China's car ownership showed the CAGR of 12.9% during 2012-2019 and it is estimated to reach 272.13 million units in 2020 with a year-on-year spike of 7.2%, invigorating the motor vehicle inspection market and with a demanding on higher motor vehicle inspection capabilities.

In recent years, regulatory authorities including the Ministry of Public Security and the Ministry of Environmental Protection have intensified their efforts for vehicle inspection, fueling a boom in the Chinese vehicle inspection market. In 2019, China’s vehicle inspection market size was estimated at RMB38.05 billion with a year-on-year spurt of 17.6%, of which vehicle inspection systems and vehicle inspection services contributed RMB4.743 billion and RMB33.31 billion respectively, surging by 24.5% and 16.7% on an annualized basis. The substantial growth of vehicle inspection systems was largely bolstered by product renewal thanks to the implementation of new standards.

China's vehicle inspection is in the early stage of intelligence and networking, lagging behind developed countries in terms of technology and configuration. As of 2019, there had been more than 13,000 vehicle inspection stations across China, namely every 10,000 vehicles could be served by only 0.5 inspection station, far lower than the average of 2 or more in Japan, the United States and Europe. This indicates huge development potentials in China. As estimated, the number of vehicle inspection stations in China will maintain a growth rate of about 9% between 2020 and 2026, expectedly registering 25,000 by 2026. Thus, the new vehicle inspection stations will demand vehicle inspection equipment worth RMB3.6 billion.

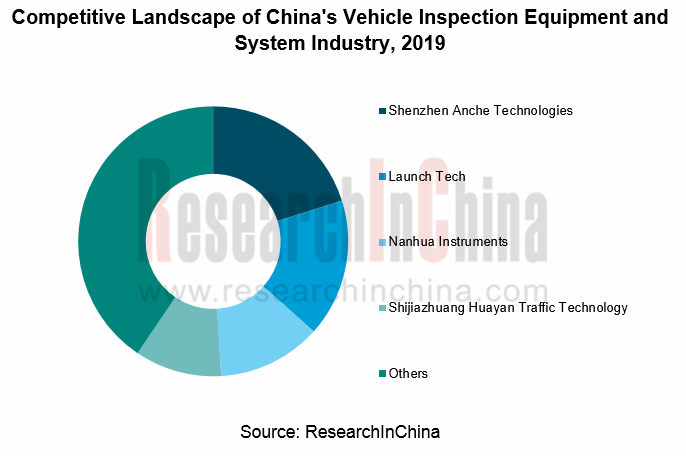

With the tightening of industry supervision and the intensification of market competition, Chinese vehicle inspection equipment and system market has become ever more concentrated. Shenzhen Anche Technologies, Launch Tech, Shijiazhuang Huayan Traffic Technology, Foshan Nanhua Instruments and Chengdu Chengbao Development have high market shares, strong R&D capabilities, and wide business coverage.

In 2019, Shenzhen Anche Technologies, Launch Tech, Nanhua Instruments and Shijiazhuang Huayan Traffic Technology seized 59.5% shares of Chinese vehicle inspection system market together. Especially, Shenzhen Anche Technologies and Nanhua Instruments quickly evolved into the industry’s leaders, with their revenue soaring by 287.0% and 82.4% year-on-year respectively.

The motor vehicle inspection service industry features geographical limitations, and the competitors can be bifurcated into state-owned enterprises and private ones, among which the former is superior in comprehensive strength, equipment and technology, but a number of third-party inspection agencies have emerged with the advancement of the vehicle inspection industry, and private vehicle inspection companies have been seizing more market share by unique competitive edges.

In 2018, Shenzhen Anche Technologies entered the motor vehicle inspection service market by acquiring 70% stake of XingChe Motor Vehicle Inspection. In September 2019, Duolun Technology established a wholly-owned subsidiary, Jiangsu Duolun Vehicle Inspection Industry Holding Co., Ltd., with a registered capital of RMB300 million, marking the company's official foray into the motor vehicle inspection industry. With the stricter requirements of new standards on inspection services as well as the involvement of private capital, the competition in Chinese vehicle inspection service market will, undoubtedly, prick up.

Chinese vehicle inspection market will continue to expand, and it is expected to worth RMB72.05 billion by 2026 under the drive of vehicle ownership growth, longer vehicle usage time, the growing number of vehicle inspection agencies, the continuous expansion of applied fields, and the upgrading of emission standards.

China Vehicle Inspection Industry Report, 2020-2026 focuses on the following:

Vehicle inspection, including definition, classification, industry chain, laws and policies;

Vehicle inspection, including definition, classification, industry chain, laws and policies;

Automobile industry, including output, sales volume and ownership;

Automobile industry, including output, sales volume and ownership;

Vehicle inspection market, including overseas market overview, status quo, market size, competition pattern, and development trend;

Vehicle inspection market, including overseas market overview, status quo, market size, competition pattern, and development trend;

Analysis on vehicle inspection system suppliers and vehicle inspection service providers.

Analysis on vehicle inspection system suppliers and vehicle inspection service providers.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...