Autonomous Driving Simulation Industry Chain Report, 2019-2020 (II)

Autonomous Driving Simulation (II): It Turns Out to Be a Battlefield of Giants

Alibaba DAMO Academy unveiled in early 2019 the "Top Ten Technology Trends of 2019", most of which are still credible today, including two trends about autonomous driving:

Trend 1: Autonomous driving is in a cooling-off period

Only "single-car intelligence" cannot achieve absolute autonomous driving in the long run, but cooperative vehicle infrastructure system (CVIS) is gathering way to bring autonomous driving on roads in a reality. In the next two years or three, autonomous driving will be commercialized in limited scenarios such as logistics and transportation, for example, fixed-route buses, unmanned delivery, and micro-circulation in parks are just around the corner.

Trend 2: Real-time simulation of cities becomes possible, and smart cities emerge

The perceived data of urban infrastructure and the real-time data flow of cities will be pooled on a big computing platform. The advances in algorithms and computing power will facilitate the real-time fusion of unstructured information like video and other structured information. Real-time simulation of cities becomes a possibility, and local intelligence in cities will be upgraded to global intelligence. In the future, urban brain technology R&D and application will be in full swing with the involvement of more forces. Beyond the physical cities, there will be smart cities with full spatiotemporal perception, full-factor linkage and full-cycle iteration.

The development of autonomous driving industry has a direct bearing on autonomous driving simulation. The decelerating autonomous driving in the past two years is an unprecedented challenge to startups not only in autonomous driving but in autonomous driving simulation. RightHook, a sensor simulation company, has made no progress for two years; meanwhile, new autonomous driving simulation startups rarely ever came out in 2019.

On the contrary, the giants perform strikingly.

At the Shanghai Auto Show in April 2019, Huawei launched the autonomous driving cloud service Octopus (including training, simulation and testing).

In December 2019, Waymo acquired Latent Logic to strengthen its simulation technology.

In April 2020, Alibaba DAMO Academy released the "hybrid simulation test platform" for autonomous driving.

GAC believes that a virtual simulation platform was the supplement of the real vehicle test platform before, but it is indispensable to the R&D of L3 (or above) autonomous driving. At present, virtual simulation tests share more than 60% of GAC’s autonomous driving R&D, a figure projected to rise to 80% in the future.

Simulation is essential for both single-car intelligence and autonomous driving R&D in CVIS route.

As autonomous driving is heading from single-car intelligence to CVIS, autonomous driving simulation has evolved from dynamics simulation, sensor simulation and road simulation (static) to traffic flow simulation (dynamic) and smart city simulation.

51VR, which has raised hundreds of millions of yuan, changed its name to 51WORLD after experiencing the VR bubble, and set about digital twin cities and autonomous driving simulation. 51WORLD signed a contract to settle in the Liangjiang New Area of Chongqing in November 2019, and will focus on expanding innovative applications of digital twin cities in Chongqing as well as autonomous driving simulation.

In fact, the combination of VR and autonomous driving simulation is not the last resort of 51WORLD. VR/AR plays a growing role in autonomous driving simulation. The technologies for building virtual scenarios are generally based on modeling software, completed games, VR / AR, and HD maps.

In August 2019, rFpro launched an autonomous driving simulation training system based on VR scenarios, featured as follows:

(1) A multitude of autonomous driving simulation operations can be fulfilled in the software.

(2) rFpro also allows the import of models from 3rd party maps, including IPG ROAD5, .max, .fbx, OpenFlight, Open Scene Graph, .obj., featured with ultra-HIDEF graphical fidelity.

Given the importance of autonomous driving simulation, the formulation of simulation standards has kicked off.

Association for Standardization of Automation and Measuring Systems (ASAM) is a global leader in autonomous driving simulation test standards (mainly OpenX Standards). Since the launch by ASAM, OpenX Standards has attracted more than 100 companies worldwide (including major automakers in Europe, America and Japan, and Tier1 suppliers) to participate in the formulation of the standards.

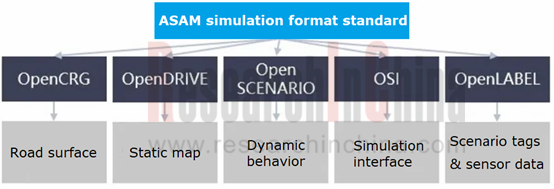

In ASAM simulation verification, OpenX Standards cover Open-DRIVE, OpenSCENARIO, Open Simulation Interface (OSI), Open-LABEL and OpenCRG.

OpenDRIVE and OpenSCENARIO unify different data formats for simulation scenarios.

OpenLABEL provides a unified calibration method for initial data and scenarios.

OSI is a generic interface that allows users to connect any sensor with a standardized interface to any automated driving function or driving simulator tool.

OpenCRG realizes the interaction between road physical information and static road scenarios.

In September 2019, China Automotive Technology & Research Center (CATARC) and ASAM jointly established the C-ASAM Working Group whose early members included Huawei, SAIC, CATARC Data Resource Center, Tencent, 51VR, Baidu, to name a few.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...