HD map industry study: the HD map market is burgeoning with the roll-out of L3 autonomous vehicles.

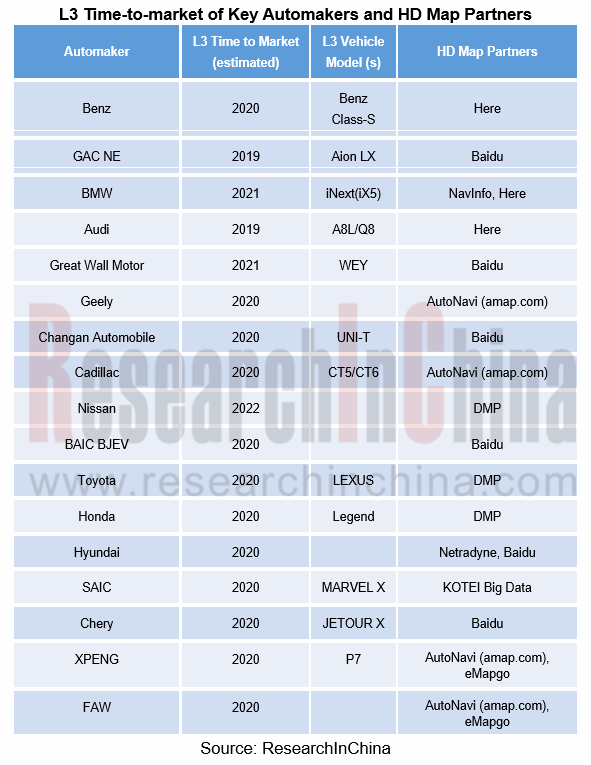

The automakers (except Volvo, Ford and NIO that claimed a leap over L3) have set foot in L3 autonomous vehicle successively, and most of them are scheduled to launch L3 models in 2020.

As HD map is indispensable to an L3 self-driving car, the HD map market ushers in a period of rapid growth.

With the advances in HD map, the map providers are turning to the data services and getting data update service charges annually. HD map has a unit price at least five times higher than traditional navigation map (about 200 yuan/vehicle) and subsequent service fee stands at 100 yuan/year or so. In 2019, AutoNavi (amap.com) introduced the standard HD map fee below 100 yuan/year per vehicle, facilitating the prevalence of HD map.

As expected, the Chinese HD map market will be worth more than RMB9 billion in 2025.

The HD map market is now in its infancy and it has not been spawned yet, but the market will be booming after 2021 when more and more intelligent connected vehicles, or ICVs will be packed with HD map with the launch of L3 self-driving vehicle models. It can be seen from use of HD map in automakers’ L3 self-driving cars to be soon mass-produced that the map leaders like Amap, Baidu Map, NavInfo and eMapgo stay ahead in HD map application.

In addition to HD map services for third parties, more companies applied in 2019 to be the eligible providers of electronic navigation mapping with class-A qualification, such as DiDi, Huawei and SF Express. JD.com is primarily focused on the maps for unmanned delivery vehicle often running on the non-motorway and JD thus needs to collect the HD map data about the non-motorway.

HD map is used mainly in the three including mobility service market, enclosed areas and parking areas. As concerns mobility service, the map providers like Baidu have tried mobility services such as RoboTaxi in China and beyond. In respect of enclosed area, SAIC has conducted a trial project “5G+L4 self-driving heavy truck” at the Shanghai Yangshan Deepwater Port. What’s more, AVP (automated valet parking) remains a hotspot over the past two years, and the map providers like Baidu and eMapgo have already launched the map solutions for automated parking.

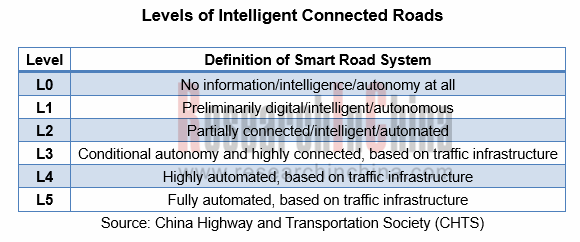

HD map is not only for autonomous vehicle but serves as a stimulus to the development of intelligent connected roads. In September 2019, the State Council put forward the importance of smart connected road construction in the Program of Building National Strength in Transportation. At the same time, China Highway and Transportation Society (CHTS) also issued the Levels of Intelligent Connected Roads and Interpretations. It is now at the L1 in China.

In the next three years, a total of about RMB75 billion will be invested to build intelligent road projects in China. HD map will be an integral part of smart road and will be onto the cloud as a platform. Moreover, it offers a unified space benchmark for roads. HD map is also an important carrier of smart road toll collection by service.

HD map is an emerging industry and is still short of unified industrial criteria, and the map vendors still apply de facto standard. An industrial standard will not be developed until the massive use of HD map in self-driving cars. China Autonomous Driving Map Working Group plans to nail down all kinds of autonomous driving map related standards and testing standards in 2022.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...