Denso CASE (Connectivity, Automation, Sharing and Electrification) Research Report, 2020

As one of the top three Tier1 suppliers in the world, Denso makes adjustments and deployments during the automotive industry disruption.

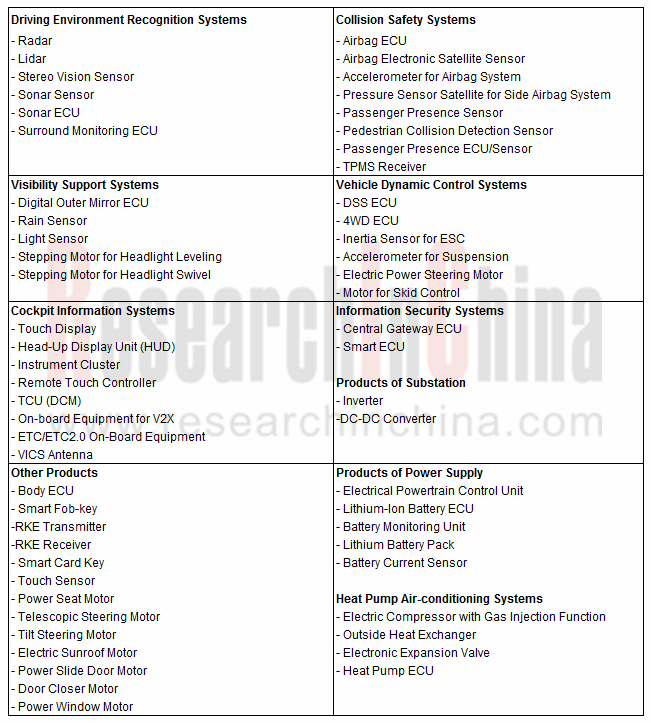

Sorting out Denso’s existing product lines, up to 200-plus varieties are found, including virtually 70 for CASE (connectivity, automation, sharing and electrification).

Denso’s CASE Products (Part)

Source: Marklines; ResearchInChina

The number of auto parts will decrease in the trend towards CASE. In a recent opinion, automotive hardware will be standardized and contribute declining revenue and profits, and future competition lies in the ability to develop software-defined vehicles. Emerging carmakers have late-mover advantages with more software talents.

Another view is that Tier1 suppliers will be marginalized by OEMs (e.g., Tesla and VW) who try to lead research and development of operating system, DCU (or vehicle central computer) and core software and hardware systems.

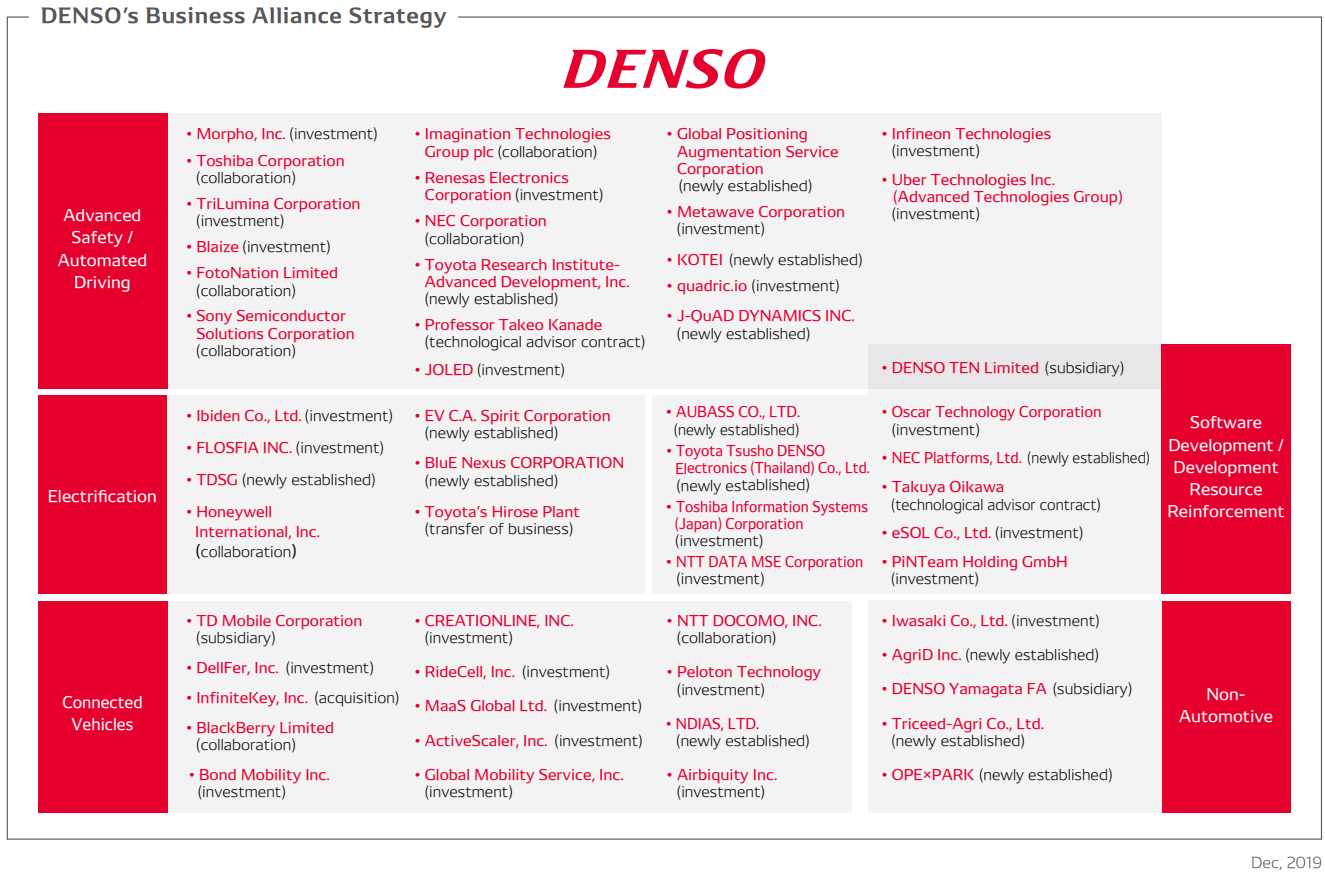

It can be seen from Denso’s CASE layout that the supplier not only makes deployments in all aspects of hardware but spends on software not less than IT-backed firms.

Denso’s Investment in Hardware

The US government’s crackdown on Chinese high-tech companies shows that just developing software and applications at the upper layer is not enough, and holding basic materials, core components and basic software is the only way to be free of others.

Denso lavishes heavily on core fundamental technologies, including magnetic materials, power semiconductors, solid-state batteries, magnetic heat pumps, human-computer interaction, AI, sensors, and quantum computing.

In 2018, Denso invested FLOSFIA and collaborated with the latter on developing a next-generation power semiconductor material (α-Ga2O3) for vehicle application. Schottky Barrier Diode (SBD), Flosfia’s α- Ga2O3 material, can work under 600V and 10A, with rated power of 100W-1kW, outperforming SiC products in both efficiency and cost. SBD is expected to be spawned in 2020. Theoretically, SBD material is seven times more efficient than GaN in low frequency and doubles GaN in high frequency or more.

Denso has been devoted to researching automotive semiconductor technology since its IC Laboratory was set up in 1968, having made improvements in ECU, sensor and other products. In September 2017, Denso founded a subsidiary -- NSITEXE, a developer of next-generation high-performance semiconductors. DFP (data flow processor) independently developed by NSITEXE, differs totally from CPU and GPU. For practical use of DFP, Denso and NSITEXE then invested Blaize and quadric.io, two semiconductor start-ups. Blaize, founded by former workers at Intel in 2012, builds software and process architectures from the underlying layer for better AI computing. NSITEXE helps to develop an autonomous driving technology which makes instant judgment in extreme scenarios, by combining DFP and EPU from quadric.io.

Leading Tier1 suppliers from Japan and Germany often adopt IDM model and have their own chip fabrication plants, compared with IC designers focusing on prevailing FABLESS model in China. Denso Hokkaido is Denso’s key manufacturing site of semiconductor sensors. To meet the robust demand from electrification and autonomous driving markets, Denso plans expansion of its Hokkaido plant. The expansion project will break ground in July 2020 and be completed in June 2021. The number of employees will expectedly rise to about 1,150 in 2025.

Denso’s Investment in Software

In 2025, Denso will boast 12,000 software talents worldwide; it will have more than 1,000 staffs and over 1,100 patents in autonomous driving field.

In addition to workforce enlargement for independent development, Denso also invests quite a few software firms.

Denso’s Big Competitive Edges in an Age of CASE

From Denso’s alliance, acquisitions and investment map as below as well as the Abstract of this report, it can be seen that Denso is sinking to research and development of core technologies and parts.

Source: Denso

Tier1 suppliers once gave an impression that they were suppliers of integrated systems for OEMs. As OEMs more set foot in system integration, Denso has turned to research and development of more basic core technologies. Weighed by new entrants from all walks of life, Denso still stays competitive on the strength of its across-the-board product matrices, economies of scale, and software and hardware synergy.

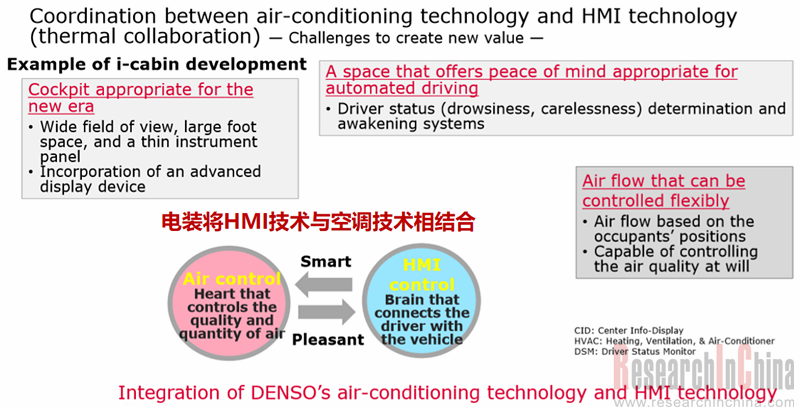

For example, Denso’s cockpit systems integrated with HMI and air-conditioning technologies will offer better user experience. This is an impossibility for the majority of companies who fail as well in high integration at the underlying layer.

Source: Denso; ResearchInChina

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...