China Commercial Vehicle Finance Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$2,600

-

- Pages:82

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZLC078

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,800

-

Over recent years, auto finance industry in China steadily developed, assisting the uprising of penetration of auto finance constantly, which achieved 43% in 2018, up 3 percentage points versus 2017. Market size of auto finance in China is estimated to be RMB 1.200 trillion in 2018, up 2.6% yr-on-yr.

Commercial vehicle enjoyed stable growth in sales volume over recent years. At present, its sales volume accounts for over 40% of the global total, and annual sales surpasses RMB 1 trillion. However, viewed from status quo of China commercial vehicle finance service, there is still an obvious gap to fill compared to developed countries. At present, penetration of commercial vehicle finance market in China is approximately 50%, which is far below that of international mature market (with 90% of penetration). Based on commercial vehicle sales volume of 4.37 million units, China commercial vehicle finance market size is estimated to be 2.19 million units in 2018.

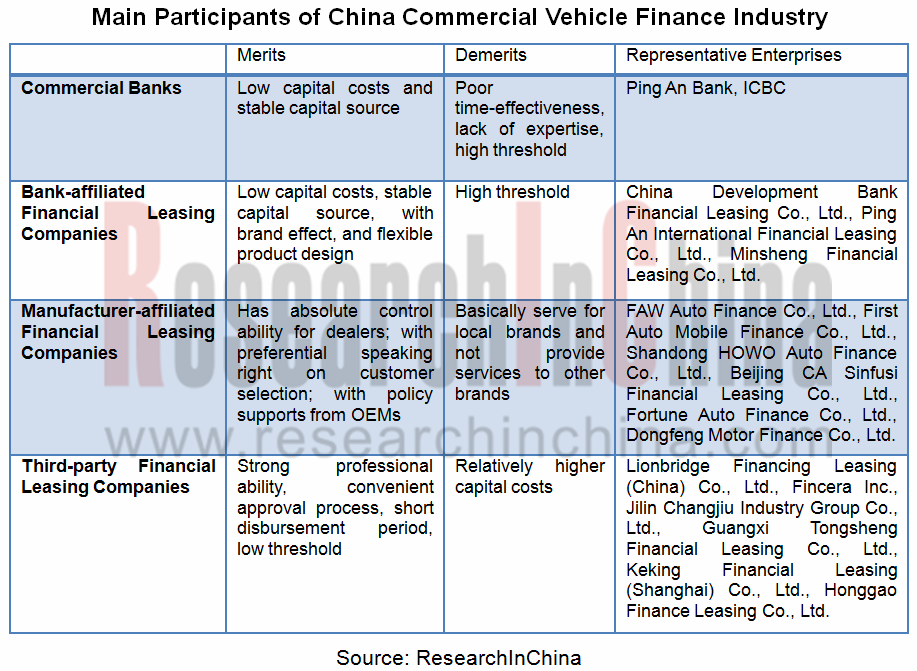

Currently, main participants of China commercial vehicle finance industry include commercial banks, bank-affiliated financial leasing companies, manufacturer-affiliated financial leasing companies, and third-party financial leasing companies. Of which, commercial banks and bank-affiliated financial leasing companies occupy more than half of the market share, while the remaining one third is held by manufacturer-affiliated financial leasing companies.

With the deeply development of commercial vehicle finance service, its shortcomings and problems are presented. For instance, commercial vehicle finance service is of weak used-car evaluation system basis, unsound risk control system, vicious competition, large financial capital demand and insufficient bank capital supply, which directly inhibited development of China commercial vehicle finance service.

At present, smart risk control and analysis & decision service providers represented by Tongdun Technology Co., Ltd. begins to offer solutions for problems (like unregulated market and unsound risk control system) occurred in commercial vehicle finance market. In the future, China commercial vehicle finance risk control ability will further be enhanced.

Thanks to favorable policy, China commercial vehicle finance market will be gradually mature, providing more products, with better risk control ability, lower credit threshold and higher penetration rate. It is forecast that penetration of commercial vehicle finance in China will be 70% by 2025.

China Commercial Vehicle Finance Industry Report, 2019-2025 mainly includes the following aspects:

Analysis on China auto finance industry, including development environment, development course, development status, market size, competition pattern and development trend;

Analysis on China auto finance industry, including development environment, development course, development status, market size, competition pattern and development trend;

Analysis on China commercial vehicle finance industry, including development status, main players, competition pattern, market size and risk control system establishment & analysis;

Analysis on China commercial vehicle finance industry, including development status, main players, competition pattern, market size and risk control system establishment & analysis;

Analysis on 16 commercial vehicle finance related enterprises, including company profile, commercial vehicle finance business analysis, etc.

Analysis on 16 commercial vehicle finance related enterprises, including company profile, commercial vehicle finance business analysis, etc.

1. Overview

1.1 Overview of Automotive Finance

1.1.1 Definition

1.1.2 Classification

1.1.3 Market Players

1.1.4 Automotive Financial Leasing

1.2 Overview of Commercial Vehicle Finance

2. Automotive Finance Industry in China

2.1 Development Environment

2.1.1 Policy

2.1.2 Economy

2.1.3 Car Ownership

2.1.4 Automobile Production and Sales

2.1.5 Commercial Vehicle Production and Sales

2.2 Development Course

2.3 Status Quo

2.4 Market Size

2.5 Competitive Landscape

2.6 Operation of Auto Finance Companies

2.7 Development Trends

2.7.1 Market Share of Auto Finance Companies Grows Further

2.7.2 Used Car Financial Business Grows Rapidly

2.7.3 Auto Financial Products Becomes More Diversified

2.7.4 Improved Credit System Pushes the Development of Auto Finance Market

2.7.5 Internet Auto Finance Has Developed into a Trend

2.7.6 Cooperation between Banks and Enterprises Drives Auto Finance

2.7.7 Competition in Auto Finance Industry Intensifies

3. Commercial Vehicle Finance Industry in China

3.1 Status Quo

3.2 Major Participants

3.2.1 Commercial Banks

3.2.2 Bank-affiliated Financial Leasing Companies

3.2.3 Manufacturer-affiliated Financial Leasing Companies

3.2.4 Third-party Financial Leasing Companies

3.3 Competitive Landscape

3.4 Market Size

3.5 Risk Control System Establishment

3.6 Summary

4. Analysis on Commercial Vehicle Finance Related Enterprises

4.1 Lionbridge Financing Leasing (China) Co., Ltd.

4.1.1 Profile

4.1.2 Development Course

4.1.3 Financing Status

4.1.4 Commercial Vehicle Finance Business

4.1.5 Developments

4.2 Fincera Inc.

4.2.1 Profile

4.2.2 Development Course

4.2.3 Commercial Vehicle Finance Business

4.3 Pangda Automobile Trade Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Commercial Vehicle Finance Business

4.4 FAW Auto Finance Co., Ltd.

4.4.1 Profile

4.4.2 Commercial Vehicle Finance Business

4.5 First AutoMobile Finance Co., Ltd.

4.5.1 Profile

4.5.2 Commercial Vehicle Finance Business

4.6 Shandong HOWO Auto Finance Co., Ltd.

4.6.1 Profile

4.6.2 Development Goals

4.6.3 Developments

4.7 Guangxi Tongsheng Financial Leasing Co., Ltd.

4.7.1 Profile

4.7.2 Commercial Vehicle Finance Business

4.8 Keking Financial Leasing (Shanghai) Co., Ltd.

4.8.1 Profile

4.8.2 Development Course

4.8.3 Financing Status

4.8.4 Commercial Vehicle Finance Business

4.8.5 Developments

4.9 Tianjin ForFin Leasing Co., Ltd.

4.9.1 Profile

4.9.2 Commercial Vehicle Finance Business

4.10 Beijing CA Sinfusi Financial Leasing Co., Ltd.

4.10.1 Profile

4.10.2 Operation

4.10.3 Commercial Vehicle Finance Business

4.10.4 Developments

4.11 Honggao Finance Leasing Co., Ltd.

4.11.1 Profile

4.11.2 Partner

4.11.3 Commercial Vehicle Finance Business

4.11.4 Developments

4.12 Fortune Auto Finance Co., Ltd.

4.12.1 Profile

4.12.2 Development Course

4.12.3 Commercial Vehicle Finance Business

4.13 Dongfeng Motor Finance Co., Ltd.

4.13.1 Profile

4.13.2 Commercial Vehicle Finance Business

4.14 Others

4.14.1 En-how Investment (Beijing) Co., Ltd.

4.14.2 Deron International Financial Leasing Co., Ltd.

4.14.3 Ping An International Financial Leasing Co., Ltd.

Auto Finance Structure Relation

Financial Leasing Procedures

Direct Financial Leasing Mode of Auto Finance

Sale-Leaseback Mode of Auto Finance

Comparison of Auto Finance Business Models

China’s GDP, 2012-2018

China Motor Vehicle Ownership Structure by Type, 2017

China’s Automobile Ownership, 2010-2017

China’s Automobile Ownership by Region, 2017

China Automobile Ownership Structure by Type, 2017

China’s Automobile Output, 2011-2019

China’s Automobile Sales Volume, 2011-2019

China’s Automobile Output and Sales Volume, 2018-2025E

Sales Volume of Top 10 Automotive Brands in China by Type, 2018

China’s Automobile Sales Volume Structure (by Type), 2011-2019

China’s Automobile Sales Volume Structure (by Type), 2018-2025E

China’s Commercial Vehicle Output, 2011-2019

China’s Commercial Vehicle Sales Volume, 2011-2019

China’s Commercial Vehicle Output & Sales Volume, 2018-2025E

China’s Commercial Vehicle Sales Volume (by Type), 2011-2018

China’s Commercial Vehicle Sales Volume Structure (by Type), 2011-2018

Penetration of Auto Finance in China, 2015-2025E

Auto Finance Market Size in China, 2014-2025E

Competition Pattern of Auto Finance Market in China, 2017

Competition Pattern of Auto Finance Market in China, 2018

Operating Results of Major Auto Finance Companies in China, 2017

Total Assets of Auto Finance Companies in China, 2013-2017

Loans of Auto Finance Companies in China (by Type), 2013-2017

Main Business Structure of Auto Finance Companies in China, 2013-2017

Number of Automobiles (by Type) that Received Loans from Auto Finance Companies in China, 2013-2017

Market Shares of Auto Finance Companies in China, 2016-2023E

Main Participants of China Commercial Vehicle Finance Industry

China Commercial Vehicle Finance Market Share, 2018

China Commercial Vehicle Finance Market Size, 2018-2025E

Penetration of Commercial Vehicle Finance Market in China, 2018-2025E

Lionbridge’s Partners

Lionbridge’s Development Course

Fincera’s Development Course

Revenue and Net Income of Pangda Automobile, 2013-2018

Revenue and Net Income of Pangda ORIX Auto Leasing Co., Ltd., 2017-2018

Financial Figures of Pangda Leye, 2014-2018

FAW Auto Finance’s Commercial Vehicle Finance Solution

First AutoMobile Finance’s Commercial Vehicle Finance Products

Keking Financial Leasing’s Development Course

Financing Status of Keking Financial Leasing

Keking Financial Leasing’s Commercial Vehicle Finance Service

First ABS Issuing Scale of Keking Financial Leasing

Tianjin ForFin’s Equity Structure

Financial Leasing Distribution of Tianjin ForFin in China

Tianjin ForFin’s Commercial Vehicle Finance Business

Advantages of Tianjin ForFin’s Commercial Vehicle Financial Products

Total Assets, Net Assets and Net Income of Beijing CA Sinfusi Financial Leasing, 2015-2017

Beijing CA Sinfusi Financial Leasing’s Commercial Vehicle Finance Business

Honggao Finance Leasing’s Partners

Honggao Finance Leasing’s Commercial Vehicle Finance Business

Advantages of Honggao Finance Leasing’s Commercial Vehicle Financial Products

Fortune Auto Finance’s Development Course

Commercial Vehicle Financial Products of Fortune Auto Finance

Commercial Vehicle Financial Products of Dongfeng Motor Finance

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...