Global and China Intelligent Cockpit Platform for Automobiles Industry Report, 2020

Cockpit electronic system refers to a complete set of system composed of center console, full LCD dashboard, HUD, rear seat entertainment system, smart audio, telematics module, streaming media rearview mirror and telematics system.

Based on cockpit domain controller, intelligent cockpit system as a foundation of human-car interaction and V2X, provides intelligent interaction, intelligent scenarios and personalized services beyond capabilities of a cockpit electronic system, through a unified software and hardware platform.

Intelligent cockpit platform is a software and hardware architecture enabling sub-systems and features of a smart cockpit. It consists of hardware and software parts: hardware part is a hardware platform comprised of domain controllers and chips; software part refers to a software platform built by operating system, Hypervisor, middleware and support tools.

With advances in technologies about chip, software, among others, one-core multi-screen multi-system integrated cockpit platform as a way to integrate systems, cut costs and meet needs for multi-screen interconnection, intelligent interaction and intelligent driving capabilities that an usual cockpit cannot provide, becomes a mainstay in next-generation cockpit.

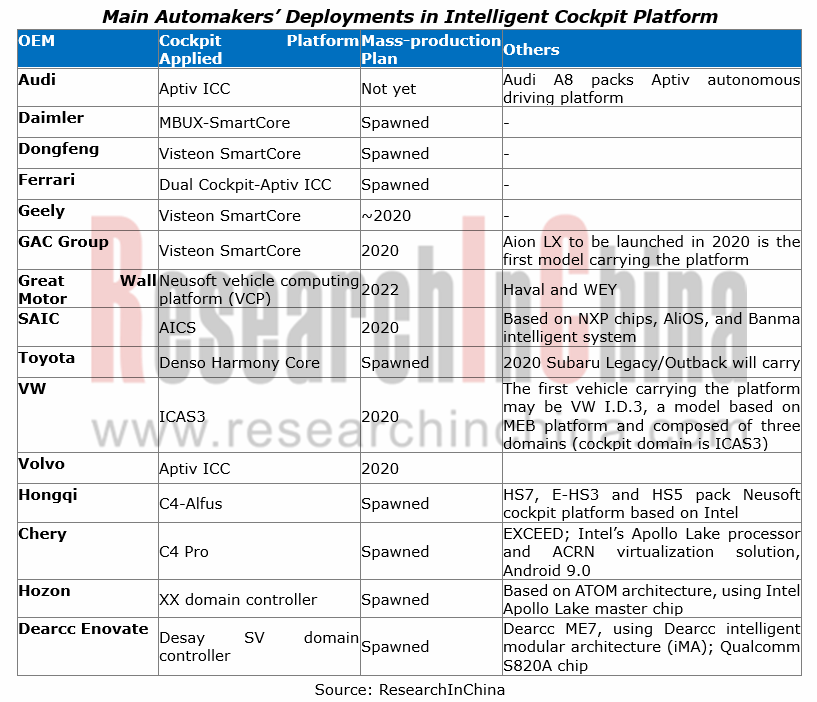

Quite a few automakers have set about deploying smart cockpit system. Some already equip the system on their production vehicles. Examples include MBUX system mounted on 2018 Mercedes-Benz A Class, and C4-Alfus 2.0 and C4-Pro, two domain controller-based cockpit platforms co-developed by Neusoft and Intel and installed in 2019 models like Hongqi HS7 and EXCEED LX.

At CES 2020, Land Rover unveiled New Defender 90 and 110, the first ever vehicles to feature dual-modem, dual eSIM design for enhanced connectivity and functionality. Powered by the Qualcomm Snapdragon S820Am Automotive Platform with the integrated Snapdragon X12 LTE Modem, the New Defender can download Software-Over-The-Air (SOTA) updates without interruption and while streaming music and apps through the vehicle’s new Pivi Pro infotainment system. The New Defender is also the first Land Rover vehicle to include a domain controller that consolidates a number of Advanced Driver Assistance Systems (ADAS) and driver convenience functions built on top of the QNX Hypervisor.

Intelligent cockpit hardware platform tends to be a fusion of more and more sub-systems and capabilities. How to well manage these sub-systems and functions rests with the upgrading of cockpit processor and smart cockpit software platform.

Smart cockpit hardware platform becomes ever more powerful in the process of integration

As the base of an intelligent cockpit hardware platform, cockpit domain controller integrated with multiple electronic control units (ECU) outperforms others in safety, size, power consumption, weight and cost, enabling seamless human-machine interaction in combination with interaction ecosystem.

All automotive system integrators are stepping up their efforts to deploy smart cockpit platform. Among them, Tier1 suppliers like Visteon, Aptiv, Neusoft and Desay SV have spawned intelligent cockpit platforms; Continental, Panasonic, Bosch, Samsung, Huawei and so forth have also rolled out their new-generation intelligent cockpit platforms. In the forthcoming years, competition in cockpit platform field will prick up.

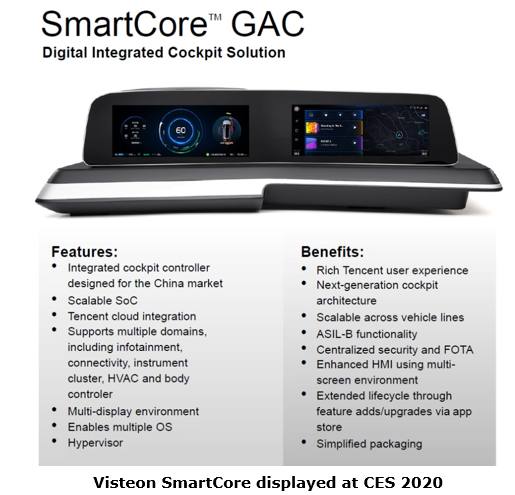

Visteon currently leads the intelligent cockpit domain controller industry. Visteon SmartCore has found massive application in Mercedes-Benz MBUX system early in 2018. At CES 2020, Visteon showcased its newest SmartCore?, an intelligent cockpit platform which is integrated with the Tencent Auto Intelligence (TAI) system and first available to GAC Aion LX, a new BEV model to be launched in 2020. Moreover, Dongfeng and Geely are also partners of Visteon.

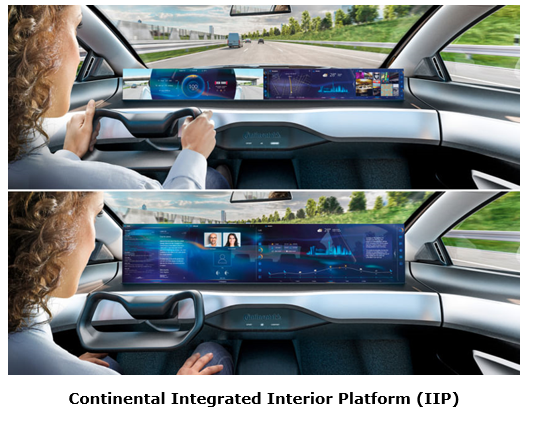

At the IAA 2019 in Frankfurt, Continental showcased the latest version of its Integrated Interior Platform (IIP), a new scalable cockpit platform favoring operating systems like QNX, Integrity, and Android. Continental plans to mass-produce the solution in 2021.

At CES 2020, Samsung Electronics unveiled Digital Cockpit 2020, which utilizes 5G to link features inside and outside the vehicle and provide connected experiences for drivers and passengers alike. Digital Cockpit 2020 is the third co-development between Samsung Electronics and Harman International, and combines Samsung’s telecommunications technologies, semiconductors and displays with HARMAN’s automotive expertise. Digital Cockpit 2020 incorporates eight displays inside the vehicle, as well as eight cameras. The solution utilizes Samsung Exynos Auto V9 SoC (System on Chip), a semiconductor for vehicle electronics, and Android 10, which allow for several features to be run at the same time. Besides, Samsung’s integrated IoT platform SmartThings can work in tandem with the revamped “Bixby in the car” to enhance connectivity by allowing the vehicle to actively communicate with the driver. Once the driver logs in using either facial recognition or a smartphone fingerprint reader, the Center Information Display can be used to show the driver’s schedule and a range of other information. Unlike the 2019 Digital Cockpit, the 2020 solution allows for connections to be made wirelessly.

Panasonic Automotive revealed its latest fully connected eCockpit concept at CES 2020. The technology platform integrates Panasonic’s proprietary SkipGen 3.0 in-vehicle infotainment (IVI) system with Google’s Android Automotive OS running on Android 10. In the concept vehicle, SkipGen 3.0 is paired with the next generation cockpit domain controller, SPYDR 3.0. At the core, the single brain SPYDR 3.0 acts as a hypervisor and is capable of driving up to eleven displays.

As the kernel of cockpit domain controllers, cockpit processors are mainly supplied by Qualcomm, NXP, Intel, Renesas, Texas Instruments, NVIDIA, Allwinner, Samsung, MediaTek, Horizon Robotics, etc. Among them, Qualcomm, Intel and Renesas are the most competitive market players by virtue of their bombshells -- Qualcomm 820a / 835A, Intel A3900 and Renesas R-Car H3 / M3. The major processor chips differ in fabrication processes, cores, and especially GPU computing power which determines the infrastructure level of the cockpit hardware platform.

Software platform becomes the focus of differentiation; Cockpit will be defined by software in future

In intelligent cockpit software platform, hypervisor and vehicle operating system are the most important components. Hypervisor allows multiple operating systems and applications to share hardware as a middle software layer that runs between the underlying physical server and the operating system.

The prevailing automotive operating systems embrace QNX, Linux, Android, AliOS, etc., each of which has merits and demerits. Among them, QNX dominates the automotive cluster system market with high security; the open-source Linux has become the underlying system of custom-made operating systems; Android and AliOS are increasingly used by IVI systems due to rich application ecosystem.

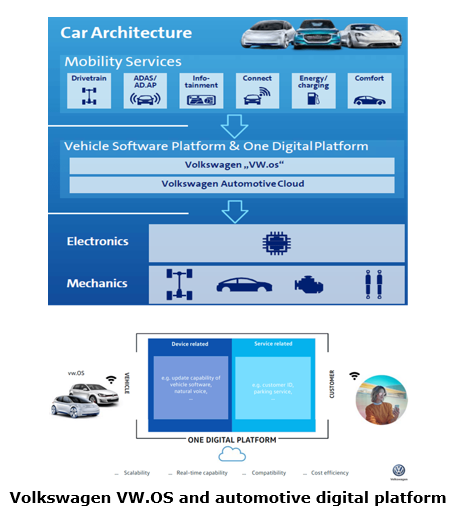

Under the software-defined car trend, operating system is crucial to the intelligent connectivity layout of automakers, and the focus of the emerging system integrators’ deployments. Tesla's self-developed operating system made a success. In 2019, Volkswagen announced to lavish huge on R&D of VW.OS. Several Chinese emerging automakers follow Tesla to develop operating systems by themselves. Yet, all Japanese automakers support AGL in which China-based SITECH also joined.

Also, the new suppliers such as Huawei, ZTE, Alibaba and Baidu have rolled out self-developed operating systems successively. In the future, there will be cut-throat competition in the automotive operating system market. At length, only two or three mainstream operating systems may survive. In fact, there are three mainstream cockpit operating systems for automakers: QNX, Android, and Linux (AGL).

Due to high requirements on safety, most clusters apply QNX. IVI, co-pilot entertainment and rear seat entertainment systems mostly make use of Android. Chinese brands like Geely, Changan, BYD, Dongfeng, Great Wall Motor and GAC are all based on Android, while SAIC prefers AliOS. Audi launched Android-based MIB3 system in 2019. BMW is extending the reach of seamless connectivity in its vehicles with the introduction of Android Auto? starting in mid-2020.

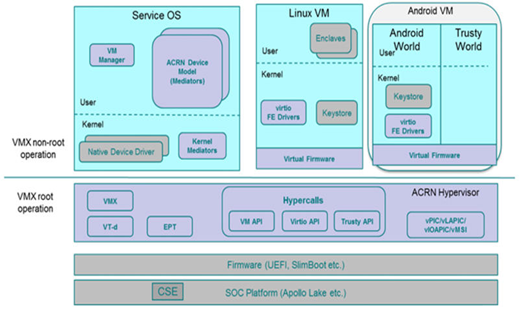

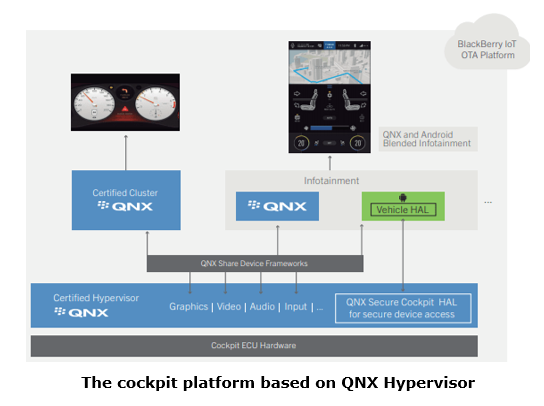

Because intelligent cockpit supports multiple operating systems such as QNX, Android and Linux simultaneously, hypervisors running directly on physical hardware have been widely used. As an intermediate software layer, hypervisors allow operating systems and applications to share hardware. Hypervisors not only coordinate access to hardware, but also impose protection between virtual machines. Common hypervisors include QNX Hypervisor, ACRN, COQOS Hypervisor, PikeOS, and Harman Device Virtualization.

QNX Hypervisor 2.0 uses BlackBerry’s 64-bit embedded operating system QNX SDP 7.0, allowing developers to unify multiple operating systems to a single computing platform or SoC chip. Operating systems such as QNX Neutrino, Linux, and Android are supported on BlackBerry QNX Hypervisor 2.0. The cockpit platforms of Visteon, Denso, Marelli, WM Motor, etc., unexceptionally render QNX Hypervisor.

Global and China Intelligent Cockpit Platform for Automobile Industry Report, 2020 highlights the followings:

Definition, status quo, industry chain and trends of automotive intelligent cockpit platforms;

Definition, status quo, industry chain and trends of automotive intelligent cockpit platforms;

Comparison between automotive intelligent cockpit platform solutions, OEM cockpit platform solution layout;

Comparison between automotive intelligent cockpit platform solutions, OEM cockpit platform solution layout;

Status quo and trends of intelligent cockpit platforms, domain controller market size forecast, typical cockpit hardware platform domain controller solutions and their customers;

Status quo and trends of intelligent cockpit platforms, domain controller market size forecast, typical cockpit hardware platform domain controller solutions and their customers;

Major intelligent cockpit hardware platform vendors (Visteon, Panasonic, Continental, Aptiv, etc.) and product layout;

Major intelligent cockpit hardware platform vendors (Visteon, Panasonic, Continental, Aptiv, etc.) and product layout;

Applied cases of intelligent cockpit hardware platform (Tesla, Mercedes-Benz, Land Rover, etc.);

Applied cases of intelligent cockpit hardware platform (Tesla, Mercedes-Benz, Land Rover, etc.);

Comparison between intelligent cockpit processors. Major cockpit processor vendors (Qualcomm, Intel, NXP, Samsung, Allwinner, Horizon Robotics) and product development;

Comparison between intelligent cockpit processors. Major cockpit processor vendors (Qualcomm, Intel, NXP, Samsung, Allwinner, Horizon Robotics) and product development;

Composition and trends of major intelligent cockpit software platforms;

Composition and trends of major intelligent cockpit software platforms;

Status quo of automotive operating systems, underlying OS market share, major automotive operating system vendors and product development;

Status quo of automotive operating systems, underlying OS market share, major automotive operating system vendors and product development;

Intelligent cockpit software platform virtualization technology (Hypervisor) layout;

Intelligent cockpit software platform virtualization technology (Hypervisor) layout;

18 global and Chinese automotive intelligent cockpit platform solution integrators (cockpit platform solutions and planning).

18 global and Chinese automotive intelligent cockpit platform solution integrators (cockpit platform solutions and planning).

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...