Global and China Automotive Operating System (OS) Industry Report, 2019-2020

With advances in smart cockpit and intelligent driving, and enormous strides of Tesla, OEMs care more about automotive operating system (OS). Yet, it is by no means easy for both new carmakers and traditional OEMs to develop base software for intelligent cars. It is in the report that world’s vehicle OS vendors are compared and analyzed.

Auto OS is generally classified into four types:

1) Basic auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

OEMs are not only striving to gain control of vehicle base software and hardware and apt to use neutral OS, but exerting itself to reduce the development cycle and costs by more collaborations and leveraging open source software organizations.

Preference to Neutral and Free OS

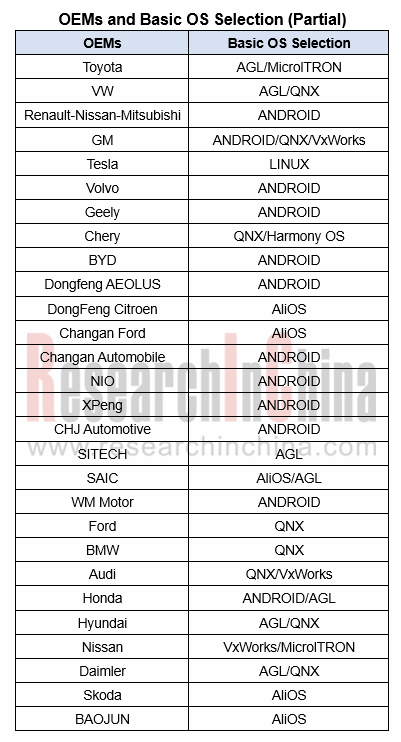

It can be seen in the table below that most Chinese automakers select Android, while foreign peers choose AGL. Both Android and and AGL are neutral and free operating systems.

AGL now has the support of 11 OEMs including Toyota, VW, Daimler, Hyundai, Mazda, Honda, Mitsubishi, Subaru, Nissan, SAIC , etc.

AGL addresses 70% of OS development work, while the remaining 30% can be developed by OEMs. This facilitates development progress and cuts costs significantly.

More than 140 AGL members work together to develop a common platform for infotainment, which will be further available to ADAS, OTA, gateway, V2X and automated driving in the future.

ANDROID ecosystem, compared with AGL, is more mature and widely used by Chinese OEMs. However, OEMs felt risky to apply ANDROID as Google banned Huawei from using the Google Mobile Services (GMS) on Huawei phones in 2019, giving vitality to other operating systems. For instance, AliOS has already been seen in at least nine auto brands.

Reduce Development Cycle and Costs with the Help of Open Source Software Organizations

The GENIVI Alliance was jointly founded by giants like BMW, GM and Intel in 2009, aiming to offer applicable standards and open source codes for in-vehicle infotainment (IVI) platform. The alliance associates with the users of Android, AUTOSAR, Linux, and other in-car software and the solution suppliers to form a productive and collaborative community of 100+ members worldwide encompassing leading automakers, Tier 1 suppliers, semiconductor suppliers, software developers and service providers. GENIVI alliance always leads in field of open source cockpit software development.

The successful operation of GENIVI Alliance shows the industry’s urgent need to reduce development costs and avoid the duplication of development via open source software organizations.

The Autoware Foundation is a non-profit organization founded in Dec. 2018, aiming to develop open source software for autonomous vehicle. With nearly 40 members globally, Autoware is adopted by over 200 organizations in the world.

IT firms Marry Cars and Various Smart Hardware via OS

LG acquired webOS (developed by Palm) from HP in 2013, and then extended webOS as a mobile phone OS to the suitable one for TVs, smart refrigerators, smart watches and smart cars. At present, LG has sold millions of its webOS-enabled Smart TVs. In the early 2020, LG’s webOS is increasingly seen in automotive sector.

Samsung has ambitious plans for Tizen, an open operating system, which has already been found in Samsung’s wearables and smart fridges, and will be applied to floor mopping robots, washing machines, air conditioners and even cars in future.

Huawei does alike in Harmony OS, a microkernel-based, distributed OS designed to deliver a 'smooth experience' across all devices in all scenarios. It enables seamless cross-terminal synergy across multiple devices and platforms including smart phone, TV, Tablet PC and automotive infotainment.

IT companies are attempting to realize intelligence of all scenarios from mobility, home to office by centering on OS. It remains to be seen whether OEMs will adopt the plan and when the plan will be actually carried out.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...