T-Box Research: 46.7% of Passenger Cars Carry T-Box in 2020Q1

T-Box (Telematics-Box), also called telematics control unit (TCU), is comprised of GPS unit, outer interfaces for communications, electronic processing units, microcontrollers, mobile communication units and memory, enabling interaction between the terminal information in the car, the cloud and the roadside unit (RSU).

Around 2014, the mainstream solution of the first-generation T-BOX was a single-chip solution resorting to a combination of 2G+GPS. From 2015 to 2016, the second-generation T-BOX was added with memory, rich interfaces, and changed to employ Beidou/GPS dual-mode; also it was endowed with such new features as fault diagnosis, low power consumption design, dormant wake-up, SD card expansion, output power, RS232/485, USB and IO interfaces.

Since 2017, T-BOX communication has been upgraded to 4G, and the 4G module -- OPEN CPU technology solution has been prevailing in the industry as it boasts more powerful edge computing capabilities, supports vehicle Ethernet, over-the-air (OTA), fault diagnosis of protocols, Bluetooth, WIFI and other functions, and it even integrates gateways, CAN gateways, etc.

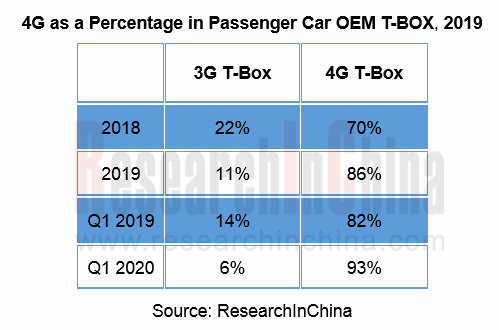

In 2019, 4G T-Box constituted 86% of passenger car OEM T-BOX, and the share rose to 93% in Q1 2020, according to ResearchInChina.

In China, 46.7% of passenger cars were installed with T-Box in Q1 2020, 14.2 percentage points higher than 32.5% in Q1 2019.

By price, the proportion of models worth RMB100,000-150,000 with T-Box rises fastest, from 34% in Q1 2019 to 40% in Q1 2020, largely thanks to Toyota (Corolla, LEVIN), Chevrolet (MONZA), Changan CS75 PLUS, etc.

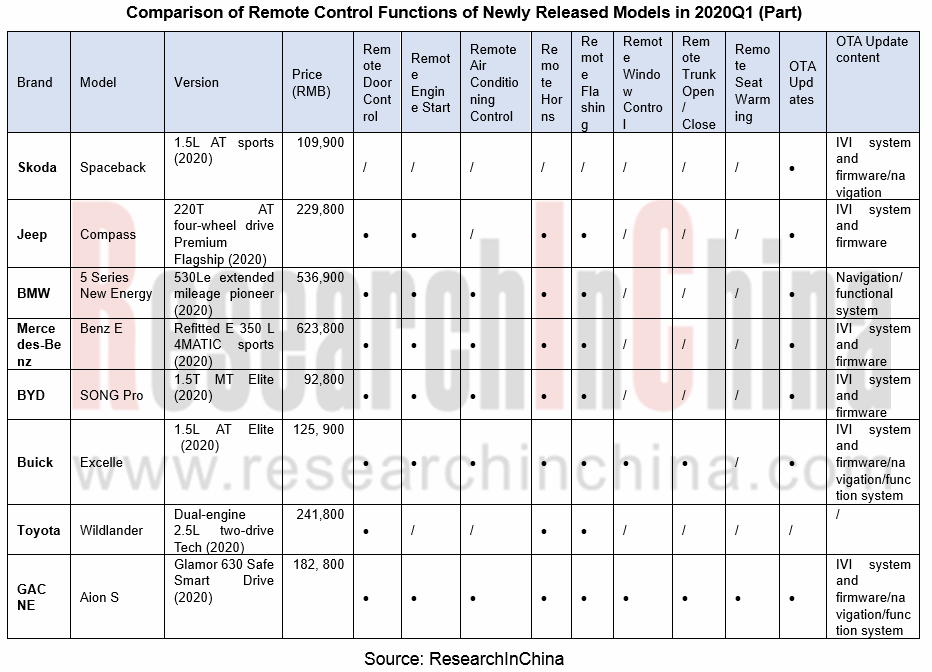

Among the new models launched in Q1 2020, GAC NE AionS has the most versatile remote functions enabling remote opening and closing of doors, windows and the trunk, remote engine start, remote air conditioning control, remote horns, remote flashing, and remote seat warming. For most models carrying T-BOX, there is universal availability of remote door control, remote horns, and remote flashing, while remote engine start-up, remote air conditioning control, remote seat warming, remote opening and closing of windows and the trunk are gaining ground.

Policies and the market players are pressing ahead with T-Box as a standard configuration.

Circular of the Ministry of Industry and Information Technology on Further Supervision over Promotion, Application and Security of New Energy Vehicles requires that the vehicles listed in the "Recommended Model Catalog for the Promotion and Application of New Energy Vehicles" must be packed with T-BOX.

On April 17, 2020, the Ministry of Ecology and Environment of China released Technical Specifications for Remote Emission Monitoring of Heavy Vehicles (Draft), which explicitly stipulates platform construction of remote emission system for heavy vehicles, T-BOX technology and measurement methodology, communication protocols and data formats.

With advances in Telematics, ADAS and OTA, in-vehicle systems will inevitably be interconnected with the cloud through T-BOX. At the same time, the massive data exchange between in-vehicle systems and remote terminals will beyond doubt fuel 4G T-BOX to head toward 5G T-BOX. Huawei is a leading enabler for 5G T-BOX.

In July 2019, Huawei rolled out the 5G automotive module -- MH5000.

In September 2019, Huawei unveiled the next-generation automotive T-Box platform at the Dongfeng Aeolus Smart Cockpit Conference, which substantially improves responsive agility and running speed of the smart cockpit and enabling remote start-up, air conditioning, vehicle control, and vehicle status review. Meanwhile, it features 5G capabilities like high speed and excellent reliability, allowing personalized interactivity such as intelligent scenario modes, voice via cloud, audiobooks and music.

In April 2020, BAIC BJEV's top-range brand ARCFOX installed the Huawei MH5000 T-BOX on its first production SUV -- ARCFOX α-T.

In May 2020, GAC Aion V pre-sales started. Aion V integrates 5G+C-V2X automotive intelligent communication system and Huawei MH5000.

Flaircomm Microelectronics, a leading Chinese T-BOX supplier, is conducting the IPO on the SSE STAR Market, with a plan to raise RMB239.84 million for 5G T-Box R&D and industrialization projects. The raised funds will be earmarked to develop the 5GNR technology-oriented T-BOX, a fusion of new technologies like CANFD, Ethernet and smart antennas.

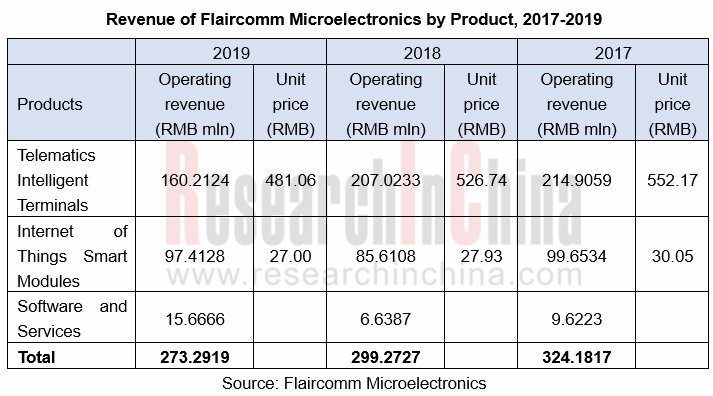

However, investors have doubts about Flaircomm Microelectronics whose revenue remains on a downswing over the past two years.

Like gateways, T-BOX, as a key integral of intelligent connected vehicle (ICV), involves OTA and network security. To take the initiative, OEMs tend to self-develop T-BOX software.

Amid OEMs enlarging software development teams, Tier1 hardware suppliers may turn into standard hardware vendors and have an ever weaker say. It is, indeed, a challenge not only to T-Box vendors but to Tier1 hardware suppliers.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...