Global and China Cluster and Center Console Industry Report, 2019-2020

-

Dec.2019

- Hard Copy

- USD

$3,600

-

- Pages:260

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

CYH090

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

As automotive electronics technology advances, cluster and center console are evolving. In an era of intelligent connected vehicles, full LCD clusters will be mainstream automotive instrument products in future. They tend to become available to entry-level models, not just being found in high-class vehicles.

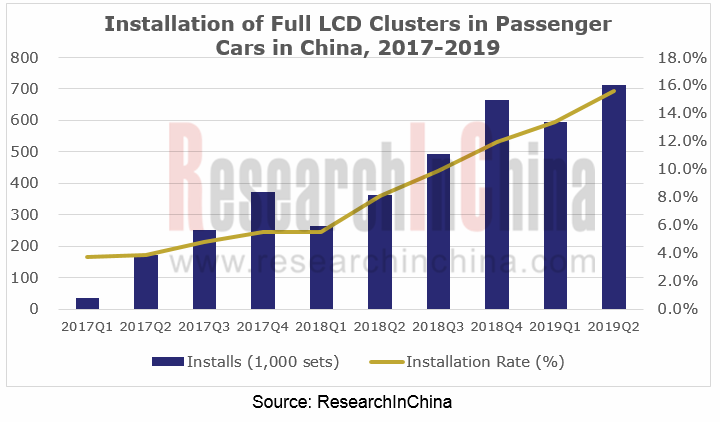

In the first half of 2019, 1,307,900 sets of full LCD clusters were installed in passenger cars in China, a like-on-like spurt of 108.5%, with installation rate jumping from 5.2% in early 2018 to 15.0% in June 2019. It is predicted that installation rate of full LCD clusters will be 35% in 2025.

In recent years, 3D clusters have come to the fore in automotive instrument deployments of players, including leading cockpit electronics suppliers like Continental and Visteon. The Natural 3D Lightfield Instrument Cluster, co-developed by Continental and a Silicon Valley company Leia Inc., will be spawned in 2022. Visteon has developed two 3D clusters: one is 3D technology for high-end models; the other is a multi-layer 3D technology, more applicable to low- and mid-end models. New PEUGEOT 208 (2019) carries Visteon’s new 3D clusters which offer real, visual 3D content and allow for higher level of interaction.

Personalized, highly customized profiled clusters (including curved ones) are a megatrend for automotive instrument cluster design. Examples include a high-tech, sleek-framed 16.8-inch curved dashboard mounted on the latest Porsche Taycan 2019 and displaying clear information, and a high performance custom-made curved dashboard rolled out by MTA, an Italian electronics supplier, in December 2019.

Intelligence tendency will fuel enthusiasm for dual or triple siamesed display design. Following Mercedes-Benz’s launch of dual siamesed display design that provides luxury experience for users, more automakers choose to employ such high-tech, more practical center console solutions in their models like: full range of Hongqi HS5 2019 with standard dual 12.3-inch siamesed displays; latest Changan CS75 PLUS packing an immersive dual 12.3-inch siamesed display; ENOVATE ME7 with a 12.3-inch LCD dashboard, a 15.6-inch center console and a 12.3-inch entertainment display at the copilot’s seat; and GAC NE Aion LX featuring dual curved screen design.

World-renowned automotive display suppliers like JDI, LGD, BOE and AU Optronics all invest more in research and development of display technology in their efforts to commercialize and spawn automotive OLED displays. At the same time, the breakthroughs in Mini Led and Micro LED technologies that may become the next-generation automotive display technologies, will make more display options a possibility.

Global and China Cluster & Center Console Industry Report, 2019-2020 highlights the following:

Global and China cluster market (size, configuration, full LCD cluster installation, automakers’ deployments, and development trends);

Global and China cluster market (size, configuration, full LCD cluster installation, automakers’ deployments, and development trends);

Global and China center console market (size, installation, and development trends);

Global and China center console market (size, installation, and development trends);

Global and China display market (size, shipments, enterprise pattern and development trends);

Global and China display market (size, shipments, enterprise pattern and development trends);

16 global and Chinese suppliers of cluster & center consoles solutions (operation, cluster & center console deployments, development plan, etc.);

16 global and Chinese suppliers of cluster & center consoles solutions (operation, cluster & center console deployments, development plan, etc.);

11 global and Chinese display suppliers (operation, automotive display deployments, new products, development trends, etc.).

11 global and Chinese display suppliers (operation, automotive display deployments, new products, development trends, etc.).

1 Overview of Cluster and Display

1.1 Cluster

1.1.1 Introduction

1.1.2 Information Display

1.1.3 Classification

1.1.4 Development Course

1.1.5 Assembly

1.1.6 Industry Chain Map

1.2 Center Console

1.2.1 Platform

1.2.2 Classification

1.2.3 Industry Chain Map

1.3 Display Technology

1.3.1 Classification of Automotive Display

1.3.2 Classification of Display Technology

1.3.3 Classification of Cluster Display

1.3.4 TFT-LCD Display

1.3.5 AMOLED Display

1.3.6 Mini LED Display

1.3.7 Micro LED Display

2 Cluster Configuration and Market Trends

2.1 Global

2.1.1 Market Size

2.1.2 Shipments

2.2 China

2.2.1 Installs of Passenger Car Clusters by Type in China, 2017-2019

2.2.2 Installation of Passenger Car Clusters by Size in China, 2017-2019

2.2.3 Installs of Passenger Car Full LCD Clusters in China, 2017-2019

2.2.4 China Automaker TOP20 by Installation of Passenger Car Full LCD Cluster, 2019H1

2.2.5 Full LCD Clusters Make Their Way into Entry-level Models from High-end Ones

2.3 Competitive Pattern of Companies

2.3.1 Major Global Cluster Suppliers

2.3.2 Main Dashboard Suppliers and Their Shares in Japanese Automobile Market

2.3.3 Development of Full LCD Cluster Business of Main Custer Suppliers in China

2.4 Typical Clusters of OEMs

2.4.1 Audi 12.3-inch Full LCD Digital Cluster

2.4.2 3D Holographic Cluster Mounted on New Peugeot Models

2.4.3 Hyundai 12.3-inch 3D Cluster

2.4.4 McLAREN Speedtail 2020

2.4.5 Continental Natural 3D Lightfield Instrument Cluster

2.4.6 Ford Explorer 2020 Adds “Calm Screen” Mode

2.4.7 SAIC Roewe 12.3-inch AR Full Virtual Cluster

2.5 Development Trends

2.5.1 Installation of Full LCD Clusters is on the Rise

2.5.2 More 3D Cluster Deployments are Being Made

2.5.3 There are More and More Siamesed, Connected Center Console Products

2.5.4 Consumable Profiled Clusters

3 Center Console Installation and Market Trends

3.1 Global Center Console Market Size

3.2 Global Center Console Shipments

3.3 Installation Rate of Passenger Car Center Console in China, 2017-2019

3.4 Horizontal Center Consoles Outshine Vertical Ones and Prevail in Market

3.5 Passenger Car Center Console Market Structure by Size in China, 2017-2019

3.6 More Models Carry Large-size Center Consoles

3.7 A Growing Number of Models Pack 20-inch-above Displays

3.7.1 Hyundai Azera 30-inch Display System

3.7.2 Dorcen G60S 26-inch Siamesed Display

3.7.3 Mercedes-Benz Dual 12.5-inch HD Display

3.7.4 Changan CS75 PLUS Immersive IMAXS Dual Siamesed Display

3.7.5 Porsche Taycan 16.8-inch Curved Dashboard

3.8 Multi-screen Trend

3.8.1 Audi 7-screen Interaction

3.8.2 BMW X7 5-screen Interaction

3.8.3 ENOVATE ME7 5-screen Interaction

3.8.4 HOZON U 5-screen Interaction

4 Automotive Display Development Trends

4.1 Global Automotive Display Shipments

4.2 Automotive Display Shipment Structure by Market Segment

4.3 Installations of OEM Passenger Car Display in China (by Purpose), 2019

4.4 Installation Rate of Passenger Car Displays in China (by Type), 2019

4.5 Market Shares of Major Global Automotive Display Vendors, 2018

4.6 Global Automotive Display Market Share, 2019

4.7 Major Automotive Display Suppliers in China, 2019

4.8 Global Vendors Invest in New Fields such as MiniLED

4.9 OLED Display /AMOLED Display

4.9.1 Audi’s OLED Interface

4.9.2 HOZON U Equipped with AMOLED Non-Blind Zone Visualization Transparent Pillar A

4.9.3 Cadillac Concept Car: OLED Front and Rear Lamps + OLED Dashboard + OLED Center Console

4.10 Curved Polymorphic Display

4.10.1 Curved Polymorphic Display of Visteon and Bosch

4.10.2 Automotive Curved Console Display of KURZ & POLYIC

4.10.3 Roewe RX5 MAX Curved Display

4.10.4 33.1-inch Curved Display of Nissan Concept Car

4.10.5 Wraparound Display of Audi Concept Car

4.11 3D Display

4.12 Shaped Display

4.13 Automotive Mini LED Display Solution Layout and Trends

4.14 Automotive Micro LED Display Solutions

4.15 Quick Response Technology

4.16 Ultra-narrow Bezel Display Technology

5 Global Center Console System Solution Providers

5.1 Continental

5.1.1 Profile

5.1.2 Business Divisions

5.1.3 Continental Automotive Group

5.1.4 Automotive Interior Business

5.1.5 Global Cluster Market Share

5.1.6 Major Clusters

5.1.7 Display Solutions

5.1.8 AMOLED Clusters

5.1.9 Natural 3D Lightfield Instrument Cluster

5.1.10 Intelligent Connected Cloud Cluster

5.1.11 3D Display and Curved OLED Seamless Coast-to-coast Display Technology

5.1.12 Development in China

5.2 Nippon Seiki

5.2.1 Profile

5.2.2 Revenue and Operating Income

5.2.3 New Capacity Expansion Projects Including Cluster

5.2.4 Major Models Supported by Nippon Seiki Clusters, 2018-2019

5.2.5 DMS Integrated Cluster

5.2.6 Clusters for Major Models

5.2.7 OLED Display

5.2.8 Shanghai Nissei Display System Co., Ltd.

5.3 Denso

5.3.1 Profile

5.3.2 Sales (by Product / by Customer)

5.3.3 Cluster Production Bases

5.3.4 Major Models Supported by Denso Clusters

5.3.5 Driver Monitors

5.3.6 Dual Curved OLED Display

5.3.7 Development in China

5.4 Visteon

5.4.1 Profile

5.4.2 Major Customers

5.4.3 Revenue from Clusters and Displays

5.4.4 Ordered Products and Customer Distribution, 2019H1

5.4.5 DICore

5.4.6 Sensor-UX Display

5.4.7 SmartCore

5.4.8 3D C and Curved Display

5.4.9 Future Cockpits

5.4.10 The First Holographic Digital Dashboard for Peugeot

5.4.11 SmartCore? Cockpit Domain Controller

5.4.12 Performance in China, 2019H1

5.4.13 Progress in Cockpit Electronics

5.5 Marelli

5.5.1 Profile

5.5.2 Main Models Supported by Marelli Clusters and Displays in 2018

5.5.3 3D Digital Clusters and Natural 3D Lightfield Clusters

5.5.4 Intelligent Cockpit Controllers

5.5.5 Janus Multi-display Electric Cockpit with HyperVisor

5.6 Bosch

5.6.1 Profile

5.6.2 Car Multimedia Division

5.6.3 Major Clusters

5.6.4 Cluster Structure of Audi TT and BMW I8

5.6.5 The First Curved Dashboard for New Volkswagen Touareg

5.6.6 Natural 3D Lightfield Display

5.6.7 Bosch Future Cabin (Shanghai) Technology Center’s Deployment in Smart Cockpit

5.7 Yazaki

5.7.1 Profile

5.7.2 Operation

5.7.3 Major Products

5.7.4 Cluster and Display Business

5.8 Faurecia

5.8.1 Profile

5.8.2 Automotive Electronics Product Lines

5.8.3 Performance in H1 2019

5.8.4 Next-generation Platform

5.8.5 Future Cockpit

5.8.6 Future Cockpit Strategy

5.9 Desay SV

5.9.1 Profile

5.9.2 Revenue

5.9.3 Progress of New Products

5.9.4 Full LCD Cluster Business

5.9.5 Smart Cockpit

5.9.6 Desay SV and Synopsys Collaborate on Virtual Cockpit

5.9.7 Four-screen Smart Cockpit Order from CHJ Automotive and Lixiang ONE

5.9.8 Five-screen Interaction of Dearcc ENOVATE ME7

5.9.9 The 2025 "SMART" Strategy

5.10 Foryou General Electronics

5.10.1 Profile

5.10.2 Automotive Electronic Product Lines

5.10.3 Next-generation Smart Cockpit

5.10.4 ClusterDA Integrates Clusters and Infotainment Systems

5.10.5 Suspended Intelligent Rotary Screen - One-touch Switching between Portrait and Landscape

5.10.6 Next-generation Automotive Chip - Holographic i.MX8 & 3D Enabling Multi-screen Display

5.11 AutoIO Technology

5.11.1 Profile

5.11.2 Full LCD Clusters

5.11.3 Full LCD Clusters and the Models Supported

5.11.4 Automotive Intelligent Operating Platform - AutoIO OS

5.12 Autorock

5.12.1 Profile

5.12.2 Major Clusters

5.12.3 Dual 12.3-inch Full-laminated LCD Clusters

5.13 HSAE

5.13.1 Profile

5.13.2 Smart Cockpit Layout

5.14 ITAS

5.14.1 Profile

5.14.2 Dual 12.3-inch Siamesed Full LCD Clusters

5.14.3 Commercial Vehicle 12.3-inch Full LCD Clusters

5.15 Willing

5.15.1 Profile

5.15.2 Development Plan

5.15.3 Clusters

5.16 Vikeer

5.16.1 Status Quo

6 Global Automotive Display Suppliers

6.1 JDI

6.1.1 Profile

6.1.2 Business Layout

6.1.3 Global Presence and Production Bases

6.1.4 Operation

6.1.5 Automotive Display Business

6.1.6 Automotive Cockpit with Multiple Displays

6.2 LGD

6.2.1 Profile

6.2.2 Revenue

6.2.3 Display Products Shipments and Capacity

6.2.4 Automotive Display Business

6.2.5 Automotive Display Product Line

6.2.6 FHD 3D Digital Instrument Cluster

6.2.7 Curved Display with High-Freedom P-OLED Technology

6.3 Tianma Micro-electronics

6.3.1 Profile

6.3.2 Revenue

6.3.3 Automotive Display Layout

6.3.4 Luxury Car Simulation Smart Cockpit - Car Simulator at the 2019 SID

6.3.5 13.3-inch TED Automotive Display and 12.3-inch a-Si Automotive Profiled Display

6.3.6 Other Automotive Display Products at the 2019 SID

6.3.7 5.99-inch Flexible Automotive Foldable WQHD AMOLED Display

6.4 BOE

6.4.1 Profile

6.4.2 Revenue

6.4.3 Display Panel Production Lines and Capacity Distribution

6.4.4 Smart Automotive Business

6.4.5 Automotive Display Products

6.4.6 Smart Infotainment Terminals

6.4.7 Smart Cockpit Automotive Display Solutions

6.4.8 "Free Spirit" Display and "Sound with Rhythm" Smart Speaker

6.5 SDC

6.5.1 Profile

6.5.2 Automotive Display Business

6.5.3 SDC Audi e-Tron Rearview Mirror OLED Screen and Digital Cockpit

6.5.4 S QD-OLED Display Layout

6.6 AUO

6.6.1 Profile

6.6.2 Revenue

6.6.3 Display Shipments

6.6.4 Automotive Display Layout

6.6.5 Automotive Display Products

6.6.6 V-shaped Curved Cockpit Display and Micro LED Automotive Display

6.7 Innolux

6.7.1 Profile

6.7.2 Automotive Display Layout

6.7.3 Automotive Display Products

6.7.4 AM mini LED Panel for Vehicle

6.7.5 50-inch Multi-curved Automotive Display

6.8 Visionox

6.8.1 Profile

6.8.2 Operation

6.8.3 Automotive Display Products

6.8.4 Conceptual Automotive Application of AMOLED Flexible Screen -- Infinite ∞Multi-screen Interaction

6.8.5 "Transparent" Pillar-A Flexible Display

6.9 Other Companies

6.9.1 Automotive Display Layout of CSOT

6.9.2 Automotive Display Layout of CPT Technology

6.9.3 Automotive Display Layout of HannStar

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...