Report on Chinese Automakers’ Telematics Products in 2019

-

Jun.2019

- Hard Copy

- USD

$3,000

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

LY008

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

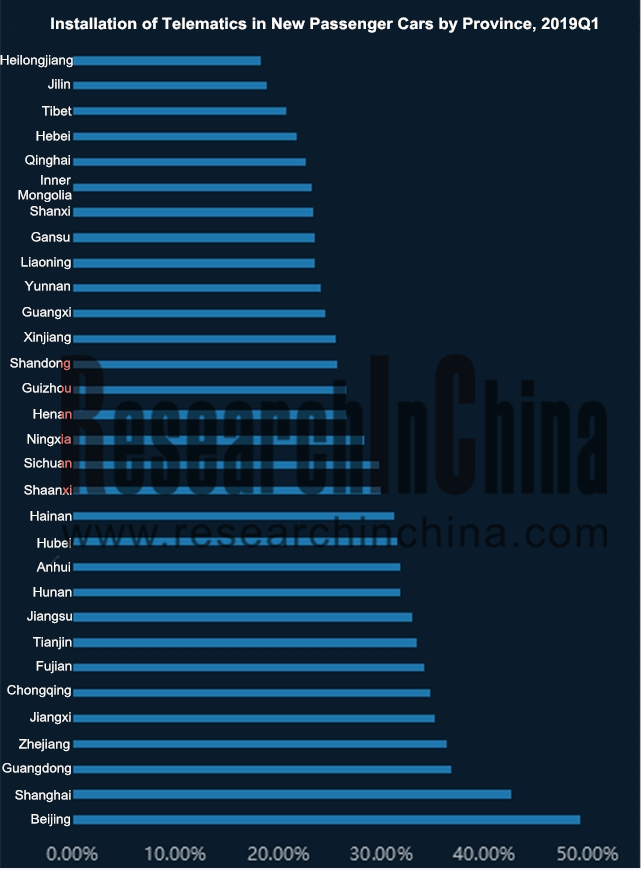

It is Shown from the Findings of Our Research on Chinese Automakers’ Telematics Products: Telematics is Available to 49% New Vehicles in Beijing, Compared with a Mere 18% in Heilongjiang.

In the first quarter of 2019, Beijing, Shanghai and Guangdong stay ahead of other provinces in availability of telematics in new passenger cars, with rates of 49.2%, 42.5% and 36.7%, respectively; Jilin and Heilongjiang were left behind with installation rates of 18.9% and 18.2%, respectively, far below the country’s average of 30.2%, according to Report on Chinese Automakers’ Telematics Products in 2019 we released recently.

Automotive telematics solution falls into built-in and external types. Built-in telematics system enables vehicles with direct connectivity; external telematics system offers connectivity for vehicles via a smartphone or other devices. Built-in telematics system has become the mainstream configuration for new vehicles as ever more of them used the system in recent two years, making the external type give its way to it. In 2018, telematics (built-in + external) installation rate in China just rose a bit.

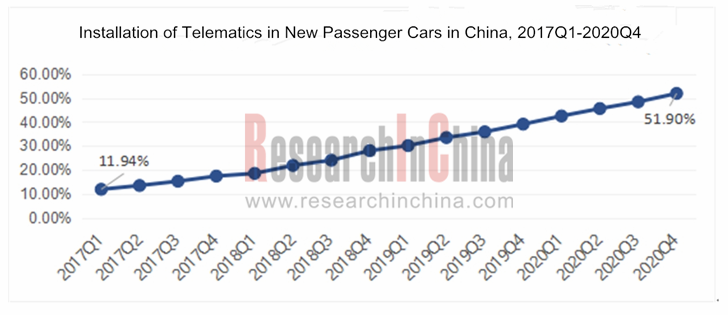

Only in terms of built-in telematics system, installation of telematics in new vehicles has soared, expectedly up to 51.9% in the fourth quarter of 2020 compared with a mere 11.94% in the first quarter of 2017.

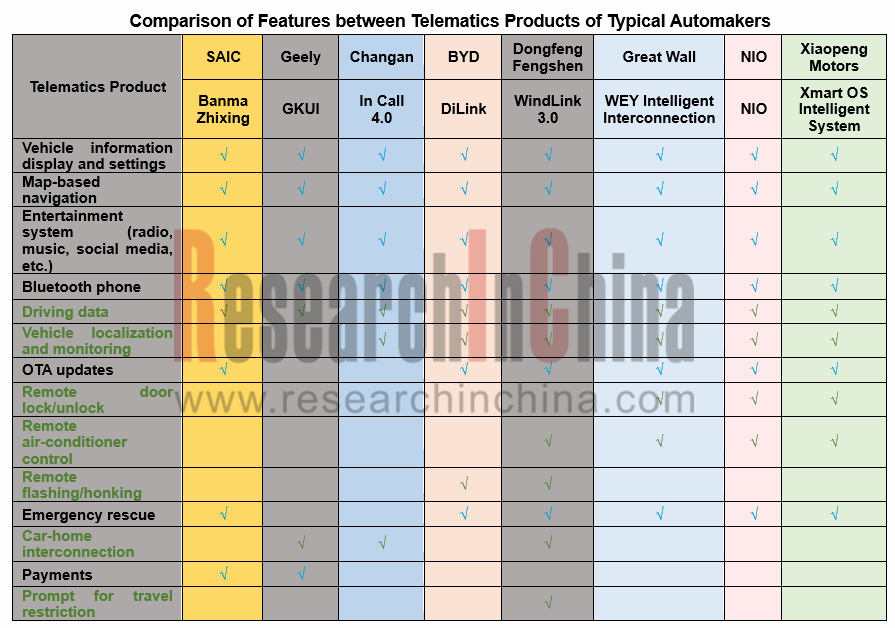

The report compares and analyzes telematics products of more than 10 Chinese automakers from the aspects as follows: features, technology providers, human-machine interaction, communications, map and navigation, voice, big data and service, dashboard and central console, car owner’s APP, remote control, cloud technology, in-vehicle infotainment, mobility services, life services, car-home interconnection deployment, pre- and after-sale services, charge mode, installation of telematics products, installation by province and municipality, etc.

1 China Telematics Industry

1.1 Overview of Telematics

1.1.1 Definition

1.1.2 System Architecture

1.1.3 Industry Chain

1.1.4 Telematics Based on Big Data Platform Extends to Service Ecosystem Market

1.1.5 Development Stage

1.2 Telematics Market

1.2.1 Installation of Telematics in New Passenger Cars in China, 2017Q1-2020Q4

1.2.2 Telematics Installation of Main Passenger Car Brands, 2017-2019

1.2.3 Installation of Telematics in New Vehicles by Province, 2017Q1-2019Q1

1.2.4 Installation and Market Shares of Main Telematics Products, 2018-2019

1.3 Telematics Development Trends

1.3.1 Telematics Terminal

1.3.2 Trend toward Integration between Service Ecosystem and Map-based Navigation

1.3.3 Related Laws, Regulations and Standards are Getting Improved

1.3.4 Multi-channel Interaction and Fusion

1.3.5 Heuristic Active Telematics Voice Service

1.3.6 Vehicle Entertainment Contents are Getting Enriched

2 Comparison of Features between Telematics Products of Typical Automakers

2.1 Comparison of Overall Telematics Layout

2.1.1 Overview of Telematics Products of Main Automakers

2.1.2 Telematics Products and Development Plans of Automakers

2.1.3 Telematics Technologies and Service Suppliers of Main Automakers

2.1.4 Comparison of Human-computer Interaction Functions between Main Automakers

2.1.5 4G is the First Choice for Telematics Communications and Manufacturers are Working to Deploy 5G

2.1.6 Automakers and Communication Firms Make Joint Efforts to Promote the Development of 5G Telematics

2.1.7 Map-based Navigation Service Suppliers of Typical Automakers

2.1.8 Voice Technology Suppliers of Typical Automakers

2.2 Comparison of Functions between Telematics Software and Hardware

2.2.1 Comparison of Highlights between Telematics Products of Typical Automakers

2.2.2 Comparison of Features between Telematics Products of Typical Automakers

2.2.3 Comparison of Telematics Big Data and Service between Typical Automakers

2.2.4 Comparison of Dashboard and Central Console between Typical Automakers

2.2.5 Comparison of Voice Control Functions between Typical Automakers

2.2.6 Comparison of Telematics APP Capabilities between Typical Automakers

2.2.7 Comparison of Remote Control Functions between Typical Automakers

2.2.8 Cloud Technology Suppliers and Functions Available of Typical Automakers

2.3 Telematics Services

2.3.1 Operating Value-added Service

2.3.2 Telematics Service Ecosystem is Expanding

2.3.3 Comparison of Vehicle Entertainment Capabilities between Typical Automakers

2.3.4 Comparison of Mobility Services between Typical Automakers

2.3.5 Comparison of Telematics-based Living Services between Typical Automakers

2.3.6 Car-home Interconnection Layout of Typical Automakers

2.3.7 Comparison of Telematics-based Pre- and After-sale Services between Typical Automakers

2.3.8 Comparison of Telematics Service Charge Mode between Typical Automakers

3 Telematics Products of Traditional Chinese Auto Brands

3.1 Passenger Car Telematics Products of SAIC

3.1.1 Overview of Passenger Car Telematics Products of SAIC

3.1.2 Telematics Suppliers and Partners of SAIC

3.1.3 Voice Control & Recognition

3.1.4 New Map-based Navigation Technology—AR-Driving

3.1.5 SAIC Telematics: IVI OS and APP

3.1.6 SAIC Telematics: Network Communications

3.1.7 SAIC Big Data Applications

3.1.8 SAIC Telematics: Dashboard & Central Console

3.1.9 MG HS Cockpit

3.1.10 MG HS Service Ecosystem

3.1.11 Installation of Passenger Car Telematics Products of SAIC, 2017Q1-2019Q1

3.1.12 Installation of SAIC AliOS by Province, 2017Q1-2019Q1

3.2 Geely GKUI

3.2.1 Overview of Geely GKUI

3.2.2 GKUI System Core

3.2.3 G-ID

3.2.4 GKUI Cloud Platform

3.2.5 Geely GKUI: User Interface (UI)

3.2.6 Geely GKUI: Map-based Navigation

3.2.7 Geely GKUI: Payment Platform

3.2.8 Geely GKUI: Network Communications

3.2.9 Geely GKUI: Intelligent Vehicle Voice Assistant

3.2.10 Geely GKUI: 5G NR Technology Co-developed with Others

3.2.11 Geely GKUI: Ecosystem Partners

3.2.12 Digital Operation Plan of Geely

3.2.13 Installation of Telematics Products of Geely, 2017Q1-2019Q1

3.2.14 Installation of Geely GKUI by Province, 2017Q1-2019Q1

3.3 Changan

3.3.1 Overview of Changan In-Call

3.3.2 Main Functions of In-Call

3.3.3 In-Call: Map-based Navigation

3.3.4 In-Call: Zhiyin Huoban APP

3.3.5 Intelligent Voice Assistant—“Xiaoan”

3.3.6 In-Call: Network Communications

3.3.7 Changan Embarks on Joint Development of LTE-V and 5G Telematics

3.3.8 Set up a Joint Venture with Tencent in Intelligent Connected Vehicle Field

3.3.9 InCall Partnered with JD Weilian

3.3.10 In-Call: Ecosystem Partners

3.3.11 Changan “Dubhe” Strategy

3.3.12 Changan Intelligent Connection Plan

3.3.13 Installation of Telematics Products of Changan, 2017Q1-2019Q1

3.3.14 Installation of Changan InCall by Province, 2017Q1-2019Q1

3.4 BYD

3.4.1 Overview of BYD DiLink

3.4.2 BYD DiPad

3.4.3 BYD Di Cloud

3.4.4 BYD Di Ecosystem

3.4.5 BYD Di Openness

3.4.6 Smart Bracelet Key--Di Band

3.4.7 DiLink: Natural Speech Recognition

3.4.8 DiLink: Map-based Navigation

3.4.9 DiLink: Network Communications

3.4.10 D++ Open Ecosystem

3.4.11 DiLink: Suppliers and Partners

3.4.12 Installation of Telematics Products of BYD, 2017Q1-2019Q1

3.4.13 Installation of DiLink by Province, 2017Q1-2019Q1

3.5 Dongfeng WindLink

3.5.1 Overview of Dongfeng Fengshen WindLink3.0

3.5.2 Highlights of Dongfeng Fengshen WindLink3.0

3.5.3 WindLink3.0 Human-machine Interaction

3.5.4 WindLink Map-based Navigation

3.5.5 WindLink App 3.0

3.5.6 WindLink3.0 Network Communications

3.5.7 Dongfeng Fengshen Application Ecosystem

3.5.8 Suppliers and Partners

3.5.9 WindLink3.0 Development Plan

3.5.10 Installation of Telematics Products of Dongfeng, 2017Q1-2019Q1

3.5.11 Installation of WindLink by Province, 2017Q1-2019Q1

3.5.12 Installation of Venucia Intelligent Connection by Province, 2017Q1-2019Q1

3.6 Great Wall Motor

3.6.1 Great Wall WEY Intelligent Interconnection

3.6.2 Great Wall WEY·Road APP

3.6.3 WEY Intelligent Interconnection: Human-Machine Interaction

3.6.4 WEY Intelligent Interconnection: Voice Control & Recognition

3.6.5 WEY Intelligent Interconnection: Map-based Navigation

3.6.6 WEY Intelligent Interconnection: Infotainment System

3.6.7 WEY Intelligent Interconnection: Connectivity

3.6.8 WEY Intelligent Interconnection: Suppliers and Partners

3.6.9 WEY Intelligent Interconnection: Business Model

3.6.10 5G Intelligent Connectivity Layout

3.6.11 Cooperated with Baidu on Telematics

3.6.12 Launched “C+ Intelligent Strategy”

3.6.13 Cooperated with JD on Smart Home and Car Delivery

3.6.14 Installation of Telematics Products of Great Wall, 2017Q1-2019Q1

3.6.15 Installation of Haval Interconnection by Province, 2017Q1-2019Q1

3.6.16 Installation of WEY Intelligent Interconnection by Province, 2017Q1-2019Q1

4 Telematics Products of Emerging Chinese Auto Brands

4.1 NIO

4.1.1 Profile

4.1.2 NOMI Vehicle Artificial Intelligence System

4.1.3 Map-based Navigation

4.1.4 Human-Machine Interaction

4.1.5 NIO APP

4.1.6 NIO Service

4.1.7 Suppliers and Partners

4.1.8 “Car Delivery” Layout

4.2 Xiaopeng Motors

4.2.1 Profile

4.2.2 X-mart OS Intelligent System

4.2.3 Xiao P AI-driven Voice Assistant

4.2.4 XPENG APP

4.2.5 XPENG: Map-based Navigation

4.2.6 Alibaba Cloud Bastion Host Information Security Technology

4.2.7 XPENG: Human-Machine Interaction

4.2.8 XPENG: G3 Network Communications

4.2.9 Business Model

4.2.10 “XPENG+” Plan

4.2.11 XPENG Vehicle Application Ecosystem

4.2.12 XPENG: Telematics Suppliers and Partners

4.3 Weltmeister (WM Motor)

4.3.1 Profile

4.3.2 Weltmeister Zhixing App

4.3.3 Weltmeister EX5: Human-Machine Interaction

4.3.4 Weltmeister EX5: Main Parameter & Intelligent Interaction

4.3.5 Weltmeister EX5: Cockpit

4.3.6 Partners

4.3.7 Car-home Interconnection Layout

4.3.8 Ride-hailing Mobility Layout

4.3.9 Pioneer Service Plan

4.4 Byton

4.4.1 Profile

4.4.2 Human-Machine Interaction

4.4.3 Byton APP

4.4.4 Byton Experience

4.4.5 BYTON Life

4.4.6 Business Model

4.5 CHJ Automotive

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...