Global and China Tire Mold Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$2,800

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

BXM127

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$3,000

-

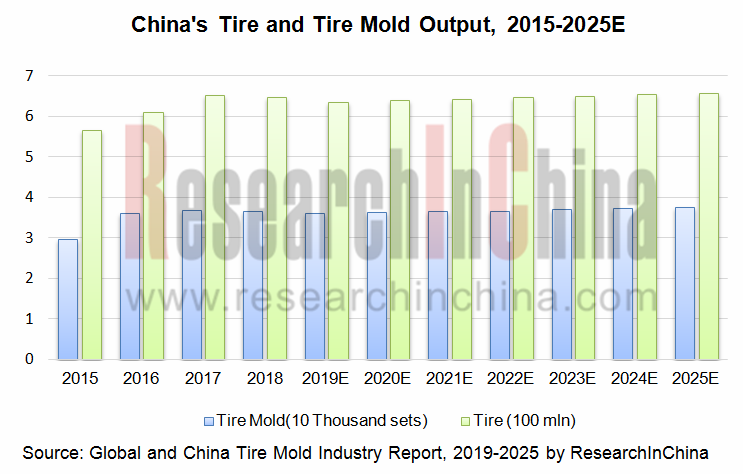

The market demand for tire molds which are consumables is positively correlated with tire output. From 2012 to 2016, the demand for tire mold remained sluggish, arising from a slowdown in growth rate of Chinese tire market. The tire market began to rebound in 2017, being a boon for the market growth of tire molds whose the year-2017 output posted 366,000 sets with a year-on-year increase of 2%. In 2018, China's automobile output and sales volume fell for the first time, accompanied by the anti-dumping and countervailing investigations launched by the United States and the EU against Chinese tires, China's tire output showed its first negative growth in the past two decades. Consequently, China's tire mold output edged down by 0.8%. In the future, Chinese tire molds will maintain steady growth along with the tire market.

At present, the increment of tire molds mainly comes from the replacement demand. On the one hand, the huge global and Chinese automobile markets favor the development of tire molds; on the other hand, the faster update of tire tread drives higher and higher tire mold renewal rate.

Tire mold manufacturers fall into the mold companies affiliated to tire makers and the third-party professional tire mold companies. To protect the intellectual property rights, the tire molds of France-based Michelin, the US-based Goodyear and the like, which are subordinate to tire makers, are generally used by themselves and not for sale. The international professional tire mold manufacturers such as the US-based QUALITY and German AZ are mostly family-owned enterprises, producing the expensive high-grade tire molds for the global high-end tire mold market.

Given high customization of tire molds, mold manufacturers mostly operate in a small scale. The largest mold makers on the market by capacity include China-based Himile Mechanical Science & Technology (Shandong) and Greatoo Intelligent Equipment, German HEBERT, and South Korean SAEHAN. Among them, Himile Mechanical Science & Technology (Shandong) has become the world's tire mold R&D and production base, teamed up with 62 of the world's top 75 tire manufacturers, and acted as the quality tire mold supplier of the world's top three tire giants Michelin, Bridgestone and Goodyear with the international market share of 25%-30% and the export value contribution of more than 90% in China.

The report highlights the following:

Global tire mold market (size, structure, key enterprises, etc.);

Global tire mold market (size, structure, key enterprises, etc.);

China tire mold market (development history, market size & structure, supply and demand, development trends, etc.);

China tire mold market (development history, market size & structure, supply and demand, development trends, etc.);

Global tire market (size, ranking of key players, status quo of the US and European markets, etc.);

Global tire market (size, ranking of key players, status quo of the US and European markets, etc.);

Chinese tire market (size, output and structure, key enterprises, etc.);

Chinese tire market (size, output and structure, key enterprises, etc.);

4 global and 13 Chinese companies (tire mold business, R&D and future planning, etc.)

4 global and 13 Chinese companies (tire mold business, R&D and future planning, etc.)

1. Tire Mold

1.1 Definition

1.2 Classification

1.3 Industry Chain

1.4 Production Process

1.5 Features

2. Global Tire Mold Industry

2.1 Status Quo

2.2 Market Situation

2.2.1 Market Size

2.2.2 Market Structure

2.3 Competition Pattern

2.4 Development Trend

3. China Tire Mold Industry

3.1 Development History

3.2 Industry Policy

3.3 Status Quo

3.3.1 Sales

3.3.2 Output

3.3.3 Demand

3.4 Corporate Competition

3.5 Development Trend

4. Tire Industry

4.1 Global

4.1.1 Market Size

4.1.2 Key Manufacturers

4.1.3 USA

4.1.4 Europe

4.2 China

4.2.1 Industrial Size and Characteristics

4.2.2 Output and Structure

4.2.3 Import & Export

4.2.4 Competitive Landscape

5. Development of Automobile Industry

5.1 Global

5.2 China

6. Key Global Companies

6.1 SAEHWA IMC

6.1.1 Profile

6.1.2 Business Distribution

6.1.3 Operation

6.1.4 Development History

6.1.5 Tire Mold Products

6.1.6 Development in China

6.1.7 Development Planning

6.2 HERBERT Maschinenbau GmbH & Co. KG

6.2.1 Profile

6.2.2 Tire Mold Products

6.3 Quality Mold Inc.

6.4 A-Z Formen- und Maschinenbau GmbH

7. Key Chinese Enterprises

7.1 Himile Mechanical Science & Technology (Shandong) Co., Ltd.

7.1.1 Profile

7.1.2 Development History

7.1.3 Operation

7.1.4 Tire Mold Business

7.1.5 R&D and Projects

7.1.6 Competitive Edge

7.2 Greatoo Intelligent Equipment Inc.

7.2.1 Profile

7.2.2 Operation

7.2.3 Major Customers

7.2.4 R & D Investment and Main Projects

7.2.5 Tire Mold Business

7.3 Shandong Wantong Mould Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.4 Tianyang Mold Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.5 Anhui Wide Way Mould Co., Ltd.

7.5.1 Profile

7.5.2 Operation

7.6 Others

7.6.1 Shandong Jinli Tire Equipment Co., Ltd

7.6.2 Qingdao Yuantong Machinery Co., Ltd.

7.6.3 Shandong Hongji Mechanical Technology Co., Ltd.

7.6.4 RongchengHongchang Mold Co., Ltd.

7.6.5 Anhui McgillMould Co., Ltd.

7.6.6 Zhejiang Laifu Mould Co., Ltd.

7.6.7 MESNAC Precise Processing Industry Co., Ltd.

7.6.8 Shandong Hengyi Mould Co., Ltd.

Classification of Tire Mold

Classification of Radial Tire Segmented Mold

Upstream and Downstream of Tire Mold Industry

Comparison of Tire Mold Pattern Processing Technologies in China

Sales Revenue of Rubber Machinery in Major Regions Worldwide, 2015-2018

Global Tire Mold Market Size, 2015-2025E

Global Demand for Tire Mold, 2015-2025E

Structure of Global Tire Mold Demand (by Product), 2018

Business Model of Major Tire Mold Manufacturers in the World

Competitive Pattern of Global Tire Mold Market, 2018

Comparison of Products between World’s Major Tire Mold Manufacturers

Development Course of China Tire Mold Industry

Policies and Laws & Regulations about China Tire Mold Industry

Sales Revenue of China Tire Mold Industry, 2015-2025E

Tire Mold Output in China, 2013-2025E

Factors Influencing Tire Mold Demand in China

Tire Mold Demand in China, 2015-2025E

Tire Mold Market Share in China, 2015

Capacity of Major Chinese Tire Mold Manufacturers in China, 2018

Radial Ratio of Tires in China, 2006-2018

Laws & Regulations on Environment-friendly Tire in Major Countries Worldwide

Global Tire Market Size, 2013-2025E

Global Car Tire Market Size, 2014-2025E

Growth Rate of Global Car Tire Market Size by Region, 2018

Growth Rate of Global Truck Tire Market Size by Region, 2018

Global Tire Shipments by Region, 2017-2018

Global Top 30 Tire manufacturers, 2018

Passenger Car OE and Replacement Tire Shipments in the United States, 2008-2019

Light-Truck OE and Replacement Tire Shipments in the United States, 2008-2019

Medium/Heavy-Truck OE and Replacement Tire Shipments in the United States, 2008-2019

Passenger Car Replacement Tire Shipments in Europe, 2015-2018

Truck & Bus Replacement Tire Shipments in Europe, 2015-2018

Agricultural Replacement Tire Shipments in Europe, 2015-2018

Two-wheeler Replacement Tire Shipments in Europe, 2015-2018

Revenue and YoY Growth of China Tire Industry, 2015-2025E

Proportion of Chinese Radial Tires, 2015-2025E

China’s Tire Output and YoY Growth, 2015-2025E

China’s Tire Output by Product, 2018

China’s Tire Export Volume, 2017-2018

China’s Semi-steel Tire Export Volume by Country, 2017-2018

China’s All-steel Tire Export Volume by Country, 2017-2018

China’s All-steel Tire Export Volume and Value to the United States, 2017-2018

China’s All-steel Tire Export Volume and Value to the EU, 2017-2018

China’s Tire Import Volume by Product, 2017-2018

Anti-dumping and Countervailing Duties by the United States against Chinese Truck & Bus Tire Enterprises

China’s Small Bus Tire Export Volume to the United States, 2015-2018

China’s Truck & Bus Tire Export Volume to the United States, 2015-2018

Anti-dumping and Countervailing Duties by the EU against Chinese Truck & Bus Tire Enterprises

Ranking of Tire Enterprises by Revenue in China, 2018

Ranking of Main Tire Enterprises by Net Income in China, 2018

Ranking of Main Tire Enterprises by Sales Volume in China, 2018

Global Automobile Output, 2010-2025E

Ownership of Automobiles in Worldwide, 2010-2025E

Key Automobile Manufacturers Worldwide, 2018

China’s Automobile Output, 2010-2025E

Ownership of Automobiles in China, 2010-2025E

Key Automobile Manufacturers in China, 2018

Global Operations of SAEHWA IMC

Major Production Bases of SAEHWA IMC in South Korea

Global Production Bases of SAEHWA IMC (Excluding South Korea)

Operation of SAEHWA IMC, 2016-2018

Revenue Breakdown of SAEHWA IMC (by Product), 2016-2018

Revenue Breakdown of SAEHWA IMC (by Region), 2017-2018

Product Development History of SAEHWA IMC

Development Course of SAEHWA IMC

Main Tire Mold Products of SAEHWA IMC

Profile of Major Tire Mold Companies of SAEHWA IMC in China

Revenue and Profits of SAEHWA IMC in China, 2017-2018

Medium and Long-term Business Strategies of SAEHWA IMC

Main Production Bases of HERBERT in the World

Revenue of HERBERT, 2015-2018

Main Tire Mold Products of HERBERT

Tire Mold Production Bases of Quality Mold Inc.

Major Pattern Types of Tire Mold of Quality Mold Inc

Main Tire Mold Products of A-Z

Operations of Major Companies under Himile Group

Development Course of Himile Mechanical Science & Technology

Revenue and Net Income of Himile Mechanical Science & Technology, 2013-2018

Revenue Structure (by Business) of Himile Mechanical Science & Technology, 2016-2018

Revenue Structure (by Region) of Himile Mechanical Science & Technology, 2016-2018

Gross Margin of Major Products of Himile Mechanical Science & Technology, 2016-2018

Major Tire Mold Products and Applications of Himile Mechanical Science & Technology

Major Overseas Tire Customers of Himile Mechanical Science & Technology

Tire Mold Capacity of Himile Mechanical Science & Technology, 2013-2018

Tire Mold Sales Volume of Himile Mechanical Science & Technology, 2013-2018

Tire Mold Sales Volume Structure (by Product) of Himile Mechanical Science & Technology, 2018

R&D Costs and % of Total Revenue of Himile Mechanical Science & Technology, 2013-2018

Tire Mold Customers of Himile Mechanical Science & Technology

Revenue and Net Income of Greatoo Intelligent Equipment, 2013-2018

Revenue Structure (by Business) of Greatoo Intelligent Equipment, 2016-2018

Revenue Structure (by Region) of Greatoo Intelligent Equipment, 2013-2018

Gross Margin of Major Products of Greatoo Intelligent Equipment, 2013-2018

Distribution of Global Customers of Greatoo Intelligent Equipment

Key Domestic and Overseas Customers of Greatoo Intelligent Equipment

R&D Costs and % of Total Revenue of Greatoo Intelligent Equipment, 2012-2018

Key Construction Projects of Greatoo Intelligent Equipment, 2018

Major Tire Mold Products of Greatoo Intelligent Equipment

Output, Sales Volume and Inventory of Major Products of Greatoo Intelligent Equipment, 2016-2018

Tire Mold Output and Sales Volume of Greatoo Intelligent Equipment, 2016-2018

Tire Mold Products of Shandong Wantong Mould

Revenue of Shandong Wantong Mould, 2013-2018

Major Tire Mold Products of Tianyang Mold

Revenue of Tianyang Mold, 2013-2018

Major Customers of Tianyang Mold

Global Footprint of Anhui Wide Way Mould

Products of Anhui Wide Way Mould

Revenue of Anhui Wide Way Mould, 2013-2018

Major Products of Qingdao Yuantong Machinery

Major Customers of Qingdao Yuantong Machinery

Revenue of Qingdao Yuantong Machinery, 2013-2018

Revenue of Shandong Hongji Mechanical Technology, 2013-2018

Revenue of Anhui McgillMould, 2013-2018

Development Course of Zhejiang Laifu Mould

Marketing Network of Zhejiang LaifuMould

Partners of Zhejiang LaifuMould

Key Financials of MESNAC Precise Processing Industry, 2013-2018

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...