 ADAS and Autonomous Driving Dynamics in 2018-2019

2.7 Veoneer

2.7.1 Profile

2.7.2 Development in 2018 and Outlook for 2019

2.7.3 Major Projects and Customers

2.7.4 Product Milestones

2.7.5 Autonomous Driving Layout

2.7.6 Vision Products and Functional Planning

2.7.7 Monocular Vision System

2.7.8 Zeus

2.7.9 Autonomous Driving Solutions

2.7.10 ADAS Partners

2.7.11 Planning for Autonomous Driving Development

2.7.12 ADAS and Autonomous Driving Dynamics in 2018-2019

2.8 Visteon

2.8.1 Profile

2.8.2 Operation (Worldwide) in 2018

2.8.3 Operation (China) in 2018

2.8.4 Positioning in the Autonomous Driving Industry Chain

2.8.5 Major Products

2.8.6 Autonomous Driving Domain Controller DriveCore

2.8.7 DriveCore Computing Platform: Compute

2.8.8 DriveCore Algorithm: Studio

2.8.9 DriveCore Middleware: Runtime

2.8.10 ADAS Development History and Autonomous Driving Roadmap

2.8.11 Three ADAS Segments and Features

2.8.12 L3/L4 Autonomous Driving Test

2.8.13 Autonomous Driving Schedule

2.8.14 Autonomous Driving Partners

2.8.15 Autonomous Driving Dynamics in 2018-2019

2.9 Magna

2.9.1 Vision Products

2.9.2 Visual ADAS

2.9.3 MAX4 Domain Controller

2.9.4 MAX4 for L4 Autonomous Driving

2.9.5 Autonomous Driving Dynamics

2.10 Denso

2.10.1 Revenue

2.10.2 Autonomous Driving Investment and R&D Layout

2.10.3 Millimeter Wave Radar

2.10.4 Denso Ten

2.10.5 ADAS and Autonomous Driving Dynamics

3 Tier 1 Suppliers of Intelligent Connected ADAS and Autonomous Driving Solutions in China

3.1 Baidu

3.1.1 Apollo Platform

3.1.2 Apollo Autonomous Driving Open Roadmap

3.1.3 Apollo Open Platform Progress

3.1.4 Apollo Partners

3.1.5 L4 Passenger Car Solution and Partners

3.1.6 L4 Autonomous Park Car Solution

3.1.7 Open Source of V2X CVIS Solution

3.1.8 Upcoming Commercial Packaged Solution

3.1.9 Autonomous Driving Progress

3.2 Tencent

3.2.1 AD Lab

3.2.2 Autonomous Driving Layout

3.2.3 Autonomous Driving Solution

3.2.4 Autonomous Driving Planning

3.3 Neusoft Reach

3.3.1 Profile

3.3.2 Product Line

3.3.3 ADAS

3.3.4 Autonomous Driving

3.3.5 Cooperation

3.4 Huawei

3.4.1 Intelligent Connected Vehicle Business

3.4.2 L4 Computing Platform

3.4.3 C-V2X Technology

3.4.4 Intelligent Connected Vehicle Partners

3.4.5 Octopus

3.5 Foryou Corporation

3.5.1 Automotive Electronics Business

3.5.2 R&D Planning in 2019

3.6 Desay SV

3.6.1 Profile

3.6.2 Intelligent Vehicle Revenue and R&D Investment

3.6.3 Development of Three Major Businesses

3.6.4 Future Development Strategy

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...