Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2019-2020

Millimeter wave radar installations soared by 44.37% year-on-year in 2019 and were available in more scenarios, encroaching on Lidar and ultrasonic.

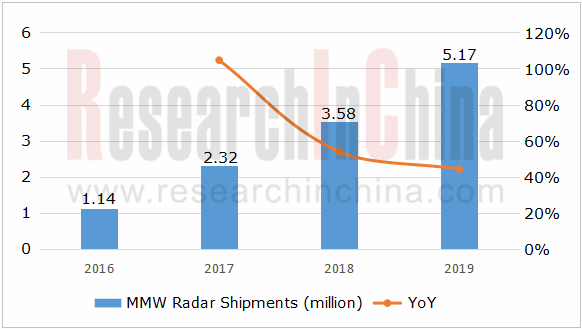

Automotive radar wins popularity and gets increasingly installed. In 2019, 5.17 million mm-wave radars were installed in passenger cars in the Chinese market with an annualized spurt of 44.37%, particularly 77GHz radar installations with an upsurge of 69.3% from a year earlier.

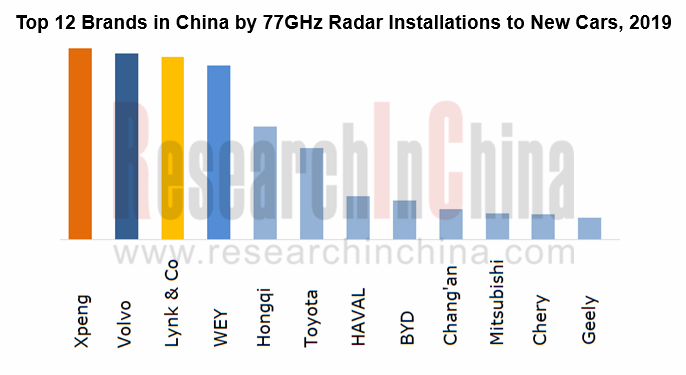

Chinese carmakers have more radar installations than joint venture brands. For the newly launched models, Geely Geometry, WM Motor, BAIC ARCFOX, Chang’an, SAIC Roewe / MAXUS, FAW Hongqi, Xpeng and other homegrown brands all emphasize L2 / L2.5 / L3 autonomous driving technology and install more sensors including mm-wave radar.

Well-known radar suppliers are promoting 77GHz radar vigorously, like the latest generation of medium- and long-range 77GHz radar launched by Bosch and Continental, and at the same time famous radar chip makers are mostly rolling out the 77GHz-centric chip generally in favor of the high modulation bandwidth 2GHz and with 3 transmitters and 4 receivers to detect farther.

The upcoming RXS816xPL is a highly integrated device that addresses the needs of 77-79 GHz radar for all safety-critical applications from automatic emergency-braking (AEB) to high-resolution radar in automated driving and that performs all functions of a radar front-end in a single device – from FMCW signal conditioning to generation of digital receive data output. It resorts to high modulation bandwidth 2 GHz to realize precise distance measurement and simultaneous transmitter operation for MIMO, capable of detecting and identifying objects within 300 meters.

Texas Instruments plans to launch the 77GHz AWR2243, an integrated single-chip FMCW transceiver working in the 76- to 81-GHz band. The device has a tiny footprint and unprecedented integration and supports 5G bandwidth. Simple programming model changes enable a wide variety of sensor implementation (short, medium, long range). Additionally, the device is provided as a complete platform solution to reduce development costs.

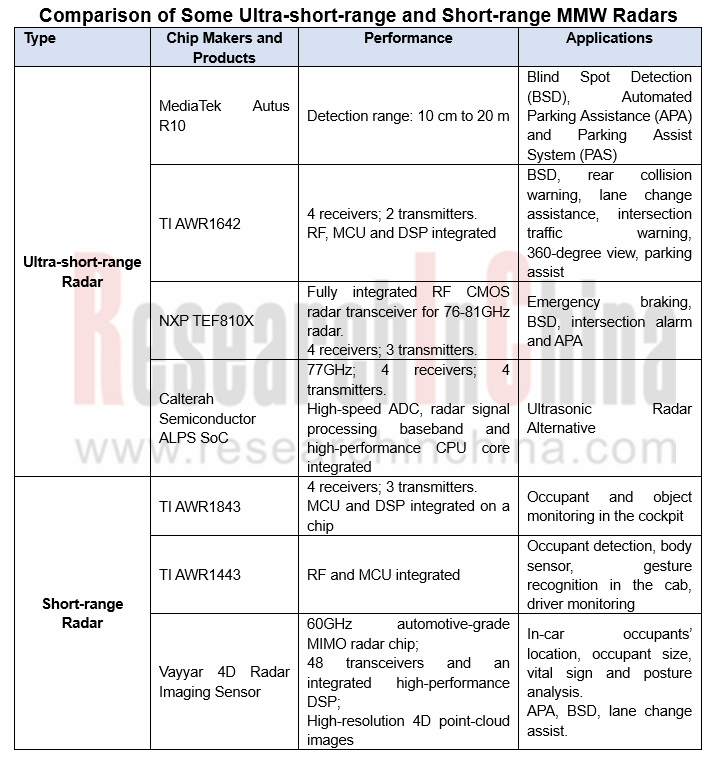

MMW radar chip vendors have released suitable chips for more applications, especially in ultra-short range and short range.

Radar finds wider applications in scenarios like cockpit and occupant monitoring, automated parking, collaborative vehicle infrastructure system (CVIS) and intelligent transportation with the help of radar chips.

Cockpit and Occupant Monitoring

Vayyar Imaging, an Israeli provider of radar imaging sensor technology, said in November 2019 it raised $109 million in a Series D funding led by Koch Disruptive Technologies, bringing its total raised to-date to $188 million. In the automotive domain, Vayyar claims its chip enables in-cabin passenger location and classification, occupant size, vital sign and posture analysis, as well as 360° exterior mapping, including monitoring cars, objects and pedestrians around a vehicle, in all lighting and weather conditions, and in real time. At the 2018 Paris Motor Show, Valeo indeed announced it was integrating Vayyar’s radar sensors with its products to monitor infants’ breathing and trigger an alert in case of emergency. Brose and Vayyar collaborate on sensor technology for new door and interior functions. Sensors recognize occupancy in the interior at all times to ensure the necessary level of safety in the interaction of mechanical and electronic systems. These sensors will also make it possible for side doors to open and close automatically and if other vehicles or obstacles are in the way, the movement ends before the door comes into contact with any object.

For L2, L3 and L4 autonomous driving, occupant monitoring is of growing importance. Autonomous vehicle interiors are fairly flexible, like sliding seats, screens and consoles, suitable for work and relaxation. The short-range radar and visual sensors work together to identify the situation in the car in real time, and the mechanical and electronic systems interact to ensure the safety.

Automated Parking

In December 2019, ZongMu Technology released in Xiamen city the second-generation autonomous parking product -- AVP Gen.2 that has main sensors including four fisheye cameras, 12 ultrasonic sensors, and four 4D MMW radars.

When all of four surround-view cameras are blocked and only mm-wave radar is available, AVP Gen. 2 can still fully implement AVP because the radar can deliver the dense point cloud information comparable to that of Lidar and clearly outline the surrounding buildings to achieve high-precision localization based on radar point clouds.

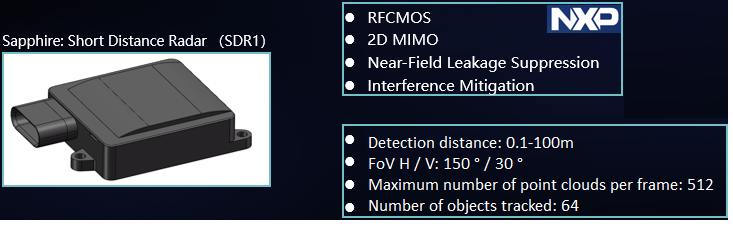

The radar used by AVP Gen.2 is called SDR1, which gets specially optimized in the typical parking scenarios (underground / ground parking lots, parks, etc.) on the basis of traditional angle radar ADAS functions to perfectly meet all parking needs. SDR1 takes into account both of low-speed parking scenarios and high-speed ADAS, and can work under extreme conditions such as wind, heavy snow, night, etc. The product will be spawned in the fourth quarter of 2020.

CVIS and Intelligent Transportation

In April 2020, Muniu Tech rolled out three WAYV-branded radars: WAYV Air, WAYV and WAYV Pro. WAYV includes T300 and S300, which are used in intelligent transportation and intelligent security respectively. WAYV Pro breaks the detection distance limit of video and infrared sensors to reach 1,000 meters, ideal for highway accident monitoring and large-area security.

With a detection range of 300 meters, Wayv T300 covers 8 lanes, detects and tracks 128 objects simultaneously, mainly serving urban traffic data perception and planning. Wayv T1000 works at a maximum distance of 1,000 meters, suitable for long-distance and highway deployment. It can detect and track 256 objects on 10 lanes simultaneously.

Market Shares of Lidar and Ultrasonic Radar Are Squeezed

Millimeter-wave radar is developing radically, with the imaging radar as an alternative to Lidar and the ultra-short-range radar as a substitute for ultrasonic.

The thriving angle radar has lured mm-wave radar vendors to develop ultra-short-range solutions for parking, AEB and short-range blind spot detection as the alternative of traditional ultrasonic sensors.

With far better performance than ultrasonic sensors on the market, the Autus R10 chip of MediaTek offers a wider detection range. Other than distance information, it can also provide speed information while ultrasonic does not. The Autus R10 chip can be used for multiple applications including blind spot detection (BSD), parking assist system (PAS), automatic parking assistance (APA), rear automatic emergency braking, cross-traffic alerts, door opening alerts and ultra-short-range BSD.

The most cost-effective ultrasonic sensor has a slow response to object detection, and it cannot classify objects into human and non-human, while mm-wave radar can perform object classification and biometric monitoring.

Many chip vendors, including traditional radar chip giants such as NXP, TI and Infineon, have launched solutions that shore up high-resolution radar. High-resolution imaging radar will outperform Lidar in terms of cost and performance. In some cases, imaging radar may identify objects such as bicycles, pedestrians, or small obstacles on the road and it also can deal with severe weather conditions.

Lidar will be replaced by Camera + imaging MMW Radar + V2X, said by Lars Reger, CTO of the NXP Semiconductors Automotive Division. The focus of the collaboration between NXP and HawkEye Technology is to create high-resolution imaging radar.

MMW Radar Boosts the Plasticization of Automotive Exterior Parts

Radars are generally fixed behind the car logo or the grille, and integrated into the lights, roof, etc. Millimeter wave radar detects the object, distance, speed and position by emitting electromagnetic waves, which are extremely sensitive to metals, and detecting echoes. In the traditional design, car head and door panels mostly made of metal cannot hide the radar.

Radars must come with plastic peripheral parts whose electrolyte conductivity should be low, especially the materials cannot contain carbon fiber or metals with electronic shielding effect. Covestro, BASF, Lotte, Orinko, Sumitomo, Mitsubishi and the like have developed wave-transparent materials PC, PP, ABS and so on for automotive exterior parts.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...