Global and China Automotive Lightweight (Materials) Industry Report, 2019-2025

-

Nov.2019

- Hard Copy

- USD

$3,400

-

- Pages:123

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZHP101

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

As an effective way to improve dynamic performance, reduce fuel consumption and cut emissions, lightweight holds the trend for automotive sector across the world.

Global automobile lightweight market sustained a CAGR of roughly 10% between 2013 and 2018, being worth approximately RMB1 trillion in 2018. The ever stricter demanding of countries on automobile fuel consumption will help automobile lightweight industry develop steadily, at a CAGR of over 5% from 2019 to 2025.

As a big automobile manufacturer and seller worldwide, China’s automobile lightweight market soared by 8.2% year on year to RMB340 billion (or virtually one-third of the global total) in 2018, which will expectedly show the CAGR of 7%-10% during 2019-2025. As well as a need to ease tight supply of crude oil and environmental pollution, wider use of new energy vehicles also fuels automobile lightweight demand.

Automobiles become lighter by way of using lightweight materials (now the mainstream in market) or advanced process or optimizing structure. Lightweight materials include high-strength steel, aluminum alloys, magnesium alloys and carbon fiber composites. China’s development plan for lightweight technology involves the following: development priorities should be given to ultra high-strength and advanced high-strength steel technologies in the short term, on third-generation automotive steel and aluminum alloy technologies in the midterm and to magnesium alloy and carbon fiber composite technologies in the long run.

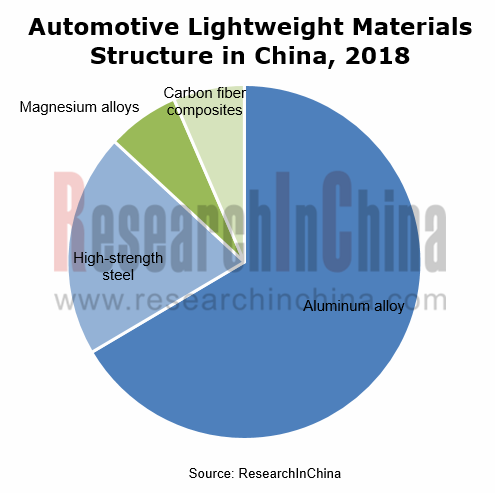

In China, high-strength steel and aluminum alloys currently find the broadest application among automotive lightweight materials. In 2018, they together commanded more than 85% of the Chinese market, of which aluminum alloys with high unit price occupied the most, over 60% in the year.

High-strength steels: mature technology, low production cost, light weight and high safety. In 2018, automotive high-strength steel market was worth RMB68 billion or so, a figure projected to outnumber RMB100 billion in 2025. Major world-renowned manufacturers include: ArcelorMittal, Nippon Steel & Sumitomo Metal (NSSM), SSAB, JFE, ThyssenKrupp and POSCO; in China, key makers are Baosteel, WISCO, Ansteel and Panzhihua Iron & Steel, among which WISCO sweeps 50% shares in the Chinese market.

Aluminum alloys: sizable lightweight effect, reasonable technology roadmap, lower cost, and other merits. Big-name brands already apply a lot of aluminum alloy wheel hubs, aluminum alloy bodies, all-aluminum engines, and aluminum alloy transmission housings in their car models of differing classes. New energy vehicle companies take lightweight as their top priority and often use aluminum alloys, considering that battery, motor and control system add weight. It is predicted that China’s automotive aluminum alloy market will be value at least RMB300 billion in 2025, compared with around RMB225 billion in 2018. More demand for aluminum alloys will be from vehicle body and chassis, and new energy vehicle aluminum alloy battery housings will be a new contributor.

Foreign aluminum alloy manufacturers are typically Ryobi, Ahresty and Georg Fischer, which remain professional and very competitive with large scale; main Chinese companies are Ningbo Xusheng Auto Technology Co., Ltd., Jiangsu Asia-Pacific Light Alloy Technology Co., Ltd. and Guangdong Hongtu Technology (holdings) Co., Ltd.. Generally speaking, Chinese companies are mostly small-sized and scattered, and the market desires to be concentrated with tremendous room for growth.

Magnesium alloys: poor corrosion resistance, flammability, high cost and other demerits. Magnesium alloys are used not so widely as aluminum alloys in automobiles. They are often found in interiors, wheel hubs and powertrains. In 2018, China’s automotive magnesium alloy market was worth about RMB20 billion. As yet, key local producers are comprised of Nanjing Yunhai Special Metals Co., Ltd., Zhejiang Wanfeng Auto Wheel Co., Ltd. and Qinghai Salt Lake Industry Co., Ltd., among which Nanjing Yunhai Special Metals Co., Ltd. leads the market.

Carbon fiber composites: application of carbon fiber composites in automobiles is still in its infancy in China. Such expensive materials are often utilized in racing cars, supercars and other luxury cars, and seldom used in general civilian cars. In 2018, China’s automotive carbon fiber composites market was valued at RMB20 billion. Carbon fiber composites will become increasingly widespread if production cost is lowered as they well outperform steel, magnesium and aluminum in reducing automobile weight.

The following are highlighted in the report:

Automotive lightweight (definition, technology, development opportunities, etc.);

Automotive lightweight (definition, technology, development opportunities, etc.);

Global automotive lightweight industry (scale, status quo in major countries, development trends, etc.);

China automotive lightweight industry (prospects, market size, market structure, development trends, etc.);

China automotive lightweight industry (prospects, market size, market structure, development trends, etc.);

Automotive lightweight materials (high-strength steel, aluminum alloy, magnesium alloy and carbon fiber composites) (application, market size, etc.);

Automotive lightweight materials (high-strength steel, aluminum alloy, magnesium alloy and carbon fiber composites) (application, market size, etc.);

Automotive lightweight (lightweight chassis, body and components) (application, market size, competitive pattern, etc.);

Automotive lightweight (lightweight chassis, body and components) (application, market size, competitive pattern, etc.);

12 aluminum alloy manufacturers, 4 high-strength steel makers, 4 carbon fiber composites producers and 4 magnesium alloy manufacturers (operation, lightweight material business, etc.).

12 aluminum alloy manufacturers, 4 high-strength steel makers, 4 carbon fiber composites producers and 4 magnesium alloy manufacturers (operation, lightweight material business, etc.).

1. Automotive Lightweight

1.1 Definition

1.2 Technologies

1.3 Development Opportunities

2. Global Automotive Lightweight Industry

2.1 Industry Analysis

2.2 Development in Major Countries

2.2.1 USA

2.2.2 Japan

2.3 Development Tendencies

3. China Automotive Lightweight Industry

3.1 Development Environment

3.1.1 Economy

3.1.2 Policy

3.2 Market Situation

3.3 Competitive Landscape

3.4 Development Trends

4. Automotive Lightweight Materials

4.1 High Strength Steel Sheet

4.1.1 Use in Automotive Lightweight

4.1.2 Market Size of High Strength Sheets for Automobiles

4.2 Aluminum Alloy

4.2.1 Use in Automotive Lightweight

4.2.2 Market Size of Aluminum Alloys for Automobiles

4.3 Magnesium Alloy

4.3.1 Use in Automotive Lightweight

4.3.2 Market Size of Magnesium Alloys for Automobiles

4.4 Carbon Fiber Composites

4.4.1 Use in Automotive Lightweight

4.4.2 Market Size of Carbon Fiber Composites

4.4.3 Market Size of Carbon Fiber Composites for Automobiles

5. Automotive Lightweight Application

5.1 Lightweight of Chassis

5.1.1 Chassis Lightweight Process

5.1.2 Penetration of Aluminum Alloy Chassis

5.1.3 Aluminum Alloy Chassis Market Size

5.1.4 Competitive Pattern of Aluminum Alloy Chassis Market

5.2 Lightweight of Vehicle Body

5.3 Lightweight of Parts

6. Aluminum Material Manufacturers

6.1 Ningbo Xusheng Auto Technology Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Aluminum Material Business

6.1.4 Development Strategy

6.2 Guangdong Hongtu Technology (Holdings) Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Aluminum Material Business

6.3 Guangdong PaiSheng Intelligent Technology Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Aluminum Material Business

6.4 Dongguan Eontec Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Aluminum Material Business

6.5 Guangdong Wencan Die Casting Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Aluminum Material Business

6.6 IKD Co., Ltd.

6.6.1 Profile

6.6.2 Operation

6.6.3 Aluminum Material Business

6.7 Zhejiang VIE Science & Technology Co., Ltd.

6.7.1 Profile

6.7.2 Operation

6.7.3 Aluminum Material Business

6.8 Bethel Automotive Safety Systems Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.8.3 Aluminum Material Business

6.9 Saint Jean

6.9.1 Profile

6.9.2 Operation

6.9.3 Aluminum Material Business

6.10 Ryobi

6.10.1 Profile

6.10.2 Operation

6.10.3 Aluminum Material Business

6.11 Ahresty

6.11.1 Profile

6.11.2 Operation

6.11.3 Aluminum Material Business

6.12 Georg Fischer

6.12.1 Profile

6.12.2 Operation

6.12.3 Aluminum Material Business

7. High Strength Steel Manufacturers

7.1 Baoshan Iron & Steel Co., Ltd. (Baosteel)

7.1.1 Profile

7.1.2 Operation

7.1.3 High Strength Steel Business

7.2 Wuhan Iron & Steel Co., Ltd. (WISCO)

7.2.1 Profile

7.2.2 Operation

7.2.3 High Strength Steel Business

7.3 Nippon Steel Corporation

7.3.1 Profile

7.3.2 Operation

7.3.3 High Strength Steel Business

7.4 SSAB

8. Carbon Fiber Composite Manufacturers

8.1 Toray

8.1.1 Profile

8.1.2 Operation

8.1.3 Carbon Fiber Business

8.1.4 Business in China

8.2 Teijin

8.2.1 Profile

8.2.2 Operation

8.2.3 Carbon Fiber Business

8.2.4 Business in China

8.3 Jiangsu Hengshen

8.3.1 Profile

8.3.2 Operation

8.3.3 Customers and Suppliers

8.3.4 Carbon Fiber Business

8.4 Jilin Tangu Carbon Fiber

8.4.1 Profile

8.4.2 Operation

8.4.3 Customers and Suppliers

8.4.4 Carbon Fiber Business

9. Magnesium Alloy Manufacturers

9.1 Zhejiang Wanfeng Auto Wheel Co., Ltd.

9.1.1 Profile

9.1.2 Operation

9.1.3 Magnesium Alloy Business

9.2 Chongqing Boao Magnesium & Aluminum Manufacturing Co., Ltd.

9.2.1 Profile

9.2.2 Magnesium Alloy Business

9.3 Nanjing Yunhai Special Metals Co., Ltd.

9.3.1 Profile

9.3.2 Magnesium Alloy Business

9.4 Dewei Co.,Ltd.

9.4.1 Profile

9.4.2 Operation

Ways for Automotive Lightweight

Major Technologies Enabling Automotive Lightweight

European Technology Roadmap for Automotive Lightweight

China’s Technology Roadmap for Automotive Lightweight

Proportion of Passenger Car Weight Reduction and Energy Efficiency Improvement

Oil Consumption Limit of ICE-Vehicle in China, America, Japan and Europe, 2015/2020/2025

Global Automotive Lightweight Market Size, 2015-2025E

China’s Policy on Oil Consumption of Passenger Cars

Changes in China’s Subsidy Policy, 2017-2019

Endurance Mileage of New Energy Vehicle in China, 2017-2018

China’s Goals for Automotive Lightweight, 2020/2025E

Automobile Sales Volume in China, 2005-2019

China Passenger Car Lightweight Market Size, 2017-2025E

China Passenger Car Lightweight Market Structure, 2018/2025E

China’s Import and Export of Magnesium Alloy, 1992-2018

Examples of Lightweight CFRP Automotive Parts

Carbon Fiber Application Cases and Suppliers of Global Automakers

Expansion of Major Global Carbon Fiber Producers in Automobile Industry, 2011-2019

Cases of Carbon Fiber Applied in Automotive Field

Effect of Mass Reduction after the Use of Magnesium Alloy in Auto Parts

Marketing Network of Ningbo Xusheng Auto Technology

Revenue and Net Income of Ningbo Xusheng Auto Technology, 2015-2019

Revenue Structure (by Business) of Ningbo Xusheng Auto Technology, 2017-2018

Revenue Structure (by Region) of Ningbo Xusheng Auto Technology, 2017-2018

Customer Structure of Ningbo Xusheng Auto Technology, 2018

Gross Margin of Ningbo Xusheng Auto Technology, 2013-2018

Aluminum Castings of Ningbo Xusheng Auto Technology

Average Value of Xusheng Auto Technology’s Supplies for Every Tesla Car, 2014-2018

Ningbo Xusheng Auto Technology’s Deposit from Tesla, 2013-2018

Ningbo Xusheng Auto Technology’s Manufacturing Capacity of Components for Automakers, 2018

Capacities under Construction of Ningbo Xusheng Auto Technology, 2019

Revenue and Net Income of Guangdong Hongtu Technology (Holdings), 2015-2019

Revenue and Net Income of Guangdong PaiSheng Intelligent Technology, 2015-2019

Revenue and Net Income of Dongguan Eontec, 2015-2019

Revenue and Net Income of Guangdong Wencan Die Casting, 2015-2019

Revenue and Net Income of IKD, 2015-2019

Revenue and Net Income of Zhejiang VIE Science & Technology, 2015-2019

Revenue and Net Income of Bethel Automotive Safety Systems, 2015-2019

Revenue and Net Income of Saint Jean, 2018

Revenue (by Region) of Ryobi, 2018

Main Operations of Ryobi

Revenue and Net Income of Ahresty, 2018

Revenue and Net Income of Georg Fischer, 2018

Revenue and Net Income of Baoshan Iron & Steel, 2015-2019

Revenue and Net Income of Wuhan Iron & Steel, 2015-2019

Global Layout of Toray

Revenue and Net Income of Toray, FY2010-FY2018

Revenue Structure of Toray by Division, FY2017-FY2018

Revenue of Toray by Region, FY2017-FY2018

Net Sales and Operating Income of Toray's Carbon Fiber Division, FY2010-FY2018

Revenue Structure of Toray's Carbon Fiber Division by Application, FY2012-FY2018

Carbon Fiber-related Investment Projects of Toray, FY2017-FY2018

Progress of Toray's GR Projects

Toray’s Companies in China

Global Presence of Teijin

Revenue and Net Income of Teijin, FY2010-FY2018

Revenue Structure of Teijin by Division, FY2017-FY2018

Key Products of Material Business Group

Revenue of Teijin’s Material Business Group, FY2016-FY2018

Revenue Structure of Teijin by Region, FY2018

Revenue and Net Income of Jiangsu Hengshen, 2013-2018

Revenue Structure of Jiangsu Hengshen by Product, 2013-2018

Revenue from Top 5 Customers and % of Total Revenue of Jiangsu Hengshen, 2013-2018

Procurement from Top 5 Suppliers and % of Total Procurement of Jiangsu Hengshen, 2013-2018

Revenue and Net Income of Jilin Tangu Carbon Fiber, 2013-2018

Carbon Fiber Precursor Sales Volume of Jilin Tangu Carbon Fiber, 2013-2018

Revenue and Net Income of Zhejiang Wanfeng Auto Wheel, 2015-2019

Revenue and Net Income of Nanjing Yunhai Special Metals, 2015-2019

Revenue and Net Income of Dewei, 2015-2019

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...