Automotive Vision Industry Chain Report 2019-2020 (I): Monocular Vision

Automotive Vision Industry Chain Report 2019-2020 (I): The front-view monocular camera market soared 95.6% year-on-year in 2019

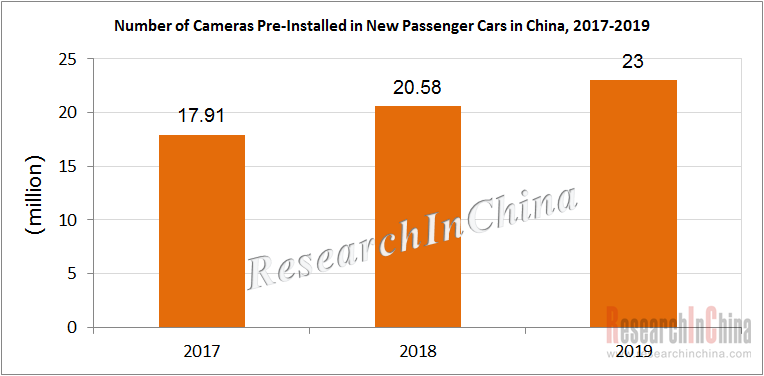

About 23 million cameras were pre-installed in new passenger cars in China in 2019, up 11.7% on an annualized basis, as is revealed by ResearchInChina.

Front-view monocular cameras and surround-view cameras grew by 95.6% and 23.9% year-on-year respectively, while both rear-view and side-view cameras dropped.

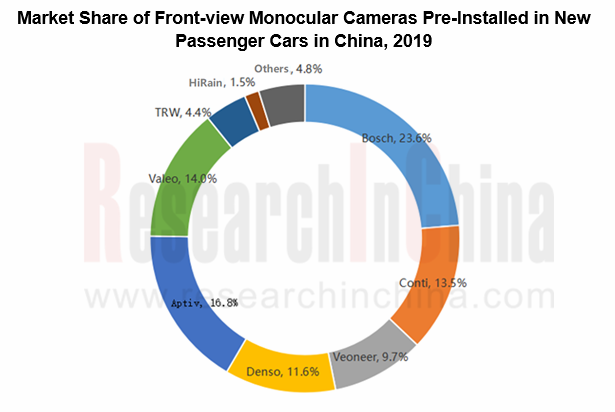

The Tier1 suppliers such as Bosch, Continental, Aptiv, Denso, Valeo, Veoneer, ZF, etc. occupy more than 90% share of the front-view monocular camera market, so that Chinese visual ADAS vendors that rarely ever break monopoly turn to focus on surround-view cameras, rear-view cameras, commercial vehicle vision ADAS and other markets.

Cameras find wider application in automobile, in forms of DMS, CMS, binocular stereo, tri-focal, night vision, etc., broadening the market space of automotive vision observably. In March 2020, Waymo unveiled its fifth-generation autonomous driving system with the synergy of 29 cameras in all around the body to see a road sign 500 meters away through the overlapped fields of view.

Driver Monitoring System (DMS)

For safer driving on roads, European Commission approved EU rules requiring life-saving technologies in vehicles. The advanced systems that will have to be fitted in all new vehicles are: intelligent speed assistance; alcohol interlock installation facilitation; driver drowsiness and attention warning; advanced driver distraction warning; emergency stop signal; reversing detection; and event data recorder (“black box”). Most of these technologies and systems are due to become mandatory as from May 2022 for new models and as from May 2024 for existing models.

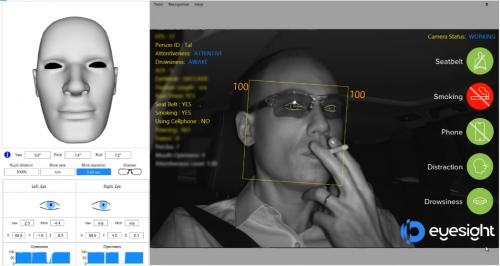

Over the past year, leading Tier1 suppliers and most visual ADAS startups have been developing DMS, especially the most active EyeSight, an Israeli start-up founded in 2005, provides driver monitoring, gesture recognition and user perception and analysis technologies.

On November 21, 2019, Eyesight announced new features for the company’s Driver Sense and Fleet Sense solutions to monitor the driver and detect driver distraction as a result of cell phone usage and smoking. The new features will be added to the company’s existing distraction and drowsiness detection capabilities to further mitigate driver distractions and prevent accidents.

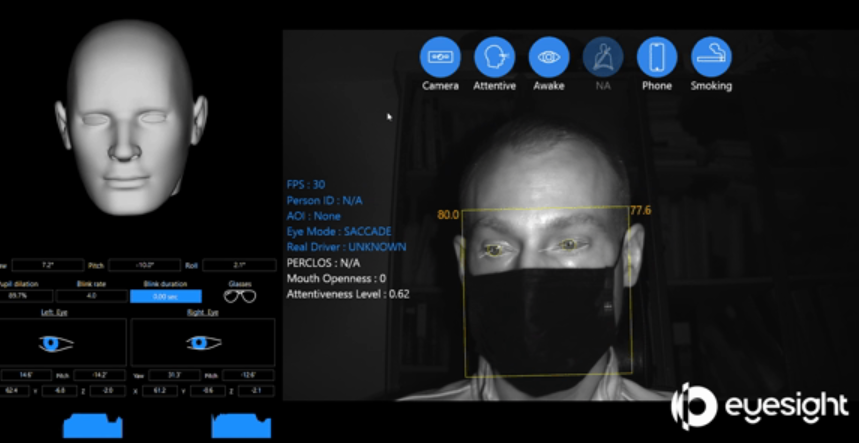

In April 2020, Eyesight upgraded its platform for in-cabin sensing solutions to detect when drivers who wear face masks get distracted or feel fatigued behind the wheel. It has developed a set of AI algorithms that can keep track of drivers’ behavior behind the wheel when wearing masks, protection goggles or sunglasses. The company’s Driver Sense and Fleet Sense leverage IR sensors to analyze head position, eye openness, pupil dilation, blink rate, and gaze direction, in any lighting condition.

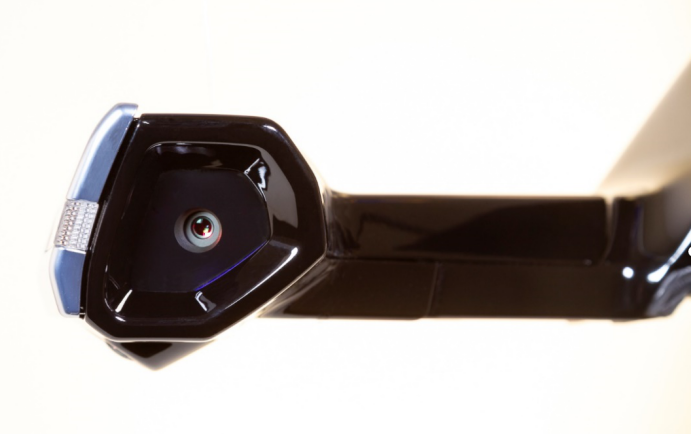

Camera Monitor System (CMS)

The spawned all-electric SUV Audi e-tron offers CMS as an option (EUR1,250). Lexus offers optional USD1,900 CMS. Honda e is the world's first model that provides CMS as a standard configuration. Tesla's first battery-electric pickup, Cyberruck, also uses CMS.

Models with CMS have much better night vision effects than the ones with traditional glass reversing mirrors.

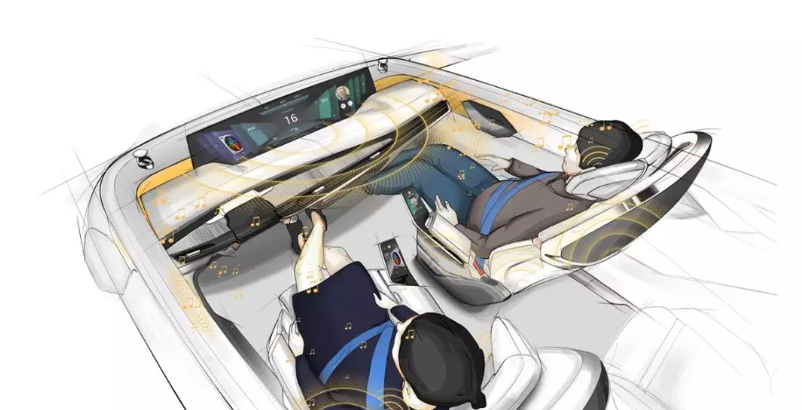

Use in Cockpit Comfort System

Cameras are mainly used as the sensing components for ADAS. The popularity of telematics and smart cockpits help wider use of cameras in cockpit comfort systems.

For instance, Faurecia integrates smart devices such as cameras with recognition capabilities, Microsoft Connected Vehicle Platform (MCVP) and cockpit domain controllers as well as the hardware like traditional speakers, smart headrests and exciters embedded on the surface of vehicles to offer the user with personalized audio options and improve the sound conditions of the entire cockpit.

Automotive Vision Industry Chain Report 2019-2020 (I) -- Monocular Vision highlights:

Automotive vision industry chain at a glance

Automotive vision industry chain at a glance

Chinese passenger car camera market

Chinese passenger car camera market

Foreign automotive vision companies

Foreign automotive vision companies

Chinese automotive monocular vision solution providers

Chinese automotive monocular vision solution providers

Automotive Vision Industry Chain Report 2019-2020 (II) -- Binocular and Surround-view Cameras highlights:

Development trend of automotive vision industry

Development trend of automotive vision industry

Binocular vision companies

Binocular vision companies

Surround-view technologies and companies

Surround-view technologies and companies

Key automotive camera parts suppliers

Key automotive camera parts suppliers

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...