Regulations and ADAS Help Intelligent Rearview Mirror Market Blossom

In our report China Automotive Intelligent Rearview Mirror Industry Report, 2020, we analyze and research the status quo of the industry and the suppliers (including exterior electronic rearview mirror, streaming media rearview mirror and intelligent cloud mirror).

Exterior electronic rearview mirror: as European Union and Japan loosen their regulations, passenger car manufacturers race to test the waters.

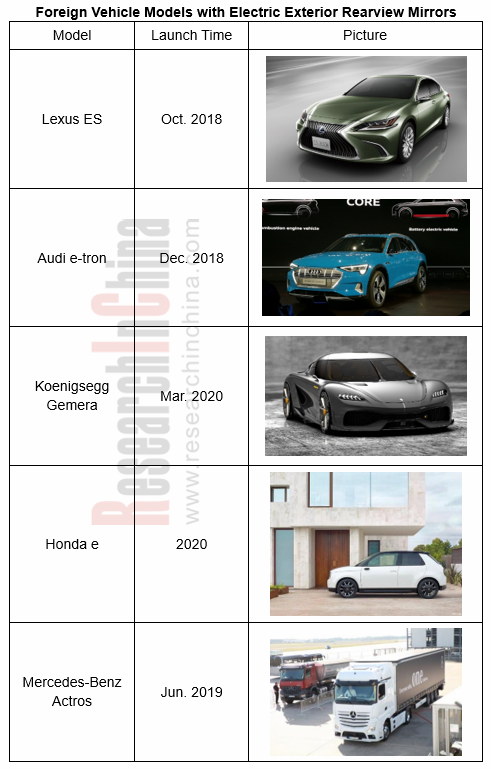

As European Union and Japan relaxed their regulatory restrictions in 2016 and 2017, separately, exterior electronic rearview mirror market gained pace there. OEMs like Audi, Lexus, Honda and Koenigsegg have introduced mature applications successively.

In China where exterior electronic rearview mirrors are still not allowed to replace conventional ones, suppliers find another way out: combining exterior electronic rearview mirror and usual one as a solution to complement commercial vehicle vision system. At present, two Chinese bus giants Yutong Bus and King Long have made product layout; in 2020 BYD rolled out a city electric bus – K9 packing exterior electronic rearview mirrors.

Foreign suppliers of exterior electronic rearview mirrors are led by Valeo, Magna,

Tokai Rika and Bosch, all of which take the mirror as an essential part of ADAS or intelligent driving system.

In China, typical suppliers are Shanghai Yuxing Electronics and Zhengzhou Senpeng Electronic Technology, of which the former has provided exterior electronic rearview mirror + conventional rearview mirror integrated solution for Yutong Bus, so has Senpeng Electronic done for BYD K9. In June 2020, Yuxing Electronics and Metoak Technology (Beijing) forged strategic partnership in the aspects of blind spot visualization and risk warning by exterior electronic rearview mirror, a kind of camera monitor system (CMS). This means automotive rearview mirror solutions of Chinese suppliers are fusing with ADAS system.

Streaming media rearview mirror: more and more vehicle models pack it.

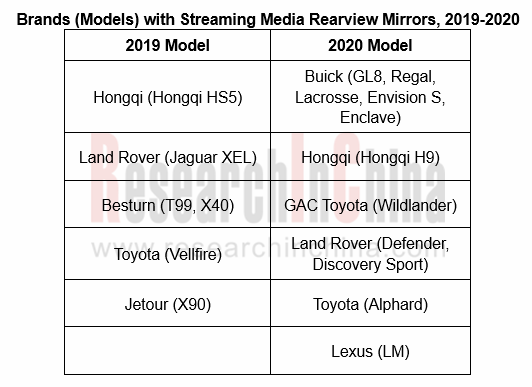

Streaming media rearview mirror market has been tepid since it was installed onto OEM models in 2015. Despite a penetration of not higher than 0.5% during 2018-2019, streaming media rearview mirrors have been mounted on a growing number of OEM models (e.g., Hongqi, Besturn, Buick, Land Rover and Toyota) between 2019 and 2020, thanks to the popularity of smart cockpits. Some models gave eye-catching performance after general availability on market. Examples include Buick GL8 with 16,580 units sold in just two months after launch in May 2020, including up to 72.5% with streaming media rearview mirrors. It is predicted that the penetration of streaming media rearview mirrors in the Chinese passenger car market will outstrip 1% in 2020.

Considering it is easy to install in vehicles, streaming media rearview mirror holds the trends as follows:

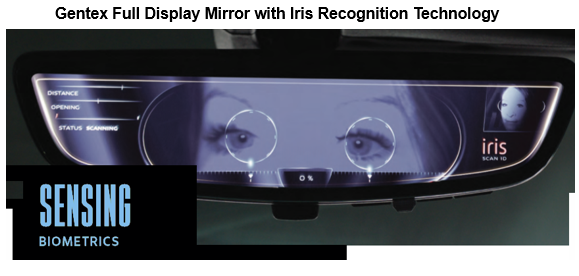

- Support such AI technologies as face recognition and iris recognition for personalized layout in OEM models;

- Show what exterior electronic rearview mirrors display, reducing screens in a vehicle;

- Fuse with other capabilities, e.g., ETC, offering more convenient driving experience.

Intelligent Cloud Mirror: The market is burgeoning, and product functions get enriched

From 2015 to 2019, China's private car ownership soared from 130 million to 240 million units, triggering huge demand for smart cloud mirrors in the aftermarket.

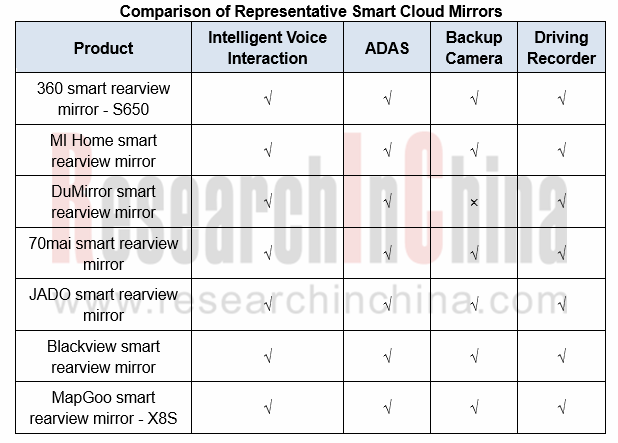

Currently, smart cloud mirror vendors highlight such capabilities of their product as ADAS alerts and intelligent voice interaction. JADO and 70mai have launched streaming media rearview mirrors and smart cloud mirror all-in-ones that support the simultaneous recording of front and rearview mirrors. In brief, smart cloud mirrors evolve from driving recorders, and now are integrated with streaming media rearview mirrors, ADAS and intelligent voice.

Internet giants such as Baidu, 360, and Xiaomi have entered the smart cloud mirror market through complete product solutions, and Alibaba has made its foray by AliOS. The market competition pricks up with the involvement of these internet tycoons.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...