AUTOSAR Research Report: in the Era of Software Defined Vehicles (SDV), Will an OEM Acquire an AUTOSAR Software Firm?

Software defined vehicle (SDV) and architecture defined vehicle are hotly debated among insiders recently. Yet, the technical standard – AUTOSAR are essential for them.

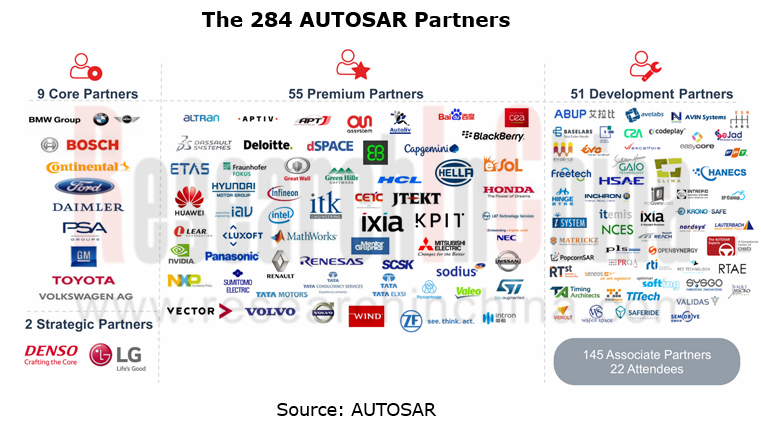

AUTomotive Open System ARchitecture (AUTOSAR) is a worldwide development partnership of vehicle manufacturers, suppliers, service providers and companies from the automotive electronics, semiconductor and software industry. Since 2003, they have been working on the development and introduction of several open, standardized software platforms for the automotive industry. The "Core Partners" of AUTOSAR are the BMW Group, Bosch, Continental, Daimler, Ford, General Motors, the PSA Group, Toyota and the Volkswagen Group.

As of May 2020, AUTOSAR has accommodated 284 members, including some Chinese companies, like Great Wall Motor, FAW, Dongfeng Motor, HiRain Technologies, iSoft Infrastructure Software, SAIC and Neusoft Reach.

It seems that not many Chinese companies are on the AUTOSAR member list. Nevertheless, the Automotive Software Ecosystem Member Organization of China (AUTOSEMO), founded in July 2020, involves 9 automakers (FAW, SAIC, GAC, NIO, Geely, Great Wall Motor, Dongfeng Motor, FAW Jiefang and Xiaopeng Motors) and 6 suppliers (Neusoft Reach, HiRain Technologies, Shanghai Nasn Automotive Electronics, Shenzhen VMAX Power, Shanghai Re-Fire Technology and Horizon Robotics). Based on AUTOSAR, AUTOSEMO is striving to develop basic software architecture standards and an industrial ecosystem that are led by Chinese companies. AUTOSEMO will temporarily not include the AUTOSAR’s application programming interface API standards (body, transmission, power, chassis, passive safety, HMI, multimedia and telematics) already under development in the business scope of its standard working groups. System software and testing standards of AUTOSEMO are consistent with AUTOSAR.

It can be seen that AUTOSEMO is basically compatible with AUTOSAR.

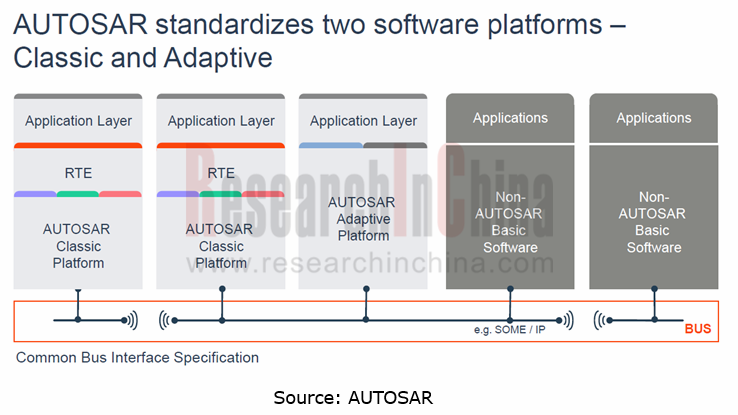

AUTOSAR standard aims to ensure standardization, reuse and interoperability of software. Currently, two complementary platforms, AUTOSAR Classic and AUTOSAR Adaptive (AP), have been introduced.

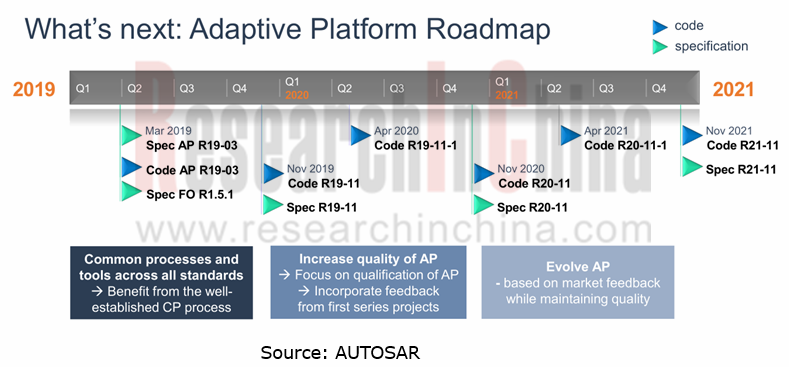

Thereof, AUTOSAR Adaptive Platform is launched to meet needs for developing new-generation autonomous, intelligent connected, electrified vehicles, with features of high flexibility, high performance, HPC support, dynamic communication, and management update. The latest version is R19-11 released in in November 2019.

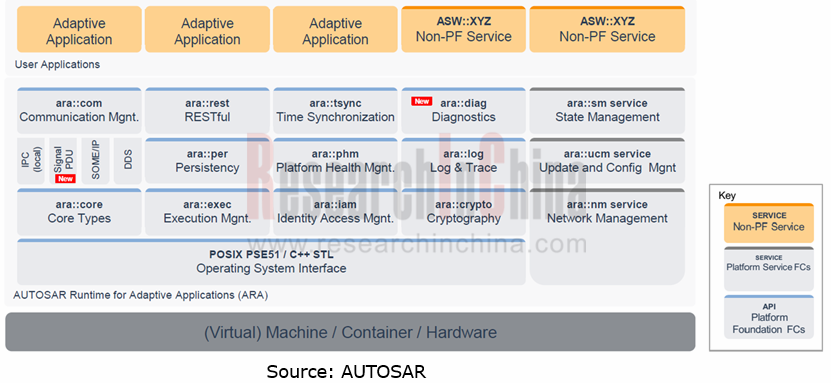

R19-11 is a layered architecture. It implements the AUTOSAR Runtime for Adaptive Applications (ARA) that consists of Foundation and Service, each of which is comprised of several modules with separate functions.

The Service is composed of three functional modules: State Management (SM), Network Management (NM) and Update & Configuration Management (UCM); the Foundation incorporates: Communication Management (COM), Cryptography (Crypto), Log & Trace (Log), Diagnostics (Diag), Persistency (Per), Execution Management (Exec), Time Synchronization (Tsync), etc.. In addition, for OS in the Foundation, the Adaptive Platform requires OS should be those subject to POSIX OS standards, e.g., Linux mcos and QNX.

The future version of AUTOSAR Adaptive Platform is expected to pack 23 new features up to multiple requirements such as better interaction between AUTOSAR Classic and AUTOSAR Adaptive, and upgrade of Security and Safety. According to the roadmap, AUTOSAR will offer a new software architecture version every year.

AUTOSAR Adaptive Platform supports all future vehicle APPs, e.g., IVI, V2X, multi-sensor fusion and autonomous driving. AUTOSAR is a standard option of next-generation automotive basic software architecture, for most automakers, components suppliers, software providers and other companies.

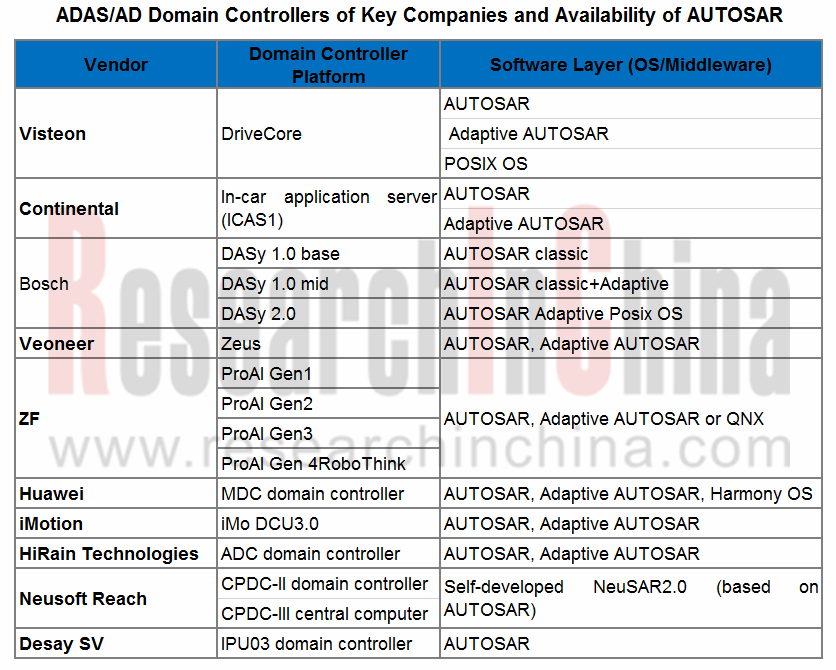

ADAS/AD is an applied field of AUTOSAR Adaptive. All autonomous driving domain controllers rolled out by Bosch, Visteon, Continental, Huawei and more, support AUTOSAR Adaptive.

Most of companies make partial use of AUTOSAR standard and few use in a full set, because AUTOSAR Adaptive came out late (the first version became available in 2017) and allows no mixed use of versions and AUTOSAR is complex and expensive with separate charge for every tool chain.

AUTOSAR has built a fairly complex technology system over a decade of development. Tool providers already develop support software to help OEMs accelerate application of AUTOSAR. Well-known AUTOSAR tool software developers include: WindRiver, EB, VECTOR, Mentor, ETAS, KPIT, Neusoft Reach, iSoft Infrastructure Software, HiRain Technologies, TaTa Elxsi and Autron. These AUTOSAR software firms also enrich product lines through mergers and acquisitions for greater competitive edges.

In 2014, Mentor Graphics announced to purchase the AUTOSAR assets, including the Mecel Picea AUTOSAR Development kit, from Mecel AB.

In September 2018, Vector acquired the Swedish embedded software specialist ARCCORE. This acquisition strengthens Vector’s portfolio of products and services in the field of AUTOSAR.

In the coming age of software defined vehicles, AUTOSAR software developers are playing an increasingly important role. It is hard for OEMs to build veteran teams shortly to develop automotive software due to lack of talent, even though they already set up their software firms or software departments in no time. Investing or purchasing AUTOSAR software firms may after all be an option.

In May 2020, Evergrande High Technology Group led the investment of tens of millions of yuan in a Series A funding round of Novauto (Beijing) Co., Ltd.. The “Basic Software Support Platform”, a product of the investee, carries the features: subject to ISO26262 ASIL D; support of AUTOSAR ADAPTIVE; compatibility with AUTOSAR Classic and ROS2; availability of middleware DDS for real-time data communication service; building of a unified, multi-QoS in-vehicle/V2V communication mechanism with high reliability, low latency and high scalability.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...