Dual and multi display solutions and development tendencies are analyzed in this report.

Amid the smart cockpit trend, the display incarnates intelligence as the main interface of human-computer interaction. Following the large screen, multi display and dual display grow the new trend of the cockpit display. The “one-core multi-display” solution has become the apple in the eyes of OEMs and cockpit system integrators.

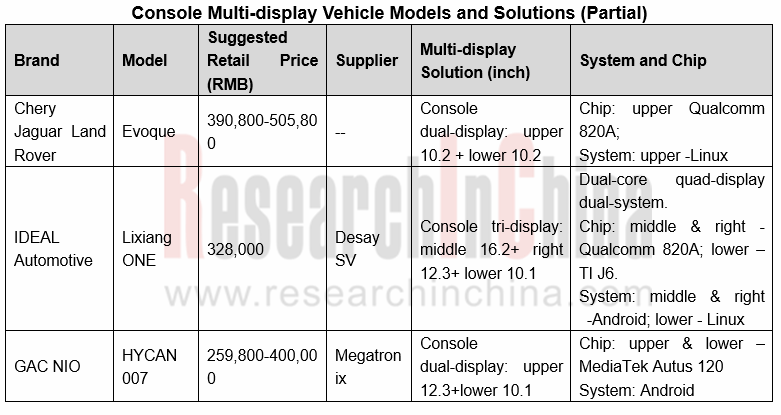

(I) Multi-display: Luxury brands adopt multi-display at first, and emerging brands follow suit.

The multi-display solution is superior in that the functions of the traditional console screen are split, so that navigation, multimedia and other information are placed on one screen or two, while vehicle information such as seats, air conditioning and ADAS are enabled on another screen. The system application menu and user’s operations are streamlined.

In 2016, Infiniti was the first to roll out a console solution with an 8.0-inch upper screen and a 7.0-inch lower screen. The Range Rover Velar unveiled in 2017 is equipped with two 10-inch console screens, featuring a sense of technology. Since then, foreign luxury brands like ACURA and Audi have followed suit.

Emerging brands such as Lixiang ONE, Nezha U, and HYCAN 007 debuted in 2019-2020 launched dual-screen consoles and even triple-screen consoles in a successive way.

In Q1 2020, the sales volume of models packed with a dual-screen console exceeded 30,000 units in China, a year-on-year spike of 165.0%; the installation rate was 1.2%, up 0.9 percentage point over the same period last year. As for terminal applications, the cost pressure confines dual-screen consoles to high-end models priced at RMB400,000-RMB500,000.

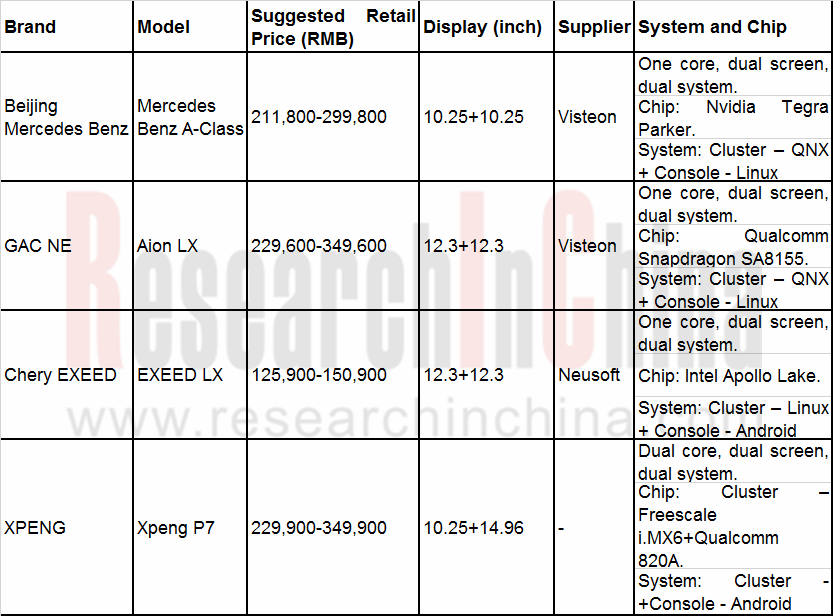

(II) Dual Display: Local Chinese Brands and Joint Venture Brands Contend for Model Launches with Dual Display during 2019-2020

The traditional console screen and the dashboard are physically separated by a large distance, so that the driver has to pay more attention to touching the console display and reading information. At the same time, console screen and LCD cluster screen interact in some content, for instance, the navigation route displayed on the console screen, music, calls and other information can be interactively showed on the LCD dashboard. In the dual-display solution, the dashboard screen and the console screen share a glass cover, being connected almost seamlessly, visually creating a sense of screen integration, making it easier for the driver to fulfil touch operations and read information.

The dual display solution first appeared in 2016. The interior of Mercedes Benz E-class mounts two 12.3-inch full HD screens housed within a single unit. In November 2018, the solution officially spread to Mercedes Benz A-class. In 2017-2018, Chinese brands such as BAIC BJEV Lite and FAW Besturn T77 began to dabble in the solution. In 2019-2020, dozens of models with dual displays, including FAW Hongqi HS5, Changan CS75 PLUS, GAC Aion LX and Chery EXEED LX, were launched successively.

In 2020Q1, China sold nearly 70,000 passenger cars equipped with the dual display solution, a year-on-year increase of 6.1%; the installation rate reached 2.4%, up 1.1 percentage points from the same period last year. The solution is mostly available in high-end models, and it has penetrated into low- and medium-end models since 2019.

(III) The “one-core multi-screen” solution: the hotspot of multi- and dual- display solutions

For chip control and system drive, the one-core multi-display is a favored solution which is seen in Benz A-Class, BUICK GL8 Avenir series, Lixiang ONE, among others, and the pioneers are in such a pre-emptive move, such as Harman, Visteon, Aptiv, Desay SV, Neusoft, etc.

In January 2020, Samsung brought its Digital Cockpit 2020 at CES. The new cockpit was developed by Samsung and its subsidiary HARMAN International, and it’s packed with technologies including an Exynos Auto V9 SoC, Android 10, a Dashboard Display which is seamlessly incorporated into the vehicle’s interior design, a Front Display, a Console Display, a Center Information Display, two physical knobs (both of which have their own displays), two 7-inch displays on each side of the dashboard as digital mirrors powered by external cameras.

Digital Cockpit 2020 by Samsung and HARMAN -- multi-display, dual-display (integrated screen), one-core multi-display system

Considering screen arrangement and chip use, Digital Cockpit 2020 jointly launched by Samsung Electronics and Harman International applies both console multi-screen and dual display solutions. The Center Information Display and the Console Display enable varied information application in the car, and the Front Display can show contents in a split-screen mode.

Digital Cockpit 2020 is packed with 4 large displays and 2 small displays:

- The 28.3-inch Front Display provides visual navigation information and is positioned to ensure that the driver keeps their eyes on the road. It is equipped with QLED Local Dimming technology and split-screen mode to allow passengers to make use of the display without distracting the driver.

- The Dashboard Display, which is seamlessly incorporated into the vehicle’s interior design, is positioned under the Front Display and delivers visual notices and alerts.

- The 12.4-inch Center Information Display can automatically rise and fall, and can provide information like driver’s schedule once the driver is authenticated via facial recognition or a connected smartphone’s fingerprint reader.

- The Console Display can be set up to control various features and the functions of other displays, as well as the vehicle itself.

- Two physical knobs, both of which have their own displays, enable users to choose music.

In a nutshell, it seems unavoidable for automakers and parts suppliers how to get perfect human-machine interaction and information display as well as full exertion of console intelligence in accompaniment with a broad range of features and applications in the car. Multi-display ‘separate governance’ and dual display ‘all in one’ are the two alternatives for the automakers. What is the most challenging now are the expensive R&D costs of the ‘one-core multi-display’ solution and a high demanding on technical strength. For the OEMs, enormous investment is necessary for chip authorization, software and operating system (OS) development, etc.; for the system integrators, software complexity remains a hard nut to crack.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...