China Passenger Car Camera Market Report, 2019Q1

-

May 2019

- Hard Copy

- USD

$1,700

-

- Pages:73

- Single User License

(PDF Unprintable)

- USD

$1,500

-

- Code:

LY007

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,300

-

- Hard Copy + Single User License

- USD

$1,900

-

Passenger Car Camera Market: Front-view Monocular Camera Installation Soared by 71.7% in 2019Q1 from the Same Period Last Year.

In China, front view monocular camera is the one largely demanded in passenger car market, with its installations in 2019Q1 surging by 71.7% from the same period of 2018, according to our recent report -- China Passenger Car Camera Market Report, 2019Q1.

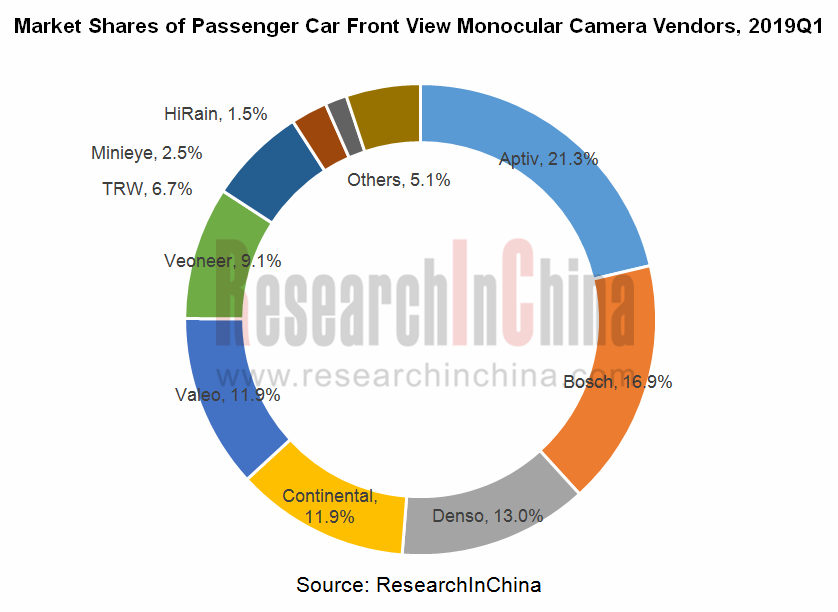

The top three players Aptiv, Bosch and Denso commanded 21.3%, 16.9% and 13.0% of the market, respectively.

Chinese vendors have made headway in ADAS camera field, among which Minieye and HiRain Technologies have entered the top ten monocular camera vendor list where the four radar monopolists, Aptiv, Bosch, Continental and Denso are also ranked, with respective market share of 2.5% and 1.5%.

Bosch vision-based ADAS products grow fast in the Chinese market. In 2019Q1, the market share of its forward looking monocular cameras jumped to 16.9% compared with less than 10% in 2018. The mass-produced Chinese vehicle models packing Bosch L2 autonomy technology include: Geely Borui GE, Changan CS55, Great Wall VV6, Geely Binrui, SAIC Marvel X and SGMW New Baojun RS-5. Bosch expects more than 40 models with its L2 capability will be available on market in 2019.

Of the 572 new car models launched in China in 2019Q1 (note: the number of models is counted based on configuration), SAIC rolled out the most, 66 models; BYD followed with 41 models having the most complete camera configurations.

In 2019Q1, BYD released 7 new cars in 41 models, including: 8 with monocular SD camera; 32 with fisheye SD camera; 26 with fisheye HD camera; 8 with around view camera; 24 with side view camera; 28 with reversing camera; 26 with driving recorder. Vision sensor configurations of some models are shown below.

This is quarterly report, are totally 4 issues a year, with annual subscription fee of USD6,000.

Reseller distribution is not allowed.

Preface

Research Background and Contents

Methodology

Terminology

1 Chinese Passenger Car Camera Market

Front-view Monocular and Stereo Camera Installations and Growth Rate in Chinese Passenger Car Market, 2019Q1

Front-view Monocular and Stereo Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Front-view Monocular Camera Installations to New Passenger Cars in China by Price, 2019Q1

Top 20 Brands by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Top 30 Models by Front-view Monocular Camera Installations to New Passenger Cars in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Share by Installations in China, 2019Q1

Front-view Monocular Camera Suppliers to New Passenger Cars and Their Installations and Share in China, 2018Q1-2019Q1

Camera Installations to New Cars and Installations by Position in China, 2019Q1

Proportion of Camera Installations to New Cars in China by Number & by Position, 2019Q1

Rear-view Camera Installations to New Cars and Growth Rate in China by Reversing Camera and Streaming Rear-view Mirror, Jan-Mar 2019

Rear-view Reversing Camera and Streaming Media Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Reversing Camera Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Reversing Camera Installations to New Cars in China, 2019Q1

Monthly Surround-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

Proportion of Surround-view System Installations to New Cars in China by Price, 2019Q1

Top 20 Brands by Surround-view System Installations to New Cars in China, 2019Q1

Side-view Camera Installations to New Cars and Growth Rate in China, Jan-Mar 2019

Side-view Camera Installations to New Cars in China, Jan 2018 - Mar 2019

2 Installations and Dynamics of Automotive Vision Suppliers

2.1 Aptiv

2.1.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.1.2 Recent Developments

2.2 Bosch

2.2.1 Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.2.2 Models Supported and Recent Developments

2.3 Denso’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.4 Continental’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.5 Valeo’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.6 Veoneer’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market

2.7 TRW’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.8 Gentex’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.9 HiRain’s Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

2.10 Minieye

Front-view Monocular Camera Installations and Share in Chinese Passenger Car Market, 2018Q1-2019Q1

Recent Developments

3 Vision Sensor Configuration and Features of Chinese Automakers

3.1 Great Wall Motor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.2 Geely

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.3 BYD

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.4 SAIC Passenger Vehicle

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.5 Chang'an Automobile

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.6 Hanteng Autos

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

3.7 Leapmotor

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4 Vision Sensor Configuration and Features of Joint Venture Brands

4.1 Beijing Benz

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.2 GAC Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.3 BMW Brilliance

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.4 SAIC Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.5 SAIC-GM

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.6 FAW-Volkswagen

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.7 FAW Toyota

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.8 Dongfeng Yueda Kia

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.9 Chery Jaguar Land Rover

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.10 Chang’an Mazda

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.11 Dongfeng Peugeot Citro?n

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

4.12 JMC Ford

Vision Sensor Configuration of Newly-launched Models, 2019Q1

Visual ADAS Features of Newly-launched Models, 2019Q1

5 Development Trends of Vision Sensor Industry

5.1 Development Trends of Visual Processing Chips

5.2 Development Trends of Software and Algorithms

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...