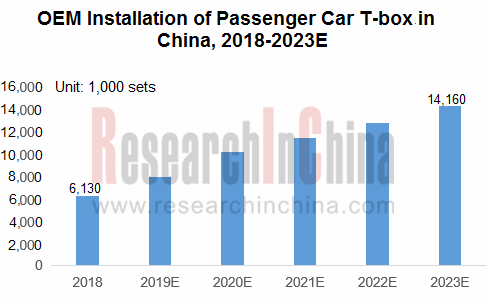

More than 14 Million Passenger Cars will be Equipped with T-Box in China in 2023

In China, passenger car T-Box installation in OEM market reached 6.13 million sets in 2018, before 2.25 million ones were installed in the first four months of 2019, a spurt of 28.9% from the same period of last year; it is predicted that the figure will hit 14.16 million in 2023, according to our Global and China T-BOX Industry Report, 2019.

T-Box (Telematics-Box), also called telematics control unit (TCU), refers to an automotive embedded system installed to control and track vehicles, including GPS unit, external interface electronic processing unit for mobile communications, microcontroller, mobile communication unit and memory. T-Box is able to acquire core vehicle data through communicating with CAN bus to send instructions and information, enabling online applied features from remote monitoring and remote control to safety monitoring & warning and remote diagnosis so that vehicles and telematics service providers (TSP) can be connected.

T-Box will deliver more powerful capabilities. The new-generation T-BOX products are mainly composed of mobile communication unit (4G/5G), C-V2X communication unit, GNSS-based high accuracy positioning module, microprocessor, in-vehicle bus controller and memory. Besides satisfying general needs, T-Box tends to be a connected controller for vehicle-to-cloud platform, vehicle-to-vehicle and vehicle-to-infrastructure communications in real time among all traffic participants. It plays a key role in intelligent connected vehicles and government’s ambition of intelligent transportation system.

In the Chinese passenger car T-Box market, vendors like LG, Continental, Shanghai Changxing Software, Huawei and Flaircomm Microelectronics, are the leading forces.

Continental ships at least 2 million sets of T-Box annually, and over 30 million connected vehicles having used its devices.

The 5G T-BOX being developed by Continental is integrated with not only 4G/5G network access technology but also DSRC and C-V2X communication technologies.

Wuhan Intest Electronic Technology Co., Ltd. (Intest for short), a conventional T-BOX vendor that has supplied passenger car T-BOX for BAIC BJEV, also expanded into the commercial vehicle market in recent years, with more than 40 OEM clients such as Zhongtong Bus, Nanjing Golden Dragon Bus, Beiqi Foton Motor, Geely New Energy Commercial Vehicle Group, Brilliance Renault New Energy Commercial Vehicle and BYD Commercial Vehicle.

Intest projected to develop fifth-generation terminal inBOX5.0 in 2018 as a preparation for the introduction of 5G communication in 2019. The new product will feature inertial navigation based on C-V2X communications, and improved and upgraded technologies like automotive Ethernet, CAN FD and Beidou high accuracy positioning. In response to the intelligent connected vehicle (ICV) development tendency, Intest also has planned development of “smart antenna” products using its inBOX5.0 technology platform, and will launch them on market in the form of usual TCU and smart antenna once they are developed.

Another T-BOX bellwether Flaircomm Microelectronics rolled out Ethernet architecture-based T-BOX 4.0 in March 2019, being featured as follows: computing power of MCU and MPU gets improved significantly; 4G wireless communications are subject to LTE CAT6 and vehicle body wireless communications support 802.11ac & BT 5.0, with ever higher bit rates; capabilities like TMPS and Bluetooth key are added; the latest 100base T1 automotive Ethernet bus becomes available and speed of CAN-FD bus is 16 times faster than the previous ones; AUTOSAR standard of latest version is supported.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...