Why is the installation rate of automated parking not high?

Automated parking was found in 7.7 percent of passenger cars in China in 2019, according to the data from ResearchInChina.

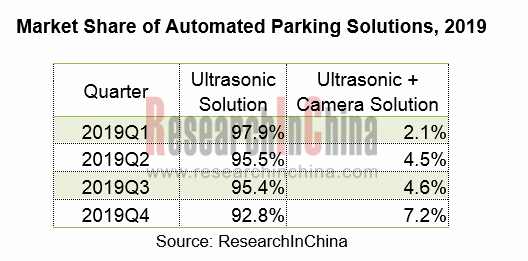

As shown in the table above, most Chinese new passenger cars were pre-installed with ultrasonic solutions for automated parking in 2019; while ultrasonic + vision fusion solution only held tiny shares but saw an uptrend from the fourth quarter.

The moderate assembly rate of automated parking results from the limited scenarios of traditional ultrasonic parking solutions where the driver has to stay in the car. To tackle this problem, there are two ways: better performance of ultrasonic radars and more sensors (such as cameras and millimeter-wave radars).

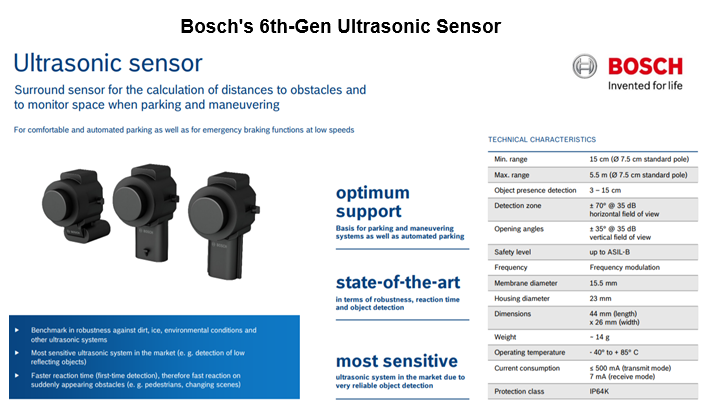

For instance, the AionS Automated Parking System, which was launched by GAC in the first half of 2019, uses 12 Bosch sixth-generation ultrasonic radars to detect a longer range than the previous generation and probe objects as close as 3cm instead of the original 6cm with faster refresh and agility.

More emerging models such as Changan CS75 PLUS, Geely Xingyue, SAIC Roewe MARVEL X, Chery EXEED, etc. have embarked on ultrasonic + vision fusion parking solutions.

Rare application of ultrasonic + visual fusion solution in the past lies in lack of algorithms and powerful compute. Tesla, the pioneer going intelligent, has long resorted to ultrasonic solutions, and its automated parking capability has not performed well. Even Smart Summon launched in the second half of 2019 is not so successful, either.

Tesla’s all models equipped with Autopilot 2.0 carry NVIDIA’s Drive PX2 chip which supports the access to up to 6 cameras. Autopilot 2.0 cannot bolster full work of 8 cameras in the car whatever the compute or video ports. Thus, Autopilot 2.0 does not attend to the fusion of ultrasonic + vision automated parking assistant sufficiently.

According to the study by Chris Zheng, Tesla annotates the mid-range camera in the front trifocal camera at 36 frames per second, records the front fisheye camera and four side-view cameras at 9 frames per second, while it temporarily abandons the remaining front long-range camera and rear-view camera. That is to say, when Autopilot is enabled, only 6 cameras in the car are involved in labeling and perception, of which only the front mid-range camera keeps a high perception frequency while the remaining 5 cameras run strenuously with the limited computing power.

Tesla began to develop chips for strong compute. In 2019, Elon Musk unveiled the Autopilot HW 3.0 hardware upgrade powered by Tesla’s self-developed FSD chip. The previous version HW2.5 uses Nvidia’s Drive PX2 chip. In terms of computing power, the new chip can process about 21 times more images per second than the old one (110 frames per second), at 2,300 frames per second. If all 8 cameras are running at 36 frames per second, the whole vehicle output will be 288 frames per second, which is equivalent to 12.5% of the processing capacity of the FSD chip and is quite sufficient for automated parking.

After solving the computing power, Tesla launched "Smart Summon" at the end of 2019, which is designed to allow the car to drive to the user or an appointed place by the user, maneuvering around objects and parking as necessary. The actual tests prove that Smart Summon still does not work in many cases, indicating that the algorithm needs improvement.

In March 2020, Musk said Tesla would finish work on Autopilot core foundation codes and 3D labelling to provide better algorithms and features for its cars, and then it would unveil "Reverse Summon" soon. Reverse Summon will likely be a mirror feature to Tesla’s existing “Smart Summon”. Whereas Smart Summon allows the user’s car to navigate from its parking space to the user, Reverse Summon likely reverses this. As such, it would conceivably entail that the user’s car can drop the user off, and then navigate to a parking space on its own. To ensure safety, Smart Summon works with the Tesla mobile app when the user’s phone is located within approximately 65 meters of the car with a projected top speed of 8 km/h.

Taking Tesla as a reference, OEMs and Tier1 suppliers are upgrading automated parking systems.

Desay SV told investors that its automated parking system using the vision + ultrasonic fusion solution (algorithms backed by MOMENTA) has been spawned for Chery EXEED, Geely Xing Yue and other models.

Tesla's new deep neural network will integrate all sub-neural networks including perception, path planning, and target recognition. The cooperation between Desay SV, which is adept at hardware, and MOMENTA, a veteran offer of neural network algorithms, inspires traditional Tier1 suppliers.

Valeo has long led the pack in the APA field, and its vision + ultrasonic fusion solution -- Park4U Remote has been applied to Mercedes-Benz's new S-Class sedans and Changan's new CS75 PLUS. With the powerful remote parking, Changan CS75 PLUS has been a best-seller nowadays.

To cater to the complicated parking scenarios in China, Valeo has prepared different sensor combinations for automated parking: Vision + Ultrasonic Radar Fusion Solution, and Millimeter Wave Radar + Ultrasonic Radar Fusion Solution. In 2020, a number of models using Valeo's automated parking solutions will be launched.

By launching Valeo.ai based in Paris, Valeo aims to host an open community network dedicated to the development of automotive applications in artificial intelligence and deep learning.

Souped-up compute and algorithms are not only necessary for automated parking and AVP systems, but also crucial to cockpit system, connected system, ADAS, etc. This involves changes in the vehicle's E/E architecture, super processors, domain controllers, vehicle OTA, information security, to name a few.

In the next few years, decentralized ECUs will be replaced by domain controllers whose development is often dominated by OEMs and Tier1 suppliers. The space for independent parking controllers is narrowing. For APA / AVP startups, it is of vital importance to improve algorithmic competences and have closer collaborations with Tier1 suppliers.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...